V8 Analysts 3 13 (1).pps

... ROE in 1-9/2013 -8.7% (9.0% in Q3). Assuming the banking industry core capital average ratio (9.30%) the ROE is 9.4% in 1-9/2013 and 9.7% in Q3. Increase in revenue from commissions – in spite of the regulatory reforms inflicting reductions in commissions, an increase in clients' activity in capital ...

... ROE in 1-9/2013 -8.7% (9.0% in Q3). Assuming the banking industry core capital average ratio (9.30%) the ROE is 9.4% in 1-9/2013 and 9.7% in Q3. Increase in revenue from commissions – in spite of the regulatory reforms inflicting reductions in commissions, an increase in clients' activity in capital ...

Taking charge of your finances

... • Installment credit usually has an agreement (contract) which must be signed outlining the repayment terms. ...

... • Installment credit usually has an agreement (contract) which must be signed outlining the repayment terms. ...

Five Strategies for a Rising-Rate Environment

... historically low fed funds rate over the next couple of years are realized, the ten-year rate need not rise materially from its current levels. In fact, long-term rates may be capped by certain structural and external factors. The most important external factor serving to dampen long-term rates is t ...

... historically low fed funds rate over the next couple of years are realized, the ten-year rate need not rise materially from its current levels. In fact, long-term rates may be capped by certain structural and external factors. The most important external factor serving to dampen long-term rates is t ...

Chapter 5

... afford monthly house payments of at most $750. The bank charges interest at a rate of 8% per year on the unpaid balance, with interest computations made at the end of each month. If the loan is to be amortized in equal monthly installments over 15 years, what is the maximum amount that the Radlers c ...

... afford monthly house payments of at most $750. The bank charges interest at a rate of 8% per year on the unpaid balance, with interest computations made at the end of each month. If the loan is to be amortized in equal monthly installments over 15 years, what is the maximum amount that the Radlers c ...

Sovereign Default: The Role of Expectations.

... • The endowment has bounded support, given by [min max] ⊂ R+ and follows a Markov process with distribution ( 0|). • We let the value after default be ...

... • The endowment has bounded support, given by [min max] ⊂ R+ and follows a Markov process with distribution ( 0|). • We let the value after default be ...

accounting review quiz

... Elements of Negotiable Instruments • In writing and signed by the maker/drawer • Unconditional promise to pay a certain sum of money • Payable at demand or at a specific date • Payable to order or bearer (Payee) • The certain sum of money must be callable to be negotiable • If time is not specified, ...

... Elements of Negotiable Instruments • In writing and signed by the maker/drawer • Unconditional promise to pay a certain sum of money • Payable at demand or at a specific date • Payable to order or bearer (Payee) • The certain sum of money must be callable to be negotiable • If time is not specified, ...

Will an inverted yield curve predict the next recession … again

... reduce demand for credit (such as car loans, business loans and mortgage rates). This is a delicate balance, as these rate adjustments tend to have the desired effect on the economy in the near term, but ultimately, a number of market factors (including inflation expectation, employment growth and g ...

... reduce demand for credit (such as car loans, business loans and mortgage rates). This is a delicate balance, as these rate adjustments tend to have the desired effect on the economy in the near term, but ultimately, a number of market factors (including inflation expectation, employment growth and g ...

Document

... the money at higher interest rates. They can loan money to the US government when they buy Treasuries (US bonds) and they can lend to businesses and households by creating checking accounts balances. The key feature of the banking system is it is a fractional reserve system, which means that banks c ...

... the money at higher interest rates. They can loan money to the US government when they buy Treasuries (US bonds) and they can lend to businesses and households by creating checking accounts balances. The key feature of the banking system is it is a fractional reserve system, which means that banks c ...

THE LEVEL OF THE EXCHANGE RATE AND THE BALANCE

... The exchange rate reflects the position of the national economy in the background of the world economy. The level of the exchange rate represents an element of credibility of the national monetary system1, it is an important macroeconomic factor, as part of the monetary policy that is surveyed by th ...

... The exchange rate reflects the position of the national economy in the background of the world economy. The level of the exchange rate represents an element of credibility of the national monetary system1, it is an important macroeconomic factor, as part of the monetary policy that is surveyed by th ...

Short-Term Finance and Planning

... Example: Compensating Balance We have a $500,000 line of credit with a 15% compensating balance requirement. The quoted interest rate is 9%. We need to borrow $150,000 for inventory for one year. How much do we need to borrow? The required amount plus the compensating balance: ...

... Example: Compensating Balance We have a $500,000 line of credit with a 15% compensating balance requirement. The quoted interest rate is 9%. We need to borrow $150,000 for inventory for one year. How much do we need to borrow? The required amount plus the compensating balance: ...

questions in real estate finance

... “Payment shock” with dramatic increase in payment Appeal is the very low initial payment designed to help offset affordability problem Contract rate adjusts monthly with maybe no limits on size of interest rate changes ...

... “Payment shock” with dramatic increase in payment Appeal is the very low initial payment designed to help offset affordability problem Contract rate adjusts monthly with maybe no limits on size of interest rate changes ...

Forecasting Interest Rates

... Suppose that your current income is equal to $50,000 and you anticipate next year’s income to be $60,000. The current interest rate is 5%. In the absence of financial markets, your consumption stream would be $50,000 this year and $60,000 next year. C = Y (Current Consumption = Current Income) C’ = ...

... Suppose that your current income is equal to $50,000 and you anticipate next year’s income to be $60,000. The current interest rate is 5%. In the absence of financial markets, your consumption stream would be $50,000 this year and $60,000 next year. C = Y (Current Consumption = Current Income) C’ = ...

Presentation - Federal Reserve Bank of New York

... ON RRP: “the Federal Reserve intends to use an overnight reverse repurchase agreement facility and other supplementary tools as needed to help control the federal funds rate. The Committee will use an overnight reverse repurchase agreement facility only to the extent necessary and will phase it ou ...

... ON RRP: “the Federal Reserve intends to use an overnight reverse repurchase agreement facility and other supplementary tools as needed to help control the federal funds rate. The Committee will use an overnight reverse repurchase agreement facility only to the extent necessary and will phase it ou ...

Quantitative and Qualitative Monetary Easing (QQE)

... excessively binding" by making a commitment to expansion of the monetary base, based on the observed CPI inflation rate, instead of the forecast of them. Given that there is a time lag for monetary policy to have effects on economic activities, it is exceptional for a central bank to make a commitme ...

... excessively binding" by making a commitment to expansion of the monetary base, based on the observed CPI inflation rate, instead of the forecast of them. Given that there is a time lag for monetary policy to have effects on economic activities, it is exceptional for a central bank to make a commitme ...

Course 2 Sample Exam Questions

... A 10-year loan of 10,000 is to be repaid with payments at the end of each year consisting of interest on the loan and a sinking fund deposit. Interest on the loan is charged at a 12% annual effective rate. The sinking fund’s annual effective interest rate is 8%. However, beginning in the sixth year, ...

... A 10-year loan of 10,000 is to be repaid with payments at the end of each year consisting of interest on the loan and a sinking fund deposit. Interest on the loan is charged at a 12% annual effective rate. The sinking fund’s annual effective interest rate is 8%. However, beginning in the sixth year, ...

Bonds - Headwater Investment Consulting

... savers looking for income, keeping interest low helps borrowers get inexpensive loans. It stimulates spending, and the hope is that it gets more money circulating in the economy, making everyone better off. ...

... savers looking for income, keeping interest low helps borrowers get inexpensive loans. It stimulates spending, and the hope is that it gets more money circulating in the economy, making everyone better off. ...

Presentation - Keith Rankin

... The paper suggests that the financial system acts in the service of creditors to both achieve financial returns for them and to serve as a pump to maintain the circular flow of expenditure in the face of habitual non-spending on the part of many creditors. The financial services industry plays a qui ...

... The paper suggests that the financial system acts in the service of creditors to both achieve financial returns for them and to serve as a pump to maintain the circular flow of expenditure in the face of habitual non-spending on the part of many creditors. The financial services industry plays a qui ...

Applications Section 4.6

... 9. The stray-cat population in a small town grows exponentially. In 1999, the town had 30 stray cats and the relative growth rate was 15% per year. (a) Find a function that models the stray-cat population t years after 1999. (b) Find the projected population in 2011. (Round to nearest whole unit). 1 ...

... 9. The stray-cat population in a small town grows exponentially. In 1999, the town had 30 stray cats and the relative growth rate was 15% per year. (a) Find a function that models the stray-cat population t years after 1999. (b) Find the projected population in 2011. (Round to nearest whole unit). 1 ...

www.lem.sssup.it

... growth rates but also more volatility, more bad debt, with a consequent rise of bankruptcy rate and default correlation Higher values of β generate higher growth rates, without causing large bankruptcy chains for modest values of and umin. For a given, high, value of β, an increase of or a decre ...

... growth rates but also more volatility, more bad debt, with a consequent rise of bankruptcy rate and default correlation Higher values of β generate higher growth rates, without causing large bankruptcy chains for modest values of and umin. For a given, high, value of β, an increase of or a decre ...

Chapter 2

... There are serial concepts concerned with cost, which are cost of purchase or net purchase, production cost, cost of products or cost of completed products, cost of sold goods, but only the cost of sold can be taken into our consideration to obtain our profit during an accounting period although all ...

... There are serial concepts concerned with cost, which are cost of purchase or net purchase, production cost, cost of products or cost of completed products, cost of sold goods, but only the cost of sold can be taken into our consideration to obtain our profit during an accounting period although all ...

Money Management Overview

... use about 90% of your money for loans. Interest – cost of loans Withdrawal limit Checking account – able to withdraw, pay bills, make purchases, use checks daily Checks – written request from your bank to issue it to ...

... use about 90% of your money for loans. Interest – cost of loans Withdrawal limit Checking account – able to withdraw, pay bills, make purchases, use checks daily Checks – written request from your bank to issue it to ...

Practice Set #1 and Solutions

... thus resources over time. The simple outcome of this limited resource problem is that €100 can be put in a bank account, or invested otherwise, to an earn interest, which in over time builds up to more than receiving €100 at a future date. Solution 2 Cash flow refers to actual money (cash) in minus ...

... thus resources over time. The simple outcome of this limited resource problem is that €100 can be put in a bank account, or invested otherwise, to an earn interest, which in over time builds up to more than receiving €100 at a future date. Solution 2 Cash flow refers to actual money (cash) in minus ...

Chapter 5, Online Monetary Transactions

... An effective way of giving those without credit cards, the ability to make purchases on the Web Flooz ...

... An effective way of giving those without credit cards, the ability to make purchases on the Web Flooz ...

q. please state your name, profession, and occupation.

... interesting is that Mr. Hill can make this statement while at the same time recommending that the required return be applied to book value. If he and the other witnesses were proposing to apply their recommended costs of equity to the market value of BGE/PEPCO’s common equity, we would not be exchan ...

... interesting is that Mr. Hill can make this statement while at the same time recommending that the required return be applied to book value. If he and the other witnesses were proposing to apply their recommended costs of equity to the market value of BGE/PEPCO’s common equity, we would not be exchan ...

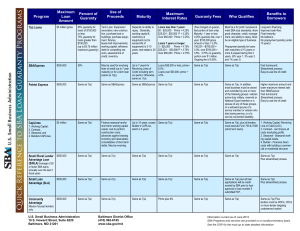

Program Maximum Loan Amount Percent of Guaranty Use of

... and controlled by one or more of the following groups: veteran, active-duty military, reservist or National Guard member or a spouse of any of these groups, or a widowed spouse of a service member or veteran who died during service, or of a ...

... and controlled by one or more of the following groups: veteran, active-duty military, reservist or National Guard member or a spouse of any of these groups, or a widowed spouse of a service member or veteran who died during service, or of a ...