Chapter 2 Macroeconomic Considerations

... • Rate of change in rents and prices over time Investors Investors • Prices (capital values) o Institutions o Overseas • Yields o Private All • Number of transactions • Take-up / absorption (quantity of space taken per period) ...

... • Rate of change in rents and prices over time Investors Investors • Prices (capital values) o Institutions o Overseas • Yields o Private All • Number of transactions • Take-up / absorption (quantity of space taken per period) ...

InnovationsKapital searching for new golden egg: invests

... and is now in its start-up phase. Independent analysts expect the market for the company’s products to be worth around USD 15 billion by 2003,” says Staffan Ingeborn, Managing General Partner of InnovationsKapital. Investment during the start-up of a business entails large risk, but also considerabl ...

... and is now in its start-up phase. Independent analysts expect the market for the company’s products to be worth around USD 15 billion by 2003,” says Staffan Ingeborn, Managing General Partner of InnovationsKapital. Investment during the start-up of a business entails large risk, but also considerabl ...

TRANSLATED VERSION As of May 30, 2014 Readers should be

... impose sanctions or to order the CIS operator to act or refrain from acting in case there is an action which may cause damages to the interest of the investors; (b) is not subject to the order of business suspension or revocation issued by home regulator; ...

... impose sanctions or to order the CIS operator to act or refrain from acting in case there is an action which may cause damages to the interest of the investors; (b) is not subject to the order of business suspension or revocation issued by home regulator; ...

slides

... these normal functions of financial and monetary systems, thereby hurting the normal functioning of the real economy. ...

... these normal functions of financial and monetary systems, thereby hurting the normal functioning of the real economy. ...

Presented by

... officers, directors, members, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this presentation or its contents. The securities discussed in this presentation may not be suitable for all investors. The value of and income from any investment ...

... officers, directors, members, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this presentation or its contents. The securities discussed in this presentation may not be suitable for all investors. The value of and income from any investment ...

SUSTAINING FINANCING: DEVELOPMENT FINANCE

... Ensure collaboration with foreign technical partners in development of appropriate development of local technology, particularly with regards to fabrication of local plant and machinery, so that costs for establishing projects are substantially reduced. The steel manufacturing sector must be given a ...

... Ensure collaboration with foreign technical partners in development of appropriate development of local technology, particularly with regards to fabrication of local plant and machinery, so that costs for establishing projects are substantially reduced. The steel manufacturing sector must be given a ...

ICG: The Rise of Private Debt as an Institutional Asset Class

... The British Venture Capital Association on this report: “The changing strategies of traditional institutional lenders in the wake of the recession continues to act as a drag on business expansion plans. This has spurred a rapid growth and increased interest in alternative forms of lending, with dema ...

... The British Venture Capital Association on this report: “The changing strategies of traditional institutional lenders in the wake of the recession continues to act as a drag on business expansion plans. This has spurred a rapid growth and increased interest in alternative forms of lending, with dema ...

Balance Sheet Capacity and Endogenous Risk

... the risk-sensitive constraints we study below. Incorporating balance sheet constraints on asset pricing problems have been examined by Adrian, Etula and Shin (2009) for the foreign exchange market, Etula (2009) for the commodities market and by Adrian, Moench and Shin (2009) for the interaction bet ...

... the risk-sensitive constraints we study below. Incorporating balance sheet constraints on asset pricing problems have been examined by Adrian, Etula and Shin (2009) for the foreign exchange market, Etula (2009) for the commodities market and by Adrian, Moench and Shin (2009) for the interaction bet ...

Principles Underlying Asset Liability Management

... objectives, for a given set of risk tolerances and constraints. ALM is critical for the sound financial management of any entity that invests to meet future cash flow needs within constraints. ALM is broader than risk mitigation1 and is inextricably linked to the liability and investment management ...

... objectives, for a given set of risk tolerances and constraints. ALM is critical for the sound financial management of any entity that invests to meet future cash flow needs within constraints. ALM is broader than risk mitigation1 and is inextricably linked to the liability and investment management ...

investor sentiment indicator

... indicates that HNW investors have little faith in equities in the coming quarter. Property is the silver lining, relatively speaking, with more HNW investors likely to be happy than unhappy with their property investments. While these findings indicate a renewed level of cautiousness and pessimism, ...

... indicates that HNW investors have little faith in equities in the coming quarter. Property is the silver lining, relatively speaking, with more HNW investors likely to be happy than unhappy with their property investments. While these findings indicate a renewed level of cautiousness and pessimism, ...

Read more - Indiana Trust

... bond market. Our recent strategic allocations to high yield bonds (both taxable and tax-exempt) in many fixed income portfolios as a complement to core investment grade bond allocations is one way to help manage interest rate risk and provide overall diversification. Also, we have adjusted bond port ...

... bond market. Our recent strategic allocations to high yield bonds (both taxable and tax-exempt) in many fixed income portfolios as a complement to core investment grade bond allocations is one way to help manage interest rate risk and provide overall diversification. Also, we have adjusted bond port ...

Chapter Title

... Top managers are ordinarily responsible for financial performance measures – not lower level managers. Non-financial measures are more likely to be understood and controlled by lower level managers. ...

... Top managers are ordinarily responsible for financial performance measures – not lower level managers. Non-financial measures are more likely to be understood and controlled by lower level managers. ...

Government Bonds

... A government bond is a debt investment in which an investor loans a certain amount of money, for a certain amount of time, to a country. As a responsible long term investor, with a geographically diverse investment portfolio, it is in Storebrand’s interests to promote good governance, stability and ...

... A government bond is a debt investment in which an investor loans a certain amount of money, for a certain amount of time, to a country. As a responsible long term investor, with a geographically diverse investment portfolio, it is in Storebrand’s interests to promote good governance, stability and ...

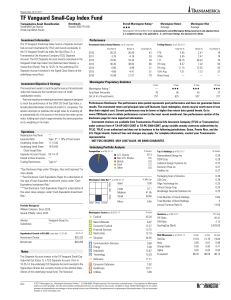

TF Vanguard Small-Cap Index Fund

... expense charges. One cannot invest directly in an index. Fund Ranking: This is the total return percentile rank within each Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. Historical percentile ranks are based on ...

... expense charges. One cannot invest directly in an index. Fund Ranking: This is the total return percentile rank within each Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. Historical percentile ranks are based on ...

Growth, Capital and Ideas - Career Account Web Pages

... •Labor: the number of workers and the time they work, as well as their physical strength, skills, and health. • Labor is also rival in production because workers’ time can only be devoted to one activity at a time. ...

... •Labor: the number of workers and the time they work, as well as their physical strength, skills, and health. • Labor is also rival in production because workers’ time can only be devoted to one activity at a time. ...

- Regional Knowledge Sharing Initiative

... been invested in 10 road, airport, wind, and waste to energy projects worth more than €4b ...

... been invested in 10 road, airport, wind, and waste to energy projects worth more than €4b ...

Fault-tolerant Mobile Agent-based Monitoring Mechanism for Highly

... The currently available system can be categorized as o Static centralized monitoring o Static decentralized monitoring Hereby the description and the functions of the above systems would be described such that it would explain the need why we have suggested and implemented our system. 2.1 STATIC CEN ...

... The currently available system can be categorized as o Static centralized monitoring o Static decentralized monitoring Hereby the description and the functions of the above systems would be described such that it would explain the need why we have suggested and implemented our system. 2.1 STATIC CEN ...

How a Banker Looks at Financial Leverage

... is self-imposed; it is what board and management determine to be the acceptable level of return on investment for risks undertaken. When a business evaluates financial leverage the overriding factor should be its ability to generate cash flow, both to service debt and to meet the necessary opportuni ...

... is self-imposed; it is what board and management determine to be the acceptable level of return on investment for risks undertaken. When a business evaluates financial leverage the overriding factor should be its ability to generate cash flow, both to service debt and to meet the necessary opportuni ...

THE RISE OF SHAREHOLDER POWER: LEGISLATION

... The legal basis for a shareholder's rights is that he bears the economic risk associated with the shares and may therefore need to control the actions of management. The law has traditionally recognised that relationship through concepts such as affectio societatis, the prohibition of unconscionable ...

... The legal basis for a shareholder's rights is that he bears the economic risk associated with the shares and may therefore need to control the actions of management. The law has traditionally recognised that relationship through concepts such as affectio societatis, the prohibition of unconscionable ...

SOURCES OF BUSINESS FINANCE Introduction

... Inter-Corporate Deposits are unsecured short term deposits made by one company with another company. These deposits are essentially brokered deposited, which led the involvement of brokers. The rate of interest on their deposits is higher than that of banks and other markets. The biggest advantage o ...

... Inter-Corporate Deposits are unsecured short term deposits made by one company with another company. These deposits are essentially brokered deposited, which led the involvement of brokers. The rate of interest on their deposits is higher than that of banks and other markets. The biggest advantage o ...

T. Rowe Price Target Date Conversion Strategy

... target date investment options as qualified default investment alternatives (QDIAs), T. Rowe Price has emerged as a leader in the target date conversion process. Our experience managing these conversions since 2005 has led to a proven, results-driven process for sponsors looking to achieve a more op ...

... target date investment options as qualified default investment alternatives (QDIAs), T. Rowe Price has emerged as a leader in the target date conversion process. Our experience managing these conversions since 2005 has led to a proven, results-driven process for sponsors looking to achieve a more op ...

6 learning and performance management

... readily than they can identify how they would learn more comfortably. It is interesting to ask students whether grading completely through group grades would change their view of individual studying and learning. Many college classes are taught by NTs, who use a particular style. Have students discu ...

... readily than they can identify how they would learn more comfortably. It is interesting to ask students whether grading completely through group grades would change their view of individual studying and learning. Many college classes are taught by NTs, who use a particular style. Have students discu ...

WORKING CAPITAL MANAGEMENT What is Working Capital

... Working capital management is more critical for those industries which seek higher liquidity for their daily operational activities or by nature whose operating cycle is higher - such as technology firms because goods take time to produce and it is reasonable to expect these firms to have a large va ...

... Working capital management is more critical for those industries which seek higher liquidity for their daily operational activities or by nature whose operating cycle is higher - such as technology firms because goods take time to produce and it is reasonable to expect these firms to have a large va ...

Chapter17

... is the stock of assets that will generate a flow of income in the future. Capital budgeting: is the planning process for allocating all expenditures that will have an expected benefit to the firm for more than one year. ...

... is the stock of assets that will generate a flow of income in the future. Capital budgeting: is the planning process for allocating all expenditures that will have an expected benefit to the firm for more than one year. ...