Hot Topics presentation March 2014

... However, what we can say is that in a risk cognisant world, developing our investment strategy such that at inception its optimised to deliver our key objective (RR) with a high probability & then refining this to improve techniques – is intuitively correct. This does not guarantee that in hindsight ...

... However, what we can say is that in a risk cognisant world, developing our investment strategy such that at inception its optimised to deliver our key objective (RR) with a high probability & then refining this to improve techniques – is intuitively correct. This does not guarantee that in hindsight ...

Interest Rate to remain unchanged

... Interest Rate to remain unchanged The Reserve Bank decided to leave the cash rate unchanged at 1.50 per cent. Conditions in the global economy have improved over recent months. Both global trade and industrial production have picked up. Above-trend growth is expected in a number of advanced economie ...

... Interest Rate to remain unchanged The Reserve Bank decided to leave the cash rate unchanged at 1.50 per cent. Conditions in the global economy have improved over recent months. Both global trade and industrial production have picked up. Above-trend growth is expected in a number of advanced economie ...

Chapter 1

... 15. Financial assets make it easy for large firms to raise capital to finance their investments in real assets. If General Motors, for example, could not issue stocks or bonds to the general public, it would have a far more difficult time raising capital. Contraction of the supply of financial asse ...

... 15. Financial assets make it easy for large firms to raise capital to finance their investments in real assets. If General Motors, for example, could not issue stocks or bonds to the general public, it would have a far more difficult time raising capital. Contraction of the supply of financial asse ...

2011 result: Shareholders restate confidence in Zenith`s management

... Also, the bank’s profit before taxation went up by 21 per cent to N60.7 billion from the previous N50.03 billion, while after tax profit witnessed 18 per cent growth to N44.2 billion as against N37.41 billion reported in corresponding period of 2010. Commenting on the results, the President, Associa ...

... Also, the bank’s profit before taxation went up by 21 per cent to N60.7 billion from the previous N50.03 billion, while after tax profit witnessed 18 per cent growth to N44.2 billion as against N37.41 billion reported in corresponding period of 2010. Commenting on the results, the President, Associa ...

First-Time Shareowner Resolutions Address Stranded Fossil Fuel

... As You Sow and the Unitarian Universalist Association have filed shareowner resolutions with two large coal companies, requesting that they report on material impact of reserves that must remain in the ground if climate change is to be addressed. SocialFunds.com -- The term stranded assets refers to ...

... As You Sow and the Unitarian Universalist Association have filed shareowner resolutions with two large coal companies, requesting that they report on material impact of reserves that must remain in the ground if climate change is to be addressed. SocialFunds.com -- The term stranded assets refers to ...

Treynor Measure

... Calculate the return on the ‘Bogey’ and on the managed portfolio Explain the difference in return based on component weights or selection Summarize the performance differences into appropriate categories ...

... Calculate the return on the ‘Bogey’ and on the managed portfolio Explain the difference in return based on component weights or selection Summarize the performance differences into appropriate categories ...

Working in partnership with financial intermediaries

... Avoiding large losses We construct portfolios to withstand market stress scenarios and avoid large drawdowns. Recovering from large losses requires even larger gains and, unfortunately, investors may often decide to reduce their risk exposure at a time when risk is most likely to be well rewarded. ...

... Avoiding large losses We construct portfolios to withstand market stress scenarios and avoid large drawdowns. Recovering from large losses requires even larger gains and, unfortunately, investors may often decide to reduce their risk exposure at a time when risk is most likely to be well rewarded. ...

Investing in shares - Bridges. Financial advice makes a difference

... allows you to balance out short-term troughs with cyclical peaks in performance ultimately smoothing your investment performance over time. By investing in managed funds, it’s easy to achieve a diversified investment portfolio with a relatively small amount of money. Another way to spread your risk ...

... allows you to balance out short-term troughs with cyclical peaks in performance ultimately smoothing your investment performance over time. By investing in managed funds, it’s easy to achieve a diversified investment portfolio with a relatively small amount of money. Another way to spread your risk ...

Birla Sun Life Focused Equity Fund - Series 4.cdr

... 3. Over next 5 years, stable political regime with key policy initiatives by the central government would aid revival in GDP growth. Therefore we believe there is a strong potential upside from current levels on a 3 year basis. We believe the GDP growth can average 6.5% p.a. over that period and wit ...

... 3. Over next 5 years, stable political regime with key policy initiatives by the central government would aid revival in GDP growth. Therefore we believe there is a strong potential upside from current levels on a 3 year basis. We believe the GDP growth can average 6.5% p.a. over that period and wit ...

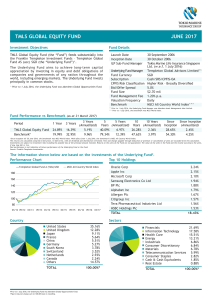

tmls global equity fund june 2017

... • Global equities advanced in the first quarter of 2017 as investors weighed a broadening global economic recovery and continued corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way ...

... • Global equities advanced in the first quarter of 2017 as investors weighed a broadening global economic recovery and continued corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way ...

Troubled Times: How We Got There and What Lies Ahead

... their incomes; and of laying aside something, however small the amount may be, for the times of greater stress that may come to us. By no other course will our people place themselves in that position of helpful usefulness to the world which the Lord intends we shall take.” ...

... their incomes; and of laying aside something, however small the amount may be, for the times of greater stress that may come to us. By no other course will our people place themselves in that position of helpful usefulness to the world which the Lord intends we shall take.” ...

TAIWAN EQUITIES – A STRAIT OPPORTUNITY

... for the fund(s) in Singapore. All views expressed cannot be construed as an offer or recommendation. Prospectus for the fund(s) is available from FISL or its distributors upon request. Potential investors should read the prospectus before deciding whether to invest in the fund(s). Reference to speci ...

... for the fund(s) in Singapore. All views expressed cannot be construed as an offer or recommendation. Prospectus for the fund(s) is available from FISL or its distributors upon request. Potential investors should read the prospectus before deciding whether to invest in the fund(s). Reference to speci ...

Ibtikar Fund Launch, Palestine`s early stage fund

... 5QHQH: a social web and mobile app that allows users to easily create and share jokes, comics, and other humor. It received more than 30,000 visitors in the first few weeks after its launch. Masari: a cloud-based accounting program targeting micro and small enterprises in the MENA region, allowing t ...

... 5QHQH: a social web and mobile app that allows users to easily create and share jokes, comics, and other humor. It received more than 30,000 visitors in the first few weeks after its launch. Masari: a cloud-based accounting program targeting micro and small enterprises in the MENA region, allowing t ...

DIRECTIONS - Seizert Capital Partners

... Certain information contained in this commentary is based upon proprietary research and is general in nature. It is not intended to be investment advice or to endorse any strategy and is provided for informational purposes only. It is not an offer to sell, or a solicitation for the offer to purchase ...

... Certain information contained in this commentary is based upon proprietary research and is general in nature. It is not intended to be investment advice or to endorse any strategy and is provided for informational purposes only. It is not an offer to sell, or a solicitation for the offer to purchase ...

This publication is intended for general guidance and represents our

... We are beginning to see innovative moves to address the illiquid nature of private company shares, with platforms such as Asset Match providing a market place for trading private company shares. While these platforms may appeal to the flexible and disruptive nature of scale-up businesses, they are ...

... We are beginning to see innovative moves to address the illiquid nature of private company shares, with platforms such as Asset Match providing a market place for trading private company shares. While these platforms may appeal to the flexible and disruptive nature of scale-up businesses, they are ...

Wells Fargo Securities_Sales and Trading Analystx

... • A bachelor or master’s degree with an emphasis in finance, economics, mathematics, computer science, engineering or a related quantitative/analytical field • Strong interest in financial markets and derivatives with expertise in macroeconomics, business cycle analysis, fixed income or commodity ma ...

... • A bachelor or master’s degree with an emphasis in finance, economics, mathematics, computer science, engineering or a related quantitative/analytical field • Strong interest in financial markets and derivatives with expertise in macroeconomics, business cycle analysis, fixed income or commodity ma ...

June 2008 Performance Review – Listed Hybrid Sector

... that displayed a high correlation to equity price falls early this year were less highly correlated this sell off and we expect that the ones that were more highly correlated this month will follow the same path in the future. We are very underweight the bank hybrid sector which has performed poorly ...

... that displayed a high correlation to equity price falls early this year were less highly correlated this sell off and we expect that the ones that were more highly correlated this month will follow the same path in the future. We are very underweight the bank hybrid sector which has performed poorly ...

DOC - Europa.eu

... financial opportunity rather than a political threat. In the developed economies, the greatest problem now facing financial markets is that a credit crunch may precipitate a global recession. And part of any solution to the credit crisis must be to encourage those with spare capital to invest, such ...

... financial opportunity rather than a political threat. In the developed economies, the greatest problem now facing financial markets is that a credit crunch may precipitate a global recession. And part of any solution to the credit crisis must be to encourage those with spare capital to invest, such ...

Royal London US Growth Trust (Income

... American companies operating across a wide range of industries. Recommendation This Fund may not be appropriate for investors who plan to withdraw their money within five years. You should aim to keep your units for at least five years, although you can sell them at any time. ...

... American companies operating across a wide range of industries. Recommendation This Fund may not be appropriate for investors who plan to withdraw their money within five years. You should aim to keep your units for at least five years, although you can sell them at any time. ...

LoneStar 529 Fund Allocation Sheet

... risks inherent to international investing, including currency, political, social and economic risks. Investments in growth stocks may be more volatile than other securities. With value investing, if the marketplace does not recognize that a security is undervalued, the expected price increase may no ...

... risks inherent to international investing, including currency, political, social and economic risks. Investments in growth stocks may be more volatile than other securities. With value investing, if the marketplace does not recognize that a security is undervalued, the expected price increase may no ...

October 2016 - Reynders, McVeigh Capital Management

... 2015 and the beginning of 2016 are reasonable indicators, this new market dynamic seems to have a significant amount of investment capital moving from “all-in” to “all-out” (and sometimes back to “all-in” again) at any sign of volatility. This makes us expect that corrective swings in equity markets ...

... 2015 and the beginning of 2016 are reasonable indicators, this new market dynamic seems to have a significant amount of investment capital moving from “all-in” to “all-out” (and sometimes back to “all-in” again) at any sign of volatility. This makes us expect that corrective swings in equity markets ...

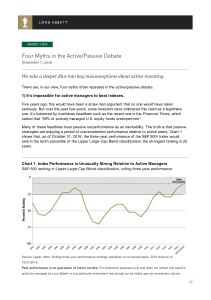

Four Myths in the Active/Passive Debate

... speaking, growth and value investments tend to react dif f erently during the economic cycle. Since value stocks are of ten cyclical in nature, they may benef it f rom the increased spending that usually occurs during an economic expansion. Growth stocks may also perf orm well during an expansion, b ...

... speaking, growth and value investments tend to react dif f erently during the economic cycle. Since value stocks are of ten cyclical in nature, they may benef it f rom the increased spending that usually occurs during an economic expansion. Growth stocks may also perf orm well during an expansion, b ...