First Bankers` Banc Securities, Inc.

... Level 1 – Inputs that utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 – Inputs that include quoted prices for similar assets and liabilities in active markets and inputs that are observable for the asset or ...

... Level 1 – Inputs that utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 – Inputs that include quoted prices for similar assets and liabilities in active markets and inputs that are observable for the asset or ...

FREE Sample Here - We can offer most test bank and

... FIs began lowering their credit quality cut-off points. Moreover, to boost their earnings, in the market now popularly known as the “subprime market,” banks and other mortgage-supplying institutions often offered relatively low “teaser” rates on adjustable rate mortgages (ARMs) at exceptionally low ...

... FIs began lowering their credit quality cut-off points. Moreover, to boost their earnings, in the market now popularly known as the “subprime market,” banks and other mortgage-supplying institutions often offered relatively low “teaser” rates on adjustable rate mortgages (ARMs) at exceptionally low ...

for Financing by Seconds of Radio–TV Advertisements

... contract with originator (IRIB) on exercising date of securities. 5- If the seconds of advertisement are considered as copyright and transferred to investors in form of Manfa’ah transaction or Manfa’ah reconciliation, there would be no kind of ownership and investors would only have the right to tra ...

... contract with originator (IRIB) on exercising date of securities. 5- If the seconds of advertisement are considered as copyright and transferred to investors in form of Manfa’ah transaction or Manfa’ah reconciliation, there would be no kind of ownership and investors would only have the right to tra ...

Central Bank of Egypt Credit Risk

... higher the risk of negative credit event (default, etc), the higher the interest rate investors will demand for assuming that risk. • •Private rating agencies (Moody’s and Standard & Poor’s) provide guidance for investors to the credit quality of various issues. ...

... higher the risk of negative credit event (default, etc), the higher the interest rate investors will demand for assuming that risk. • •Private rating agencies (Moody’s and Standard & Poor’s) provide guidance for investors to the credit quality of various issues. ...

CREF Money Market

... or other borrower may not be able to make timely principal, interest, or settlement payments on an obligation. In this event, the issuer of a fixed-income security may have its credit rating downgraded or defaulted, which may reduce the potential for income and value of the portfolio. Income: The in ...

... or other borrower may not be able to make timely principal, interest, or settlement payments on an obligation. In this event, the issuer of a fixed-income security may have its credit rating downgraded or defaulted, which may reduce the potential for income and value of the portfolio. Income: The in ...

Compared to U.S. Treasury investors, should U.S. Agency MBS

... Sources: Amundi SB calculations, based on data from Bloomberg Indices. crisis. Although U.S. Agency Mortgages suffered no credit or liquidity issues, all spread assets dramatically underperformed U.S. However, excess returns are not free. This performance advantage Treasuries due to the massive flig ...

... Sources: Amundi SB calculations, based on data from Bloomberg Indices. crisis. Although U.S. Agency Mortgages suffered no credit or liquidity issues, all spread assets dramatically underperformed U.S. However, excess returns are not free. This performance advantage Treasuries due to the massive flig ...

Bank Loans vs. Global High Yield

... the portfolio management services, research and other resources of Brandywine Global Investment (Europe) Limited, an affiliate. Fixed income securities are subject to credit risk and interest rate risk. High yield, lower-rated, fixed income securities involve greater risk than investment-grade fixed ...

... the portfolio management services, research and other resources of Brandywine Global Investment (Europe) Limited, an affiliate. Fixed income securities are subject to credit risk and interest rate risk. High yield, lower-rated, fixed income securities involve greater risk than investment-grade fixed ...

here - BudgetWhys IDA

... How to open and maintain a bank account Briefly describe two types of deposit accounts ...

... How to open and maintain a bank account Briefly describe two types of deposit accounts ...

AOFM Normal Template - The Australian Office of Financial

... While this method shows the amounts involved in a common currency, the cost in Australian dollars of meeting the various obligations will differ from ...

... While this method shows the amounts involved in a common currency, the cost in Australian dollars of meeting the various obligations will differ from ...

chap008-- - MCST-CS

... strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least avoid a loss) no matter which direction the security's price takes. Hedging may reduce risk, but it is importan ...

... strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least avoid a loss) no matter which direction the security's price takes. Hedging may reduce risk, but it is importan ...

Lecture 11: Real Estate

... – Debt is incurred a little at a time – Payment schedules are different, can become ever more indebted while paying the minimum amount each month. ...

... – Debt is incurred a little at a time – Payment schedules are different, can become ever more indebted while paying the minimum amount each month. ...

6. Key Indicators

... • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • Total debt divided by equity or net worth. • Often a c ...

... • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • Total debt divided by equity or net worth. • Often a c ...

CLOs, CDOs and the Search for High Yield

... bank loans and for a CDO, a pool of bonds and mortgages. Under a CLO or CDO the investor earns income in the form of interest payments from these debt instruments and is otherwise subject to the gains and losses on those loans over time as their prices change/and or if defaults occur. CLO/CDOs can a ...

... bank loans and for a CDO, a pool of bonds and mortgages. Under a CLO or CDO the investor earns income in the form of interest payments from these debt instruments and is otherwise subject to the gains and losses on those loans over time as their prices change/and or if defaults occur. CLO/CDOs can a ...

How to Predict the Next Fiasco

... management and not the shareholders, and thus is more freewheeling with it than a more conservative company is. Enron may be a case in point; its downward spiral into bankruptcy-court protection started as investors focused on nettlesome related-party transactions involving the then-chief financial ...

... management and not the shareholders, and thus is more freewheeling with it than a more conservative company is. Enron may be a case in point; its downward spiral into bankruptcy-court protection started as investors focused on nettlesome related-party transactions involving the then-chief financial ...

Efficient Market Theory and the Crisis

... After the 1982 recession, the U.S. and world economies entered into a long period where the fluctuations in variables such as gross domestic product, industrial production, and employment were significantly lower than they had been since World War II. Economists called this period the "Great Moderat ...

... After the 1982 recession, the U.S. and world economies entered into a long period where the fluctuations in variables such as gross domestic product, industrial production, and employment were significantly lower than they had been since World War II. Economists called this period the "Great Moderat ...

bank loans and private placements

... Generally no CUSIP number Not subject to some of the laws/requirements designed to protect investors U.S. Supreme Court Case Reves vs. Ernst & Young, Inc., 494 U.S. 56 (1990) ...

... Generally no CUSIP number Not subject to some of the laws/requirements designed to protect investors U.S. Supreme Court Case Reves vs. Ernst & Young, Inc., 494 U.S. 56 (1990) ...

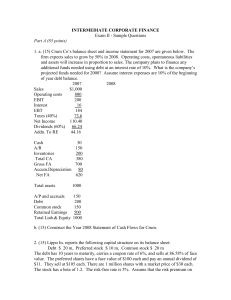

A corporate bond maturing in 5 years carries a 10% coupon rate and

... a. What is the after-tax cost of debt, preferred stock and common stock? b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an ope ...

... a. What is the after-tax cost of debt, preferred stock and common stock? b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an ope ...

Tightest Credit Market in 16 Years Rejects Bernanke`s Bid

... Professionals with established careers whose earnings fluctuate may no longer be considered good credit risks and are having trouble getting conventional financing. This includes self-employed professionals, doctors with their own practices and nurses who cannot show two years with an employer becau ...

... Professionals with established careers whose earnings fluctuate may no longer be considered good credit risks and are having trouble getting conventional financing. This includes self-employed professionals, doctors with their own practices and nurses who cannot show two years with an employer becau ...