Towards Efficient Benchmarks for Infrastructure Equity Investments

... of the physical assets is returned to the public sector at the end of the contract. This model is typically used to deliver social infrastructure projects like schools, hospitals or government building. • Commercial schemes, by which the public sector enters into the same contract with an investor b ...

... of the physical assets is returned to the public sector at the end of the contract. This model is typically used to deliver social infrastructure projects like schools, hospitals or government building. • Commercial schemes, by which the public sector enters into the same contract with an investor b ...

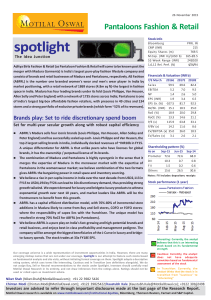

Information Trading

... the weakest links in financial markets –earnings reports that come from firms (where accounting games skew earnings)and analyst forecasts of these earnings (which are often biased). To the extent that analysts influence trades made by their clients, they are likely to affect prices when they revise ...

... the weakest links in financial markets –earnings reports that come from firms (where accounting games skew earnings)and analyst forecasts of these earnings (which are often biased). To the extent that analysts influence trades made by their clients, they are likely to affect prices when they revise ...

The Valuation of Collateralised Debt Obligations - DORAS

... largest borrowing firms in the market, many debt portfolio-based structured products have been created. For example, single-tranche collateralised debt obligations and rPto-default swaps are traded in huge volume. The theoretical framework necessary to underpin an analysis o f these products has bee ...

... largest borrowing firms in the market, many debt portfolio-based structured products have been created. For example, single-tranche collateralised debt obligations and rPto-default swaps are traded in huge volume. The theoretical framework necessary to underpin an analysis o f these products has bee ...

Chapter 02 Financial Assets, Money, Financial

... 97. There is a term missing from the identity shown below: Expenditures out of Current Income - Current Income Receipts = Change in Holdings of Debt and Equity During the Current Period - ____. Which of the terms shown below correctly completes the identity above? A. Change in holdings of real and f ...

... 97. There is a term missing from the identity shown below: Expenditures out of Current Income - Current Income Receipts = Change in Holdings of Debt and Equity During the Current Period - ____. Which of the terms shown below correctly completes the identity above? A. Change in holdings of real and f ...

ASPEN INSURANCE HOLDINGS LTD (Form: 8-K

... earnings call to be held on April 22, 2016, will be presented by the Chief Executive Officer, the Chief Financial Officer and other members of senior management to various investors throughout the second quarter of 2016. Safe Harbor for Forward-Looking Statements Some of the statements in Exhibit 99 ...

... earnings call to be held on April 22, 2016, will be presented by the Chief Executive Officer, the Chief Financial Officer and other members of senior management to various investors throughout the second quarter of 2016. Safe Harbor for Forward-Looking Statements Some of the statements in Exhibit 99 ...

Westpac Businesses of Tomorrow Report

... This report outlines what it takes to be a prosperous business in an ever-changing, competitive marketplace and why having prosperous businesses matters for Australia’s future. Businesses obviously play a critical role in the economy – satisfying consumer demands and generating profits for sharehold ...

... This report outlines what it takes to be a prosperous business in an ever-changing, competitive marketplace and why having prosperous businesses matters for Australia’s future. Businesses obviously play a critical role in the economy – satisfying consumer demands and generating profits for sharehold ...

Li, Yu Qiong

... IIROC is the national self-regulatory organization which oversees all investment dealers and their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficie ...

... IIROC is the national self-regulatory organization which oversees all investment dealers and their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficie ...

Presentation

... complicated, controls for cross boarder data views and use become more critical Clear responsibilities associated with data assets must be established which will be challenging in a cloud environment due to the transient nature of data processing. Establishing trust boundaries are key between user a ...

... complicated, controls for cross boarder data views and use become more critical Clear responsibilities associated with data assets must be established which will be challenging in a cloud environment due to the transient nature of data processing. Establishing trust boundaries are key between user a ...

The People`s Republic of China: 2016 Article IV Consultation

... consistent, well-coordinated, and clearly-communicated policies are key to a smooth, successful transition, which will eventually benefit the global economy. Directors highlighted the urgency of addressing the corporate debt problem through a comprehensive approach. They encouraged the authorities t ...

... consistent, well-coordinated, and clearly-communicated policies are key to a smooth, successful transition, which will eventually benefit the global economy. Directors highlighted the urgency of addressing the corporate debt problem through a comprehensive approach. They encouraged the authorities t ...

Do Shareholder Preferences Affect Corporate

... Harford, Jenter and Li (2007) document that cross-holdings by a firm’s shareholders affect its choice of takeover targets. In the most closely related study to this paper, Cronqvist and Fahlenbrach (2007) document the heterogeneity of blockholders in terms of the financial, investment, and executive ...

... Harford, Jenter and Li (2007) document that cross-holdings by a firm’s shareholders affect its choice of takeover targets. In the most closely related study to this paper, Cronqvist and Fahlenbrach (2007) document the heterogeneity of blockholders in terms of the financial, investment, and executive ...

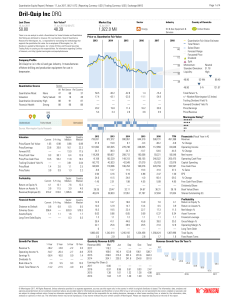

Dril-Quip Inc DRQ

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

Credit Suisse Global Investment Returns Yearbook 2013

... Bond returns were especially high. Over the 33 years since 1980, a period that exceeds the working lifetime of most of today’s investment professionals, world bonds (just) beat world equities. Past performance conditions our thinking and aspirations. Investors grew used to high returns. Equity inves ...

... Bond returns were especially high. Over the 33 years since 1980, a period that exceeds the working lifetime of most of today’s investment professionals, world bonds (just) beat world equities. Past performance conditions our thinking and aspirations. Investors grew used to high returns. Equity inves ...

1 this announcement is for information only and is not an offer to

... may be communicated to (1) persons who have professional experience in matters relating to investments, being investment professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); (2) persons who fall within Article 49(2)(a) ...

... may be communicated to (1) persons who have professional experience in matters relating to investments, being investment professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); (2) persons who fall within Article 49(2)(a) ...

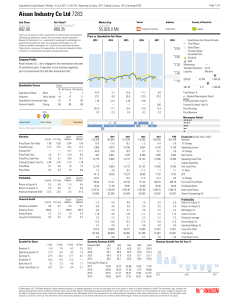

Aisan Industry Co Ltd 7283

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

BARCLAYS BANK PLC /ENG/ (Form: 424B2, Received: 12

... The payment of a Quarterly Contingent Payment on any Quarterly Contingent Payment Date will be dependent on the Closing Value of each Reference Asset on the related Valuation Date and the corresponding return of each Reference Asset as measured from that Valuation Date to the Initial Valuation Date. ...

... The payment of a Quarterly Contingent Payment on any Quarterly Contingent Payment Date will be dependent on the Closing Value of each Reference Asset on the related Valuation Date and the corresponding return of each Reference Asset as measured from that Valuation Date to the Initial Valuation Date. ...

Threat and Risk Assessments - RTF Version

... procedural controls; personnel controls; financial controls; technological controls; and development quality controls. ...

... procedural controls; personnel controls; financial controls; technological controls; and development quality controls. ...

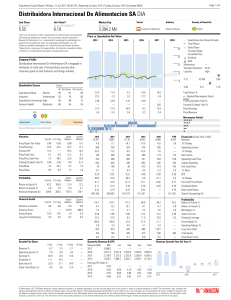

Distribuidora Internacional De Alimentacion SA DIA

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

On the Compatibility of Value at Risk, Other Risk Concepts, and

... • g has more weight in the tails than f, • g is equal to f plus noise. However, since these are partial orderings only, in a lot of cases these concepts of risk will not enable one to decide whether g is riskier, less risky or equally risky compared to f. Also, these concepts of risk only rank risk, ...

... • g has more weight in the tails than f, • g is equal to f plus noise. However, since these are partial orderings only, in a lot of cases these concepts of risk will not enable one to decide whether g is riskier, less risky or equally risky compared to f. Also, these concepts of risk only rank risk, ...

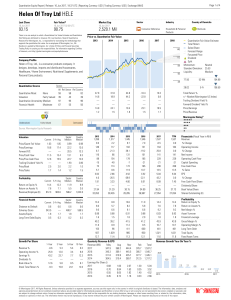

Helen Of Troy Ltd HELE

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

Bonds, Stocks, and Sources of Mispricing

... Canonical asset pricing theories assert that risk is correctly priced by rational agents in frictionless markets. However, to the extent that predictable patterns in the cross section of average returns do not reflect compensation for risk exposures, they point to persistent mispricing attributable ...

... Canonical asset pricing theories assert that risk is correctly priced by rational agents in frictionless markets. However, to the extent that predictable patterns in the cross section of average returns do not reflect compensation for risk exposures, they point to persistent mispricing attributable ...

Accounting for Leases

... operating leases in their statements of financial position according to the nature of the asset’. That is, the lessor effectively retains control of the asset under an operating lease and, therefore, should disclose the asset that has been leased to another party. Further, if the asset is depreciabl ...

... operating leases in their statements of financial position according to the nature of the asset’. That is, the lessor effectively retains control of the asset under an operating lease and, therefore, should disclose the asset that has been leased to another party. Further, if the asset is depreciabl ...