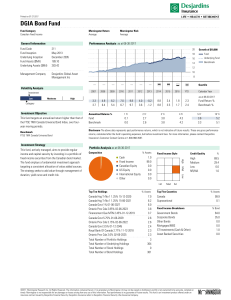

DGIA Bond Fund - Desjardins Life Insurance

... Cash Fixed Income Canadian Equity US Equity International Equity Other ...

... Cash Fixed Income Canadian Equity US Equity International Equity Other ...

Assessment of alternative international monetary regimes

... US issues short-term low-risk assets (T-bills) US invests in high risk foreign assets (foreign equity and direct investment) Earns excess returns on its external position: “exorbitant privilege”. ...

... US issues short-term low-risk assets (T-bills) US invests in high risk foreign assets (foreign equity and direct investment) Earns excess returns on its external position: “exorbitant privilege”. ...

The following is a sample One-Pager to be used in legislative

... The following is a sample One-Pager to be used in legislative meetings. This document is intended to be left with the elected official or their staffer, and function as a “resume” for your credit union. It should be printed on credit union stationary and customized for the products and services offe ...

... The following is a sample One-Pager to be used in legislative meetings. This document is intended to be left with the elected official or their staffer, and function as a “resume” for your credit union. It should be printed on credit union stationary and customized for the products and services offe ...

credit_test_review_powerpoint

... What is the numerical value applied to your credit report by a consumer credit bureau that rate an individual’s creditworthiness for lenders? ...

... What is the numerical value applied to your credit report by a consumer credit bureau that rate an individual’s creditworthiness for lenders? ...

The Potential for Tax-Advantaged Income From Preferred Securities

... U.S. domestic market. (d) BofA Merrill Lynch Municipal Master Index (credit quality: AA-) tracks the performance of U.S. dollar-denominated investment-grade tax-exempt debt publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. domestic market. (e) BofA Merrill ...

... U.S. domestic market. (d) BofA Merrill Lynch Municipal Master Index (credit quality: AA-) tracks the performance of U.S. dollar-denominated investment-grade tax-exempt debt publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. domestic market. (e) BofA Merrill ...

Annex A4.12 - National Balance Sheet Accounts in Israel

... • The balance sheets were first developed within the NA. • The collaboration with the Central Bank has proved fruitful and has lead to wider use of the balance sheets, mainly for financial stability. • The constant development of the balance sheets will make it possible to have further analyses in t ...

... • The balance sheets were first developed within the NA. • The collaboration with the Central Bank has proved fruitful and has lead to wider use of the balance sheets, mainly for financial stability. • The constant development of the balance sheets will make it possible to have further analyses in t ...

The Bursting Bubble

... growth continually creates new growth (process reverses when Bubble bursts and becomes an anti-Bubble). Valuations become absurd, Fraud widespread. Once a Bubble starts to burst it can NOT be Re-Inflated for many years, sometimes never again. ...

... growth continually creates new growth (process reverses when Bubble bursts and becomes an anti-Bubble). Valuations become absurd, Fraud widespread. Once a Bubble starts to burst it can NOT be Re-Inflated for many years, sometimes never again. ...

Chapter 17 Instructor`s Manual

... collecting their accounts receivable. Business finance companies finance business loan needs in general. Leasing companies purchase equipment needed by their customers and lease it to their customers. 2. How do finance companies fund their operations? Solution: Most have lines of credit at commercia ...

... collecting their accounts receivable. Business finance companies finance business loan needs in general. Leasing companies purchase equipment needed by their customers and lease it to their customers. 2. How do finance companies fund their operations? Solution: Most have lines of credit at commercia ...

Glossary-to-financial-market-statistics

... Subordinated debentures are a kind of interest bearing convertible debt with a period of many years, issued by banks, industrial corporations and housing credit institutions. The subordinated debenture certifies that the holders have lent money without any specific security. Debenture loans are a lo ...

... Subordinated debentures are a kind of interest bearing convertible debt with a period of many years, issued by banks, industrial corporations and housing credit institutions. The subordinated debenture certifies that the holders have lent money without any specific security. Debenture loans are a lo ...

When Banks Won`t Lend, There Are Alternatives, Though Often

... Some creative alternatives have been around forever; others emerged during the crisis. Almost all are substantially more expensive than traditional bank loans, which is why they have been sources of last resort. But as demand for alternative options has increased, some prices have come down. This gu ...

... Some creative alternatives have been around forever; others emerged during the crisis. Almost all are substantially more expensive than traditional bank loans, which is why they have been sources of last resort. But as demand for alternative options has increased, some prices have come down. This gu ...

Lesotho: Launching of the Maseru Securities Market On the 22nd

... suffocate market development. The MSM is a registered legal entity, and, in common with international practice, a philosophy of self-regulation by the markets will be adopted.. Thirdly the institutional framework was put in place. This simply means establishing the MSM as a legally registered instit ...

... suffocate market development. The MSM is a registered legal entity, and, in common with international practice, a philosophy of self-regulation by the markets will be adopted.. Thirdly the institutional framework was put in place. This simply means establishing the MSM as a legally registered instit ...

Total financial assets

... Financial crisis in 2008 was mostly unforeseen Do not explaing today what happened yesterday ...

... Financial crisis in 2008 was mostly unforeseen Do not explaing today what happened yesterday ...

Prudential Short Duration High Yield Income Fund

... have sales charges and may be available to group retirement plans and institutional investors through certain retirement, mutual fund wrap, and asset allocation programs and to institutions at an investment minimum of $5,000,000 ...

... have sales charges and may be available to group retirement plans and institutional investors through certain retirement, mutual fund wrap, and asset allocation programs and to institutions at an investment minimum of $5,000,000 ...