Is Islamic Equity Index efficient than India`s National Index?-A

... undervalued stocks or try to predict trends in the market through fundamental analysis or technical analysis (Investopedia, 2013). According to the EMH, stocks always trade at their fair value on stock exchanges. It makes impossible for investors to purchase undervalued stocks. It also makes impossi ...

... undervalued stocks or try to predict trends in the market through fundamental analysis or technical analysis (Investopedia, 2013). According to the EMH, stocks always trade at their fair value on stock exchanges. It makes impossible for investors to purchase undervalued stocks. It also makes impossi ...

Urban Studies

... to anchoring transnational investment. Yet, the acknowledged dearth of studies on the real estate industry in post-liberalisation India limits our understanding of the ongoing empowerment of local urban actors, including developers. Adopting a cultural political economy perspective, the paper analys ...

... to anchoring transnational investment. Yet, the acknowledged dearth of studies on the real estate industry in post-liberalisation India limits our understanding of the ongoing empowerment of local urban actors, including developers. Adopting a cultural political economy perspective, the paper analys ...

1 TIAA RISK AND COMPLIANCE COMMITTEE CHARTER Amended

... company’s enterprise wide risk management framework including risk appetite and limits, risk governance and culture, risk policies, and risk management capabilities established by management to identify, assess, manage and mitigate risk; (ii) the review of management’s assessment of the Company’s ri ...

... company’s enterprise wide risk management framework including risk appetite and limits, risk governance and culture, risk policies, and risk management capabilities established by management to identify, assess, manage and mitigate risk; (ii) the review of management’s assessment of the Company’s ri ...

pract3s

... (a) Calculate the expected value and standard deviation for the dollar return per $1000 invested for each of the two investments. (b) Calculate the covariance and correlation coefficient between the two investments. (c) What is the expected return and standard deviation on a portfolio consisting of ...

... (a) Calculate the expected value and standard deviation for the dollar return per $1000 invested for each of the two investments. (b) Calculate the covariance and correlation coefficient between the two investments. (c) What is the expected return and standard deviation on a portfolio consisting of ...

2012 Winter Newsletter - Student Managed Investment Fund

... executed in early January, and our remaining 55 shares were sold later that month. Although the Fund continues to be cautious on the sector as a whole, we believe there are prudent, yet lucrative opportunities to be had. The resounding consensus in the class is a cry for best-in-class financial comp ...

... executed in early January, and our remaining 55 shares were sold later that month. Although the Fund continues to be cautious on the sector as a whole, we believe there are prudent, yet lucrative opportunities to be had. The resounding consensus in the class is a cry for best-in-class financial comp ...

trAnSition to 401(k) PLAnS - Sonoma County Association of Retired

... fully a third of the value of all 401(k) plan balances.8 So where can one invest to get a sufficient return? The entire Social Security fund is invested in special issues of the U.S. Treasuries that paid an average of 2.76% for 2010 and 2.82% for 2011.9 Even if made available to 401(k) investors, th ...

... fully a third of the value of all 401(k) plan balances.8 So where can one invest to get a sufficient return? The entire Social Security fund is invested in special issues of the U.S. Treasuries that paid an average of 2.76% for 2010 and 2.82% for 2011.9 Even if made available to 401(k) investors, th ...

Efficient Market Hypothesis : A Historical

... that if such data ever conveyed reliable signals about future performance, all investors would have learned already to exploit the signals. Ultimately, the signals lose their value as they become widely known because a buy signal, for instance, would result in an immediate price increase. In a weak ...

... that if such data ever conveyed reliable signals about future performance, all investors would have learned already to exploit the signals. Ultimately, the signals lose their value as they become widely known because a buy signal, for instance, would result in an immediate price increase. In a weak ...

Investor Preferences and Portfolio Selection: Is Diversification an

... We focus on the current 30 components of the DJIA for both computational tractability and the prominence of the index in the investment arena. 6 The DJIA is very widely quoted in investment news and is among the most scrutinized indicators of U.S. stock market performance. It includes a wide variet ...

... We focus on the current 30 components of the DJIA for both computational tractability and the prominence of the index in the investment arena. 6 The DJIA is very widely quoted in investment news and is among the most scrutinized indicators of U.S. stock market performance. It includes a wide variet ...

lifeplan icfs financial advice satisfaction index

... and reliability, and technical abilities of an advisor. However, the period of taking advice did not impact the perceptions of performance. We do note that investors with longer than 10 years of taking financial advice did have a higher perception of performance which was statistically significant. ...

... and reliability, and technical abilities of an advisor. However, the period of taking advice did not impact the perceptions of performance. We do note that investors with longer than 10 years of taking financial advice did have a higher perception of performance which was statistically significant. ...

Common Errors in DCF Models

... pays the mortgage; earnings do not. Equity investors are business buyers. While most shareholders own only a small fraction of a company, they are owners nonetheless. The source of shareholder value, and value changes, is no different than the sole proprietor’s: it’s all about the cash. Most investo ...

... pays the mortgage; earnings do not. Equity investors are business buyers. While most shareholders own only a small fraction of a company, they are owners nonetheless. The source of shareholder value, and value changes, is no different than the sole proprietor’s: it’s all about the cash. Most investo ...

Lecture 1

... of the people within them and their attitudes, perceptions and behaviors affect how an organization will operate. Organization’s Role in Society •Organizations exist to allow accomplishment of work that could not be achieved by people alone. •As long as the goals of an organization are appropriate, ...

... of the people within them and their attitudes, perceptions and behaviors affect how an organization will operate. Organization’s Role in Society •Organizations exist to allow accomplishment of work that could not be achieved by people alone. •As long as the goals of an organization are appropriate, ...

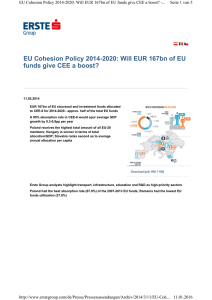

EU Cohesion Policy 2014-2020: Will EUR 167bn of EU funds give

... Roughly the same amount should go to environmental projects while one tenth of the EU funds should flow into the business sector (mainly SMEs). Around 15% of the total allocation should be invested in tackling labor market, social inclusion and work-life balance issues. CEF Program: “The highest pot ...

... Roughly the same amount should go to environmental projects while one tenth of the EU funds should flow into the business sector (mainly SMEs). Around 15% of the total allocation should be invested in tackling labor market, social inclusion and work-life balance issues. CEF Program: “The highest pot ...

PORTFOLIO REVIEW

... Editor's Note: The Sabrient Earnings Busters newsletter is written by Daniel Vickers, analyst at Sabrient. Daniel also assists in the selection of stocks and maintenance of the portfolio. He can be reached at [email protected] Disclaimer: This newsletter is published solely for informat ...

... Editor's Note: The Sabrient Earnings Busters newsletter is written by Daniel Vickers, analyst at Sabrient. Daniel also assists in the selection of stocks and maintenance of the portfolio. He can be reached at [email protected] Disclaimer: This newsletter is published solely for informat ...

Nonparametric nearest neighbor based empirical

... strategies for sequential investment in financial markets. The portfolio problematic is very close to the so called aggregation strategies, which have been extensively studied in the more classical context of regression and classification (see [5]). Throughout the paper it is assumed that the vector ...

... strategies for sequential investment in financial markets. The portfolio problematic is very close to the so called aggregation strategies, which have been extensively studied in the more classical context of regression and classification (see [5]). Throughout the paper it is assumed that the vector ...

Financial Reporting Council

... The proposed amendments clarify that an entity should measure the fair value of quoted investments and quoted CGUs as the product of the quoted price for the individual financial instruments that make up the investments held by the entity and the quantity of financial instruments. The Exposure Draft ...

... The proposed amendments clarify that an entity should measure the fair value of quoted investments and quoted CGUs as the product of the quoted price for the individual financial instruments that make up the investments held by the entity and the quantity of financial instruments. The Exposure Draft ...

PORTFOLIO THEORY : KEY CONCEPTS

... Practical Issues 1) Suppose all investors do not have the same views about expected returns and covariances. ~ we can still use our methodology to work out optimal proportions/weights for for each individual investor. 2) The optimal weights will change as forecasts of returns and correlations chang ...

... Practical Issues 1) Suppose all investors do not have the same views about expected returns and covariances. ~ we can still use our methodology to work out optimal proportions/weights for for each individual investor. 2) The optimal weights will change as forecasts of returns and correlations chang ...

CARPENTER TECHNOLOGY CORP

... conditions; (13) Carpenter’s manufacturing processes are dependent upon highly specialized equipment located primarily in facilities in Reading and Latrobe, Pennsylvania and Athens, Alabama for which there may be limited alternatives if there are significant equipment failures or a catastrophic even ...

... conditions; (13) Carpenter’s manufacturing processes are dependent upon highly specialized equipment located primarily in facilities in Reading and Latrobe, Pennsylvania and Athens, Alabama for which there may be limited alternatives if there are significant equipment failures or a catastrophic even ...

The New Job Security- The 5 Best Strategies for Taking Control of

... Your job security, either in your current job or in the one you’re planning, is about to take a leap forward. Pam Lassiter, President of the global career management firm, Lassiter Consulting, will bring you the latest news from her research on career management trends as presented in The New Job Se ...

... Your job security, either in your current job or in the one you’re planning, is about to take a leap forward. Pam Lassiter, President of the global career management firm, Lassiter Consulting, will bring you the latest news from her research on career management trends as presented in The New Job Se ...

Storage Decisions 2003

... Where to Start: Getting An RFP Together Vendor Selection Considerations – the list • Priorities and the Worksheet…. 5 Gotchas to Consider During Selection Process Red Herrings to Look For from Vendors • Key questions to ask vendors ...

... Where to Start: Getting An RFP Together Vendor Selection Considerations – the list • Priorities and the Worksheet…. 5 Gotchas to Consider During Selection Process Red Herrings to Look For from Vendors • Key questions to ask vendors ...

Ch10std

... For stock returns, a more spread out distribution means there is a higher probability of returns being farther away from the mean (or expected return). For our estimate of the expected return, we can use the mean of returns from a sample of stock returns. For our estimate of the risk, we can u ...

... For stock returns, a more spread out distribution means there is a higher probability of returns being farther away from the mean (or expected return). For our estimate of the expected return, we can use the mean of returns from a sample of stock returns. For our estimate of the risk, we can u ...

Market Discipline and Internal Governance in the Mutual Fund Industry

... The portfolio management industry has undergone dramatic growth in the last few decades, thereby also generating an increasing interest among regulators and academics. The question how to ensure efficient governance of delegated portfolio management has attracted particular attention. Most theoreti ...

... The portfolio management industry has undergone dramatic growth in the last few decades, thereby also generating an increasing interest among regulators and academics. The question how to ensure efficient governance of delegated portfolio management has attracted particular attention. Most theoreti ...

Allocation of Long Term Commercial Fishing Rights

... obligation determined at WSSD with a deadline of 2010 ...

... obligation determined at WSSD with a deadline of 2010 ...