Introducing Expected Returns into Risk Parity

... problem is that the Markowitz optimization is a very aggressive model of active management, detecting arbitrage opportunities that are sometimes false and may result from noise data. The model then transforms these arbitrage opportunities into investment bets in an optimistic way without considering ...

... problem is that the Markowitz optimization is a very aggressive model of active management, detecting arbitrage opportunities that are sometimes false and may result from noise data. The model then transforms these arbitrage opportunities into investment bets in an optimistic way without considering ...

Week Ahead: All eyes on European leaders, corporate earnings and

... Investors await action from European leaders – The Greek sovereign debt crisis will remain at the forefront of investors’ minds this week. Overnight, Germany’s Angela Merkel and France’s Nicholas Sarkozy met to discuss next steps in averting a regional crisis. Both leaders were tight-lipped on the d ...

... Investors await action from European leaders – The Greek sovereign debt crisis will remain at the forefront of investors’ minds this week. Overnight, Germany’s Angela Merkel and France’s Nicholas Sarkozy met to discuss next steps in averting a regional crisis. Both leaders were tight-lipped on the d ...

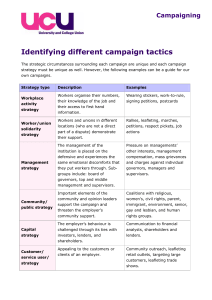

Identifying different campaign tactics

... The strategic circumstances surrounding each campaign are unique and each campaign strategy must be unique as well. However, the following examples can be a guide for our own campaigns. Strategy type Workplace activity strategy Worker/union solidarity strategy ...

... The strategic circumstances surrounding each campaign are unique and each campaign strategy must be unique as well. However, the following examples can be a guide for our own campaigns. Strategy type Workplace activity strategy Worker/union solidarity strategy ...

12 Billion Dirhams Profits of 65 Companies Listed on ADX 19

... Deutsche Bank and Citi Banking Group. ADX goals are in line with Abu Dhabi Government Economic Vision 2030. The 2030 economic plan plays a vital role in ADX strategy since it places the financial market in the context of economic and social development. The development would be through diverting sav ...

... Deutsche Bank and Citi Banking Group. ADX goals are in line with Abu Dhabi Government Economic Vision 2030. The 2030 economic plan plays a vital role in ADX strategy since it places the financial market in the context of economic and social development. The development would be through diverting sav ...

print to PDF - Willis Owen

... Where investors are increasingly searching for income in a low interest environment, we will have a look at the sector that is designed to meet the needs of providing income. What is the UK equity income sector? The UK Equity Income sector is part of the Investment Association (IA) and was establish ...

... Where investors are increasingly searching for income in a low interest environment, we will have a look at the sector that is designed to meet the needs of providing income. What is the UK equity income sector? The UK Equity Income sector is part of the Investment Association (IA) and was establish ...

1 Hong Kong / Singapore, 19 August 2014 SOCIETE GENERALE

... Societe Generale: 150 years In 2014, Societe Generale Group celebrates its 150th anniversary with a focus on entrepreneurial spirit, innovation and team spirit. Founded by a group of industrialists and financiers, the bank’s very name illustrated their ambition: "Société Générale pour favoriser le d ...

... Societe Generale: 150 years In 2014, Societe Generale Group celebrates its 150th anniversary with a focus on entrepreneurial spirit, innovation and team spirit. Founded by a group of industrialists and financiers, the bank’s very name illustrated their ambition: "Société Générale pour favoriser le d ...

PRACTICE ONLY

... 4. Which of the following is true about typical real estate investment (unlevered, at the direct property level) and inflation risk? (a) Real estate investment appreciation returns do not generally keep pace with inflation in the long run, but real estate investment provides a hedge against inflatio ...

... 4. Which of the following is true about typical real estate investment (unlevered, at the direct property level) and inflation risk? (a) Real estate investment appreciation returns do not generally keep pace with inflation in the long run, but real estate investment provides a hedge against inflatio ...

Exemption From Audit Requirement For A Regulated Mutual Fund.

... Authority must be satisfied that the exemption will not contravene any terms of the fund’s articles or other constitutive documents and its offering document, or prejudice the fund’s investors and creditors. In addition to the documents to be provided pursuant to section 5 below, an operator of the ...

... Authority must be satisfied that the exemption will not contravene any terms of the fund’s articles or other constitutive documents and its offering document, or prejudice the fund’s investors and creditors. In addition to the documents to be provided pursuant to section 5 below, an operator of the ...

UNITED NATIONS

... Undertaking data entry into the contributions tables based on the approved core and ITL budgets and decisions of the Parties and advising Parties on the status of their contributions including reminders for overdue amounts. Assisting in the update and maintenance of the status of voluntary contribut ...

... Undertaking data entry into the contributions tables based on the approved core and ITL budgets and decisions of the Parties and advising Parties on the status of their contributions including reminders for overdue amounts. Assisting in the update and maintenance of the status of voluntary contribut ...

Document

... Output Standards - measures performance results in terms of quantity, quality, cost, or time. Input Standards - measures work efforts that go into a performance task. ...

... Output Standards - measures performance results in terms of quantity, quality, cost, or time. Input Standards - measures work efforts that go into a performance task. ...

Are investment certificates too complex?

... bonds are. However it is only if the issuer becomes bankrupt that the certificate holder suffers a total loss or receives only part of the invested capital back. There are now ways of hedging against this default risk. ...

... bonds are. However it is only if the issuer becomes bankrupt that the certificate holder suffers a total loss or receives only part of the invested capital back. There are now ways of hedging against this default risk. ...

This PDF is a selection from a published volume from... Bureau of Economic Research Volume Title: Quantifying Systemic Risk

... with the indirect credit demand channel. And bank credit growth slowdowns are primarily the results of the declines in aggregate real demand, not the other way around. It is the most important finding in the chapter, which also has implications for the financial-centric approach in systemic risk. Fo ...

... with the indirect credit demand channel. And bank credit growth slowdowns are primarily the results of the declines in aggregate real demand, not the other way around. It is the most important finding in the chapter, which also has implications for the financial-centric approach in systemic risk. Fo ...

AMP Capital - Productivity Commission

... an alternative approach would see governments (collectively) co-invest equity with the private sector in the development of high economic benefit projects. The re-development of blighted sites, usually old industrial areas in major cities in the United States, is an interesting precedent. In these c ...

... an alternative approach would see governments (collectively) co-invest equity with the private sector in the development of high economic benefit projects. The re-development of blighted sites, usually old industrial areas in major cities in the United States, is an interesting precedent. In these c ...

II. strategy Learning objective 4 Define strategy and explain the

... effort to deplete inventories. This would help free up money for a better year-end position, allowing for more money to be passed on to stockholders of the company. However, this causes a problem: summer sales are higher than in normal months. This creates an inability to meet customer demand for va ...

... effort to deplete inventories. This would help free up money for a better year-end position, allowing for more money to be passed on to stockholders of the company. However, this causes a problem: summer sales are higher than in normal months. This creates an inability to meet customer demand for va ...

April Economic Roundup QUOTEDDATA

... In terms of events which will make headlines in 2015, we have an election in the UK in early May, with the prospect of another referendum, this time on EU membership, creating uncertainty. Whatever the outcome it will take time for any changes to make a material difference to the profit and loss acc ...

... In terms of events which will make headlines in 2015, we have an election in the UK in early May, with the prospect of another referendum, this time on EU membership, creating uncertainty. Whatever the outcome it will take time for any changes to make a material difference to the profit and loss acc ...

Liquidity Management Policy Summary

... Whether the asset trades on listed or private markets; and ...

... Whether the asset trades on listed or private markets; and ...

Invisible Receipts Purpose Description Code . No. SERVICES

... Remittances made on account of dividends by companies, firms, and banks to foreign shareholders having direct investment (ownership of 10% or more) in the enterprises operating in Pakistan. ...

... Remittances made on account of dividends by companies, firms, and banks to foreign shareholders having direct investment (ownership of 10% or more) in the enterprises operating in Pakistan. ...

american business school

... Host Institutions: American Business School (ABS) Updated on: November 2014 This document contains typical course offerings during the Fall, Spring and Summer terms. KEI and ABS reserve the right to modify and cancel courses without prior notice. Students must select alternate courses when applying ...

... Host Institutions: American Business School (ABS) Updated on: November 2014 This document contains typical course offerings during the Fall, Spring and Summer terms. KEI and ABS reserve the right to modify and cancel courses without prior notice. Students must select alternate courses when applying ...

NEWS RELEASE

... company almost dominates the domestic market and is among the global market leaders for terpene resins. Strong relationships with suppliers allow for stable procurement of raw materials. Thanks to this, as well as the advantage of having blue-chip companies on its client list, the earnings base is s ...

... company almost dominates the domestic market and is among the global market leaders for terpene resins. Strong relationships with suppliers allow for stable procurement of raw materials. Thanks to this, as well as the advantage of having blue-chip companies on its client list, the earnings base is s ...

Slajd 1

... subject to negotiation with the local authorities only in case if the investor is the owner of the building (provided by the Commune Council) ...

... subject to negotiation with the local authorities only in case if the investor is the owner of the building (provided by the Commune Council) ...

to view our Weekly Market Commentary for

... changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrowe ...

... changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrowe ...