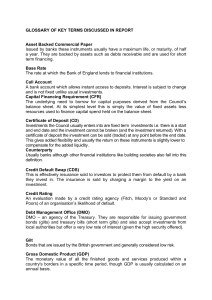

GLOSSARY OF KEY TERMS DISCUSSED IN

... Investments the Council usually enters into are fixed term investments i.e. there is a start and end date and the investment cannot be broken (and the investment returned). With a certificate of deposit the investment can be sold (traded) at any point before the end date. This gives added flexibilit ...

... Investments the Council usually enters into are fixed term investments i.e. there is a start and end date and the investment cannot be broken (and the investment returned). With a certificate of deposit the investment can be sold (traded) at any point before the end date. This gives added flexibilit ...

Total real assets

... • Venture Capital and Private Equity • Venture capital • Investment to finance new firm ...

... • Venture Capital and Private Equity • Venture capital • Investment to finance new firm ...

OFFICER`S CERTIFICATE TO: British Columbia Securities

... Affairs and Secretary of the Corporation and PNI, in such capacity and not in her personal capacity, certifies for and on behalf of the Corporation and PNI, that: ...

... Affairs and Secretary of the Corporation and PNI, in such capacity and not in her personal capacity, certifies for and on behalf of the Corporation and PNI, that: ...

Statement of Financial Position Form

... reached where any candidate beginning ordained ministry has been required to repay a government student loan taken out prior to ordination training. This is because the Student Loan Scheme, up until September 1998, stipulated that a loan need not be repaid in any year where a graduate’s income falls ...

... reached where any candidate beginning ordained ministry has been required to repay a government student loan taken out prior to ordination training. This is because the Student Loan Scheme, up until September 1998, stipulated that a loan need not be repaid in any year where a graduate’s income falls ...

Slide 1

... • Venture Capital and Private Equity • Venture capital • Investment to finance new firm ...

... • Venture Capital and Private Equity • Venture capital • Investment to finance new firm ...

PDF - EMM Wealth Management

... leak to borrowers that were previously seen as being too risky or to sectors of the economy that are already highly indebted while also allowing borrowers to negotiate more lenient terms (including greater leverage ratios) and looser covenants. Tighter spreads and a wider availability of capital dri ...

... leak to borrowers that were previously seen as being too risky or to sectors of the economy that are already highly indebted while also allowing borrowers to negotiate more lenient terms (including greater leverage ratios) and looser covenants. Tighter spreads and a wider availability of capital dri ...

Bild 1

... 25-maj 27-maj 29-maj 31-maj 02-jun 04-jun 06-jun 08-jun 10-jun 12-jun 14-jun 16-jun 18-jun ...

... 25-maj 27-maj 29-maj 31-maj 02-jun 04-jun 06-jun 08-jun 10-jun 12-jun 14-jun 16-jun 18-jun ...

- Grifols

... (410 MM euros). Demand from institutional investors, mainly from the US, exceeded 1,000 MM dollars. The funds raised will allow Grifols to restructure its debt from short term to long term, while securing the resources necessary for the group to boost its future plans, especially in R&D. Grifols is ...

... (410 MM euros). Demand from institutional investors, mainly from the US, exceeded 1,000 MM dollars. The funds raised will allow Grifols to restructure its debt from short term to long term, while securing the resources necessary for the group to boost its future plans, especially in R&D. Grifols is ...

Corporation

... • Certificate of deposit, promise by the bank to repay a certain amount plus interest with specific and for specific periods of time, that can be trade on the secondary market ...

... • Certificate of deposit, promise by the bank to repay a certain amount plus interest with specific and for specific periods of time, that can be trade on the secondary market ...

Proposed Risk-Based Capital Rule For Credit Unions

... • Cash equivalents (investments with original maturities of three months or less). Cash equivalents are short-term, highly liquid non non-security security investments that have an original maturity of 3 months or less at the time of purchase, are readily convertible to known amounts of cash, and ar ...

... • Cash equivalents (investments with original maturities of three months or less). Cash equivalents are short-term, highly liquid non non-security security investments that have an original maturity of 3 months or less at the time of purchase, are readily convertible to known amounts of cash, and ar ...

Strong Demand for Muni Bonds Yields Pros, Cons

... demand, which is bidding up prices. Not only is the domestic desire for munis running hot, the presence of negative interest rates in developed Europe and Asia has escalated the amount of money flowing in from overseas banks, pension funds and other institutions. The not-so-good news? Bond issuance ...

... demand, which is bidding up prices. Not only is the domestic desire for munis running hot, the presence of negative interest rates in developed Europe and Asia has escalated the amount of money flowing in from overseas banks, pension funds and other institutions. The not-so-good news? Bond issuance ...