What is management?

... Abraham Maslow He was a humanistic psychologist who proposed a hierarchy of human needs: physiological needs, safety, social, esteem and selfactualization. Maslow argued that each level in the hierarchy must be satisfied before the next could be activated. ...

... Abraham Maslow He was a humanistic psychologist who proposed a hierarchy of human needs: physiological needs, safety, social, esteem and selfactualization. Maslow argued that each level in the hierarchy must be satisfied before the next could be activated. ...

Bendigo Socially Responsible Growth Fund

... The Bendigo Socially Responsible Growth Fund (Fund) and Bendigo SmartStart Super ABN 57 526 653 420 are issued by Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) a subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879 (the Bank). Both of these companies ...

... The Bendigo Socially Responsible Growth Fund (Fund) and Bendigo SmartStart Super ABN 57 526 653 420 are issued by Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) a subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879 (the Bank). Both of these companies ...

Reading Ch 2 A Tycoon Of The MUTUAL FUNDS

... funds liquid, or easily transferred into other funds. Bonds. A popular investment of mutual funds is the wide assortment of long-term corporate bonds, Treasury bonds, and municipal bonds. Some of these funds, especially those for municipal bonds, can provide tax- free interest. However, be sure to r ...

... funds liquid, or easily transferred into other funds. Bonds. A popular investment of mutual funds is the wide assortment of long-term corporate bonds, Treasury bonds, and municipal bonds. Some of these funds, especially those for municipal bonds, can provide tax- free interest. However, be sure to r ...

IFC MAKES FIRST INVESTMENT IN SA`s

... sciences and biotechnology expertise in South Africa with a pioneering investment of R20-million in the Biotech Venture Partners Fund (Bioventures). Bioventures is South Africa's first venture capital fund which focuses on the life sciences and biotechnology sector. Mr Michael Tiller, IFC's regional ...

... sciences and biotechnology expertise in South Africa with a pioneering investment of R20-million in the Biotech Venture Partners Fund (Bioventures). Bioventures is South Africa's first venture capital fund which focuses on the life sciences and biotechnology sector. Mr Michael Tiller, IFC's regional ...

Investment and Spending Policy Community Colleges of New

... explicit restriction on the holding of cash equivalents. The custodian bank short-term investment fund (“STIF”) is an allowed investment, as are other cash equivalents, provided they carry an S&P rating of at least A1 or an equivalent rating. Equity Investments The purpose of the equity allocation ( ...

... explicit restriction on the holding of cash equivalents. The custodian bank short-term investment fund (“STIF”) is an allowed investment, as are other cash equivalents, provided they carry an S&P rating of at least A1 or an equivalent rating. Equity Investments The purpose of the equity allocation ( ...

RHB-OSK China-India Dynamic Growth Fund

... In China, we see policy easing being supportive the markets now despite weaker than expected economic data. Valuations remain very attractive, versus the region and its history too. The government’s focus on reforms and restructuring SOEs could improve sentiment and improve corporate profitability. ...

... In China, we see policy easing being supportive the markets now despite weaker than expected economic data. Valuations remain very attractive, versus the region and its history too. The government’s focus on reforms and restructuring SOEs could improve sentiment and improve corporate profitability. ...

continued from cover - Association Reserves

... Select individual securities that have maturities of one to five years. Structure these maturities so that an approximately equal proportion comes due every month. With matured funds, consistently purchase securities at the long end of the maturity range. The Board may reduce the longest maturity as ...

... Select individual securities that have maturities of one to five years. Structure these maturities so that an approximately equal proportion comes due every month. With matured funds, consistently purchase securities at the long end of the maturity range. The Board may reduce the longest maturity as ...

BANFF AND BUCHAN AREA COMMITTEE

... recommendations. Subsequent to that meeting I have had a discussion with John MacKinnon, Solicitor for the Feuars Managers agreeing the wisdom of setting up a new Agreement, consolidating and up-dating the earlier Agreements. ...

... recommendations. Subsequent to that meeting I have had a discussion with John MacKinnon, Solicitor for the Feuars Managers agreeing the wisdom of setting up a new Agreement, consolidating and up-dating the earlier Agreements. ...

Bond Yields Underpinning Equities

... levels have increased only marginally. It is certainly a good thing when firms distribute rather than waste their cash, but it is less encouraging when they do so en masse. With less investment, corporate cash flows will grow more slowly over the long term. That equity markets have been resilient in ...

... levels have increased only marginally. It is certainly a good thing when firms distribute rather than waste their cash, but it is less encouraging when they do so en masse. With less investment, corporate cash flows will grow more slowly over the long term. That equity markets have been resilient in ...

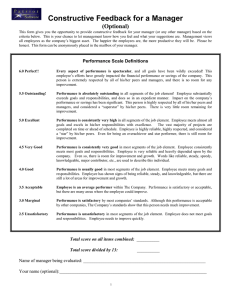

Now It`s Your Turn to Rate NIS

... This form gives you the opportunity to provide constructive feedback for your manager (or any other manager) based on the criteria below. This is your chance to let management know how you feel and what your suggestions are. Management views all employees as the company’s biggest asset. The happier ...

... This form gives you the opportunity to provide constructive feedback for your manager (or any other manager) based on the criteria below. This is your chance to let management know how you feel and what your suggestions are. Management views all employees as the company’s biggest asset. The happier ...

Change Management-MBA625 LECTURE #10 GROWTH RATE OF

... The speed at which organization experiences phases of evolution and revolution is closely related to the market environment of its industry. Different industries have different growth rates, for example computers, automobiles and banking all have different growth rates. Evolution can be prolonged, a ...

... The speed at which organization experiences phases of evolution and revolution is closely related to the market environment of its industry. Different industries have different growth rates, for example computers, automobiles and banking all have different growth rates. Evolution can be prolonged, a ...

Identify the right investments

... Consulting an Independent Financial Adviser (IFA) is an obvious first step for many, particularly those who are looking at the various types of collective investment vehicles available rather than planning to invest directly in shares. What are the options ? Direct investment All the forms of invest ...

... Consulting an Independent Financial Adviser (IFA) is an obvious first step for many, particularly those who are looking at the various types of collective investment vehicles available rather than planning to invest directly in shares. What are the options ? Direct investment All the forms of invest ...

18 November - MoneyLetter

... may be looking ahead to 2016, as it seems to have absorbed the concept of higher rates and some recent soft economic reports. After a strong rebound in October, the S&P 500 had trimmed 2.8% since Fed Chair Janet Yellen said a rate hike was a “live possibility” on November 4th. The threat of tighter ...

... may be looking ahead to 2016, as it seems to have absorbed the concept of higher rates and some recent soft economic reports. After a strong rebound in October, the S&P 500 had trimmed 2.8% since Fed Chair Janet Yellen said a rate hike was a “live possibility” on November 4th. The threat of tighter ...

Long-Term Investment Policy - American Speech

... modifications or exceptions (temporary or otherwise) in writing to the FPB when they deem it appropriate. Only the FPB may approve such requests. 11. The FPB will report to the Board at least annually on the status of the Fund. ...

... modifications or exceptions (temporary or otherwise) in writing to the FPB when they deem it appropriate. Only the FPB may approve such requests. 11. The FPB will report to the Board at least annually on the status of the Fund. ...

- Cacharya

... Benefit under Section 80D upto Rs.15000 on policies for yourself, spouse and children. And if you are paying health insurance premium for your parents as well, then you can get an additional benefit of Rs.15000 taking total benefit of Rs.30000. These benefits are subject to couple of condition ...

... Benefit under Section 80D upto Rs.15000 on policies for yourself, spouse and children. And if you are paying health insurance premium for your parents as well, then you can get an additional benefit of Rs.15000 taking total benefit of Rs.30000. These benefits are subject to couple of condition ...

Dreyfus/Standish Global Fixed Income Fund Mar 31

... Emerging Market Risk: Emerging markets tend to be more volatile than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. The fund’s concentration in securities of companies in e ...

... Emerging Market Risk: Emerging markets tend to be more volatile than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. The fund’s concentration in securities of companies in e ...

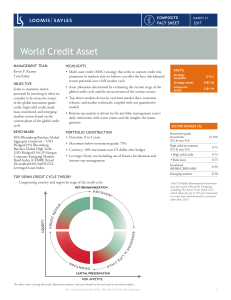

Loomis Sayles Wins Institutional Investor Award for Performance

... magazine's editorial and research teams in consultation with eVestment’s research team. Investment strategies are analyzed based on factors used by institutional investors in their own eVestment searches, including one-, three- and 5-year performance, Sharpe ratio, information ratio, standard deviat ...

... magazine's editorial and research teams in consultation with eVestment’s research team. Investment strategies are analyzed based on factors used by institutional investors in their own eVestment searches, including one-, three- and 5-year performance, Sharpe ratio, information ratio, standard deviat ...

Fact Sheet:

... During 15 years of significant positions in the Pharmaceutical industry, management experience includes Big Pharma, Specialty Pharma, small Biotech and international positions. As many as 10 direct reports were managed as head of an international regulatory affairs (RA) department. Board experience ...

... During 15 years of significant positions in the Pharmaceutical industry, management experience includes Big Pharma, Specialty Pharma, small Biotech and international positions. As many as 10 direct reports were managed as head of an international regulatory affairs (RA) department. Board experience ...

Strategic Value Dividend (MA) Select UMA

... hold similar portfolios of investments, in other portfolios or products it manages (including mutual funds). These may be available at Morgan Stanley or elsewhere, and may cost an investor more or less than this strategy in Morgan Stanley's Select UMA program. ...

... hold similar portfolios of investments, in other portfolios or products it manages (including mutual funds). These may be available at Morgan Stanley or elsewhere, and may cost an investor more or less than this strategy in Morgan Stanley's Select UMA program. ...

World Credit Asset

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

Schroders Outlook 2015: UK Corporate Bonds

... strategic bond fundsi, as well as equity and multi-asset income funds. In the hunt for yield driven by government intervention in financial markets, investors have become comfortable taking on additional corporate credit risk, but less sanguine about interest rate exposure or ‘duration’. This is bec ...

... strategic bond fundsi, as well as equity and multi-asset income funds. In the hunt for yield driven by government intervention in financial markets, investors have become comfortable taking on additional corporate credit risk, but less sanguine about interest rate exposure or ‘duration’. This is bec ...

Risk and Return Analysis

... CAPM is however not a generally accepted model and the debate regarding it has raged ever since its inception almost 40 years ago. Finding the “market portfolio” is a difficult task, as it is supposed to include all risky assets in their relative proportion, of which only a fraction are traded and q ...

... CAPM is however not a generally accepted model and the debate regarding it has raged ever since its inception almost 40 years ago. Finding the “market portfolio” is a difficult task, as it is supposed to include all risky assets in their relative proportion, of which only a fraction are traded and q ...