Economics 434 Financial Markets - SHANTI Pages

... • CAPM puts Tobin’s model in equilibrium, by assuming that everyone faces the same portfolio choice problem as in Tobin’s problem • Only difference between people in CAPM is that each has their own preferences (utility function) ...

... • CAPM puts Tobin’s model in equilibrium, by assuming that everyone faces the same portfolio choice problem as in Tobin’s problem • Only difference between people in CAPM is that each has their own preferences (utility function) ...

Net Inflows in December 2016

... The Azimut Group recorded total net inflows of € 722 million in December 2016, reaching a total of € 6.5 billion net inflows in the entire 2016. The figure in December benefited from ca. € 260 million of inflows by institutional investors into the Money Market fund in China, who typically tend to in ...

... The Azimut Group recorded total net inflows of € 722 million in December 2016, reaching a total of € 6.5 billion net inflows in the entire 2016. The figure in December benefited from ca. € 260 million of inflows by institutional investors into the Money Market fund in China, who typically tend to in ...

Document

... counsel to individual and institutional sponsors and investors, including financial/bank holding companies, pension trusts, foundations and endowments, in the creation and marketing of a wide-selection of private investment funds. He has managed, negotiated, and closed a wide variety of mergers and ...

... counsel to individual and institutional sponsors and investors, including financial/bank holding companies, pension trusts, foundations and endowments, in the creation and marketing of a wide-selection of private investment funds. He has managed, negotiated, and closed a wide variety of mergers and ...

Emerging Markets – Income Opportunities

... has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P.Morgan Asset Management. Any forecasts, figures, opinions, statements of ...

... has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P.Morgan Asset Management. Any forecasts, figures, opinions, statements of ...

Performance of Private Equity Real Estate Funds

... • Emerging managers and earlier funds are shown to have higher returns and realised returns of past funds are shown to be a reliable indicator of future success. • Managers should not focus on growing assets under management (fund size) but on quality investments. • Investors should pay a lot attent ...

... • Emerging managers and earlier funds are shown to have higher returns and realised returns of past funds are shown to be a reliable indicator of future success. • Managers should not focus on growing assets under management (fund size) but on quality investments. • Investors should pay a lot attent ...

Chap008

... Firms with most-favorable recommendations outperform firms with least-favorable recommendations ...

... Firms with most-favorable recommendations outperform firms with least-favorable recommendations ...

Market comment for the week of March 3, 2017 Beware the Ides…?

... abrupt change in market expectations for the next rate increase. The shift was best captured in the Fed funds futures market, where the probability of an Ides-of-March 15 rate increase jumped from 40% to 94% in the space of a week. Prompting the change: the positive spin to recent data here, gatheri ...

... abrupt change in market expectations for the next rate increase. The shift was best captured in the Fed funds futures market, where the probability of an Ides-of-March 15 rate increase jumped from 40% to 94% in the space of a week. Prompting the change: the positive spin to recent data here, gatheri ...

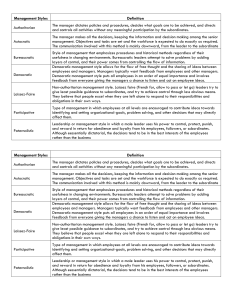

Management Styles

... employees and managers. Managers typically want feedback from employees and other managers. Democratic management style puts all employees in an order of equal importance and involves feedback from everyone giving the managers a chance to listen and act on employee ideas. ...

... employees and managers. Managers typically want feedback from employees and other managers. Democratic management style puts all employees in an order of equal importance and involves feedback from everyone giving the managers a chance to listen and act on employee ideas. ...

TIAA-CREF mutual funds CHOOSE THE RIGHT INVESTMENT

... The TIAA-CREF Growth & Income Fund may include the following risks: Market Risk, the risk that the price of securities may fall in response to economic conditions; Company Risk, the risk that the financial condition of a company may deteriorate, causing a decline in the value of the securities it is ...

... The TIAA-CREF Growth & Income Fund may include the following risks: Market Risk, the risk that the price of securities may fall in response to economic conditions; Company Risk, the risk that the financial condition of a company may deteriorate, causing a decline in the value of the securities it is ...

Cap Sustainable Growth Fact Sheet

... Holdings that contributed the most to performance during the quarter were Facebook and Alibaba Group. Facebook continues to grow advertising revenue and take share in the online digital marketing space. The company delivers an unprecedented global reach of 20% of the earth’s population to advertiser ...

... Holdings that contributed the most to performance during the quarter were Facebook and Alibaba Group. Facebook continues to grow advertising revenue and take share in the online digital marketing space. The company delivers an unprecedented global reach of 20% of the earth’s population to advertiser ...

Seven Out of Seven Times, Emerging Market

... higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk. As a result of political or economic i ...

... higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk. As a result of political or economic i ...

REVISED March 24.09 Presentation

... Providing strategic advice and project leadership to corporate, government and financial stakeholders. Sound guidance is provided for acquisitions, divestitures, growth strategies, turnarounds, refinancings and the development of optimal financial structures. ...

... Providing strategic advice and project leadership to corporate, government and financial stakeholders. Sound guidance is provided for acquisitions, divestitures, growth strategies, turnarounds, refinancings and the development of optimal financial structures. ...

Investment_Officer_Job_Profile

... • Service Orientation implies a desire to identify and serve customers/clients, who may include the public, co-workers, other branches/divisions, other ministries/agencies, other government organizations, and non-government organizations. It means focusing one's efforts on discovering and meeting th ...

... • Service Orientation implies a desire to identify and serve customers/clients, who may include the public, co-workers, other branches/divisions, other ministries/agencies, other government organizations, and non-government organizations. It means focusing one's efforts on discovering and meeting th ...

Curb Your Mind – Understanding Why Investors Don`t Achieve Their

... is very common. In fact, we are shocked every day to find investor’s with the investment strategy of local municipal bonds and large U.S. stocks with the intention of holding forever. The world has changed drastically since this strategy was effective. A static portfolio is no longer optimal. In ord ...

... is very common. In fact, we are shocked every day to find investor’s with the investment strategy of local municipal bonds and large U.S. stocks with the intention of holding forever. The world has changed drastically since this strategy was effective. A static portfolio is no longer optimal. In ord ...

Large Cap Research Equity

... There is no guarantee the Portfolio’s investment strategy will be successful. Investing involves risk, and an investment in the Portfolio could lose money. The Portfolio’s principal risks include: ...

... There is no guarantee the Portfolio’s investment strategy will be successful. Investing involves risk, and an investment in the Portfolio could lose money. The Portfolio’s principal risks include: ...

Chapter 1: Goals and Governance of the Firm

... Do managers maximize shareholder wealth? Mangers have many constituencies “stakeholders” “Agency Problems” represent the conflict of interest between management and owners ...

... Do managers maximize shareholder wealth? Mangers have many constituencies “stakeholders” “Agency Problems” represent the conflict of interest between management and owners ...

Short Readings 1

... to each article) and answer the following questions a. One article argues that increased integration of financial services has decreased economic volatility. However, recent economic events have suggested that this integration and growth of larger banks may have contributed to economic volatility. I ...

... to each article) and answer the following questions a. One article argues that increased integration of financial services has decreased economic volatility. However, recent economic events have suggested that this integration and growth of larger banks may have contributed to economic volatility. I ...

Investments

... Gain familiarity with the institutions and language of Wall Street so as to facilitate the development of an effective personal investment strategy. To help you make investment decisions that will enhance your economic welfare To create realistic expectations about the outcome of investment decision ...

... Gain familiarity with the institutions and language of Wall Street so as to facilitate the development of an effective personal investment strategy. To help you make investment decisions that will enhance your economic welfare To create realistic expectations about the outcome of investment decision ...

- Liontrust

... Your investment should provide a good and increasing level of income in real terms while also preserving the value of your capital over time. If a fund can consistently deliver these objectives over the long term, there is a good chance that it will be more rewarding than many other investments, and ...

... Your investment should provide a good and increasing level of income in real terms while also preserving the value of your capital over time. If a fund can consistently deliver these objectives over the long term, there is a good chance that it will be more rewarding than many other investments, and ...