File ch21 Type: Multiple Choice 1. Which of the following is NOT one

... a) Capital gains are taxed differently than ordinary income. b) The popular press often highlights funds or stocks that have recently done well. c) Much investment information is oriented to institutional investors. d) Life-cycle funds become more conservative as the investor ages. Ans: C ...

... a) Capital gains are taxed differently than ordinary income. b) The popular press often highlights funds or stocks that have recently done well. c) Much investment information is oriented to institutional investors. d) Life-cycle funds become more conservative as the investor ages. Ans: C ...

Key Information Document

... Operational risk: political, legal and operational systems may be less developed and hence more risky in emerging markets; Liquidity risk: there may be a smaller number of buyers or sellers of the underlying securities and this may affect the price at which these securities can be sold; Counterparty ...

... Operational risk: political, legal and operational systems may be less developed and hence more risky in emerging markets; Liquidity risk: there may be a smaller number of buyers or sellers of the underlying securities and this may affect the price at which these securities can be sold; Counterparty ...

Steady as she goes?

... or guarantee the performance of any Wells Fargo Fund. When applying an asset allocation strategy to your own situation, variables such as your investment objectives, time frame, income requirements and resources, inflation, and potential rates of return should be considered when you determine which ...

... or guarantee the performance of any Wells Fargo Fund. When applying an asset allocation strategy to your own situation, variables such as your investment objectives, time frame, income requirements and resources, inflation, and potential rates of return should be considered when you determine which ...

File

... •Many individual investors want to diversify, that is, own a wide range of stocks and/or bonds from different firms and different levels of government, so that they don't have to worry too much about what happens with any individual firm. • A mutual fund is an investment company that raises money f ...

... •Many individual investors want to diversify, that is, own a wide range of stocks and/or bonds from different firms and different levels of government, so that they don't have to worry too much about what happens with any individual firm. • A mutual fund is an investment company that raises money f ...

PruFund Expected Growth Rates

... Important Information about the Expected Growth Rates The EGR set at each quarter date may be higher, the same or lower than those applying at the start of your investment. In addition, there may be times where the unit price may be adjusted which will impact the growth received. The overall return ...

... Important Information about the Expected Growth Rates The EGR set at each quarter date may be higher, the same or lower than those applying at the start of your investment. In addition, there may be times where the unit price may be adjusted which will impact the growth received. The overall return ...

Understanding How management fee rebates are taxed

... If you invest in Series PW/PWT8 and Series PWF/PWF8, you do not pay these management fees directly. Instead, the fund itself is charged the management fee on a daily basis. How you get the discount Since the full management fee is charged to the fund on a daily basis, how do you get the discount? We ...

... If you invest in Series PW/PWT8 and Series PWF/PWF8, you do not pay these management fees directly. Instead, the fund itself is charged the management fee on a daily basis. How you get the discount Since the full management fee is charged to the fund on a daily basis, how do you get the discount? We ...

Breaking free of investing costs

... Sales commissions – Some mutual funds charge a ‘load’, or one-time fee paid to an advisors’ firm for selling a mutual fund. The load might be charged when you buy the fund, or when you sell it. Most mutual funds offered by banks do not have load charges. Short-term trading fees – Mutual funds intend ...

... Sales commissions – Some mutual funds charge a ‘load’, or one-time fee paid to an advisors’ firm for selling a mutual fund. The load might be charged when you buy the fund, or when you sell it. Most mutual funds offered by banks do not have load charges. Short-term trading fees – Mutual funds intend ...

Stocks Are Not The New Bonds

... finding a home in dividend-paying stocks. This “chase for yield” has pushed up traditional high-dividend payers like real estate investment trusts (REITs), utilities and telecom stocks to historically rich price/earnings multiples. This is the most concrete evidence we have seen in years that invest ...

... finding a home in dividend-paying stocks. This “chase for yield” has pushed up traditional high-dividend payers like real estate investment trusts (REITs), utilities and telecom stocks to historically rich price/earnings multiples. This is the most concrete evidence we have seen in years that invest ...

Al Beit Al Mali Fund Al-Beit Al Mali Fund

... weight causing a decline in other country weights. Also, important to note that the market’s -4.8% decline on the last trading day was driven by some last minute aggressive selling. Most of this was reversed on the following day. Looking at individual stocks, we find those with index weight decrease ...

... weight causing a decline in other country weights. Also, important to note that the market’s -4.8% decline on the last trading day was driven by some last minute aggressive selling. Most of this was reversed on the following day. Looking at individual stocks, we find those with index weight decrease ...

Somendra Sarwal

... & business strategies Experienced finance professional in Corporate and Institutional Banking domain in various capacities in India. Initial years were focused on ground level exposure to banking operations, products and mid & large corporate clients. This was followed by exposure to credit risk & ...

... & business strategies Experienced finance professional in Corporate and Institutional Banking domain in various capacities in India. Initial years were focused on ground level exposure to banking operations, products and mid & large corporate clients. This was followed by exposure to credit risk & ...

Advisen Industry Report

... Widely regarded as one of the financial sector’s most lucrative industries, the investment bank industry has long enjoyed high returns given its involvement in big-ticket transactions with large business establishments and governments. However, high returns often involve great risks, which could con ...

... Widely regarded as one of the financial sector’s most lucrative industries, the investment bank industry has long enjoyed high returns given its involvement in big-ticket transactions with large business establishments and governments. However, high returns often involve great risks, which could con ...

Atlantic Bridge Dr Helen McBreen, INVESTMENT DIRECTOR Best

... University Bridge Fund seeks to invest in companies built from research generated at all Irish Universities (7) and Institutes of Technology (13) ...

... University Bridge Fund seeks to invest in companies built from research generated at all Irish Universities (7) and Institutes of Technology (13) ...

prudential qma strategic value fund

... preservation, but with more of an emphasis on seeking returns that are superior to those of traditional money market offerings. Average weighted market capitalization is the average market capitalization of stocks in a fund, each weighted by its proportion of assets. The P/E Ratio (Source: Morningst ...

... preservation, but with more of an emphasis on seeking returns that are superior to those of traditional money market offerings. Average weighted market capitalization is the average market capitalization of stocks in a fund, each weighted by its proportion of assets. The P/E Ratio (Source: Morningst ...

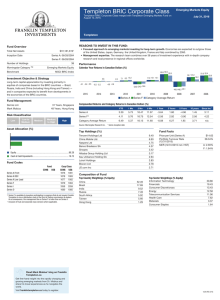

Templeton BRIC Corporate Class Series A

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

Telegraph fund focus

... Should you invest - and what are the alternatives? Mark Slater deserves credit for his stock selection over the years, according to Ben Willis of Whitechurch Securities, but the MFM SlaterGrowth fund must be considered a long-term hold. Mr Slater can invest in smaller companies and firms listed on t ...

... Should you invest - and what are the alternatives? Mark Slater deserves credit for his stock selection over the years, according to Ben Willis of Whitechurch Securities, but the MFM SlaterGrowth fund must be considered a long-term hold. Mr Slater can invest in smaller companies and firms listed on t ...

Financing Infrastructure Through Capital Market

... Creditworthy or credit enhanced borrowers Acceptance of cost recovery principles and/or appropriate subsidy where required Developed capital market – access - yield curves to price risk- tradability Risk/reward in balance Clear policy framework Capacity to deal with defaults Trust from investment se ...

... Creditworthy or credit enhanced borrowers Acceptance of cost recovery principles and/or appropriate subsidy where required Developed capital market – access - yield curves to price risk- tradability Risk/reward in balance Clear policy framework Capacity to deal with defaults Trust from investment se ...

ADV Part 2B - VZD Capital Management

... Ms. Davis is not engaged in any business activities outside of VZD Capital Management, LLC. Item 5 – Additional Compensation Other than a regular salary (contingent on the success of the business) and share of profits as the owner of the firm, Ms. Davis receives no additional economic benefits, sal ...

... Ms. Davis is not engaged in any business activities outside of VZD Capital Management, LLC. Item 5 – Additional Compensation Other than a regular salary (contingent on the success of the business) and share of profits as the owner of the firm, Ms. Davis receives no additional economic benefits, sal ...

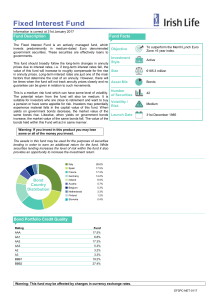

Fixed Interest Fund - Irish Life Corporate Business

... prices due to interest rates, i.e. if long-term interest rates fall, the value of this fund will increase to roughly compensate for the rise Size in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the ...

... prices due to interest rates, i.e. if long-term interest rates fall, the value of this fund will increase to roughly compensate for the rise Size in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the ...

Investment Advisor RFP Sample

... We also require an investment strategy for an operating fund with approximately $1.8 million in assets that mesh with the operating needs of the organization. Approximately $900,000 of the operating fund would need to be accessible for monthly operations, but invested in funds that provide higher y ...

... We also require an investment strategy for an operating fund with approximately $1.8 million in assets that mesh with the operating needs of the organization. Approximately $900,000 of the operating fund would need to be accessible for monthly operations, but invested in funds that provide higher y ...

Global Absolute Return Strategies Fund

... investment strategies based on advanced derivative techniques, resulting in a highly diversified portfolio. The fund can take long and short positions in markets, securities and groups of securities through derivative contracts. ...

... investment strategies based on advanced derivative techniques, resulting in a highly diversified portfolio. The fund can take long and short positions in markets, securities and groups of securities through derivative contracts. ...