Behavioral Finance

... Results in under-diversification Home bias, local bias Bias is more substantial if take into account human capital ...

... Results in under-diversification Home bias, local bias Bias is more substantial if take into account human capital ...

High Yield Bond Fund

... lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the fund and its share price can be sudden an ...

... lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the fund and its share price can be sudden an ...

Equity Investment Approach - Retirement Income Management

... factors come into focus in the screening process including the size of the company, dividend growth, return on equity, sales growth, cash flow growth, earnings growth, earnings momentum/surprise, and debt levels. Standard & Poors Quality Rankings (sales, earnings, and dividends) are also utilized as ...

... factors come into focus in the screening process including the size of the company, dividend growth, return on equity, sales growth, cash flow growth, earnings growth, earnings momentum/surprise, and debt levels. Standard & Poors Quality Rankings (sales, earnings, and dividends) are also utilized as ...

es220050945197.ps, page 1-3 @ Normalize_2 ( cs220050945197 )

... (a) the definitions of “advising on futures contracts” and “advising on securities” are amended so that the giving of advice by a person, who is licensed or registered for Type 9 regulated activity, solely for the purposes of carrying on securities or futures contracts management, as the case may be ...

... (a) the definitions of “advising on futures contracts” and “advising on securities” are amended so that the giving of advice by a person, who is licensed or registered for Type 9 regulated activity, solely for the purposes of carrying on securities or futures contracts management, as the case may be ...

The primary objective of business financial

... c. minimize the chance of losses. d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the tim ...

... c. minimize the chance of losses. d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the tim ...

Complaint Form - IMT Financial Advisors AG

... Reception and transmission of orders in relation to one or more financial instruments Investment research and financial analysis or other forms of general recommendation relating to transactions in financial instruments Execution of orders on behalf of the customer ...

... Reception and transmission of orders in relation to one or more financial instruments Investment research and financial analysis or other forms of general recommendation relating to transactions in financial instruments Execution of orders on behalf of the customer ...

Document

... current income vs. total return (capital gains + reinvestment of current income) how much risk is right for you? ...

... current income vs. total return (capital gains + reinvestment of current income) how much risk is right for you? ...

Welcome to the Lafayette Investment Club

... 500 stocks. The index is designed to measure performance of the broad DOMESTIC economy through changes in the aggregate market value of 500 stocks representing all major industries. ...

... 500 stocks. The index is designed to measure performance of the broad DOMESTIC economy through changes in the aggregate market value of 500 stocks representing all major industries. ...

NN Global Investment Grade Credit - Home

... aversion during the second half of May subsided. During a hearing before the Senate Intelligence Committee, former FBI director James Comey declined to say whether President Trump’s encouragement to drop the FBI investigation of former national security adviser Michael Flynn was obstruction of justi ...

... aversion during the second half of May subsided. During a hearing before the Senate Intelligence Committee, former FBI director James Comey declined to say whether President Trump’s encouragement to drop the FBI investigation of former national security adviser Michael Flynn was obstruction of justi ...

The Euro-Debt Crisis: Effects on the US Market and the

... constitute investment advice or an offer to sell, or the solicitation of an offer to purchase shares or other securities. Investors should always obtain and read an up-to-date investment services description or prospectus before deciding whether to appoint an investment manager or to invest in a fun ...

... constitute investment advice or an offer to sell, or the solicitation of an offer to purchase shares or other securities. Investors should always obtain and read an up-to-date investment services description or prospectus before deciding whether to appoint an investment manager or to invest in a fun ...

Overview of Craft3 Powerpoint with information on

... The skilled work of many hands over time triples positive impacts on local economies, the environment, and opportunity for the excluded. ...

... The skilled work of many hands over time triples positive impacts on local economies, the environment, and opportunity for the excluded. ...

85 reasons why investors avoided the stock market:Layout 1.qxd

... instruments. Nothing presented herein is intended to constitute investment advice. You should consult your financial advisor prior to making any investment ...

... instruments. Nothing presented herein is intended to constitute investment advice. You should consult your financial advisor prior to making any investment ...

Introduction to Hansa Investment Funds What is risk?

... Political risk – risk, that the value of the investment can decrease because of the changes political and/or regulatory environment – Political risk can realize through increased taxes, capital controls, currency devaluation, revolution etc – Scale: credit rating ...

... Political risk – risk, that the value of the investment can decrease because of the changes political and/or regulatory environment – Political risk can realize through increased taxes, capital controls, currency devaluation, revolution etc – Scale: credit rating ...

(Attachment: 5)Report (79K/bytes)

... previous short term asset allocation. The current political, economic and market conditions are similar to previous advice provided at meetings and do not suggest any need to make any major strategy changes. Currently, the key component when setting the short term asset allocation is the Bond yield ...

... previous short term asset allocation. The current political, economic and market conditions are similar to previous advice provided at meetings and do not suggest any need to make any major strategy changes. Currently, the key component when setting the short term asset allocation is the Bond yield ...

Document

... • This section will help you recognize and avoid different types of investment fraud. You'll also learn what questions to ask before investing, where to get information about companies, who to call for help, and what to do if you run into ...

... • This section will help you recognize and avoid different types of investment fraud. You'll also learn what questions to ask before investing, where to get information about companies, who to call for help, and what to do if you run into ...

FIN-121 Personal Finance

... financial opportunities, resolve personal financial problems, achieve self-satisfactions and strive towards financial security. ...

... financial opportunities, resolve personal financial problems, achieve self-satisfactions and strive towards financial security. ...

Borrowing money to make money

... investment and your interest cost is tax deductible. This type of debt is called “good debt” and is usually anything that is tax deductible and provides value as the asset appreciates ...

... investment and your interest cost is tax deductible. This type of debt is called “good debt” and is usually anything that is tax deductible and provides value as the asset appreciates ...

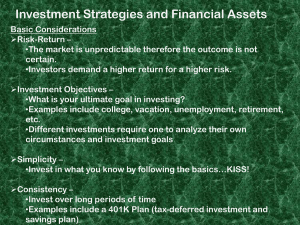

Financial Markets - Duluth High School

... • Risk: a situation in which the outcome is not certain but can be estimated –Higher risk = higher rate of return –Low risk = lower rate of return ...

... • Risk: a situation in which the outcome is not certain but can be estimated –Higher risk = higher rate of return –Low risk = lower rate of return ...

Document

... The idea was that workers would carry out highly specialized and narrowly focused tasks for which they would be paid piece work rate. This system gives management a very high level of control of workers. This approach emphasized efficiency at all cost and poorly regarded trust between the coporation ...

... The idea was that workers would carry out highly specialized and narrowly focused tasks for which they would be paid piece work rate. This system gives management a very high level of control of workers. This approach emphasized efficiency at all cost and poorly regarded trust between the coporation ...

INVESTMENT focuS - Castanea Partners

... INVESTMENT focus Castanea is focused on investing in dynamic consumer brands, multi-channel retail, and marketing services companies that enable such brands to connect with their customers. The firm also seeks to invest in select business-to-business providers of key information. The firm summarizes ...

... INVESTMENT focus Castanea is focused on investing in dynamic consumer brands, multi-channel retail, and marketing services companies that enable such brands to connect with their customers. The firm also seeks to invest in select business-to-business providers of key information. The firm summarizes ...