Insurance Liabilities - International Actuarial Association

... readily ascertainable through a financial market. This is in contrast to publicly traded assets such as bonds and stocks. However various approaches can be taken to determine estimates of such values based on discounted cash flow (DCF) techniques. Such techniques are also used to determine the fair ...

... readily ascertainable through a financial market. This is in contrast to publicly traded assets such as bonds and stocks. However various approaches can be taken to determine estimates of such values based on discounted cash flow (DCF) techniques. Such techniques are also used to determine the fair ...

Growing the Social Investment Market: A vision and strategy

... commissioners, open-source planning controls, and our Community Organiser programme are all part of this. As part of our public service reform, we will break up public sector monopoly suppliers, encourage a wider diversity of providers, and give more choice and control to service users. The Work Pro ...

... commissioners, open-source planning controls, and our Community Organiser programme are all part of this. As part of our public service reform, we will break up public sector monopoly suppliers, encourage a wider diversity of providers, and give more choice and control to service users. The Work Pro ...

Chapter 6-Risk and Rates of Return

... Market related Risk - Risk due to overall market conditions Stock price is likely to rise if overall stock market is ...

... Market related Risk - Risk due to overall market conditions Stock price is likely to rise if overall stock market is ...

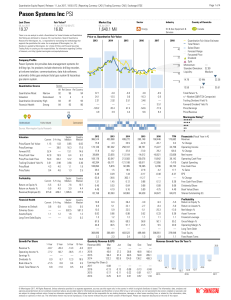

Pason Systems Inc PSI

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

PDF

... banking crisis and from the subsequent Black Death (1348), international financial linkages grew strong once again. The Catholic church, through its usury doctrine, unwittingly promoted the internationalization of banking in this period. While domestic loans for interest were prohibited, there was ...

... banking crisis and from the subsequent Black Death (1348), international financial linkages grew strong once again. The Catholic church, through its usury doctrine, unwittingly promoted the internationalization of banking in this period. While domestic loans for interest were prohibited, there was ...

Phase I Report - Task Force on Climate

... In most G20 jurisdictions, issuers have a legal obligation to disclose any material risk in their financial reports—which includes climate-related risks. The absence of a standardized framework for disclosing climate-related risks makes it difficult for preparers to determine what information should ...

... In most G20 jurisdictions, issuers have a legal obligation to disclose any material risk in their financial reports—which includes climate-related risks. The absence of a standardized framework for disclosing climate-related risks makes it difficult for preparers to determine what information should ...

1 THE DIVIDEND DEBATE: GROWTH VERSUS YIELD Introduction

... stocks, has nearly doubled.i Placing a greater level of emphasis on dividends is not unjustified in our opinion, as dividends are not only an important form of capital return but also theoretically underpin the value of all equities. However, are all dividend paying companies created equal? The answ ...

... stocks, has nearly doubled.i Placing a greater level of emphasis on dividends is not unjustified in our opinion, as dividends are not only an important form of capital return but also theoretically underpin the value of all equities. However, are all dividend paying companies created equal? The answ ...

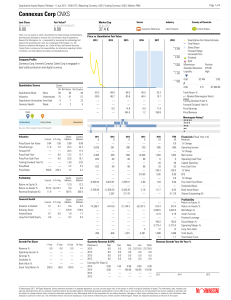

Connexus Corp CNXS

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

Special Edition Bond Series `Autopilot` (Issue 5)

... of 50 European blue-chip stocks from those countries participating in the EMU. The index includes shares such as Banco Santander, Daimler Chrysler, L’Oreal, Nokia, Siemens and Total. ...

... of 50 European blue-chip stocks from those countries participating in the EMU. The index includes shares such as Banco Santander, Daimler Chrysler, L’Oreal, Nokia, Siemens and Total. ...

Structured Bonds and Greek Demons Is the attack

... confusion to the investment community especially when criticisms have to do with the opaqueness of the securitized products with the failure of the rating agencies to reflect the potential risks of various tranches in their rating assessments, and with their level of complexity that makes them inapp ...

... confusion to the investment community especially when criticisms have to do with the opaqueness of the securitized products with the failure of the rating agencies to reflect the potential risks of various tranches in their rating assessments, and with their level of complexity that makes them inapp ...

7. Which of the following statements regarding money

... The par value of common stock is usually $100. The market value of common stock is equal to its book value. Dividends on common stock are at the discretion of the company. All of the above are true. ...

... The par value of common stock is usually $100. The market value of common stock is equal to its book value. Dividends on common stock are at the discretion of the company. All of the above are true. ...

COVENTRY GROUP LTD ANNUAL REPORT

... include gains from the ‘one time’ sale of properties used in the automotive business. Without these gains the profit before tax in the period was $7.4 million ($10.3 million in the prior comparative period). This reduction in profit was, in part, due to a series of macro-economic factors, including: ...

... include gains from the ‘one time’ sale of properties used in the automotive business. Without these gains the profit before tax in the period was $7.4 million ($10.3 million in the prior comparative period). This reduction in profit was, in part, due to a series of macro-economic factors, including: ...

accounting ratios

... Return on Capital Employed or Return on Investment judges the overall performance of the enterprise. It measures how efficiently the sources entrusted to the business are being used. The return on capital employed is a fair measure of the profitability of any concern. This ratio also helps in judgin ...

... Return on Capital Employed or Return on Investment judges the overall performance of the enterprise. It measures how efficiently the sources entrusted to the business are being used. The return on capital employed is a fair measure of the profitability of any concern. This ratio also helps in judgin ...

Sec 0 Cover - 2 Title TOC Tabs Etc.XLS

... The Board of County Commissioners Mike Shalati, County Manager Citizens of Union County, North Carolina Laws of the State of North Carolina, along with policies and procedures of the North Carolina Local Government Commission, require that all local governments in the State publish a complete set of ...

... The Board of County Commissioners Mike Shalati, County Manager Citizens of Union County, North Carolina Laws of the State of North Carolina, along with policies and procedures of the North Carolina Local Government Commission, require that all local governments in the State publish a complete set of ...

Evaluating Sustainable Competitive Advantages: Entry and Exit

... Markets and High Quality Stocks in Emerging Markets, we showed that high-quality stocks generate superior investment returns with lower risk compared to their benchmark indexes. While both papers laid out a quantitative framework for identifying high-quality businesses, the optimal investment select ...

... Markets and High Quality Stocks in Emerging Markets, we showed that high-quality stocks generate superior investment returns with lower risk compared to their benchmark indexes. While both papers laid out a quantitative framework for identifying high-quality businesses, the optimal investment select ...

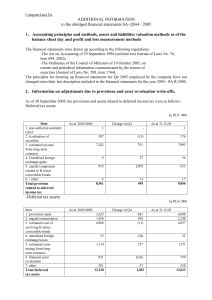

notes to - Sygnity

... -The Act on Accounting of 29 September 1994 (uniform text Journal of Laws No. 76, item 694, 2002); -The Ordinance of the Council of Ministers of 19 October 2005, on current and periodical information communicated by the issuers of securities (Journal of Laws No. 209, item 1744); The principles for d ...

... -The Act on Accounting of 29 September 1994 (uniform text Journal of Laws No. 76, item 694, 2002); -The Ordinance of the Council of Ministers of 19 October 2005, on current and periodical information communicated by the issuers of securities (Journal of Laws No. 209, item 1744); The principles for d ...

Foreign Direct Investment in an Emerging Market

... the host country, as playing an important role in the investment decision making process (Stobaugh 1969, Papadopoulos 1993, Wee, Lim. and Tan 1993, Root 1994). The majority of publications concerning FDI describes the investment in developed countries (i.e. USA, Western Europe), while very little is ...

... the host country, as playing an important role in the investment decision making process (Stobaugh 1969, Papadopoulos 1993, Wee, Lim. and Tan 1993, Root 1994). The majority of publications concerning FDI describes the investment in developed countries (i.e. USA, Western Europe), while very little is ...

Factors Influencing Chinese Firms` Decision Making in Foreign

... language and cultural diversity, general attitude towards foreigner and the overall position towards free enterprises. I stands for Internalization incentive advantage. It is another great advantage associated with FDI in terms of the ability to replace the external market relationship with one firm ...

... language and cultural diversity, general attitude towards foreigner and the overall position towards free enterprises. I stands for Internalization incentive advantage. It is another great advantage associated with FDI in terms of the ability to replace the external market relationship with one firm ...

Intergenerational Transfers and Public Policy [First Draft]

... For other intergenerational assets such as public goods or education, contract issues are paramount. Policies changing the levels of these assets can be categorized according to whether they are non-contractual because agents cannot contract or because contracts cannot be enforced, and whether they ...

... For other intergenerational assets such as public goods or education, contract issues are paramount. Policies changing the levels of these assets can be categorized according to whether they are non-contractual because agents cannot contract or because contracts cannot be enforced, and whether they ...

Is the Investment-Uncertainty Link Really Elusive?

... economists have to say and what most people’s intuition take for granted. Despite the recent convergence provided by the real options approach to investment, which highlights the harmful effects of uncertainty when investment is at least partially irreversible and can be postponed, the issue remains ...

... economists have to say and what most people’s intuition take for granted. Despite the recent convergence provided by the real options approach to investment, which highlights the harmful effects of uncertainty when investment is at least partially irreversible and can be postponed, the issue remains ...

Bright Directions 529 College Savings Program

... Before investing in the Bright Directions College Savings Program, you should consider carefully the following: 1. Depending on the laws of your home state or that of your designated beneficiary, favorable state tax treatment or other benefits offered by such home state for investing in 529 college ...

... Before investing in the Bright Directions College Savings Program, you should consider carefully the following: 1. Depending on the laws of your home state or that of your designated beneficiary, favorable state tax treatment or other benefits offered by such home state for investing in 529 college ...

![Intergenerational Transfers and Public Policy [First Draft]](http://s1.studyres.com/store/data/015306800_1-a59071eef6d38befec1a9b878c1d4840-300x300.png)