Systematic and Unsystematic Risks

... risk that are common in all international investment plus specific risk associated with certain markets. The exchange rate risk is the most important required adjustments. If such currency risk can be hedged, the adjustment requirement is simply just the cost of hedging. However, very few currencies ...

... risk that are common in all international investment plus specific risk associated with certain markets. The exchange rate risk is the most important required adjustments. If such currency risk can be hedged, the adjustment requirement is simply just the cost of hedging. However, very few currencies ...

Syllabus - KEI Abroad

... The primary objective of this course is to introduce the student to the fundamental principles of finance so as to provide a sound foundation for further studies in the area of finance. In addition the course provides the non-finance student with a basic understanding of the fundamentals of finance ...

... The primary objective of this course is to introduce the student to the fundamental principles of finance so as to provide a sound foundation for further studies in the area of finance. In addition the course provides the non-finance student with a basic understanding of the fundamentals of finance ...

Three Trends in Middle Market Private Equity

... In 2015, approximately 35% of funds raised were below $100 million, compared to fewer than 25% in 2006. ...

... In 2015, approximately 35% of funds raised were below $100 million, compared to fewer than 25% in 2006. ...

investment portfolio management. objectives and constraints

... assess investor’s risk tolerance is to ask them to examine subjective probability distributions for various portfolios and to indicate which combination of risk and return is most appealing. A similar way to evaluate an investor’s attitude toward risk and return is by simulation. The portfolio manag ...

... assess investor’s risk tolerance is to ask them to examine subjective probability distributions for various portfolios and to indicate which combination of risk and return is most appealing. A similar way to evaluate an investor’s attitude toward risk and return is by simulation. The portfolio manag ...

Consider the risks - Guinness Asset Management

... and it may be difficult to sell or realise the investment or obtain reliable information about their value. Investors should not consider investing money in an offering which can hold shares in unlisted companies if their investment may be required during the life of the offering, which is normally ...

... and it may be difficult to sell or realise the investment or obtain reliable information about their value. Investors should not consider investing money in an offering which can hold shares in unlisted companies if their investment may be required during the life of the offering, which is normally ...

mou 2014-15 negotiation meeting

... Indian Renewable Energy Fund ( 1 Billion US$) : To raise funds to invest in Renewable Energy Projects and associated value chain including equity (Proposed) ...

... Indian Renewable Energy Fund ( 1 Billion US$) : To raise funds to invest in Renewable Energy Projects and associated value chain including equity (Proposed) ...

Lesson 10-2 Principles of Saving and Investing

... money on a regular basis, such as monthly, regardless of market conditions. ...

... money on a regular basis, such as monthly, regardless of market conditions. ...

High Quality Dividend Yield

... * Any investment is subject to risk. Past performance is not a guarantee of future results. The data presented was obtained from the Advisor Partners High Quality Dividend Yield Composite, which seeks to invest in dividend paying companies that have high quality financial characteristics within the ...

... * Any investment is subject to risk. Past performance is not a guarantee of future results. The data presented was obtained from the Advisor Partners High Quality Dividend Yield Composite, which seeks to invest in dividend paying companies that have high quality financial characteristics within the ...

Large Cap Strategies

... The value of an investment in the Fund will fluctuate, which means that an investor could lose the principal amount invested. Investing in emerging and foreign markets may involve additional risks such as economic and political instability, market illiquidity, and currency volatility. Growth stocks ...

... The value of an investment in the Fund will fluctuate, which means that an investor could lose the principal amount invested. Investing in emerging and foreign markets may involve additional risks such as economic and political instability, market illiquidity, and currency volatility. Growth stocks ...

SEBI (Venture Capital Funds) Regulations, 1996

... ARDC credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's IPO in 1968 ARDC made an annualized return of 101% on the transaction ...

... ARDC credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's IPO in 1968 ARDC made an annualized return of 101% on the transaction ...

Click here - WHAS Crusade for Children

... Enclosed is a copy of the 22 page current Endowment Investment and Spending Policy. If your proposal would conflict with this Policy, you should identify the area of conflict and give your reasoning and suggested changes. Also, Section IX – Investment Strategy enumerates several criteria that are to ...

... Enclosed is a copy of the 22 page current Endowment Investment and Spending Policy. If your proposal would conflict with this Policy, you should identify the area of conflict and give your reasoning and suggested changes. Also, Section IX – Investment Strategy enumerates several criteria that are to ...

Invesco High Yield Municipal Fund fact sheet

... principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating. Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment ...

... principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating. Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment ...

In last year`s briefing on the investment result for 2009 for the

... investor and consumer sentiment in the US may provide some support to the equity markets in the short run. However, other fundamental factors, notably the high unemployment rate, very soft housing market and the de-leveraging of the households etc, may become negative factors affecting the sustainab ...

... investor and consumer sentiment in the US may provide some support to the equity markets in the short run. However, other fundamental factors, notably the high unemployment rate, very soft housing market and the de-leveraging of the households etc, may become negative factors affecting the sustainab ...

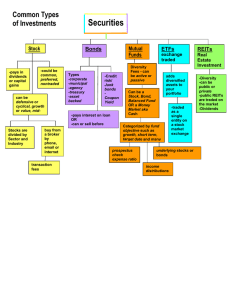

Securities

... composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading price. Very similar to Mutual Funds with these exceptions – ...

... composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading price. Very similar to Mutual Funds with these exceptions – ...

3rd Quarter - Legacy Asset Management

... Our long-term outlook has not changed since last December. We are still looking for modest GDP growth over the next several quarters as the country works through a dormant job cycle, excessive housing inventory and uncertainty related to regulation, taxes and national debt. Since last December, we h ...

... Our long-term outlook has not changed since last December. We are still looking for modest GDP growth over the next several quarters as the country works through a dormant job cycle, excessive housing inventory and uncertainty related to regulation, taxes and national debt. Since last December, we h ...

RIVERPARK INTRODUCES RIVERPARK LONG/SHORT

... performance since inception of the investment. Different indices and investments will experience drawdowns over different time periods. However, comparing max drawdowns over a common time period among multiple investments or indices provides a common basis for comparing two or more sets of data. Th ...

... performance since inception of the investment. Different indices and investments will experience drawdowns over different time periods. However, comparing max drawdowns over a common time period among multiple investments or indices provides a common basis for comparing two or more sets of data. Th ...

FINDING RELATIVE VALUE OPPORTUNITIES IN FIXED INCOME

... an expanded set of investment opportunities within a single fund. In addition, these funds have tremendous scope to adjust the asset allocation, based on the manager’s view of the likely returns and risks of any asset class. However, this ‘go anywhere’ investment flexibility is not the only differen ...

... an expanded set of investment opportunities within a single fund. In addition, these funds have tremendous scope to adjust the asset allocation, based on the manager’s view of the likely returns and risks of any asset class. However, this ‘go anywhere’ investment flexibility is not the only differen ...

The MSc in International Securities, Investment and Banking is a

... University, the ICMA Centre, Henley Business School with a very practical edge. Such a high calibre degree is valuable both towards building a career in asset management as well as towards Malta’s booming finance industry which cannot grow unless it invests in advanced education. This degree adds va ...

... University, the ICMA Centre, Henley Business School with a very practical edge. Such a high calibre degree is valuable both towards building a career in asset management as well as towards Malta’s booming finance industry which cannot grow unless it invests in advanced education. This degree adds va ...