This PDF is a selection from a published volume from... Economic Research Volume Title: NBER International Seminar on Macroeconom

... effectiveness, the dangers of deflation, and the resulting rationale for quantitative easing were laid out and analyzed in Orphanides and Wieland (1998, 2000) and Coenen and Wieland (2003, 2004). As long as savers have the option to choose cash—a zero‐interest‐bearing asset—as a store of value, a ra ...

... effectiveness, the dangers of deflation, and the resulting rationale for quantitative easing were laid out and analyzed in Orphanides and Wieland (1998, 2000) and Coenen and Wieland (2003, 2004). As long as savers have the option to choose cash—a zero‐interest‐bearing asset—as a store of value, a ra ...

here - Reverse Market Insight

... Greater liquidity means lenders can offer lower margins to borrowers ...

... Greater liquidity means lenders can offer lower margins to borrowers ...

Chapter 10

... • Answer. If Zapata borrows an additional Mex$ 15,000 (in millions) and uses these funds to pay a dividend to its parent, its liabilities will rise by Mex$ 15,000 and its equity will fall by the same amount. With the added peso liabilities, its exposure will fall by Mex$ 15,000 or $1.875 million re ...

... • Answer. If Zapata borrows an additional Mex$ 15,000 (in millions) and uses these funds to pay a dividend to its parent, its liabilities will rise by Mex$ 15,000 and its equity will fall by the same amount. With the added peso liabilities, its exposure will fall by Mex$ 15,000 or $1.875 million re ...

Initial value

... Instead of in “spurts,” this type of growth occurs continuously growth of money in an account that pays interest continuously the decay of radioactive material which occurs continuously The number e (2.718…) represents the maximum compound rate of growth from a process that grows at 100% for one ...

... Instead of in “spurts,” this type of growth occurs continuously growth of money in an account that pays interest continuously the decay of radioactive material which occurs continuously The number e (2.718…) represents the maximum compound rate of growth from a process that grows at 100% for one ...

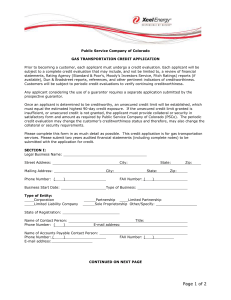

Contact - Xcel Energy - Web site maintenance

... Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured credit limit granted is insufficient, or unsecured credit is not granted, the applicant must provide collateral or securi ...

... Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured credit limit granted is insufficient, or unsecured credit is not granted, the applicant must provide collateral or securi ...

Bond Interest Payments Mason Company Investors

... Financial Leverage and Tax Advantage of Debt Financing Financial leverage: Debt financing can increase return on equity when the borrower earns more on the borrowed funds than it pays in interest. As this example shows, the cost of financing is the same, but debt financing has a tax advantage. ...

... Financial Leverage and Tax Advantage of Debt Financing Financial leverage: Debt financing can increase return on equity when the borrower earns more on the borrowed funds than it pays in interest. As this example shows, the cost of financing is the same, but debt financing has a tax advantage. ...

Compensating Balances

... COMMERCIAL PAPER 4. Non-bank lending : Commercial Paper a. Definition: short-term unsecured promissory note generally sold by large MNCs on a discount basis. b. Standard maturities c. Bank fees charged for: ...

... COMMERCIAL PAPER 4. Non-bank lending : Commercial Paper a. Definition: short-term unsecured promissory note generally sold by large MNCs on a discount basis. b. Standard maturities c. Bank fees charged for: ...

FRBSF L CONOMIC

... output sensitivity to a short-term interest rate in Rudebusch (2002). If the Fed’s purchases reduced long rates by ½ to ¾ of a percentage point, the resulting stimulus would be very roughly equal to a 1½ to 3 percentage point cut in the funds rate. Assuming unconventional policy stimulus is maintain ...

... output sensitivity to a short-term interest rate in Rudebusch (2002). If the Fed’s purchases reduced long rates by ½ to ¾ of a percentage point, the resulting stimulus would be very roughly equal to a 1½ to 3 percentage point cut in the funds rate. Assuming unconventional policy stimulus is maintain ...

Post-Closing Trial Balance

... If the difference between the two totals is divisible by 10, it is probably an addition error. If the difference between the two totals is a number not divisible by 10, look for an account balance which equals that number— it may have been omitted from the list of account. ...

... If the difference between the two totals is divisible by 10, it is probably an addition error. If the difference between the two totals is a number not divisible by 10, look for an account balance which equals that number— it may have been omitted from the list of account. ...

CFI-Letterhead Template

... Assume a company is valued at $1,000,000 and is generating $60,000 in net profits a year. The Return on Asset (ROA) is therefore 6%. Is the return adequate or not? Here is how people tend to answer this question: 1. Business is operating at above breakeven so return is adequate. 2. The return is gre ...

... Assume a company is valued at $1,000,000 and is generating $60,000 in net profits a year. The Return on Asset (ROA) is therefore 6%. Is the return adequate or not? Here is how people tend to answer this question: 1. Business is operating at above breakeven so return is adequate. 2. The return is gre ...

Chap 5 - TCU.edu

... instruments will increase significantly above the current 6% yield, then the money market fund might result in a higher HPR than the savings deposit. The 20-year Treasury bond offers a yield to maturity of 9% per year, which is 150 basis points higher than the rate on the one-year savings deposit; h ...

... instruments will increase significantly above the current 6% yield, then the money market fund might result in a higher HPR than the savings deposit. The 20-year Treasury bond offers a yield to maturity of 9% per year, which is 150 basis points higher than the rate on the one-year savings deposit; h ...

Solution

... Since the interest rate is 10% in Northlandia and 6% in Southlandia, demanders of loanable funds in Northlandia will want to borrow in Southlandia and suppliers of loanable funds in Southlandia will want to lend in Northlandia. As the supply of loanable funds falls in Southlandia, the interest rate ...

... Since the interest rate is 10% in Northlandia and 6% in Southlandia, demanders of loanable funds in Northlandia will want to borrow in Southlandia and suppliers of loanable funds in Southlandia will want to lend in Northlandia. As the supply of loanable funds falls in Southlandia, the interest rate ...

110-S- Advanced Accounting_R_2017

... When noncash assets are liquidated and the amount received exceeds the book value of the asset liquidated, there is a a. net income b. net loss c. gain on the realization d. loss on the realization ...

... When noncash assets are liquidated and the amount received exceeds the book value of the asset liquidated, there is a a. net income b. net loss c. gain on the realization d. loss on the realization ...

Looking Beyond the Fed for Clues on Interest Rates TH E

... Default risk should ease as economic growth picks up. Some of Trump’s progrowth proposals—cutting regulation and ...

... Default risk should ease as economic growth picks up. Some of Trump’s progrowth proposals—cutting regulation and ...

The RBI holds and the US Fed raises

... Overall there is an improved customer sentiment fueling a growth in demand. This demand growth in turn is creating capacity constraints and creating more job opportunities in manufacturing. The improved customer sentiment can also be seen in the inflation. The month on month inflation of the Eurozon ...

... Overall there is an improved customer sentiment fueling a growth in demand. This demand growth in turn is creating capacity constraints and creating more job opportunities in manufacturing. The improved customer sentiment can also be seen in the inflation. The month on month inflation of the Eurozon ...

statement of risk - ACT Department of Treasury

... twelve months) and fixed interest bonds (maturity greater than twelve months), each of which has its own unique risk/return characteristics. The diversification between these markets provides some trade off between returns and interest rate risk. Changes in the fair market valuations of investments ...

... twelve months) and fixed interest bonds (maturity greater than twelve months), each of which has its own unique risk/return characteristics. The diversification between these markets provides some trade off between returns and interest rate risk. Changes in the fair market valuations of investments ...

1 - JustAnswer.de

... a.) Due, but not payable for more than one year b.) Due and receivable within one year c.) Due, but not receivable for more than one year d.) Due and payable within one year 2.) 2.) Notes may be issued a.) To creditors to temporarily satisfy an account payable created earlier b.) When borrowing mone ...

... a.) Due, but not payable for more than one year b.) Due and receivable within one year c.) Due, but not receivable for more than one year d.) Due and payable within one year 2.) 2.) Notes may be issued a.) To creditors to temporarily satisfy an account payable created earlier b.) When borrowing mone ...

Zero-coupon bonds assessment using a new stochastic model.

... and dt(x) is the first derivative of Dt(x). Three models will be presented in section 2 using the approach cited above for random rate of interest and random waiting times between changes in the rate of interest. The first two (Models I.a and I.b) for independent rates of interest in the different w ...

... and dt(x) is the first derivative of Dt(x). Three models will be presented in section 2 using the approach cited above for random rate of interest and random waiting times between changes in the rate of interest. The first two (Models I.a and I.b) for independent rates of interest in the different w ...

PRESS RELEASE July 25, 2011 The Bank of Israel leaves the

... in June that were not indexed to the CPI, at variable interest rates, fell significantly, to 32 percent, down from 45 percent in May. The reduction in this share was due among other things to a directive issued by the Supervisor of Banks regarding the maximum permitted share of a housing loan at a f ...

... in June that were not indexed to the CPI, at variable interest rates, fell significantly, to 32 percent, down from 45 percent in May. The reduction in this share was due among other things to a directive issued by the Supervisor of Banks regarding the maximum permitted share of a housing loan at a f ...

TAYLOR RULE IN EAST ASIAN COUNTRIES

... part due to inclusion of the lagged interest rate. All have fairly high adjustment coefficients indicating that the changes in interest rate are implemented very quickly. Since the periodicity of the data is monthly the central banks of these nations adjust to their desired rate of interest within a ...

... part due to inclusion of the lagged interest rate. All have fairly high adjustment coefficients indicating that the changes in interest rate are implemented very quickly. Since the periodicity of the data is monthly the central banks of these nations adjust to their desired rate of interest within a ...

Multiple Choice - Marriott School

... Part I. Multiple Choice (30 points: 3 points each) There are ten multiple-choice questions. Choose only one answer for each question. You do not have to explain why you have selected a particular one. If you feel that a question is ambiguous, feel free to write a justification for your answer on the ...

... Part I. Multiple Choice (30 points: 3 points each) There are ten multiple-choice questions. Choose only one answer for each question. You do not have to explain why you have selected a particular one. If you feel that a question is ambiguous, feel free to write a justification for your answer on the ...

COMMERCIAL INFORMATION AND CREDIT ANALYSIS

... Lenders always choose their clientele. An important source of new business for most lenders is introductions from professional advisers such as accountants and solicitors. But, a bank has no obligation to lend to customers introduced in this way. 2. The application by the customer; The application ( ...

... Lenders always choose their clientele. An important source of new business for most lenders is introductions from professional advisers such as accountants and solicitors. But, a bank has no obligation to lend to customers introduced in this way. 2. The application by the customer; The application ( ...

Progress Towards Creating more Effective Resolution Regimes

... Availability of Information: The first Credit Information Company is expected to be licensed by the end of 2014 which will help in enhancing access to finance especially for SMEs . Credit Guarantees: In cooperation with the IFC, restructuring and procedural improvements of the JLGC is undergone in o ...

... Availability of Information: The first Credit Information Company is expected to be licensed by the end of 2014 which will help in enhancing access to finance especially for SMEs . Credit Guarantees: In cooperation with the IFC, restructuring and procedural improvements of the JLGC is undergone in o ...

When US rates rise

... However, it is worth remembering that rate rises are on the horizon only because the US economic recovery is judged to be sufficiently robust. In addition, what matters more from the real economy and long term investor perspective is not the precise date of the first small rate hike from a historica ...

... However, it is worth remembering that rate rises are on the horizon only because the US economic recovery is judged to be sufficiently robust. In addition, what matters more from the real economy and long term investor perspective is not the precise date of the first small rate hike from a historica ...