4-Natives-of-Kodiak-Shareholders-Presentation

... HighMark Capital Management, Inc. (HighMark), an SEC-registered investment adviser, is a subsidiary of MUFG Union Bank, N.A (MUB). HighMark manages institutional separate account portfolios for a wide variety of for-profit and non-profit organizations, public agencies, public and private retirement ...

... HighMark Capital Management, Inc. (HighMark), an SEC-registered investment adviser, is a subsidiary of MUFG Union Bank, N.A (MUB). HighMark manages institutional separate account portfolios for a wide variety of for-profit and non-profit organizations, public agencies, public and private retirement ...

MIGA in Kosovo

... Catalyze foreign contractors/suppliers and investors into underdeveloped and risky markets, particularly into ...

... Catalyze foreign contractors/suppliers and investors into underdeveloped and risky markets, particularly into ...

Harnessing FDI for Sustainable Development

... Specific guidelines for the design of investment-specific policies and regulations, including not only establishment and operations, treatment and protection of investments, and investment promotion and facilitation, but also investor responsibilities Guidance on the encouragement of responsible ...

... Specific guidelines for the design of investment-specific policies and regulations, including not only establishment and operations, treatment and protection of investments, and investment promotion and facilitation, but also investor responsibilities Guidance on the encouragement of responsible ...

The Investment Funds Act, 2003 - Securities Commission of the

... ______________________________________________________________ ______________________________________________________________ ______________________________________________________________ (c) Shareholder’s Equity: ______________________________________________________________ ______________________ ...

... ______________________________________________________________ ______________________________________________________________ ______________________________________________________________ (c) Shareholder’s Equity: ______________________________________________________________ ______________________ ...

AC ALTERNATIVES® Equity Market Neutral

... The opinions expressed are those of the portfolio investment team and are no guarantee of the future performance of any American Century Investments portfolio. Statements regarding specific holdings represent personal views and compensation has not been received in connection with such views. This i ...

... The opinions expressed are those of the portfolio investment team and are no guarantee of the future performance of any American Century Investments portfolio. Statements regarding specific holdings represent personal views and compensation has not been received in connection with such views. This i ...

Infrastructure investment in international comparison

... • UK always low on these graphs, around 1% of GDP for energy and water, 1 to 1.5% for transport. • Most European countries somewhat higher, especially France, in this data set running to 2003. ...

... • UK always low on these graphs, around 1% of GDP for energy and water, 1 to 1.5% for transport. • Most European countries somewhat higher, especially France, in this data set running to 2003. ...

Investment

... market that issues the security’s certificate after a company is established and offered its shares for public subscription or issued debt instruments. ...

... market that issues the security’s certificate after a company is established and offered its shares for public subscription or issued debt instruments. ...

PIMCO VIT Income Portfolio — Advisor Class

... PIMCO VIT Income Portfolio — Advisor Class Investment Strategy from investment’s prospectus The investment seeks to maximize current income; long-term capital appreciation is a secondary objective. The portfolio seeks to achieve its investment objectives by investing under normal circumstances at le ...

... PIMCO VIT Income Portfolio — Advisor Class Investment Strategy from investment’s prospectus The investment seeks to maximize current income; long-term capital appreciation is a secondary objective. The portfolio seeks to achieve its investment objectives by investing under normal circumstances at le ...

joe rizzi resume 2013 Size: 34.5kb Last modified: Mon

... Specialty consulting firm focusing on the financial services industry with an emphasis on developing growth and restructuring strategies including capital planning; mergers and acquisitions and risk management. CapGen Financial, New York City, NY 2008-2012 Senior Investment Strategist at $500 millio ...

... Specialty consulting firm focusing on the financial services industry with an emphasis on developing growth and restructuring strategies including capital planning; mergers and acquisitions and risk management. CapGen Financial, New York City, NY 2008-2012 Senior Investment Strategist at $500 millio ...

Motley Fool Asset Management - AAII

... or sell, a solicitation of an offer to buy or sell, or a recommendation regarding any security by Motley Fool Asset Management, LLC (“MFAM”), or anybody else. MFAM does not guarantee the suitability or potential value of any particular investment or information source. Investing involves risk, inclu ...

... or sell, a solicitation of an offer to buy or sell, or a recommendation regarding any security by Motley Fool Asset Management, LLC (“MFAM”), or anybody else. MFAM does not guarantee the suitability or potential value of any particular investment or information source. Investing involves risk, inclu ...

daily review 2016-07-20

... Readership: This document is intended solely for the addressee(s). Its content may be legally privileged and/or confidential. This material is only valid if distributed in the Philippines. Opinions: Any opinions expressed in this document may be subject to change without notice and is not intended t ...

... Readership: This document is intended solely for the addressee(s). Its content may be legally privileged and/or confidential. This material is only valid if distributed in the Philippines. Opinions: Any opinions expressed in this document may be subject to change without notice and is not intended t ...

ECOWAS - Investment Policy and Promotion

... Growing Foreign Investment, and Maximizing Impact for the Local Economy This document was produced by The Investment Policy and Promotion Unit of the World Bank Group ...

... Growing Foreign Investment, and Maximizing Impact for the Local Economy This document was produced by The Investment Policy and Promotion Unit of the World Bank Group ...

JBWere SMA Listed Fixed Income Portfolio

... For years investors have been weighing up the flexibility and transparency of listed security ownership against the convenience and expertise of managed funds. Separately Managed Accounts (SMAs) offer a third way to invest that combines some of the best features of listed securities and managed fund ...

... For years investors have been weighing up the flexibility and transparency of listed security ownership against the convenience and expertise of managed funds. Separately Managed Accounts (SMAs) offer a third way to invest that combines some of the best features of listed securities and managed fund ...

EIB - North Sweden European Office

... recovered metals to the existing non-ferrous metals smelter. By tripling the amount of recycled e-scrap, the project will have an overall significant positive impact on the environment. ...

... recovered metals to the existing non-ferrous metals smelter. By tripling the amount of recycled e-scrap, the project will have an overall significant positive impact on the environment. ...

Wang Chaoyoung

... Mr. Wang Chaoyong has received numerous awards including Top 10 Most Successful Western Returned Entrepreneur in China and Aspen 7 in Brainstorm by Fortune. He is also a frequent speaker to leading investment conferences and universities. In addition, Mr. Wang also holds social posts such as Funding ...

... Mr. Wang Chaoyong has received numerous awards including Top 10 Most Successful Western Returned Entrepreneur in China and Aspen 7 in Brainstorm by Fortune. He is also a frequent speaker to leading investment conferences and universities. In addition, Mr. Wang also holds social posts such as Funding ...

further to run in this business cycle

... The views expressed are as of January 1, 2015, may change as market or other conditions change, and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, wheth ...

... The views expressed are as of January 1, 2015, may change as market or other conditions change, and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, wheth ...

Investment Insight - December 2016

... offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to ...

... offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to ...

es220050945197.ps, page 1-3 @ Normalize_2 ( cs220050945197 )

... “(xv) in any case where each of the parties to the transaction or proposed transaction under which securities are or will be acquired, disposed of, subscribed for or underwritten as described in paragraph (a) is an authorized financial institution, is an approved money broker within the meaning of s ...

... “(xv) in any case where each of the parties to the transaction or proposed transaction under which securities are or will be acquired, disposed of, subscribed for or underwritten as described in paragraph (a) is an authorized financial institution, is an approved money broker within the meaning of s ...

New Client Questionnaire

... How would you describe your level of knowledge with regard to finance and investing? (select one) o _____ Minimal. I have very little interest in understanding finance and investing, or I have not had the opportunity to learn. o _____ Low. I have basic knowledge of finance, such as understanding wha ...

... How would you describe your level of knowledge with regard to finance and investing? (select one) o _____ Minimal. I have very little interest in understanding finance and investing, or I have not had the opportunity to learn. o _____ Low. I have basic knowledge of finance, such as understanding wha ...

Closed-End Fund GGM Guggenheim Credit Allocation Fund

... Expense ratios are annualized and reflect the funds operating expense, excluding interest expense, or in the case of a fund with a fee waiver, net operating expense, as of the most recent annual or semiannual report. The expense ratio, based on common assets, including interest expense was 2.40%. Al ...

... Expense ratios are annualized and reflect the funds operating expense, excluding interest expense, or in the case of a fund with a fee waiver, net operating expense, as of the most recent annual or semiannual report. The expense ratio, based on common assets, including interest expense was 2.40%. Al ...

Key Investor Information Franklin Global Aggregate Investment

... are derived from the ownership of a pool of underlying mortgage debts. Debt securities: Securities representing the issuer’s obligation to repay a loan at a specified date and to pay interest. Emerging markets: Countries whose economy, stock market, political situation and regulatory framework are n ...

... are derived from the ownership of a pool of underlying mortgage debts. Debt securities: Securities representing the issuer’s obligation to repay a loan at a specified date and to pay interest. Emerging markets: Countries whose economy, stock market, political situation and regulatory framework are n ...

tripartite financing

... objectives, financial situation or needs of any person or entity. Neither this publication nor anything in it shall form the basis of any contract or commitment. The provision of any services by Triland to any person or entity is subject to Triland’s client acceptance procedures and the client enter ...

... objectives, financial situation or needs of any person or entity. Neither this publication nor anything in it shall form the basis of any contract or commitment. The provision of any services by Triland to any person or entity is subject to Triland’s client acceptance procedures and the client enter ...

SEC amends Rule 2a-7 to eliminate dependency on NRSRO ratings

... security is an Eligible Security (not to mention, whether it is a First Tier or Second Tier security), money market funds will now be required to make a determination that a security presents minimal credit risks based on analysis of the capacity of the security’s issuer or guarantor to meet its fin ...

... security is an Eligible Security (not to mention, whether it is a First Tier or Second Tier security), money market funds will now be required to make a determination that a security presents minimal credit risks based on analysis of the capacity of the security’s issuer or guarantor to meet its fin ...

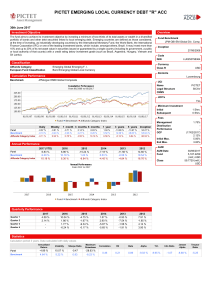

pictet emerging local currency debt "r" acc

... The fund aims to achieve its investment objective by investing a minimum of two-thirds of its total assets or wealth in a diversified portfolio of bonds and other debt securities linked to local emerging debt. Emerging countries are defined as those considered, at the time of investing, as industria ...

... The fund aims to achieve its investment objective by investing a minimum of two-thirds of its total assets or wealth in a diversified portfolio of bonds and other debt securities linked to local emerging debt. Emerging countries are defined as those considered, at the time of investing, as industria ...