Funding for Traditional Finnish Whole Log homes There are several

... There are several ways to purchase a property of this construction, depending upon what your intended use is for it. These can vary from domestic mortgages to commercial mortgages. One of the easier ways though is through a high street bank that allows wooden frame construction properties. This bank ...

... There are several ways to purchase a property of this construction, depending upon what your intended use is for it. These can vary from domestic mortgages to commercial mortgages. One of the easier ways though is through a high street bank that allows wooden frame construction properties. This bank ...

global fixed income core plus bond

... opportunistically, as market conditions warrant, to potentially enhance excess returns over a full market cycle. ...

... opportunistically, as market conditions warrant, to potentially enhance excess returns over a full market cycle. ...

TopicsInAnalysis

... What’s a theoretical construct? (c) The “financial principle of relativity” – laws must be valid whatever the numeraire FIRST TOPIC: TIME VALUE OF MONEY 2. Government Bonds – time dimension, but no uncertainty Why would anyone want to own a government bond? (To receive guaranteed payments of money a ...

... What’s a theoretical construct? (c) The “financial principle of relativity” – laws must be valid whatever the numeraire FIRST TOPIC: TIME VALUE OF MONEY 2. Government Bonds – time dimension, but no uncertainty Why would anyone want to own a government bond? (To receive guaranteed payments of money a ...

It Was the Best of Times, It Was the Worst of Times…

... end and barely above 3 percent for 10-year treasuries? All this and more has happened in little more than the proverbial blink of an eye. Against this background, I think about the financial situations of many of the banks in this country. While some celebrate the steepening of the yield curve and t ...

... end and barely above 3 percent for 10-year treasuries? All this and more has happened in little more than the proverbial blink of an eye. Against this background, I think about the financial situations of many of the banks in this country. While some celebrate the steepening of the yield curve and t ...

Comparing Different Asset Classes for Banking

... of choice due to the fact that it has the strongest guarantees for growth, death benefit, and premium commitment. That said, those guarantees come with the tradeoff of having less funding flexibility than you would with other asset classes since it requires at least some sort of minimum annual premi ...

... of choice due to the fact that it has the strongest guarantees for growth, death benefit, and premium commitment. That said, those guarantees come with the tradeoff of having less funding flexibility than you would with other asset classes since it requires at least some sort of minimum annual premi ...

indirect loans

... origination of the loan. Some credit unions prefer to compare the yield to the marginal cost of raising funds (e.g., a share certificate promotion) or alternative investment choices. A $400 fee to the dealer for a three percent four year $20,000 loan (2%) can be fairly costly representing 99bps for ...

... origination of the loan. Some credit unions prefer to compare the yield to the marginal cost of raising funds (e.g., a share certificate promotion) or alternative investment choices. A $400 fee to the dealer for a three percent four year $20,000 loan (2%) can be fairly costly representing 99bps for ...

Cash and Marketable Securities

... Global Company in the Czech Republic and Slovak Republic-Case of McDonald Financial Markets in the Czech Republic and their Regulation in the Context of Global Crisis Microsoft Business Activities in the Czech Republic Public Finance/ Health Care Sector in CR The Financial Aspects of doing Business ...

... Global Company in the Czech Republic and Slovak Republic-Case of McDonald Financial Markets in the Czech Republic and their Regulation in the Context of Global Crisis Microsoft Business Activities in the Czech Republic Public Finance/ Health Care Sector in CR The Financial Aspects of doing Business ...

Chapter 12

... – 75% of investment goes through banks – State-owned enterprises (48% of GDP) receive 73% of credit – Need to use banks less. ...

... – 75% of investment goes through banks – State-owned enterprises (48% of GDP) receive 73% of credit – Need to use banks less. ...

File

... an item for later purchase. Revolving debt: Debt owed on an account that the borrower can repeatedly use and pay back without having to reapply every time credit is used. Credit cards are the most common type of revolving account. ...

... an item for later purchase. Revolving debt: Debt owed on an account that the borrower can repeatedly use and pay back without having to reapply every time credit is used. Credit cards are the most common type of revolving account. ...

Canadian Fixed Income 2017 Outlook

... Credit spreads tightened considerably in the latter half of 2016, a trend supported in part by a lack of new supply from Canadian issuers and by demand from international investors. These investors, especially in regions with negative yields, have shifted allocations toward positiveyielding “safe ha ...

... Credit spreads tightened considerably in the latter half of 2016, a trend supported in part by a lack of new supply from Canadian issuers and by demand from international investors. These investors, especially in regions with negative yields, have shifted allocations toward positiveyielding “safe ha ...

Repricings May Increase in Volatile Market

... agreement became effective, a prepayment penalty may be required. Typically, prepayments in credit agreements are 1 percent of the prepaid loans for the first six or 12 months after the agreement became effective. They are usually structured as “soft call” penalties that are payable only if the all- ...

... agreement became effective, a prepayment penalty may be required. Typically, prepayments in credit agreements are 1 percent of the prepaid loans for the first six or 12 months after the agreement became effective. They are usually structured as “soft call” penalties that are payable only if the all- ...

Alternative ways of SME financing and a credit risk appropriate

... Loans from banks and financing via business (trade receivables) Financing via banking loans, not as one company loan, but as a credit for the group companies bounded by mutual guarantees. Typical representative of this approach is European Association of Mutual Guarantee Societies (AECM). For exampl ...

... Loans from banks and financing via business (trade receivables) Financing via banking loans, not as one company loan, but as a credit for the group companies bounded by mutual guarantees. Typical representative of this approach is European Association of Mutual Guarantee Societies (AECM). For exampl ...

Disruption in the Capital Markets: What Happened? Joseph P. Forte

... their transactions. The purchaser’s acquisition financing must be in place before the merger process proceeds with the seller. Many of the commitments had CMBS financing components. Over the last several months, the $330 Billion in outstanding leverage finance commitments held by the banks have begu ...

... their transactions. The purchaser’s acquisition financing must be in place before the merger process proceeds with the seller. Many of the commitments had CMBS financing components. Over the last several months, the $330 Billion in outstanding leverage finance commitments held by the banks have begu ...

Buying a home

... Issues to Consider The drop in first-timers could lead to pressure for more incentives to get people buying. Should housing lead the recovery or wait for the economy to start producing more jobs which will result in more financially confidant buyers? Are lenders overcorrecting to compensate for loo ...

... Issues to Consider The drop in first-timers could lead to pressure for more incentives to get people buying. Should housing lead the recovery or wait for the economy to start producing more jobs which will result in more financially confidant buyers? Are lenders overcorrecting to compensate for loo ...

Securities Purchase Ad

... may slip away due to insufficient fund in your investment account. ICBC (Asia) is pleased to introduce our new Securities Purchase Ad-hoc Facility. It allows you to grasp every investment opportunity for higher potential returns in the dynamic market. Operation Mechanism of the Service: In case of i ...

... may slip away due to insufficient fund in your investment account. ICBC (Asia) is pleased to introduce our new Securities Purchase Ad-hoc Facility. It allows you to grasp every investment opportunity for higher potential returns in the dynamic market. Operation Mechanism of the Service: In case of i ...

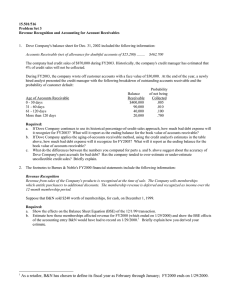

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

economic overview

... underlying securities, and the liquidity risk may be very high. Structured Investment Vehicles (SIVs) aka Conduits: A pool of investment assets that attempts to profit from credit spreads between short-term debt and long-term structured finance products such as asset-backed securities (ABS). Funding ...

... underlying securities, and the liquidity risk may be very high. Structured Investment Vehicles (SIVs) aka Conduits: A pool of investment assets that attempts to profit from credit spreads between short-term debt and long-term structured finance products such as asset-backed securities (ABS). Funding ...

Treasury Terminology

... etc.) are allowed to bought and sold by banks in India on a fully hedged basis. The option seller should be a bank abroad. USD/INR options are on the anvil. In the context of bonds, a call option gives the issuer the right to redeem the bonds before maturity. This will happen if interest rates have ...

... etc.) are allowed to bought and sold by banks in India on a fully hedged basis. The option seller should be a bank abroad. USD/INR options are on the anvil. In the context of bonds, a call option gives the issuer the right to redeem the bonds before maturity. This will happen if interest rates have ...