Bond Basics: Yield Curve Strategies. Craig Sullivan, CFA, CAIA

... lowest yields. This scenario is considered ‘normal’ because longer-term securities generally bear the greatest investment risks (inflation risk, reinvestment risk, price volatility, and while not a factor for US Treasuries – default risk and credit risk). As a result the longer the time to maturity, ...

... lowest yields. This scenario is considered ‘normal’ because longer-term securities generally bear the greatest investment risks (inflation risk, reinvestment risk, price volatility, and while not a factor for US Treasuries – default risk and credit risk). As a result the longer the time to maturity, ...

Research on Evaluation of Regional Innovation System Environmental Risk

... RIS development. At present, most technology innovation, especially that of high-tech industry, demand a great deal of funds devotion, although the innovation cooperator can share the high expenses which R&D needs, it is still necessary to depend on exterior funds to a large extent, such as the risk ...

... RIS development. At present, most technology innovation, especially that of high-tech industry, demand a great deal of funds devotion, although the innovation cooperator can share the high expenses which R&D needs, it is still necessary to depend on exterior funds to a large extent, such as the risk ...

Transparency, Financial Accounting Information, and Corporate

... economic outcomes. At the heart of theories connecting a welldeveloped financial sector with enhanced resource allocation and growth is the role of the financial sector in reducing information costs and transaction costs.4 Despite the central role of information costs in these theories, until recent ...

... economic outcomes. At the heart of theories connecting a welldeveloped financial sector with enhanced resource allocation and growth is the role of the financial sector in reducing information costs and transaction costs.4 Despite the central role of information costs in these theories, until recent ...

Master Budgeting

... 3. Motivation is generally higher when individuals participate in setting their own goals than when the goals are imposed from above. 4. A manager who is not able to meet a budget imposed from above can claim that it was unrealistic. Self-imposed budgets eliminate this excuse. ...

... 3. Motivation is generally higher when individuals participate in setting their own goals than when the goals are imposed from above. 4. A manager who is not able to meet a budget imposed from above can claim that it was unrealistic. Self-imposed budgets eliminate this excuse. ...

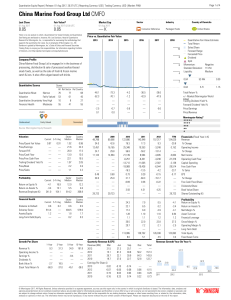

China Marine Food Group Ltd CMFO

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

NBER WORKING PAPER SERIES THE EQUITY PREMIUM IN RETROSPECT Rajnish Mehra

... More than two decades ago, we demonstrated that the equity premium (the return earned by a risky security in excess of that earned by a relatively risk-free T-bill), was an order of magnitude greater than could be rationalized in the context of the standard neoclassical paradigms of financial econom ...

... More than two decades ago, we demonstrated that the equity premium (the return earned by a risky security in excess of that earned by a relatively risk-free T-bill), was an order of magnitude greater than could be rationalized in the context of the standard neoclassical paradigms of financial econom ...

The securities described in this prospectus are offered

... As a result of the temporary maintenance of the 20% tax credit applicable against Québec income tax upon the purchase of Fondaction shares (see subsection 6.1 “Tax credits”), for the fiscal years ending May 31, 2017 and May 31, 2018, a limit has been imposed on the capital that Fondaction may raise ...

... As a result of the temporary maintenance of the 20% tax credit applicable against Québec income tax upon the purchase of Fondaction shares (see subsection 6.1 “Tax credits”), for the fiscal years ending May 31, 2017 and May 31, 2018, a limit has been imposed on the capital that Fondaction may raise ...

The Use of Financial Accounts in Assessing Financial Stability[1]

... stability analysis Several methodological differences between financial accounts and indicators underlying financial stability analysis have to be taken into account when using both data sets in parallel for the assessment of financial stability.9 Specifically, it has to taken into account which und ...

... stability analysis Several methodological differences between financial accounts and indicators underlying financial stability analysis have to be taken into account when using both data sets in parallel for the assessment of financial stability.9 Specifically, it has to taken into account which und ...

Diversification Bias

... • One study examined employee behavior in the retirement saving plans of 170 companies • It found that the more stock mutual funds a plan offered, the greater was the percentage of employees’ money that was invested in stocks ...

... • One study examined employee behavior in the retirement saving plans of 170 companies • It found that the more stock mutual funds a plan offered, the greater was the percentage of employees’ money that was invested in stocks ...

Investing in CLOs - CION Investments

... suddenly the most significant constraint on their ability to invest… at which point it was almost too late to do anything about it. Few managers, even those with better foresight, could articulate a strategy for managing around this constraint. Those ...

... suddenly the most significant constraint on their ability to invest… at which point it was almost too late to do anything about it. Few managers, even those with better foresight, could articulate a strategy for managing around this constraint. Those ...

Adverse Selection, Liquidity, and Market Breakdown

... when both types coexist. In this case, the equilibrium type depends on the investors’beliefs about quality of assets sold in the market. The private information about asset quality may be welfare bene…cial if adverse selection does not lead to the market breakdown. The ability to trade based on priv ...

... when both types coexist. In this case, the equilibrium type depends on the investors’beliefs about quality of assets sold in the market. The private information about asset quality may be welfare bene…cial if adverse selection does not lead to the market breakdown. The ability to trade based on priv ...

Two investment solutions for CTL forestry machines

... of the problem background, which the problem formulation is then based on. From the problem originates the aim at this study is defined. ...

... of the problem background, which the problem formulation is then based on. From the problem originates the aim at this study is defined. ...

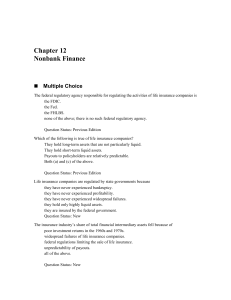

1) When those most likely to produce the outcome insured against

... Question Status: New The key factor causing life insurance companies to move into the management of pension funds was the investment expertise of insurance companies. a request for this change by managers of pension funds. a change in state laws. a change in federal legislation. all of the above. Qu ...

... Question Status: New The key factor causing life insurance companies to move into the management of pension funds was the investment expertise of insurance companies. a request for this change by managers of pension funds. a change in state laws. a change in federal legislation. all of the above. Qu ...

2003fe15 - General Guide To Personal and Societies Web

... It looks as if at the beginning of the 20th century, Britain like most other countries was dominated by powerful families. They may have been incompetent but at least they were there and presumably their extinction was a consequence of their incompetence. According to this view, the origins of the B ...

... It looks as if at the beginning of the 20th century, Britain like most other countries was dominated by powerful families. They may have been incompetent but at least they were there and presumably their extinction was a consequence of their incompetence. According to this view, the origins of the B ...

BSTDB: Navigating Through Uncertainty in the Black Sea Region

... 2008, whereas in the Eurozone (and much of the rest of the non-Eurozone EU) it is still below pre-crisis levels. The US stabilized its financial system and restored functionality after the financial panic. Economic output recovered from the crisis more robustly via a combination of ‘stimulative’ fis ...

... 2008, whereas in the Eurozone (and much of the rest of the non-Eurozone EU) it is still below pre-crisis levels. The US stabilized its financial system and restored functionality after the financial panic. Economic output recovered from the crisis more robustly via a combination of ‘stimulative’ fis ...

Strategic Management-An Introduction [ppt]

... Strategic Management is all about identification and description of the strategies that managers can carry so as to achieve better performance and a competitive advantage for their organization. An organization is said to have competitive advantage if its profitability is higher than the average pro ...

... Strategic Management is all about identification and description of the strategies that managers can carry so as to achieve better performance and a competitive advantage for their organization. An organization is said to have competitive advantage if its profitability is higher than the average pro ...

Labor Studies/Latin/Latin American Studies/Liberal Studies

... 3 credit hours. Prerequisite: MGT 301 and MATH 248. Offered spring. ...

... 3 credit hours. Prerequisite: MGT 301 and MATH 248. Offered spring. ...

fao investment centre

... In addition, this study emphasizes several new elements in support of a deeper understanding of this emerging asset class. Firstly, it provides a comprehensive overview of private equity fund investments today in large-scale primary agriculture in the selected countries within the EBRD region. Secon ...

... In addition, this study emphasizes several new elements in support of a deeper understanding of this emerging asset class. Firstly, it provides a comprehensive overview of private equity fund investments today in large-scale primary agriculture in the selected countries within the EBRD region. Secon ...

Does direct foreign investment affect domestic firms

... This same study states that because of low domestic interest rates, foreign firms preferred to keep excess liquidity offshore. And, as a result, the government borrowed heavily abroad to capitalize local banks. ...

... This same study states that because of low domestic interest rates, foreign firms preferred to keep excess liquidity offshore. And, as a result, the government borrowed heavily abroad to capitalize local banks. ...

Political Connections, Financial Crisis and Firm`s Value

... severe corruption and incomplete legal institutions. When one of the company senior management steps into political cycles, the firm’s stock can get positive abnormal return. Fisman (2001) focused on the close relationship between President Suharto and Indonesian listed companies. When the news abou ...

... severe corruption and incomplete legal institutions. When one of the company senior management steps into political cycles, the firm’s stock can get positive abnormal return. Fisman (2001) focused on the close relationship between President Suharto and Indonesian listed companies. When the news abou ...

Game Management Annual Report 2015-16

... sectors. Wendy is also currently Chair of the Murray Regional Tourism Board, a unique cross border partnership of two state governments and 13 local government authorities. She has previously held various government and private directorships including Chair of the Australian Institute of Management, ...

... sectors. Wendy is also currently Chair of the Murray Regional Tourism Board, a unique cross border partnership of two state governments and 13 local government authorities. She has previously held various government and private directorships including Chair of the Australian Institute of Management, ...

Dividend Policy as a Signaling Mechanism Under Different Market

... Gompers et al. (2003) document superior stock price performance of firms with lower agency problems relative to firms with higher agency problems. In this paper, we aim to study whether the arguments put forward in the prior literature regarding the signaling value of dividend policy hold across di ...

... Gompers et al. (2003) document superior stock price performance of firms with lower agency problems relative to firms with higher agency problems. In this paper, we aim to study whether the arguments put forward in the prior literature regarding the signaling value of dividend policy hold across di ...

- Covenant University Repository

... many" and serves as one of the silent prerequisites of any free and efficient market. It is also known as "full disclosure" and helps to prevent corruption that inevitably occurs when a select few have access to important information, allowing them to use it for personal gain. It simply means the d ...

... many" and serves as one of the silent prerequisites of any free and efficient market. It is also known as "full disclosure" and helps to prevent corruption that inevitably occurs when a select few have access to important information, allowing them to use it for personal gain. It simply means the d ...

P a g e 1

... And everyone knows that the "less significant" institutions can indeed be significant for the stability of the banking system - not individually, but collectively as associations of savings banks and cooperative banks. That is particularly true when you consider that many small and medium-sized inst ...

... And everyone knows that the "less significant" institutions can indeed be significant for the stability of the banking system - not individually, but collectively as associations of savings banks and cooperative banks. That is particularly true when you consider that many small and medium-sized inst ...

![The Use of Financial Accounts in Assessing Financial Stability[1]](http://s1.studyres.com/store/data/021047713_1-aafed391479db698c5f5ae679c369a1e-300x300.png)

![Strategic Management-An Introduction [ppt]](http://s1.studyres.com/store/data/002368178_1-4d6f847ca530194c6f58dbc984404e70-300x300.png)