The Optimal Rotation Period 01 Renewable Resources

... crative: Forestry management requires darity about how long a single tree should grow. This problem of the so-called "optimal rotation period" arises with all renewable resources, not only in tilling the soil, but also in animal farming such as pig fattening. 1 However, it is astounding that, for th ...

... crative: Forestry management requires darity about how long a single tree should grow. This problem of the so-called "optimal rotation period" arises with all renewable resources, not only in tilling the soil, but also in animal farming such as pig fattening. 1 However, it is astounding that, for th ...

WHAT ARE OPEN MARKET OPERATIONS (OMO)? As the nation`s

... system by buying back those securities. The buying and selling of these securities by the central bank is called OMO. ...

... system by buying back those securities. The buying and selling of these securities by the central bank is called OMO. ...

TrialBalance

... If an accounting software package is used, the computer will print this report. The software program will balance all the ledger accounts and then show them with either a debit or credit balance. If you have a manual system, you need to work out the balance of each account and then manually write ou ...

... If an accounting software package is used, the computer will print this report. The software program will balance all the ledger accounts and then show them with either a debit or credit balance. If you have a manual system, you need to work out the balance of each account and then manually write ou ...

NBER WORKING PAPER SERIES HOUSING, CREDIT MARKETS AND THE BUSINESS CYCLE

... for risky investments, including private equity acquisitions. Loans to support private equity deals that were already in the pipeline could not be syndicated, forcing the commercial banks and investment banks to hold those loans on their own books. Banks are also being forced to honor credit guarant ...

... for risky investments, including private equity acquisitions. Loans to support private equity deals that were already in the pipeline could not be syndicated, forcing the commercial banks and investment banks to hold those loans on their own books. Banks are also being forced to honor credit guarant ...

Investment and Financial Markets

... you retire, your employer offers you’re the following options: 1) You can have the $500,000 that was set aside, or 2) the firm would take the $500,000 and purchase you an annuity contract---a financial instrument that would pay you a fixed annual payment of $35,000 per year as long as you live. ...

... you retire, your employer offers you’re the following options: 1) You can have the $500,000 that was set aside, or 2) the firm would take the $500,000 and purchase you an annuity contract---a financial instrument that would pay you a fixed annual payment of $35,000 per year as long as you live. ...

Monetary Policy and the Risk-Taking Channel

... Jiménez et al. (2008) use exhaustive loan-level data combined with bank and firm information from Spain’s Central Credit Register for the 1988–2008 period to examine whether monetary policy in the European Union led to the origination of riskier individual bank loans in Spain. They investigate the ...

... Jiménez et al. (2008) use exhaustive loan-level data combined with bank and firm information from Spain’s Central Credit Register for the 1988–2008 period to examine whether monetary policy in the European Union led to the origination of riskier individual bank loans in Spain. They investigate the ...

Investing in the desert

... reasonable give-up for a more even ride. But, it’s the last 30 years that are very interesting here. Since 1980, the returns from investing in equities and the returns from investing in government bonds over this 30 year period have been remarkably close. This has led some public figures to conclude ...

... reasonable give-up for a more even ride. But, it’s the last 30 years that are very interesting here. Since 1980, the returns from investing in equities and the returns from investing in government bonds over this 30 year period have been remarkably close. This has led some public figures to conclude ...

Institute of Actuaries of India INDICATIVE SOLUTIONS November 2012 Examinations

... changing prepayment rates stochastically due to various interest rate changes and accordingly calculates the average price of the MBS. Valuation measure of MBS/CMO The yield spread, the standard measure of incremental return over a benchmark Treasury, is inappropriate valuation measure as it compare ...

... changing prepayment rates stochastically due to various interest rate changes and accordingly calculates the average price of the MBS. Valuation measure of MBS/CMO The yield spread, the standard measure of incremental return over a benchmark Treasury, is inappropriate valuation measure as it compare ...

Credit: The Promise to Pay

... Provides information about how long it would take to pay off a loan if minimum payments are paid. Protects potential credit consumers under the age of 21, who must have a cosigner with a means to repay debt of the consumer. ...

... Provides information about how long it would take to pay off a loan if minimum payments are paid. Protects potential credit consumers under the age of 21, who must have a cosigner with a means to repay debt of the consumer. ...

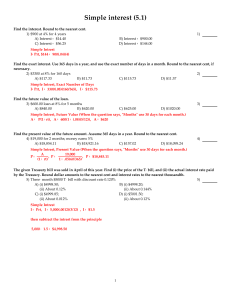

Simple interest (5.1)

... The given Treasury bill was sold in April of this year. Find (i) the price of the T-bill, and (ii) the actual interest rate paid by the Treasury. Round dollar amounts to the nearest cent and interest rates to the nearest thousandth. 5) Three-month $5000 T-bill with discount rate 0.120% ...

... The given Treasury bill was sold in April of this year. Find (i) the price of the T-bill, and (ii) the actual interest rate paid by the Treasury. Round dollar amounts to the nearest cent and interest rates to the nearest thousandth. 5) Three-month $5000 T-bill with discount rate 0.120% ...

What is double entry accounting and how does it analyze business

... Rules for Liability and Owner’s Equity Accounts The liability and capital accounts are increased (+) on the credit side. The liability and capital accounts are decreased (-) on the debit side. The normal balance for the liability and capital accounts is a credit ...

... Rules for Liability and Owner’s Equity Accounts The liability and capital accounts are increased (+) on the credit side. The liability and capital accounts are decreased (-) on the debit side. The normal balance for the liability and capital accounts is a credit ...

Linear Equation Word Problems

... Example. Tee Shirts sell for $15 each and striped shirts for $22 each. A total of 62 shirts are sold, and the total value of the shirts is $1098. How many of each kind of shirt were sold? Let x be the number of tee shirts sold. Since 62 tickets were sold all together, the number of striped shirts so ...

... Example. Tee Shirts sell for $15 each and striped shirts for $22 each. A total of 62 shirts are sold, and the total value of the shirts is $1098. How many of each kind of shirt were sold? Let x be the number of tee shirts sold. Since 62 tickets were sold all together, the number of striped shirts so ...

DOC - JMap

... doubles every seven years. The value of the investment, V, is determined by the equation , where t represents the number of years since the money was deposited. How many years, to the nearest tenth of a year, will it take the value of the investment to reach $1,000,000? ...

... doubles every seven years. The value of the investment, V, is determined by the equation , where t represents the number of years since the money was deposited. How many years, to the nearest tenth of a year, will it take the value of the investment to reach $1,000,000? ...

PDF (figures and comments)

... manage those risks as we think about the appropriate path for monetary policy ...

... manage those risks as we think about the appropriate path for monetary policy ...

Financial Institution Accounts- pages 252-254

... An SSI-related child’s savings account of less than $500 is disregarded when determining Medicaid eligibility. The funds must be accumulated from gifts from non-legally responsible relatives and/or from the child's own earned income. Each SSI-related child is allowed one account; when the child has ...

... An SSI-related child’s savings account of less than $500 is disregarded when determining Medicaid eligibility. The funds must be accumulated from gifts from non-legally responsible relatives and/or from the child's own earned income. Each SSI-related child is allowed one account; when the child has ...

PFF EOC 2010 ppt with answers

... B. Are insured by the FDIC C. Have members that possess a common bond such as people who live, work or attend school in a well defined geographical area D. Provide loans at a higher interest rate and savings instruments with a lower rates ...

... B. Are insured by the FDIC C. Have members that possess a common bond such as people who live, work or attend school in a well defined geographical area D. Provide loans at a higher interest rate and savings instruments with a lower rates ...

Nonagency MBS, CMBS, ABS

... Senior Interest The proportion of the mortgage balance of the senior bond class to the total mortgage deal is referred to as senior interest (initial senior interest = $400m/$500m = .80). Subordinate Interest The proportion of the mortgage balance of the subordinated bond classes to the total mo ...

... Senior Interest The proportion of the mortgage balance of the senior bond class to the total mortgage deal is referred to as senior interest (initial senior interest = $400m/$500m = .80). Subordinate Interest The proportion of the mortgage balance of the subordinated bond classes to the total mo ...

Eggertsson and Woodford (2003) - notes

... assumption that interest rate policy is specified in a way that implies that these openmarket operations have no consequences for interest rate policy, either immediately (which is trivial, because it would not be possible for them to lower current interest rates, which is the only effect that would ...

... assumption that interest rate policy is specified in a way that implies that these openmarket operations have no consequences for interest rate policy, either immediately (which is trivial, because it would not be possible for them to lower current interest rates, which is the only effect that would ...

What Negative Libor Would Mean For The Lending

... borrower unless it agrees to amend the credit agreement to provide for a zero floor. Given the large number of credit agreements that are potentially affected, approaching each such borrower individually to document these amendments may prove quite cumbersome. Additionally, in syndicated deals many ...

... borrower unless it agrees to amend the credit agreement to provide for a zero floor. Given the large number of credit agreements that are potentially affected, approaching each such borrower individually to document these amendments may prove quite cumbersome. Additionally, in syndicated deals many ...

Glossary-to-financial-market-statistics

... entrepreneur households where the loans are unsecured or have other guarantees than government guarantees (for example personal guarantees). Consumption credits include delayed debit card and credit card credits because these loans, in general, have no collateral. For a further description of how in ...

... entrepreneur households where the loans are unsecured or have other guarantees than government guarantees (for example personal guarantees). Consumption credits include delayed debit card and credit card credits because these loans, in general, have no collateral. For a further description of how in ...

International Capital Flows and US Interest Rates

... • Do foreign purchases of US debt significantly affect US interest rates? – tighter short-term interest rates since 2003 have not led to much higher long-term interest rates • Estimate an IS/LM motivated empirical specification for US long-term interest rates (10-yr Treasuries) – foreign (official) ...

... • Do foreign purchases of US debt significantly affect US interest rates? – tighter short-term interest rates since 2003 have not led to much higher long-term interest rates • Estimate an IS/LM motivated empirical specification for US long-term interest rates (10-yr Treasuries) – foreign (official) ...

UNIT 1:

... 12. A famous quarterback just signed a contract providing $3 million a year for 5 years. A less famous receiver signed a 5-year contract providing $4 million today and $2 million a year for 5 years. Who is better paid if interest rate is 10% compounded annually? ...

... 12. A famous quarterback just signed a contract providing $3 million a year for 5 years. A less famous receiver signed a 5-year contract providing $4 million today and $2 million a year for 5 years. Who is better paid if interest rate is 10% compounded annually? ...

Translation Exposure

... Purpose: Need to translate foreign subs statement into US$ If subs financial statements kept in $, no need for translation. Is local currency functional currency? ...

... Purpose: Need to translate foreign subs statement into US$ If subs financial statements kept in $, no need for translation. Is local currency functional currency? ...

Chapters 15 and 16 Chapter 15

... c. the interest expense is deductible for tax purposes by the corporation. d. a higher earnings per share is guaranteed for existing common shareholders. 2. When the maturities of a bond issue are spread over several dates, the bonds are called a. serial bonds b. bearer bonds c. debenture bonds d. t ...

... c. the interest expense is deductible for tax purposes by the corporation. d. a higher earnings per share is guaranteed for existing common shareholders. 2. When the maturities of a bond issue are spread over several dates, the bonds are called a. serial bonds b. bearer bonds c. debenture bonds d. t ...

Project Finance Overview

... by the sponsor before the loans are made to the SPV, being the project borrower, and the SPV is the entity that owns the project assets and signs the project contracts) because of the large debt liabilities and complex risk management associated with them 3. they involve some manner of revenuegenera ...

... by the sponsor before the loans are made to the SPV, being the project borrower, and the SPV is the entity that owns the project assets and signs the project contracts) because of the large debt liabilities and complex risk management associated with them 3. they involve some manner of revenuegenera ...