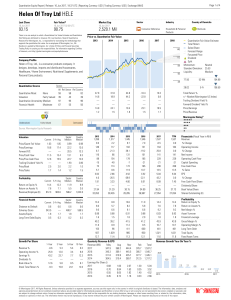

Helen Of Troy Ltd HELE

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

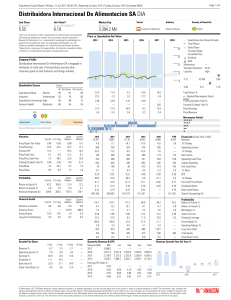

Distribuidora Internacional De Alimentacion SA DIA

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

Best Practice Risk Management

... Executive Officer of CIBC, and is a member of the Senior Executive Team (Management Committee). Dr. Mark has global responsibility to cover all credit, market and operating risks for all of CIBC as well as for its subsidiaries. He has been appointed to the Boards of the Fields Institute for Research ...

... Executive Officer of CIBC, and is a member of the Senior Executive Team (Management Committee). Dr. Mark has global responsibility to cover all credit, market and operating risks for all of CIBC as well as for its subsidiaries. He has been appointed to the Boards of the Fields Institute for Research ...

criminal asset recovery in the eu - Europol

... value of confiscated assets after final court decisions. Although it is hard to give a comprehensive picture of the amount of seized and confiscated assets across the EU, this study will try to provide some insights on values and trends at EU level. The value of criminal profits/benefits is estimate ...

... value of confiscated assets after final court decisions. Although it is hard to give a comprehensive picture of the amount of seized and confiscated assets across the EU, this study will try to provide some insights on values and trends at EU level. The value of criminal profits/benefits is estimate ...

Are Handouts Good for Growth

... reliability of potential investment partners. Therefore, the EBRD is in a position to make better informed decisions and, importantly, other investors can follow it and invest into the same or similar projects, thereby leading to a snow-balling of investment.4 The EBRD can have a favorable effect on ...

... reliability of potential investment partners. Therefore, the EBRD is in a position to make better informed decisions and, importantly, other investors can follow it and invest into the same or similar projects, thereby leading to a snow-balling of investment.4 The EBRD can have a favorable effect on ...

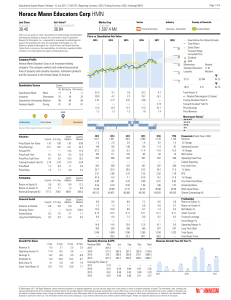

Horace Mann Educators Corp HMN

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

... The Quantitative Ratings are calculated daily and derived from the analystdriven ratings of a company’s peers as determined by statistical algorithms. Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and q ...

A Financial Optimization Approach to Quantitative

... administration. It has several tasks and the main one is to manage the central government’s debt in a way that minimizes the cost with due regard to risk. The debt management problem is to choose currency composition and maturity profile – a problem made difficult because of the many stochastic fact ...

... administration. It has several tasks and the main one is to manage the central government’s debt in a way that minimizes the cost with due regard to risk. The debt management problem is to choose currency composition and maturity profile – a problem made difficult because of the many stochastic fact ...

Fact Sheet: Xerox to Acquire Advectis, Inc.

... Association estimates that more than $2 trillion worth of mortgages will be originated in 2007. We believe that the recent challenges in the mortgage industry will encourage lenders to adapt new technological solutions that improve efficiency while managing underwriting risks through increased docum ...

... Association estimates that more than $2 trillion worth of mortgages will be originated in 2007. We believe that the recent challenges in the mortgage industry will encourage lenders to adapt new technological solutions that improve efficiency while managing underwriting risks through increased docum ...

HullFund8eCh03ProblemSolutions

... dollars if the yen appreciates? If the company can do so, its foreign exchange exposure may be quite low. The key estimates required are those showing the overall effect on the company’s profitability of changes in the exchange rate at various times in the future. Once these estimates have been pro ...

... dollars if the yen appreciates? If the company can do so, its foreign exchange exposure may be quite low. The key estimates required are those showing the overall effect on the company’s profitability of changes in the exchange rate at various times in the future. Once these estimates have been pro ...

The Introduction of Economic Value Added (EVA ) in the Greek

... Uyemura et al. (1996) studied the relationship between MVA and four traditional performance measures: EPS, NI, ROE and ROA. They provided evidence suggesting that the correlation between MVA and those measures are: EVA 40 per cent, ROA 13 per cent, ROE 10 per cent, NI 8 per cent and EPS 6 per cent. ...

... Uyemura et al. (1996) studied the relationship between MVA and four traditional performance measures: EPS, NI, ROE and ROA. They provided evidence suggesting that the correlation between MVA and those measures are: EVA 40 per cent, ROA 13 per cent, ROE 10 per cent, NI 8 per cent and EPS 6 per cent. ...

Transforming NGO MFIs: Critical Ownership Issues to Consider

... together with related parties (including companies ...

... together with related parties (including companies ...

Stronger Support for Growth in Challenging Times Annual Report

... to the demand for its services in the Black Sea region. The Board of Directors approved 25 new operations for EUR 487.2 million, which represents a 39.6% increase over 2014. During the year, the Bank signed 25 loan agreements for EUR 480.2 million, an increase of 125.5% compared to 2014, mainly cove ...

... to the demand for its services in the Black Sea region. The Board of Directors approved 25 new operations for EUR 487.2 million, which represents a 39.6% increase over 2014. During the year, the Bank signed 25 loan agreements for EUR 480.2 million, an increase of 125.5% compared to 2014, mainly cove ...

Franklin Flexible Alpha Bond Fund Prospectus

... Franklin Maryland Tax-Free Income Fund Franklin Massachusetts Tax-Free Income Fund Franklin Michigan Tax-Free Income Fund Franklin Minnesota Tax-Free Income Fund Franklin Missouri Tax-Free Income Fund Franklin New Jersey Tax-Free Income Fund Franklin North Carolina Tax-Free Income Fund Franklin Ohio ...

... Franklin Maryland Tax-Free Income Fund Franklin Massachusetts Tax-Free Income Fund Franklin Michigan Tax-Free Income Fund Franklin Minnesota Tax-Free Income Fund Franklin Missouri Tax-Free Income Fund Franklin New Jersey Tax-Free Income Fund Franklin North Carolina Tax-Free Income Fund Franklin Ohio ...

Aging, Savings, and Financial Markets

... The Relationship between Aging and Savings in the Region Researchers have tried to quantify the impact of aging on savings in two ways: an empirical approach, relying on econometric tools to estimate the empirical relationship between dependency rates and savings, and a general equilibrium approach. ...

... The Relationship between Aging and Savings in the Region Researchers have tried to quantify the impact of aging on savings in two ways: an empirical approach, relying on econometric tools to estimate the empirical relationship between dependency rates and savings, and a general equilibrium approach. ...

AllianceImportance.Intro.1

... Source: Columbia University, European Trade Commission, Studies by BA&H, AC.1983-1987, 1988-1993, 1994-1996, 1999 ...

... Source: Columbia University, European Trade Commission, Studies by BA&H, AC.1983-1987, 1988-1993, 1994-1996, 1999 ...

A Model of Competitive Stock Trading Volume Jiang Wang

... It provides no additional information about prices given characterizations of the aggregate risk. The weak empirical performance of the representative agent models has led researchers to develop models with heterogeneous investors and an incomplete asset market (see, e.g., Mankiw 1986; Scheinkman an ...

... It provides no additional information about prices given characterizations of the aggregate risk. The weak empirical performance of the representative agent models has led researchers to develop models with heterogeneous investors and an incomplete asset market (see, e.g., Mankiw 1986; Scheinkman an ...

SEC Comment - The Committee For The Fiduciary Standard

... our March 18 meeting with EBSA staff and officials. In this letter we set out views regarding the fiduciary standard, generally, and then address several of the questions that either EBSA staff has raised, or have been raised buy commenters. Summary The fiduciary backdrop against which ERISA was ena ...

... our March 18 meeting with EBSA staff and officials. In this letter we set out views regarding the fiduciary standard, generally, and then address several of the questions that either EBSA staff has raised, or have been raised buy commenters. Summary The fiduciary backdrop against which ERISA was ena ...

Details

... Internal Uses of Financial Ratios: • Financial ratios are internally used by – management to • Identify deficiencies of the company and take immediate remedial action such as poor control on costs. • Understand and compare the financial performance of different divisions, e.g. which product lines ar ...

... Internal Uses of Financial Ratios: • Financial ratios are internally used by – management to • Identify deficiencies of the company and take immediate remedial action such as poor control on costs. • Understand and compare the financial performance of different divisions, e.g. which product lines ar ...

Property Portfolio - Falcon Real Estate Investment

... investors in U.S. real estate. Many of the services provided to our clients are similar to those provided by international private banks. The real estate professionals on Falcon’s staff are selected because they understand the need to provide expert real estate advice, while at the same time providi ...

... investors in U.S. real estate. Many of the services provided to our clients are similar to those provided by international private banks. The real estate professionals on Falcon’s staff are selected because they understand the need to provide expert real estate advice, while at the same time providi ...

Reexamining the Role of Heterogeneous Agents in

... puzzles refer to unconditional properties of asset prices and returns, a number of conditional properties of asset prices and returns has been established too. There is now strong evidence that equity premium and Sharpe ratio are high in recessions and low in booms. Moreover, variables such as the p ...

... puzzles refer to unconditional properties of asset prices and returns, a number of conditional properties of asset prices and returns has been established too. There is now strong evidence that equity premium and Sharpe ratio are high in recessions and low in booms. Moreover, variables such as the p ...

What rate of return can we expect over the next decade?

... might expect the stock-price multiple to contract, dragging down returns, and vice versa for a currently low stock price valuation. This is the idea underlying Shiller’s famous CAPE. Shiller expects stocks to perform poorly when CAPE is high. There is a tension here. On the one hand, some researcher ...

... might expect the stock-price multiple to contract, dragging down returns, and vice versa for a currently low stock price valuation. This is the idea underlying Shiller’s famous CAPE. Shiller expects stocks to perform poorly when CAPE is high. There is a tension here. On the one hand, some researcher ...