SEC amends Rule 2a-7 to eliminate dependency on NRSRO ratings

... security is an Eligible Security (not to mention, whether it is a First Tier or Second Tier security), money market funds will now be required to make a determination that a security presents minimal credit risks based on analysis of the capacity of the security’s issuer or guarantor to meet its fin ...

... security is an Eligible Security (not to mention, whether it is a First Tier or Second Tier security), money market funds will now be required to make a determination that a security presents minimal credit risks based on analysis of the capacity of the security’s issuer or guarantor to meet its fin ...

American Funds Bond Fund

... Variable life and annuity products are offered by prospectus only. Prospectuses for variable products issued by a MetLife insurance company, and for the investment portfolios offered thereunder, are available from your financial professional. The contract prospectus contains information about the co ...

... Variable life and annuity products are offered by prospectus only. Prospectuses for variable products issued by a MetLife insurance company, and for the investment portfolios offered thereunder, are available from your financial professional. The contract prospectus contains information about the co ...

Slides

... • Provide housing finance to people with some combination of spotty credit histories, a lack of income documentation, or no money for a down payment ...

... • Provide housing finance to people with some combination of spotty credit histories, a lack of income documentation, or no money for a down payment ...

risk periods and “extreme” market conditions

... One way to describe the distribution of the CDO asset spreads to the various liabilities is to use a Credit Correlation metric. (This metric is used through the Dealer community) ...

... One way to describe the distribution of the CDO asset spreads to the various liabilities is to use a Credit Correlation metric. (This metric is used through the Dealer community) ...

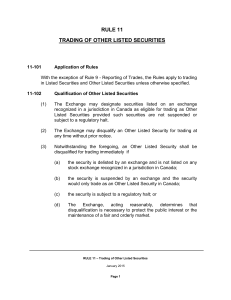

CSE RULE 11 – Trading of Other Listed Securities

... recognized in a jurisdiction in Canada as eligible for trading as Other Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

... recognized in a jurisdiction in Canada as eligible for trading as Other Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

4 - Cengage

... If the investor purchases between 20% and 50% of the outstanding stock of the investee, the investor is considered to have significant influence over the investee and the investment is accounted for using the equity method. ...

... If the investor purchases between 20% and 50% of the outstanding stock of the investee, the investor is considered to have significant influence over the investee and the investment is accounted for using the equity method. ...

Schroder Fixed Income Fund - Wholesale Class Fund Summary Overview

... (or starting point) portfolio, unencumbered by any predetermined benchmark allocations. We combine our medium term expectations of fixed income asset class risk and return with shorter term views on market valuation, cyclical developments and liquidity considerations, matched against the Fund’s obje ...

... (or starting point) portfolio, unencumbered by any predetermined benchmark allocations. We combine our medium term expectations of fixed income asset class risk and return with shorter term views on market valuation, cyclical developments and liquidity considerations, matched against the Fund’s obje ...

Fear and loathing of negative yielding debt: bond investor`s

... there are few good options left. Even in the U.S., long the destination of choice in times of stress, Treasuries are in such demand that when their cash flows are converted into euros, yields are even worse than the scant returns on German bunds. For euro-based buyers of 10-year Treasuries, swapping ...

... there are few good options left. Even in the U.S., long the destination of choice in times of stress, Treasuries are in such demand that when their cash flows are converted into euros, yields are even worse than the scant returns on German bunds. For euro-based buyers of 10-year Treasuries, swapping ...

Winter 2015 - RBC Wealth Management

... plants, equipment and labour. It could be financed by the record high levels of cash sitting on corporate balance sheets. These developments are good news for the next 10-20 years in my opinion. However this does not mean we can cease to be careful! I will remind everyone we have not seen a correcti ...

... plants, equipment and labour. It could be financed by the record high levels of cash sitting on corporate balance sheets. These developments are good news for the next 10-20 years in my opinion. However this does not mean we can cease to be careful! I will remind everyone we have not seen a correcti ...