Course: ISyE 6308, Analysis of Production Operations, Spring 1995

... of the course. It is your responsibility for bringing materials to class as long as they were posted by midnight the previous day; otherwise, it will be my responsibility. 2. Course Description and Objectives Students learn the basic terminology, concepts and issues relevant to financial engineering ...

... of the course. It is your responsibility for bringing materials to class as long as they were posted by midnight the previous day; otherwise, it will be my responsibility. 2. Course Description and Objectives Students learn the basic terminology, concepts and issues relevant to financial engineering ...

What are Financial Intermediaries (FIs)?

... “It is the ability to foretell what is going to happen tomorrow, next week, next month, and next year. And to have the ability afterwards to explain why it didn’t happen.” Sir Winston Churchill ...

... “It is the ability to foretell what is going to happen tomorrow, next week, next month, and next year. And to have the ability afterwards to explain why it didn’t happen.” Sir Winston Churchill ...

Innovest - Kellogg School of Management

... Innovest’s Carbon Beta™ platform, which currently covers over 1,500 international companies in high-impact sectors, is an extension of this proven methodology. It is supported by Innovest’s 50-strong team of global sector specialists, as well as many years of empirical stock market return attributio ...

... Innovest’s Carbon Beta™ platform, which currently covers over 1,500 international companies in high-impact sectors, is an extension of this proven methodology. It is supported by Innovest’s 50-strong team of global sector specialists, as well as many years of empirical stock market return attributio ...

Delivering Active Management in REITs

... Tracking error is the amount by which the performance of the portfolio differed from that of the benchmark. Alpha is a measure of the difference between a fund’s actual returns and its expected performance, given its level of risk as measured by beta. Run up % is the cumulative return during a perio ...

... Tracking error is the amount by which the performance of the portfolio differed from that of the benchmark. Alpha is a measure of the difference between a fund’s actual returns and its expected performance, given its level of risk as measured by beta. Run up % is the cumulative return during a perio ...

FREE Sample Here

... ownership. Under the limited partnership, only the general partner(s) has unlimited liability, with limited partners obligated only to the extent of their initial contribution. Finally, all shareholders in a corporation have limited liability, although owner/ shareholders of small businesses often h ...

... ownership. Under the limited partnership, only the general partner(s) has unlimited liability, with limited partners obligated only to the extent of their initial contribution. Finally, all shareholders in a corporation have limited liability, although owner/ shareholders of small businesses often h ...

Interest Rate Risk

... c. How are the bank/financial institution ranked vs. its peers in the same country? d. What are the bank/financial institution’s credit rating? Foreign Currency Risk The risk of devaluation. The exchange rate is highly influenced by: a. Political stability of the country b. Technical factors c. Econ ...

... c. How are the bank/financial institution ranked vs. its peers in the same country? d. What are the bank/financial institution’s credit rating? Foreign Currency Risk The risk of devaluation. The exchange rate is highly influenced by: a. Political stability of the country b. Technical factors c. Econ ...

Risk Management and Financial Institutions

... are traded in the same way as the shares of any other company The share price tends to be less than the NAV calculated from the market value of the investments ...

... are traded in the same way as the shares of any other company The share price tends to be less than the NAV calculated from the market value of the investments ...

The Word from Hansard - Alliance Partnership

... Equity fund flows surged to EURO1.91bn in September, the first positive monthly figure since February, Morningstar's latest European fund flows data has shown. European large-cap funds saw EURO506m of fresh inflows, their first positive quarter since Q1 2011, while the Europe ex-UK large-cap equity ...

... Equity fund flows surged to EURO1.91bn in September, the first positive monthly figure since February, Morningstar's latest European fund flows data has shown. European large-cap funds saw EURO506m of fresh inflows, their first positive quarter since Q1 2011, while the Europe ex-UK large-cap equity ...

(PPT, 130KB)

... Investment Management provides asset management products and services in equity, fixed income, alternative investments, real estate investment, and private equity to institutional and retail clients through thirdparty retail distribution channels, intermediaries and Morgan Stanley's institutional di ...

... Investment Management provides asset management products and services in equity, fixed income, alternative investments, real estate investment, and private equity to institutional and retail clients through thirdparty retail distribution channels, intermediaries and Morgan Stanley's institutional di ...

Closed-End Fund GGM Guggenheim Credit Allocation Fund

... Risks and Other Considerations There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to in ...

... Risks and Other Considerations There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to in ...

Chapter 1 -- The Role of Financial Management

... What is the best dividend policy (e.g., dividend-payout ratio)? How will the funds be physically ...

... What is the best dividend policy (e.g., dividend-payout ratio)? How will the funds be physically ...

Chapter 3 – Outline

... Financial Markets a. Physical Assets versus Financial Assets b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature i ...

... Financial Markets a. Physical Assets versus Financial Assets b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature i ...

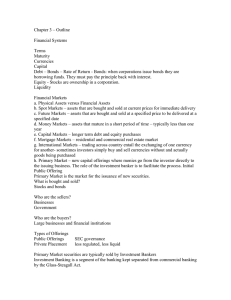

What is a Secondary? - Voya Investment Management

... In the initial years of a traditional primary investment, a fund will exhibit low or negative returns and cash flows. This is normal as during this time of a fund’s lifecycle the private equity fund manager is making investments, which will have a dragging effect on the internal rate of return (IRR) ...

... In the initial years of a traditional primary investment, a fund will exhibit low or negative returns and cash flows. This is normal as during this time of a fund’s lifecycle the private equity fund manager is making investments, which will have a dragging effect on the internal rate of return (IRR) ...

ZI Barings Developed and Emerging Markets High Yield Bond

... liabilities to its policy owners, up to 90% of the liability to the protected policy owner will be met. ...

... liabilities to its policy owners, up to 90% of the liability to the protected policy owner will be met. ...

Corporate Superannuation Association

... has to be funded and this is done to a large extent by fund levies. Our organisation has repeatedly raised issues, in submissions to Treasury on levy methodologies, regarding the equity of the distribution of these levies (which, through “capping”, place a disproportionately high burden on medium si ...

... has to be funded and this is done to a large extent by fund levies. Our organisation has repeatedly raised issues, in submissions to Treasury on levy methodologies, regarding the equity of the distribution of these levies (which, through “capping”, place a disproportionately high burden on medium si ...

financial focus - Pegasus Asset Management, Inc.

... Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or inves ...

... Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or inves ...

Q3 2010 - Spears Abacus

... the years. We no longer are confined to equity portfolios, with a few fixed income issues when appropriate. Many of our clients’ circumstances warrant a more holistic approach to return and risk. Although our equity research is where we can distinguish ourselves and add the most value over time, we ...

... the years. We no longer are confined to equity portfolios, with a few fixed income issues when appropriate. Many of our clients’ circumstances warrant a more holistic approach to return and risk. Although our equity research is where we can distinguish ourselves and add the most value over time, we ...

PRO-IV`s patented IoT system connects the

... PRO-IV's patented IoT system connects the patients receiving infusion therapy and their caregivers to the internet. It's proven technology improves dramatically the compliance and reduces errors by a unique management and monitoring system. It provides on-line information and real time reports for c ...

... PRO-IV's patented IoT system connects the patients receiving infusion therapy and their caregivers to the internet. It's proven technology improves dramatically the compliance and reduces errors by a unique management and monitoring system. It provides on-line information and real time reports for c ...

RCF presentation

... The newly available debt financing options enable a sophisticated real estate investor to return most of investors’ capital via refinancing. More appropriate capital structures also improve current yields and facilitate the return of capital. Domestic Institutional Buyers: The emerging class of do ...

... The newly available debt financing options enable a sophisticated real estate investor to return most of investors’ capital via refinancing. More appropriate capital structures also improve current yields and facilitate the return of capital. Domestic Institutional Buyers: The emerging class of do ...

A Depositor Run in Securities Markets: The Korean Experience

... state prosecutors indicted executives of SK Global, a subsidiary of Korea’s third largest conglomerate SK Group, on charges of falsifying financial statements. SK Global was accused of inflating profits by 1.6 trillion won and hiding debt totalling 1.1 trillion won. Similar to the market reaction a ...

... state prosecutors indicted executives of SK Global, a subsidiary of Korea’s third largest conglomerate SK Group, on charges of falsifying financial statements. SK Global was accused of inflating profits by 1.6 trillion won and hiding debt totalling 1.1 trillion won. Similar to the market reaction a ...

the relevance of real estate market trends for investment property

... • Mueller and Laposa (1994) investigated the cyclical movements of fifty-two office markets in the U.S. By examining average vacancy and deviations from this average as an indication of market risk or volatility, they classified and captured the nature of cyclical risk inherent in these markets. The ...

... • Mueller and Laposa (1994) investigated the cyclical movements of fifty-two office markets in the U.S. By examining average vacancy and deviations from this average as an indication of market risk or volatility, they classified and captured the nature of cyclical risk inherent in these markets. The ...