Private banking

... are offered by banks to their top clients in exchange for a commission or a fixed tax (monthly or yearly), depending on each bank’s strategy. The accumulation of wealth has prompted the development of private banking services for high net worth individuals, offering special relationships and investm ...

... are offered by banks to their top clients in exchange for a commission or a fixed tax (monthly or yearly), depending on each bank’s strategy. The accumulation of wealth has prompted the development of private banking services for high net worth individuals, offering special relationships and investm ...

Does Academic Research Destroy Stock Return Predictability?*

... show that the relative returns to high-momentum stocks increased after the publication of their 1993 paper, while Schwert (2003) argues that since the publication of the value and size effects, index funds based on these variables fail to generate alpha.2 In this paper, we synthesize information fro ...

... show that the relative returns to high-momentum stocks increased after the publication of their 1993 paper, while Schwert (2003) argues that since the publication of the value and size effects, index funds based on these variables fail to generate alpha.2 In this paper, we synthesize information fro ...

earnings management and dividend policy of small and medium

... and dividend yield (Adelegan, 2003; Farinha and Moreira, 2007). Additionally, there are several previous studies worldwide which focused on the influence of earnings management on dividend policy of listed companies; however, the results are still ambiguous. That is, earnings management was found to ...

... and dividend yield (Adelegan, 2003; Farinha and Moreira, 2007). Additionally, there are several previous studies worldwide which focused on the influence of earnings management on dividend policy of listed companies; however, the results are still ambiguous. That is, earnings management was found to ...

Volatility of an Impossible Object Risk, Fear, and Safety in Games of

... It is the Goldilocks bull market of fear. The data is just bad enough for monetary authorities to keep printing but not so bad as to usher in the next deflationary collapse. If the Fed follows through on its promise to buy MBS indefinitely they will own the entire market in a decade (2). In addition ...

... It is the Goldilocks bull market of fear. The data is just bad enough for monetary authorities to keep printing but not so bad as to usher in the next deflationary collapse. If the Fed follows through on its promise to buy MBS indefinitely they will own the entire market in a decade (2). In addition ...

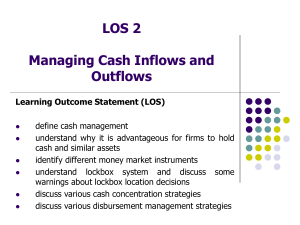

Managing Cash Inflows and Cash Outflows

... Expected return on investment opportunities. e.g. If expected returns are high, organizations should be quick to invest excess cash Transaction cost of withdrawing cash and making an investment. ...

... Expected return on investment opportunities. e.g. If expected returns are high, organizations should be quick to invest excess cash Transaction cost of withdrawing cash and making an investment. ...

PDF

... investments in building infrastructure, efforts to stimulate local entrepreneurship, or strengthening existing business clusters. For the most part these decisions are framed as choices among certain outcomes. The ...

... investments in building infrastructure, efforts to stimulate local entrepreneurship, or strengthening existing business clusters. For the most part these decisions are framed as choices among certain outcomes. The ...

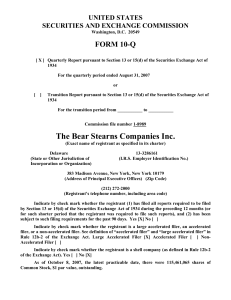

The Bear Stearns Companies Inc.

... Cash payments for interest were $8.25 billion and $5.61 billion during the nine months ended August 31, 2007 and 2006, respectively. Cash payments for income taxes, net of refunds, were $522.7 million and $592.4 million for the nine months ended August 31, 2007 and 2006, respectively. Cash payments ...

... Cash payments for interest were $8.25 billion and $5.61 billion during the nine months ended August 31, 2007 and 2006, respectively. Cash payments for income taxes, net of refunds, were $522.7 million and $592.4 million for the nine months ended August 31, 2007 and 2006, respectively. Cash payments ...

Overcoming Adverse Selection: How Public Intervention Can

... tar, Thomas Mariotti, and François Salanié (2009) show that the Akerlof outcome obtains under divisibility provided that relationships be non-exclusive. Eric S. Maskin and Jean Tirole (1992) characterize equilibria of the signaling (informed principal) version of Rothschild-Stiglitz models.6 The ...

... tar, Thomas Mariotti, and François Salanié (2009) show that the Akerlof outcome obtains under divisibility provided that relationships be non-exclusive. Eric S. Maskin and Jean Tirole (1992) characterize equilibria of the signaling (informed principal) version of Rothschild-Stiglitz models.6 The ...

an exploratory study of Italian listed state

... Since the State is effectively in control of the company, private shareholders are a minority (Argento et al. 2010). The major shareholder’s interest will at times be at odds with the minority’s. This, in Agency Theory, constitutes a Principal-Principal conflict. There exists also a risk of appropri ...

... Since the State is effectively in control of the company, private shareholders are a minority (Argento et al. 2010). The major shareholder’s interest will at times be at odds with the minority’s. This, in Agency Theory, constitutes a Principal-Principal conflict. There exists also a risk of appropri ...

Measuring Investment Distortions When Risk-Averse

... correct model for a firm’s capital structure, having estimates of investment distortions that are not dependent on a firm’s capital structure being optimal is also a benefit of our approach. Further, in related work, Ju, Parrino, Poteshman, and Weisbach (2005) show that the optimal capital structure ...

... correct model for a firm’s capital structure, having estimates of investment distortions that are not dependent on a firm’s capital structure being optimal is also a benefit of our approach. Further, in related work, Ju, Parrino, Poteshman, and Weisbach (2005) show that the optimal capital structure ...

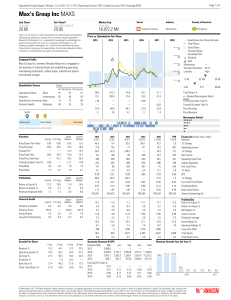

Max`s Group Inc MAXS

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

the use of innovative financial instruments for financing eu policies

... components attract financiers. InFIs can only be used for projects with significant European added value, where the internal rate of return (IRR) is either close to positive, or positive but not high enough to attract financiers because of market failures, long maturities or other barriers that can ...

... components attract financiers. InFIs can only be used for projects with significant European added value, where the internal rate of return (IRR) is either close to positive, or positive but not high enough to attract financiers because of market failures, long maturities or other barriers that can ...

Document

... expect from her investment next year assuming all else remains the same as in the past? • The geometric average answers the question, what rate of return Mary can expect over a five-year period? Copyright © 2011 Pearson Prentice Hall. All rights reserved. ...

... expect from her investment next year assuming all else remains the same as in the past? • The geometric average answers the question, what rate of return Mary can expect over a five-year period? Copyright © 2011 Pearson Prentice Hall. All rights reserved. ...

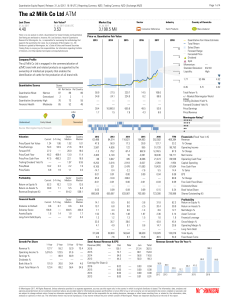

The a2 Milk Co Ltd ATM

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

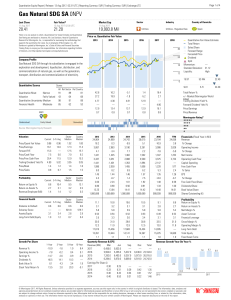

Gas Natural SDG SA 0NPV

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

risk adjusted performance measures

... 1998; Zaik et al., 1996). This is an important concept in the efficient allocation of capital where there are competing priorities. Firms that make business decisions without explicitly incorporating the opportunity cost of capital will be inefficient users of capital, engaging in investments that g ...

... 1998; Zaik et al., 1996). This is an important concept in the efficient allocation of capital where there are competing priorities. Firms that make business decisions without explicitly incorporating the opportunity cost of capital will be inefficient users of capital, engaging in investments that g ...

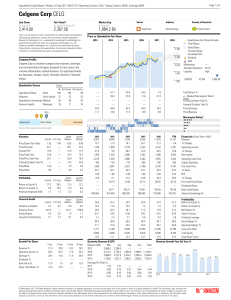

Celgene Corp CELG

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

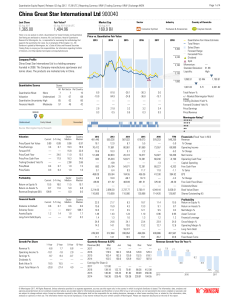

China Great Star International Ltd 900040

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

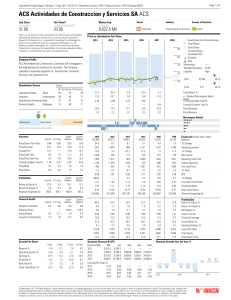

ACS Actividades de Construccion y Servicios SA ACS

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

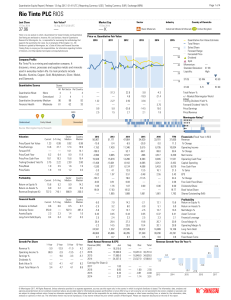

Rio Tinto PLC RIOS

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

USING DAILY STOCK RETURNS

... in daily excess returns and changes in their variance conditional on an event can sometimes be advantageous. In addition, tests ignoring cross-sectional dependence can be well-specified and have higher power than tests which account for potential dependence. ...

... in daily excess returns and changes in their variance conditional on an event can sometimes be advantageous. In addition, tests ignoring cross-sectional dependence can be well-specified and have higher power than tests which account for potential dependence. ...