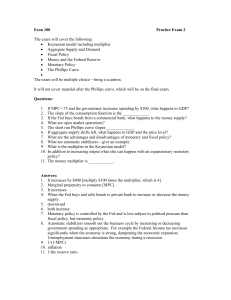

Econ 100Practice Exam 2

... 1. It increases by $400 [multiply $100 times the multiplier, which is 4]. 2. Marginal propensity to consume [MPC]. 3. It increases. 4. When the Fed buys and sells bonds to private bank to increase or decrease the money supply. 5. downward 6. both increase 7. Monetary policy is controlled by the Fed ...

... 1. It increases by $400 [multiply $100 times the multiplier, which is 4]. 2. Marginal propensity to consume [MPC]. 3. It increases. 4. When the Fed buys and sells bonds to private bank to increase or decrease the money supply. 5. downward 6. both increase 7. Monetary policy is controlled by the Fed ...

FMI Commercial Banking

... • The US had by far the most banks (7,540 at end-2005) and branches (75,000) in the world. The large number of banks in the US is an indicator of its geography and regulatory structure, resulting in a large number of small to medium sized institutions in its banking ...

... • The US had by far the most banks (7,540 at end-2005) and branches (75,000) in the world. The large number of banks in the US is an indicator of its geography and regulatory structure, resulting in a large number of small to medium sized institutions in its banking ...

Presentation to the AEA National Conference on Teaching Economics and... Economic Education San Francisco, California

... unpredictable link between money and the economy. Other major central banks target short-term interest rates as well. The money multiplier during the crisis and recession The breakdown of the standard money multiplier has been especially pronounced during the crisis and recession. Banks typically ha ...

... unpredictable link between money and the economy. Other major central banks target short-term interest rates as well. The money multiplier during the crisis and recession The breakdown of the standard money multiplier has been especially pronounced during the crisis and recession. Banks typically ha ...

The Meiji Restoration

... Government reassessed productivity of land Placed a tax of around 3% on the value of the land Also eliminated the ban on the sale of land ...

... Government reassessed productivity of land Placed a tax of around 3% on the value of the land Also eliminated the ban on the sale of land ...

Lecture 13: Monetary Policy

... • Granted monopoly on joint stock banking by Parliament in return for war loans. • Not an invention of economists, started off as a powerful bank that was able to demand that other banks held deposits in it. • Did not have government monopoly on note issue, but achieved it through its monopoly power ...

... • Granted monopoly on joint stock banking by Parliament in return for war loans. • Not an invention of economists, started off as a powerful bank that was able to demand that other banks held deposits in it. • Did not have government monopoly on note issue, but achieved it through its monopoly power ...

Mankiw 6e PowerPoints

... The Fed can change the reserve-deposit ratio using reserve requirements: Fed regulations that impose a minimum reserve-deposit ratio To reduce the reserve-deposit ratio, the Fed could reduce reserve requirements interest on reserves: the Fed pays interest on bank reserves deposited with the Fe ...

... The Fed can change the reserve-deposit ratio using reserve requirements: Fed regulations that impose a minimum reserve-deposit ratio To reduce the reserve-deposit ratio, the Fed could reduce reserve requirements interest on reserves: the Fed pays interest on bank reserves deposited with the Fe ...

pob 4.02 the banking system

... Inspects banks by auditing financial records Audit -an inspection of records to verify the: 1. accuracy of books (records) of the bank 2. bank is complying with banking laws Similar to Individuals/corporations who are audited by the IRS to review the accuracy of a tax return. ...

... Inspects banks by auditing financial records Audit -an inspection of records to verify the: 1. accuracy of books (records) of the bank 2. bank is complying with banking laws Similar to Individuals/corporations who are audited by the IRS to review the accuracy of a tax return. ...

The Traditional Securitization Process Bank

... Banks are unable to securitize or syndicate these loans due to the decreased volume of new deals Even if they could sell off these unwanted loans, the prices would be low as spreads increase. SO: Banks did not really remove the risks from their balance sheets. Underestimate correlation between on an ...

... Banks are unable to securitize or syndicate these loans due to the decreased volume of new deals Even if they could sell off these unwanted loans, the prices would be low as spreads increase. SO: Banks did not really remove the risks from their balance sheets. Underestimate correlation between on an ...

AP Macro 4-3 Three Tools of Monetary Policy

... The FED adjusting the money supply by changing any one of the following: 1. Setting Reserve Requirements (Ratios) 2. Lending Money to Banks & Thrifts •Discount Rate ...

... The FED adjusting the money supply by changing any one of the following: 1. Setting Reserve Requirements (Ratios) 2. Lending Money to Banks & Thrifts •Discount Rate ...

State-owned Enterprises (SOEs)

... Autonomous factors affecting them: – Demand for bank notes; e.g., after salary pay days, before holidays, etc. – Changes in the government cash balance when held by the central bank; i.e., tax and other revenues, public expenditures and government cash funding. – Cross border capital flows with the ...

... Autonomous factors affecting them: – Demand for bank notes; e.g., after salary pay days, before holidays, etc. – Changes in the government cash balance when held by the central bank; i.e., tax and other revenues, public expenditures and government cash funding. – Cross border capital flows with the ...

MONEY, THE BANKING SYSTEM & THE FEDERAL RESERVE

... • As of 1995, in the United States, were required to hold 10% on all checkable deposits exceeding $54 million • Since large banks would face a 10% reserve requirement on any new deposits, a money multiplier of 10 would be expected • The money multiplier in the United States is actually between 2 and ...

... • As of 1995, in the United States, were required to hold 10% on all checkable deposits exceeding $54 million • Since large banks would face a 10% reserve requirement on any new deposits, a money multiplier of 10 would be expected • The money multiplier in the United States is actually between 2 and ...

BANK OF JAMAICA - THE FIRST FORTY YEARS

... In assessing the contribution of the Bank of Jamaica to economic management, one should also to indicate the extent to which the issues of greatest relative importance have changed over time. Hence, for example prior to the liberalization of the foreign exchange system, there was a huge department e ...

... In assessing the contribution of the Bank of Jamaica to economic management, one should also to indicate the extent to which the issues of greatest relative importance have changed over time. Hence, for example prior to the liberalization of the foreign exchange system, there was a huge department e ...

Overview of First National Bank

... • What the regulators don’t understand! – Increasing the bank’s capital ratios is the wrong solution to the problem in the near-term – The higher the capital ratio requirement, the harder it is to operate the bank in a safe and sound manner. Ironically, regulators give you more time to fix asset qu ...

... • What the regulators don’t understand! – Increasing the bank’s capital ratios is the wrong solution to the problem in the near-term – The higher the capital ratio requirement, the harder it is to operate the bank in a safe and sound manner. Ironically, regulators give you more time to fix asset qu ...

Programme Information

... BTC will either apply Fitch’s simulation model should any asset’s rating fall below AA- or subject to the terms and conditions of the Credit Enhancement Agreement SBSA will fully guarantee the asset ...

... BTC will either apply Fitch’s simulation model should any asset’s rating fall below AA- or subject to the terms and conditions of the Credit Enhancement Agreement SBSA will fully guarantee the asset ...

Commodity money

... - Some countries have not own or shared currency Ecuador (since 2000), Panama - Some countries have more than one “currency” Argentina 1999-2002 has more than 15 currencies! ...

... - Some countries have not own or shared currency Ecuador (since 2000), Panama - Some countries have more than one “currency” Argentina 1999-2002 has more than 15 currencies! ...

The role of government in the United States economy

... tax incomes (personal and business). This provided more money for the government to fund the projects that it needed to pay for so that the U.S. economy could grow. ...

... tax incomes (personal and business). This provided more money for the government to fund the projects that it needed to pay for so that the U.S. economy could grow. ...

Intro to Business Reading Guide Name: Period: ______ 17

... A) Certified Checks B) Cashier's Checks C) Traveler's Checks D) Money Orders bank postal express telegraphic - ...

... A) Certified Checks B) Cashier's Checks C) Traveler's Checks D) Money Orders bank postal express telegraphic - ...

Exam 11th Febraury 2005: Solution

... The process goes on and on. Every time money is deposited and a bank loan is made, more money is created. The money eventually created in the economy is: ...

... The process goes on and on. Every time money is deposited and a bank loan is made, more money is created. The money eventually created in the economy is: ...

Governor`s Opening Remarks

... Recent moves in financial markets have borne out this progress. Although lower bank equity prices are consistent with investor concerns over an uncertain economic outlook and lower bank profitability, overall bank funding costs have not increased. Markets are focused on returns not concerned with re ...

... Recent moves in financial markets have borne out this progress. Although lower bank equity prices are consistent with investor concerns over an uncertain economic outlook and lower bank profitability, overall bank funding costs have not increased. Markets are focused on returns not concerned with re ...

Name - Parkland School District

... which is the fraction of a deposit that must be kept on hand required by the Federal Reserve. 17. The amount of new money that will be created by lending is given by the ____________________, which is calculated as ____________. 18. How much money creation will an initial deposit of $1,000 yield wit ...

... which is the fraction of a deposit that must be kept on hand required by the Federal Reserve. 17. The amount of new money that will be created by lending is given by the ____________________, which is calculated as ____________. 18. How much money creation will an initial deposit of $1,000 yield wit ...

A rise in the price of oil imports has resulted in a decrease of short

... a. output and prices both increase. b. output and prices both decrease. c. output rises and prices fall. d. output falls and prices rise.. 16. Which of the following is the equation showing what GDP will be? a. A + B + C. b. M1 + M2 + Bank Reserves. c. Saving accounts + Checking accounts + Cash outs ...

... a. output and prices both increase. b. output and prices both decrease. c. output rises and prices fall. d. output falls and prices rise.. 16. Which of the following is the equation showing what GDP will be? a. A + B + C. b. M1 + M2 + Bank Reserves. c. Saving accounts + Checking accounts + Cash outs ...

What is so different about Finance?

... “The IMF’s ability to correctly identify the mounting risks was hindered by a high degree of groupthink, intellectual capture, a general mindset that a major financial crisis in large advanced economies was unlikely, and inadequate analytical approaches. “ IMF Independent Evaluation Office Report 20 ...

... “The IMF’s ability to correctly identify the mounting risks was hindered by a high degree of groupthink, intellectual capture, a general mindset that a major financial crisis in large advanced economies was unlikely, and inadequate analytical approaches. “ IMF Independent Evaluation Office Report 20 ...