P a g e 1

... And everyone knows that the "less significant" institutions can indeed be significant for the stability of the banking system - not individually, but collectively as associations of savings banks and cooperative banks. That is particularly true when you consider that many small and medium-sized inst ...

... And everyone knows that the "less significant" institutions can indeed be significant for the stability of the banking system - not individually, but collectively as associations of savings banks and cooperative banks. That is particularly true when you consider that many small and medium-sized inst ...

Dividend Policy as a Signaling Mechanism Under Different Market

... Gompers et al. (2003) document superior stock price performance of firms with lower agency problems relative to firms with higher agency problems. In this paper, we aim to study whether the arguments put forward in the prior literature regarding the signaling value of dividend policy hold across di ...

... Gompers et al. (2003) document superior stock price performance of firms with lower agency problems relative to firms with higher agency problems. In this paper, we aim to study whether the arguments put forward in the prior literature regarding the signaling value of dividend policy hold across di ...

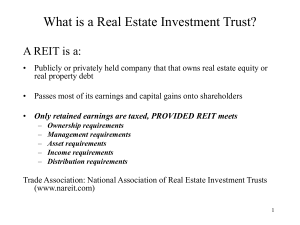

Real Estate Investment Trusts (REITs)

... – REITs allowed to own 100% of a Taxable REIT Subsidiary (TRS). • REIT Modernization Act of 1999 (effective 2001) • TRS can provide services to REIT tenants and others (previously, this was not allowed). • Debt and rental payments from TRS to REIT are limited to ensure that the TRS actually pays inc ...

... – REITs allowed to own 100% of a Taxable REIT Subsidiary (TRS). • REIT Modernization Act of 1999 (effective 2001) • TRS can provide services to REIT tenants and others (previously, this was not allowed). • Debt and rental payments from TRS to REIT are limited to ensure that the TRS actually pays inc ...

Gold and currencies: hedging foreign-exchange risk

... new markets has been growing. In fact, investors who eschew international investment face not only the prospect of high correlation risk among domestic assets, but also the effect that inflation and/or capital outflows can have in their own currency. The potential for enhanced returns on investments ...

... new markets has been growing. In fact, investors who eschew international investment face not only the prospect of high correlation risk among domestic assets, but also the effect that inflation and/or capital outflows can have in their own currency. The potential for enhanced returns on investments ...

a review of the earnings management literature and its implications

... management does affect resource allocation. For example, some of the overpricing observed for firms that sell new equity may be attributable to earnings management prior to the issue. There is also evidence of significant negative stock market responses to ...

... management does affect resource allocation. For example, some of the overpricing observed for firms that sell new equity may be attributable to earnings management prior to the issue. There is also evidence of significant negative stock market responses to ...

Country risk, country risk indices, and valuation of FDI: A real options

... is common to use three categories when describing foreign investments: lending, equity investment, and foreign direct investment (FDI), see Figure 1. Lending covers direct lending or the purchase of bonds from the state, government, or from private companies in a country. Equity may cover investment ...

... is common to use three categories when describing foreign investments: lending, equity investment, and foreign direct investment (FDI), see Figure 1. Lending covers direct lending or the purchase of bonds from the state, government, or from private companies in a country. Equity may cover investment ...

Risk Allocation, Debt Fueled Expansion and Financial Crisis ∗ Paul Beaudry

... factors, one of the central goals of this paper is present a mechanism whereby the determination of the risk premium and it effect on the cost of working capital provides a link between financial and real factors. There are several features which we believe are key to understanding this period. Fir ...

... factors, one of the central goals of this paper is present a mechanism whereby the determination of the risk premium and it effect on the cost of working capital provides a link between financial and real factors. There are several features which we believe are key to understanding this period. Fir ...

Profitability of Pairs Trading Strategy

... pricing world that is relatively efficient, simple strategies based on mean-reversion concepts should not generate consistent profits. Gatev, Goetzmann, and Rouwenhorst (2006), however, document pairs trading generates consistent arbitrage profits in the U.S. equity markets, which are considered the ...

... pricing world that is relatively efficient, simple strategies based on mean-reversion concepts should not generate consistent profits. Gatev, Goetzmann, and Rouwenhorst (2006), however, document pairs trading generates consistent arbitrage profits in the U.S. equity markets, which are considered the ...

Transition Risk Toolbox - 2° Investing Initiative

... Who: companies vs. investors and regulators. The Who is important because impacts on companies’ balance sheets and cash flows don’t necessarily translate one-to-one into risk for financial institutions. This is true both because operating companies may mitigate the risk themselves before it passes t ...

... Who: companies vs. investors and regulators. The Who is important because impacts on companies’ balance sheets and cash flows don’t necessarily translate one-to-one into risk for financial institutions. This is true both because operating companies may mitigate the risk themselves before it passes t ...

How different is the regulatory capital from the economic capital

... the portfolio credit risk. To this aim, we compare the level of capital requirements computed by using regulatory Basel 2 formula to the level of capital computed by using a model of portfolio credit risk which take into account multiple sources of risk as well as borrowers’ heterogeneity. Therefore ...

... the portfolio credit risk. To this aim, we compare the level of capital requirements computed by using regulatory Basel 2 formula to the level of capital computed by using a model of portfolio credit risk which take into account multiple sources of risk as well as borrowers’ heterogeneity. Therefore ...

Push Factors and Capital Flows to Emerging Markets

... (2014) did not find that better macroeconomic fundamentals (e.g., lower public debt, a higher level of reserves, or higher economic growth) provided insulation during the tantrum episode. Rather, larger markets experienced more pressures, as investors were better able to rebalance their portfolios i ...

... (2014) did not find that better macroeconomic fundamentals (e.g., lower public debt, a higher level of reserves, or higher economic growth) provided insulation during the tantrum episode. Rather, larger markets experienced more pressures, as investors were better able to rebalance their portfolios i ...

q. are you the same charles e. olson whose direct testimony

... the case in this proceeding, but we are persuaded that to the extent it may be based upon circular reasoning, it should be tested in its end result by the application of other evidence of comparable earnings. In determining just and reasonable rates of return, we must consider all relevant evidence ...

... the case in this proceeding, but we are persuaded that to the extent it may be based upon circular reasoning, it should be tested in its end result by the application of other evidence of comparable earnings. In determining just and reasonable rates of return, we must consider all relevant evidence ...

9535 Testimony [Dave] - Maryland Public Service Commission

... (262 U.S. 679), which was decided in 1923. In this decision, the Court stated: "What annual rate will constitute just compensation depends upon many circumstances and must be determined by the exercise of a fair and enlightened judgment, having regard to all relevant facts. A public utility is entit ...

... (262 U.S. 679), which was decided in 1923. In this decision, the Court stated: "What annual rate will constitute just compensation depends upon many circumstances and must be determined by the exercise of a fair and enlightened judgment, having regard to all relevant facts. A public utility is entit ...

Market Forces at Work in the Banking Industry: Evidence from the

... The U.S. banking industry has long enjoyed access to a federal safety net composed of deposit insurance, a lender of last resort, and payment system finality. If this safety net insulates counterparties from the full effects of a bank's default, the usual market incentives to maintain adequate capi ...

... The U.S. banking industry has long enjoyed access to a federal safety net composed of deposit insurance, a lender of last resort, and payment system finality. If this safety net insulates counterparties from the full effects of a bank's default, the usual market incentives to maintain adequate capi ...

What is a stock?

... commonly look at stocks with high dividend yields. A growth-targeted portfolio buys undervalued stocks to obtain high rates of long-term capital growth for the portfolio. Dividends or other cash flow would commonly be reinvested to increase this growth rate. ...

... commonly look at stocks with high dividend yields. A growth-targeted portfolio buys undervalued stocks to obtain high rates of long-term capital growth for the portfolio. Dividends or other cash flow would commonly be reinvested to increase this growth rate. ...

Value-at-Risk and Extreme Returns

... A major concern for regulators and owners of financial institutions is catastrophic market risk and the adequacy of capital to meet such risk. Well publicized losses incurred by several institutions such as Orange County, Procter and Gamble, and NatWest, through inappropriate derivatives pricing and ...

... A major concern for regulators and owners of financial institutions is catastrophic market risk and the adequacy of capital to meet such risk. Well publicized losses incurred by several institutions such as Orange County, Procter and Gamble, and NatWest, through inappropriate derivatives pricing and ...

Nuveen Build America Bond Fund

... by capital appreciation of the Fund’s portfolio. The potential to achieve such capital appreciation will depend largely on NAM’s investment capabilities in executing the Fund’s investment strategy as well as the performance of BABs relative to the securities underlying the Fund’s hedging instruments ...

... by capital appreciation of the Fund’s portfolio. The potential to achieve such capital appreciation will depend largely on NAM’s investment capabilities in executing the Fund’s investment strategy as well as the performance of BABs relative to the securities underlying the Fund’s hedging instruments ...

20 12 Trends Emerging

... for foreign funds and regional investors alike, but some interviewees question whether this will continue. Not only is the export-oriented city especially subject to global economic problems, but cap rates have become extremely compressed and an oncoming flood of new commercial office space is likel ...

... for foreign funds and regional investors alike, but some interviewees question whether this will continue. Not only is the export-oriented city especially subject to global economic problems, but cap rates have become extremely compressed and an oncoming flood of new commercial office space is likel ...

Asian Journal of Business Management 5(1): 60-76, 2013

... may be referred to as book value. Net worth is stated as at a particular year in time. Net worth is an important determinant of the value of a company, considering it is composed primarily of all the money that has been invested since its inception, as well as the retained earnings for the duration ...

... may be referred to as book value. Net worth is stated as at a particular year in time. Net worth is an important determinant of the value of a company, considering it is composed primarily of all the money that has been invested since its inception, as well as the retained earnings for the duration ...

colony capital, inc. - corporate

... Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, part ...

... Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, part ...

![9535 Testimony [Dave] - Maryland Public Service Commission](http://s1.studyres.com/store/data/009524184_1-6690ffe236a26be1dddea21ad3b9b7b9-300x300.png)