NEWS RELEASE

... company almost dominates the domestic market and is among the global market leaders for terpene resins. Strong relationships with suppliers allow for stable procurement of raw materials. Thanks to this, as well as the advantage of having blue-chip companies on its client list, the earnings base is s ...

... company almost dominates the domestic market and is among the global market leaders for terpene resins. Strong relationships with suppliers allow for stable procurement of raw materials. Thanks to this, as well as the advantage of having blue-chip companies on its client list, the earnings base is s ...

to view our Weekly Market Commentary for

... changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrowe ...

... changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrowe ...

IOSR Journal of Business and Management (IOSR-JBM) ISSN: 2278-487X.

... would be vital for development of emerging countries. As a matter of fact, the intensity of flow of finance in the form of FDI would generally depend upon the policies and regulations framed by Government to attract Foreign Direct investment (FDI). The Retail Industry is the paramount sector of econ ...

... would be vital for development of emerging countries. As a matter of fact, the intensity of flow of finance in the form of FDI would generally depend upon the policies and regulations framed by Government to attract Foreign Direct investment (FDI). The Retail Industry is the paramount sector of econ ...

Certification Letter - Academic Institutions

... 1.06 Institutionally held investments are properly valued. 1.07 Provisions for uncollectible receivables have been properly identified and recorded. 1.08 Interfund, internal, and intra-entity activity and balances have been appropriately classified and reported. 1.09 Applicable laws and regulations ...

... 1.06 Institutionally held investments are properly valued. 1.07 Provisions for uncollectible receivables have been properly identified and recorded. 1.08 Interfund, internal, and intra-entity activity and balances have been appropriately classified and reported. 1.09 Applicable laws and regulations ...

Competitive Pressures - Morowitz Gaming Advisors

... legacy operators to maintain or grow cash flows. Unfortunately, much of this growth was at the cost of declining margins and lower-than-required return on investment. As operators in Las Vegas, Atlantic City and across the country prepare for increased competitive investment, they must ask themselv ...

... legacy operators to maintain or grow cash flows. Unfortunately, much of this growth was at the cost of declining margins and lower-than-required return on investment. As operators in Las Vegas, Atlantic City and across the country prepare for increased competitive investment, they must ask themselv ...

Term 3 exam practice questions File

... The annual fees paid to a school for the school years 2000, 2001 and 2002 increase as a geometric progression. The table below shows the fee structure. ...

... The annual fees paid to a school for the school years 2000, 2001 and 2002 increase as a geometric progression. The table below shows the fee structure. ...

Präsentationstitel max. zweizeilig

... Different level of support (400 – 1.500 €/kW), depending on capacity ...

... Different level of support (400 – 1.500 €/kW), depending on capacity ...

IOSR Journal of Business and Management (IOSR-JBM)

... The results have shown that FDI has both short run and long run significant impact on the GDP of Nigeria. This indicates that foreign direct investment has been acknowledged as an important source of improving efficiency of the productive sectors of an economy though competition stimulate economic p ...

... The results have shown that FDI has both short run and long run significant impact on the GDP of Nigeria. This indicates that foreign direct investment has been acknowledged as an important source of improving efficiency of the productive sectors of an economy though competition stimulate economic p ...

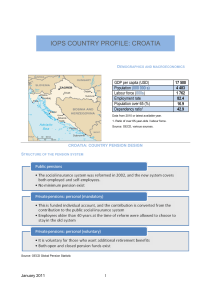

IOPS COUNTRY PROFILE: CROATIA

... (OMFs), which can only manage one mandatory fund each. By law, these funds must invest at least 50% of their assets in conservative government securities issued by the Republic of Croatia or the Croatian National Bank. In addition, no more than 45% of pension fund assets may be invested outside Croa ...

... (OMFs), which can only manage one mandatory fund each. By law, these funds must invest at least 50% of their assets in conservative government securities issued by the Republic of Croatia or the Croatian National Bank. In addition, no more than 45% of pension fund assets may be invested outside Croa ...

IFM7 Chapter 27

... Excess of revenues over expenses Charitable contributions Government grants ...

... Excess of revenues over expenses Charitable contributions Government grants ...

Meanwhile, Jassim Alseddiqi, Chairman of SHUAA Capital, said

... (USD 129 billion). Those securities include 66 public joint stock companies, 2 private joint stock companies, 1 Exchange Traded Fund (ETF), 1 Abu Dhabi Government Fund, and 1 convertible bond. ADX listed companies are allocated in nine sectors; Banking, Real Estate, Consumer Staples, Investment and ...

... (USD 129 billion). Those securities include 66 public joint stock companies, 2 private joint stock companies, 1 Exchange Traded Fund (ETF), 1 Abu Dhabi Government Fund, and 1 convertible bond. ADX listed companies are allocated in nine sectors; Banking, Real Estate, Consumer Staples, Investment and ...

The weekend effect

... to the past 6-months return, realized a return that was 12,01% higher than expected on average per year an effect that is also found by Carhart (1997). One of the possible explanations they give for both these effect is the under-reaction of investors on short-term prospect, but over-reaction to lon ...

... to the past 6-months return, realized a return that was 12,01% higher than expected on average per year an effect that is also found by Carhart (1997). One of the possible explanations they give for both these effect is the under-reaction of investors on short-term prospect, but over-reaction to lon ...

The concept of investment efficiency and its application to

... assets. The process can be further refined to add more details. For example, it can be used to determine allocations to alternative asset classes such as real estate, private equity or hedge funds. The resulting asset mix forms the strategic asset allocation. For the avoidance of doubt, this stage i ...

... assets. The process can be further refined to add more details. For example, it can be used to determine allocations to alternative asset classes such as real estate, private equity or hedge funds. The resulting asset mix forms the strategic asset allocation. For the avoidance of doubt, this stage i ...

"The Alpha and Omega of Hedge Fund Performance Measurement"

... Sound investment decisions rest on identifying and selecting portfolio managers who are expected to deliver superior performance. There is ample evidence that portfolio managers following traditional active strategies on average under-perform passive investment strategies (see for example Jensen (19 ...

... Sound investment decisions rest on identifying and selecting portfolio managers who are expected to deliver superior performance. There is ample evidence that portfolio managers following traditional active strategies on average under-perform passive investment strategies (see for example Jensen (19 ...

The Tortoise versus The Hare... Who Wins in 2014?

... continuing to grow. He goes on to say that this is partially explained by share buy backs which “artificially elevates stock prices” and is a worry for corporate America going forward and “may haunt America’s future.” - Another major boost for the EPS number is the fact that the percentage of US GDP ...

... continuing to grow. He goes on to say that this is partially explained by share buy backs which “artificially elevates stock prices” and is a worry for corporate America going forward and “may haunt America’s future.” - Another major boost for the EPS number is the fact that the percentage of US GDP ...

A stable option for uncertain times

... When you use Principal Executive Variable Universal Life II1 insurance, you get a death benefit that can provide survivor benefits or be used to recover plan costs. Plus, the policy builds cash value. You select how premium payments will be invested by choosing from more than 100 sub-accounts. How t ...

... When you use Principal Executive Variable Universal Life II1 insurance, you get a death benefit that can provide survivor benefits or be used to recover plan costs. Plus, the policy builds cash value. You select how premium payments will be invested by choosing from more than 100 sub-accounts. How t ...

The Impact of Post- Financial Crisis Regulations

... A typical VC firm will have several funds, investing in specific sectors of industry such as energy, financial, healthcare, internet, mobile, etc. Each fund will invest in several start-ups and/or innovative enterprises. After receiving the investment, these companies are called portfolio companies ...

... A typical VC firm will have several funds, investing in specific sectors of industry such as energy, financial, healthcare, internet, mobile, etc. Each fund will invest in several start-ups and/or innovative enterprises. After receiving the investment, these companies are called portfolio companies ...

KKR Private Equity Investors Reports Second Quarter Results

... number of ownership and transfer restrictions. Information concerning these ownership and transfer restrictions is included in the Investor Relations section of KPE’s website at www.kkrpei.com. Forward-Looking Statements This release may contain certain forward-looking statements with respect to the ...

... number of ownership and transfer restrictions. Information concerning these ownership and transfer restrictions is included in the Investor Relations section of KPE’s website at www.kkrpei.com. Forward-Looking Statements This release may contain certain forward-looking statements with respect to the ...

Chapter 1: Finance and the Firm

... expected cash flows derived from the firms business activities. The financial manager should make decisions that cause this value to be maximized. Value depends on future prospects and risk. ...

... expected cash flows derived from the firms business activities. The financial manager should make decisions that cause this value to be maximized. Value depends on future prospects and risk. ...

No such thing as a free lunch, even with private REITs

... public cousins. The wild swings in REIT prices were evident in 2008 when the sector crashed along with the broader market. The S&P/TSX Capped REIT Index plunged nearly 40 per cent. “The market decides what [a public REIT] is worth on a minute-by-minute basis,” says David Kaufman, president of Westco ...

... public cousins. The wild swings in REIT prices were evident in 2008 when the sector crashed along with the broader market. The S&P/TSX Capped REIT Index plunged nearly 40 per cent. “The market decides what [a public REIT] is worth on a minute-by-minute basis,” says David Kaufman, president of Westco ...

Joint-stock Company supporting the capitalization and

... The Guarantee guarantees investments in the Company’s share capital and ensures recovery of 80 per cent of the difference between (i) capital injected to the Company for any reason plus investment costs and (ii) the amount received by the relevant investor, for any reason, during each fiscal year, ...

... The Guarantee guarantees investments in the Company’s share capital and ensures recovery of 80 per cent of the difference between (i) capital injected to the Company for any reason plus investment costs and (ii) the amount received by the relevant investor, for any reason, during each fiscal year, ...