NBER WORKING PAPER SERIES IRREVERSIBLE INVESTMENT, CAPITAL COSTS AND PRODUCTIVITY GROWTH:

... Irreversible investment implies that a firm must incur substantial costs as it attempts to disinvest, and accordingly capital cannot be shed like many other inputs. If network investments were reversible a firm could readily disinvest when market conditions become unfavorable and thereby avoid the f ...

... Irreversible investment implies that a firm must incur substantial costs as it attempts to disinvest, and accordingly capital cannot be shed like many other inputs. If network investments were reversible a firm could readily disinvest when market conditions become unfavorable and thereby avoid the f ...

Article 46. Guaranteed Asset Protection Waivers. § 66

... Fiduciary Duty. – Funds received or held by a creditor or administrator and belonging to an insurer, creditor, or administrator, pursuant to the terms of a written agreement, shall be held by the creditor or administrator in a fiduciary capacity. (2013-193, s. 1.) ...

... Fiduciary Duty. – Funds received or held by a creditor or administrator and belonging to an insurer, creditor, or administrator, pursuant to the terms of a written agreement, shall be held by the creditor or administrator in a fiduciary capacity. (2013-193, s. 1.) ...

THE FINANCIAL SERVICES COMMISSION

... DETAILS OF APPLICANT’S/BENEFICIAL OWNER’S BUSINESS RECORD1 ...

... DETAILS OF APPLICANT’S/BENEFICIAL OWNER’S BUSINESS RECORD1 ...

Irwin/McGraw-Hill

... T3.6 Hermetic, Inc., Common-Size Balance Sheet (concluded) More on Standardized Statements Suppose we ask: “What happened to Hermetic’s net plant and equipment (NP&E) over the period?” 1. Based on the 1998 and 1999 B/S, NP&E rose from $985 to $1100, so NP&E rose by $115 (a use of cash). 2. If we st ...

... T3.6 Hermetic, Inc., Common-Size Balance Sheet (concluded) More on Standardized Statements Suppose we ask: “What happened to Hermetic’s net plant and equipment (NP&E) over the period?” 1. Based on the 1998 and 1999 B/S, NP&E rose from $985 to $1100, so NP&E rose by $115 (a use of cash). 2. If we st ...

The Relationship Between Competition and Innovation: How

... Innovation projects are by definition risky, complex, involve intangible assets and their outcome is realized in the long-run. As competition increases, firms’ profits decrease, so firms are less able to both self finance their innovation projects and have access to the necessary external funds due ...

... Innovation projects are by definition risky, complex, involve intangible assets and their outcome is realized in the long-run. As competition increases, firms’ profits decrease, so firms are less able to both self finance their innovation projects and have access to the necessary external funds due ...

Operating Leases

... Consequences for the lessee: 1. The lease asset is not reported on the balance sheet - net operating asset turnover (NOAT) is higher. 2. The lease liability is not reported on the balance sheet - financial leverage is improved. 3. Without analytical adjustments (see later section on capitalization o ...

... Consequences for the lessee: 1. The lease asset is not reported on the balance sheet - net operating asset turnover (NOAT) is higher. 2. The lease liability is not reported on the balance sheet - financial leverage is improved. 3. Without analytical adjustments (see later section on capitalization o ...

NBER WORKING PAPER SERIES CAPITAL FLOWS AND CONTROLS Ilan Goldfajn

... However, the combination of a few factors suggests a new trend. First, the floating exchange rate regime is providing more incentives for borrowers to better assess risk, in particular in the non-tradable sector. Second, exports are increasing in a magnitude not seen before, leading to a record low ...

... However, the combination of a few factors suggests a new trend. First, the floating exchange rate regime is providing more incentives for borrowers to better assess risk, in particular in the non-tradable sector. Second, exports are increasing in a magnitude not seen before, leading to a record low ...

Choosing Not to Choose - The Australia Institute

... that consumers are interested in and able to make sensible decisions about their retirement. Compulsion, on the other hand, assumes that most individuals need help to save adequately for retirement. What has been missing is a set of policy arrangements that promote the interests of disengaged consum ...

... that consumers are interested in and able to make sensible decisions about their retirement. Compulsion, on the other hand, assumes that most individuals need help to save adequately for retirement. What has been missing is a set of policy arrangements that promote the interests of disengaged consum ...

Corporate Social Responsibility, Noise, and Stock Market Volatility

... stock’s actual price equals its fundamental value, which is defined as the discounted sum of expected future cash flows. This efficient market hypothesis suggests that rational utility-maximizing investors consider all publicly available information2 about a firm’s actions (including CSR and its imp ...

... stock’s actual price equals its fundamental value, which is defined as the discounted sum of expected future cash flows. This efficient market hypothesis suggests that rational utility-maximizing investors consider all publicly available information2 about a firm’s actions (including CSR and its imp ...

1 - Review of Management and Economic Engineering

... not a safe place by identifying the main Internet frauds. No matter what means for protecting against hackers we take, they will find new ways to steal both information and money, which is why we will also bring in consideration some means to protect ourselves against these threats. Key words: cyber ...

... not a safe place by identifying the main Internet frauds. No matter what means for protecting against hackers we take, they will find new ways to steal both information and money, which is why we will also bring in consideration some means to protect ourselves against these threats. Key words: cyber ...

esma_ce_g_aifmd__afme_replyform

... or may even cause them to avoid providing custody services altogether in certain jurisdictions because there may be no adequate commercial rationale for building the necessary infrastructure. The likely result is that AIFs that use prime brokers will face a significantly reduced choice of (i) deposi ...

... or may even cause them to avoid providing custody services altogether in certain jurisdictions because there may be no adequate commercial rationale for building the necessary infrastructure. The likely result is that AIFs that use prime brokers will face a significantly reduced choice of (i) deposi ...

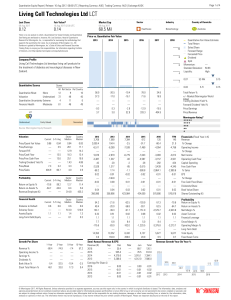

Living Cell Technologies Ltd LCT

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

Financially distressed firms are more likely to issue equity

... flexible to very strict target leverage (Graham & Harvey, 2001). This is in favor of the tradeoff theory. One study was done on small to medium sized companies, both investigating pecking order and trade-off theory. While the theory is that for these types of companies information asymmetry should b ...

... flexible to very strict target leverage (Graham & Harvey, 2001). This is in favor of the tradeoff theory. One study was done on small to medium sized companies, both investigating pecking order and trade-off theory. While the theory is that for these types of companies information asymmetry should b ...

2 amended and restated private placement

... California corporation. In 2013 the managing entity, Rubicon Management LLC, was converted via California state law from a limited liability company to a corporation and its name was changed to Rubicon Realty Advisors, Inc. The Fund will engage in business as a mortgage lender for the purpose of mak ...

... California corporation. In 2013 the managing entity, Rubicon Management LLC, was converted via California state law from a limited liability company to a corporation and its name was changed to Rubicon Realty Advisors, Inc. The Fund will engage in business as a mortgage lender for the purpose of mak ...

BUSINESS MODELS FOR COMPETITIVE

... The second paper, “Business Models for Competitive Success in the U.S. Textile Industry”, is an attempt to guide firms in their quest for financial success by addressing the question, How do we get there? In his textbook on strategic management, Lester Digman observes, “Stripped of its complexities ...

... The second paper, “Business Models for Competitive Success in the U.S. Textile Industry”, is an attempt to guide firms in their quest for financial success by addressing the question, How do we get there? In his textbook on strategic management, Lester Digman observes, “Stripped of its complexities ...

Managerial Accounting, Canadian Edition

... Business scandals cause massive investment losses and employee layoffs ...

... Business scandals cause massive investment losses and employee layoffs ...

Building a Holistic Capital Management Framework

... balance sheet to support those risks and stay solvent. Since ECap incorporates not just a bank’s capital position but also the underlying risk, it is a very useful tool for capital management. ...

... balance sheet to support those risks and stay solvent. Since ECap incorporates not just a bank’s capital position but also the underlying risk, it is a very useful tool for capital management. ...

Managed Futures: Portfolio Diversification Opportunities

... A portfolio that includes managed futures, historically, would have provided higher returns and lower risk than one without managed futures at all. In this Efficient Frontier example, the addition of managed futures to the typical stock and bond portfolio increases the annual rate of return, while l ...

... A portfolio that includes managed futures, historically, would have provided higher returns and lower risk than one without managed futures at all. In this Efficient Frontier example, the addition of managed futures to the typical stock and bond portfolio increases the annual rate of return, while l ...

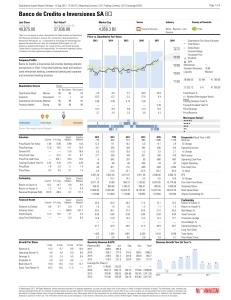

Banco de Credito e Inversiones SA BCI

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...