Making Finance Work for Africa

... In only 3 countries are most of the banking systems in the hands of governments. (You know why) Scale: good for efficiency and maybe OK for client focus too with modern lending technologies ...

... In only 3 countries are most of the banking systems in the hands of governments. (You know why) Scale: good for efficiency and maybe OK for client focus too with modern lending technologies ...

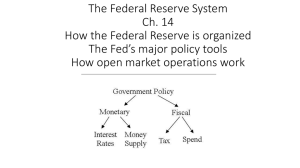

The Federal Reserve System

... • Pete pays Sue for a used car. He gives her a check for $2,000. • Sue deposits the check in her bank and is credited with $2,000 in her account. • Sue’s bank sends the check to FRB who increases the bank’s reserve account by $2,000. • FRB decreases Pete’s bank’s reserve by ...

... • Pete pays Sue for a used car. He gives her a check for $2,000. • Sue deposits the check in her bank and is credited with $2,000 in her account. • Sue’s bank sends the check to FRB who increases the bank’s reserve account by $2,000. • FRB decreases Pete’s bank’s reserve by ...

Home Economics

... lubrication of a fully functioning economy is the most basic • If some people are storing money then it may not be able to lubricate the economy efficiently • Speculation can mean that money is sucked out of the local economy to areas of the world where it can attract a higher rate of return as inve ...

... lubrication of a fully functioning economy is the most basic • If some people are storing money then it may not be able to lubricate the economy efficiently • Speculation can mean that money is sucked out of the local economy to areas of the world where it can attract a higher rate of return as inve ...

The Monetary System

... The Federal Reserve System • The Fed’s jobs – Control the money supply • Quantity of money available in the economy ...

... The Federal Reserve System • The Fed’s jobs – Control the money supply • Quantity of money available in the economy ...

Speech by Mervyn King, Governor on 21 October

... riskiness of the underlying loans. By securitising mortgages on such a scale, banks transformed the liquidity of their lending book. They also financed it by short-term wholesale borrowing. But in the light of rising defaults and falling house prices – first in the United States and then elsewhere – ...

... riskiness of the underlying loans. By securitising mortgages on such a scale, banks transformed the liquidity of their lending book. They also financed it by short-term wholesale borrowing. But in the light of rising defaults and falling house prices – first in the United States and then elsewhere – ...

Chapter 15 - IR-517: Politics and the Political Economy of

... institutions that supply medium and long-term loans for creation / expansion of industrial enterprises. How do they raise capital? Bilateral and multilateral loans from national aid agencies (i.e. USAID) or international donor agencies (i.e. World Bank). ...

... institutions that supply medium and long-term loans for creation / expansion of industrial enterprises. How do they raise capital? Bilateral and multilateral loans from national aid agencies (i.e. USAID) or international donor agencies (i.e. World Bank). ...

Money is - Positive Money Sheffield

... Banks do not wait for customers’ savings before they can make a new loan When a bank makes a loan, it creates a matching ‘deposit’, creating new money When the loan is repaid, money disappears Physical cash is less than 3% of the total stock of money in the economy Commercial bank money makes up the ...

... Banks do not wait for customers’ savings before they can make a new loan When a bank makes a loan, it creates a matching ‘deposit’, creating new money When the loan is repaid, money disappears Physical cash is less than 3% of the total stock of money in the economy Commercial bank money makes up the ...

Lecture 6 (POWER POINT)

... open market from a US car dealer. The car dealer uses their proceeds of yen to acquire $500,000 worth of Hondas. A Dutch trader receives a dividend check from IBM for $25,000. The check is drawn on a bank in New York. ...

... open market from a US car dealer. The car dealer uses their proceeds of yen to acquire $500,000 worth of Hondas. A Dutch trader receives a dividend check from IBM for $25,000. The check is drawn on a bank in New York. ...

Multiple Choice: Circle the answer the best completes each question

... True or False: Identify the following statements as true or False and if it is false, re-write it to make it into a true statement. 23. One way the Fed can try to combat inflation would be to sell bonds. 24. The most powerful monetary tool is the reserve requirement. 25. One necessary characteristic ...

... True or False: Identify the following statements as true or False and if it is false, re-write it to make it into a true statement. 23. One way the Fed can try to combat inflation would be to sell bonds. 24. The most powerful monetary tool is the reserve requirement. 25. One necessary characteristic ...

Current and Future Banking Trends for Municipalities

... – Improve the banking sector’s ability to absorb shocks arising from financial and economic stress – Improve risk management and governance – Strengthen banks’ transparency and disclosures ...

... – Improve the banking sector’s ability to absorb shocks arising from financial and economic stress – Improve risk management and governance – Strengthen banks’ transparency and disclosures ...

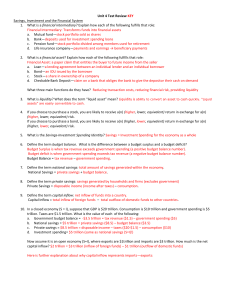

Unit 4 Test Review KEY Savings, Investment and the Financial

... c. If the current interest rate was below equilibrium, what would eventually happen to interest rates? If interest rates fall below equilibrium quantity of money supplied will be less than quantity demanded (shortage); market forces will eventually bring interest rates back up to equilibrium. Bankin ...

... c. If the current interest rate was below equilibrium, what would eventually happen to interest rates? If interest rates fall below equilibrium quantity of money supplied will be less than quantity demanded (shortage); market forces will eventually bring interest rates back up to equilibrium. Bankin ...

Presented - World Bank

... and bankruptcy law, courts and police)--or compensate bankers for the possibility that they will be expropriated (limits on competition to raise rates of return, limited liability). ...

... and bankruptcy law, courts and police)--or compensate bankers for the possibility that they will be expropriated (limits on competition to raise rates of return, limited liability). ...

Automatic Bank Draft Authorization Form *** Be sure to enclose a

... I authorize the City of Corpus Christi’s Utilities Business Office to draft against my _____ checking ...

... I authorize the City of Corpus Christi’s Utilities Business Office to draft against my _____ checking ...

What Is Monetary Policy? - Central Bank of Nigeria

... central bank, while for others they are not. The objectives of monetary policy may vary from country to country but there are two main views. The first view calls for monetary policy to achieve price stability, while the second view seeks to achieve price stability and other macroeconomic objectives ...

... central bank, while for others they are not. The objectives of monetary policy may vary from country to country but there are two main views. The first view calls for monetary policy to achieve price stability, while the second view seeks to achieve price stability and other macroeconomic objectives ...

Russia's Multilateral Aid Bilateral and multilateral sources of development

... •Uzbekistan – 0,87 ...

... •Uzbekistan – 0,87 ...

Management Presentation Template

... political stability in India is enormous, but we must be appreciate and respect that the road ahead inhibits a steep learning curve ...

... political stability in India is enormous, but we must be appreciate and respect that the road ahead inhibits a steep learning curve ...

Banks lend more as economy grows

... for additional eligible borrowing from banks During CY16, corporate lending also increased, due to higher credit demand for larger working capital to finance growing outputs. A number of them went for fixed investment. Senior bankers say that private sector companies, taking advantage of low intere ...

... for additional eligible borrowing from banks During CY16, corporate lending also increased, due to higher credit demand for larger working capital to finance growing outputs. A number of them went for fixed investment. Senior bankers say that private sector companies, taking advantage of low intere ...

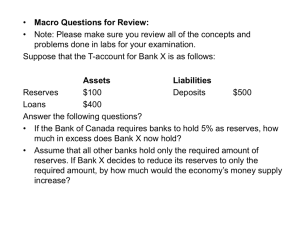

MTR

... problems done in labs for your examination. Suppose that the T-account for Bank X is as follows: Assets Liabilities Reserves ...

... problems done in labs for your examination. Suppose that the T-account for Bank X is as follows: Assets Liabilities Reserves ...

Quiz 9

... (2) 1. Which of the following is true according to The Economist? a. The US federal government can end the financial crisis in the US by adding layers of new regulations on financial institutions b. An expected increase in state and local government spending will help keep the US economy our of rece ...

... (2) 1. Which of the following is true according to The Economist? a. The US federal government can end the financial crisis in the US by adding layers of new regulations on financial institutions b. An expected increase in state and local government spending will help keep the US economy our of rece ...