equity method of accounting

... • Be aware of how to account for equity investments • Be aware that investments in associates (defined as investees over which the investor has significant influence) must be accounted for by using the equity method of accounting, and know how to apply this method of accounting • Understand that if ...

... • Be aware of how to account for equity investments • Be aware that investments in associates (defined as investees over which the investor has significant influence) must be accounted for by using the equity method of accounting, and know how to apply this method of accounting • Understand that if ...

Foreign Direct Investment and Foreign Portfolio Investment

... shareholder faces the following well-known free-rider problem:if the shareholder does something to improve the quality of management, then the benefits will be enjoyed by all shareholders. Unless the shareholder is altruistic, she will ignore this beneficial effect on other shareholders and so will ...

... shareholder faces the following well-known free-rider problem:if the shareholder does something to improve the quality of management, then the benefits will be enjoyed by all shareholders. Unless the shareholder is altruistic, she will ignore this beneficial effect on other shareholders and so will ...

Uncertainty shocks, asset supply and pricing over the business cycle

... The operating cost captures reorganization in the corporate sector that redistributes resources away from shareholders. One example is expenses incurred in ”packaging” earnings in the form of individual firm payouts such as the cost of mergers, spin-offs or IPO’s, all of which can vary over time bec ...

... The operating cost captures reorganization in the corporate sector that redistributes resources away from shareholders. One example is expenses incurred in ”packaging” earnings in the form of individual firm payouts such as the cost of mergers, spin-offs or IPO’s, all of which can vary over time bec ...

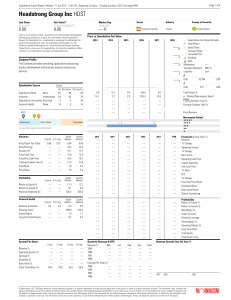

Headstrong Group Inc HDST

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

ACCA F9 Workbook Questions 1

... 2. What is the primary function of the stock market? 3. What are the advantages to the company of being listed? 4. Are there any disadvantages of being listed? 5. A company has 10m shares in issue at a share price of $7 and undertakes a rights issue of 1 for 5 to raise $12m. What is the Theoretical ...

... 2. What is the primary function of the stock market? 3. What are the advantages to the company of being listed? 4. Are there any disadvantages of being listed? 5. A company has 10m shares in issue at a share price of $7 and undertakes a rights issue of 1 for 5 to raise $12m. What is the Theoretical ...

2015-2016 - Plymouth Marine Laboratory

... (1) Results for the year Net expenditure for the year amounted to £175k (2015 net income £30k). It has been a challenging year due to the external funding environment, especially a hiatus in a principal source of funding (EU). As a result costs have been reduced, whilst still maintaining capability ...

... (1) Results for the year Net expenditure for the year amounted to £175k (2015 net income £30k). It has been a challenging year due to the external funding environment, especially a hiatus in a principal source of funding (EU). As a result costs have been reduced, whilst still maintaining capability ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... shocks (1973 and 1979). The current account deficit was also exacerbated by the increase in U.S. interest rates in 1979. The deficits were financed basically by syndicated loans, in the context of a large expansion of international financial market liquidity. The external financing and investments u ...

... shocks (1973 and 1979). The current account deficit was also exacerbated by the increase in U.S. interest rates in 1979. The deficits were financed basically by syndicated loans, in the context of a large expansion of international financial market liquidity. The external financing and investments u ...

The Variability of IPO Initial Returns

... • But the extreme persistence of IRs and volatility, given the characteristics of the offering, suggests that there are important aspects of uncertainty about the valuation of IPOs that are simply hard to predict – Suggests alternative methods for selling IPOs are worth considering – e.g., IPO auc ...

... • But the extreme persistence of IRs and volatility, given the characteristics of the offering, suggests that there are important aspects of uncertainty about the valuation of IPOs that are simply hard to predict – Suggests alternative methods for selling IPOs are worth considering – e.g., IPO auc ...

MSCI World High Dividend Yield Index

... For more than 40 years, MSCI' research-based indexes and analytics have helped the world' leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative res ...

... For more than 40 years, MSCI' research-based indexes and analytics have helped the world' leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative res ...

Internal control and audit

... Internal auditing is an independent appraisal function established within an organization which examines and evaluates its activities as a service to the organization. The objective of internal auditing is to assist the organization, in particular managers and members of the board of directors, to d ...

... Internal auditing is an independent appraisal function established within an organization which examines and evaluates its activities as a service to the organization. The objective of internal auditing is to assist the organization, in particular managers and members of the board of directors, to d ...

Banks bailout, time-consistency and distributional effects

... several redistributive channels: the bailout reduces the after tax wage of all agents, lowers the loss of either depositors or bankers or potentially both and a higher share of risky assets increases the total income of bankers. The redistributive impact of a bailout is thus subtle. We compare the ...

... several redistributive channels: the bailout reduces the after tax wage of all agents, lowers the loss of either depositors or bankers or potentially both and a higher share of risky assets increases the total income of bankers. The redistributive impact of a bailout is thus subtle. We compare the ...

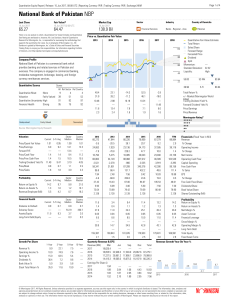

National Bank of Pakistan NBP

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

29 - San Francisco State University

... the organization in a unique way. Of these categories, environmental munificence (the environment’s capacity to accommodate firms) has particular relevance to organizational decline and turnaround (Arogyaswamy et al., 1995). It has long been acknowledged in the organizational ecology literature that ...

... the organization in a unique way. Of these categories, environmental munificence (the environment’s capacity to accommodate firms) has particular relevance to organizational decline and turnaround (Arogyaswamy et al., 1995). It has long been acknowledged in the organizational ecology literature that ...

investing for the future

... past, commentators and lobbyists have argued for some form of national bank in the UK to tackle each of these. There is a risk, however, that establishing an institution that aims, from the start, to tackle so many problems would result in failure on all fronts. This is particularly true for those p ...

... past, commentators and lobbyists have argued for some form of national bank in the UK to tackle each of these. There is a risk, however, that establishing an institution that aims, from the start, to tackle so many problems would result in failure on all fronts. This is particularly true for those p ...

International Financial Integration and Crisis Contagion ∗ Michael B. Devereux Changhua Yu

... focus mainly on perfect risk sharing for investors. Second, the mechanism is quite different. We study a channel of fire sales, in which both asset prices and quantities of assets adjust endogenously to exogenous shocks, while they focus only on the quantity adjustment of assets. Another related pa ...

... focus mainly on perfect risk sharing for investors. Second, the mechanism is quite different. We study a channel of fire sales, in which both asset prices and quantities of assets adjust endogenously to exogenous shocks, while they focus only on the quantity adjustment of assets. Another related pa ...

Financial facts - Great West Life

... The rate shown applies to policies issued on or after Sept. 16, 1968. These policies have a variable policy loan rate provision, whereas policies issued before this date have a fixed policy loan rate provision and may have a different dividend scale interest rate. The 60-year average annual dividend ...

... The rate shown applies to policies issued on or after Sept. 16, 1968. These policies have a variable policy loan rate provision, whereas policies issued before this date have a fixed policy loan rate provision and may have a different dividend scale interest rate. The 60-year average annual dividend ...

chapter 3 - Erasmus University Thesis Repository

... subdued during recessions while the more efficient acquirers earn higher merger profits during “merger waves” than outside of waves. There is a difference in the definition of an Acquisition and a Merger 1, but throughout our study we will treat both terms equivalently. And the most important reason ...

... subdued during recessions while the more efficient acquirers earn higher merger profits during “merger waves” than outside of waves. There is a difference in the definition of an Acquisition and a Merger 1, but throughout our study we will treat both terms equivalently. And the most important reason ...

Dynamic Correlation or Tail Dependence Hedging for Portfolio

... models (e.g. Bollerslev et al. (1988) or the principal component GARCH of Alexander (2002)), the parsimonious Dynamic Conditional Correlation model of Engle (2002), Engle and Sheppard (2001), and Tse and Tsui (2002), or alternatively the nonparametric model of range-based covariance obtained from in ...

... models (e.g. Bollerslev et al. (1988) or the principal component GARCH of Alexander (2002)), the parsimonious Dynamic Conditional Correlation model of Engle (2002), Engle and Sheppard (2001), and Tse and Tsui (2002), or alternatively the nonparametric model of range-based covariance obtained from in ...

The impact of the Credit Crunch on the Sterling Corporate Bond

... predominantly driven by cash flow (e.g. the need to invest proceeds, replace redeemed bonds, and pay out cash to the fund’s investors). While there is an element of speculative trading by these institutional investors, this does not represent their major investment objective. Generally bond markets ...

... predominantly driven by cash flow (e.g. the need to invest proceeds, replace redeemed bonds, and pay out cash to the fund’s investors). While there is an element of speculative trading by these institutional investors, this does not represent their major investment objective. Generally bond markets ...

Equity Management

... from the price paid for some thing or some service. The small amount is then retained as cooperative equity. This is most commonly used by marketing cooperatives where a small charge may be retained from the marketing of a unit of a certain commodity. ...

... from the price paid for some thing or some service. The small amount is then retained as cooperative equity. This is most commonly used by marketing cooperatives where a small charge may be retained from the marketing of a unit of a certain commodity. ...