Beyond Libor: The Evolution of `Risk-Free` Benchmarks

... has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. PIMCO provid ...

... has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. PIMCO provid ...

Enterprise Capital Funds

... • Distribution of a fixed share of profit to BBFL – remainder shared between private investors and the fund manager ...

... • Distribution of a fixed share of profit to BBFL – remainder shared between private investors and the fund manager ...

RBC Capital Markets

... Other leading edge technologies, like quantum computing and nanotechnology ...

... Other leading edge technologies, like quantum computing and nanotechnology ...

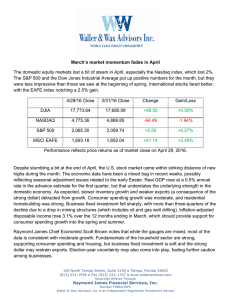

March`s market momentum fades in April The domestic equity

... Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an un ...

... Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an un ...

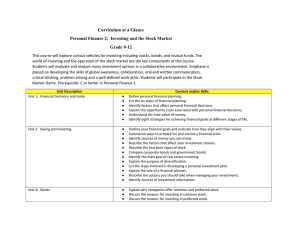

Curriculum at a Glance Personal Finance 2: Investing and the Stock

... Outline your financial goals and evaluate how they align with their values. Summarize ways to prepare for and survive a financial crisis. Identify sources of money you can invest. Describe the factors that affect your investment choices. Describe the two basic types of stock. Compare corporate bonds ...

... Outline your financial goals and evaluate how they align with their values. Summarize ways to prepare for and survive a financial crisis. Identify sources of money you can invest. Describe the factors that affect your investment choices. Describe the two basic types of stock. Compare corporate bonds ...

UNIVERSITY OF NIGERIA, NSUKKA

... banking services, thereby enhancing social welfare. Banking competition also promotes economic growth by increasing firms’ access to external financing, lowering the costs of banking products and services, exerting corporate controls, managing and mitigating banking risks, mobilizing savings and inv ...

... banking services, thereby enhancing social welfare. Banking competition also promotes economic growth by increasing firms’ access to external financing, lowering the costs of banking products and services, exerting corporate controls, managing and mitigating banking risks, mobilizing savings and inv ...

an investment summit on 19 th December 2014, at which HE the

... It is hoped that the Home is Best Summit will change the stereo type notion that Northern Uganda is war ravaged and unsafe. The Government of Uganda is committed to ensuring that the sustained peace in the region will continue to provide a conducive environment for trade and investment. Our fellow ...

... It is hoped that the Home is Best Summit will change the stereo type notion that Northern Uganda is war ravaged and unsafe. The Government of Uganda is committed to ensuring that the sustained peace in the region will continue to provide a conducive environment for trade and investment. Our fellow ...

Oil, Currencies, and the Fed

... slowing economy. While U.S. based Chinese equity ETFs performed roughly in line with U.S. benchmarks, the Shanghai benchmark index is up 50% this year. This performance disparity reflects many issues. Much trading is done on margin by Chinese nationals inexperienced with equity risk in markets with ...

... slowing economy. While U.S. based Chinese equity ETFs performed roughly in line with U.S. benchmarks, the Shanghai benchmark index is up 50% this year. This performance disparity reflects many issues. Much trading is done on margin by Chinese nationals inexperienced with equity risk in markets with ...

Chenavari enter into an agreement to acquire BuyWay Personal

... to outperform the most relevant indices (CAC Mid & Small, and LPX Europe). Altamir invests through the funds managed by Apax Partners MidMarket in France, a leading private equity firm in French-speaking Europe, and through Apax Partners LLP, one of the world’s leading private equity investment grou ...

... to outperform the most relevant indices (CAC Mid & Small, and LPX Europe). Altamir invests through the funds managed by Apax Partners MidMarket in France, a leading private equity firm in French-speaking Europe, and through Apax Partners LLP, one of the world’s leading private equity investment grou ...

mou 2014-15 negotiation meeting

... Proposed Dedicated Renewable Energy Fund For India Govt. of India (through IREDA) proposes to set up USD 1 to 1.5 bn fund for renewable energy Fund is to be setup in line with National Infrastructure Investment Fund (NIIF) structure Govt. owned entities such as PFC, REC, NTPC and IREDA have i ...

... Proposed Dedicated Renewable Energy Fund For India Govt. of India (through IREDA) proposes to set up USD 1 to 1.5 bn fund for renewable energy Fund is to be setup in line with National Infrastructure Investment Fund (NIIF) structure Govt. owned entities such as PFC, REC, NTPC and IREDA have i ...

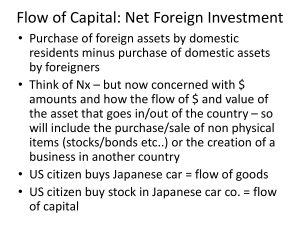

5. CH 29 NFI and B O P notes

... • When American citizens and firms exchange goods and services with foreign consumers and firms, payments are sent back and forth through major banks around the world. ………= • A country’s balance of payments accounts : record its international trading, borrowing, and lending. • = THE BALANCE B/W ALL ...

... • When American citizens and firms exchange goods and services with foreign consumers and firms, payments are sent back and forth through major banks around the world. ………= • A country’s balance of payments accounts : record its international trading, borrowing, and lending. • = THE BALANCE B/W ALL ...

(wealth accumulator established).

... review program will guide, educate and enable your journey by accumulating, protecting and enhancing your wealth. Managing your money wisely can make a big difference to your lifestyle and secure financial success now and for the future. ...

... review program will guide, educate and enable your journey by accumulating, protecting and enhancing your wealth. Managing your money wisely can make a big difference to your lifestyle and secure financial success now and for the future. ...

Equity Research Analyst - JHM Professional Development and

... Update and maintain daily valuation sheets ...

... Update and maintain daily valuation sheets ...

BANK OF NOVA SCOTIA (Form: FWP, Received: 10

... value of the euro against the U.S. dollar, which you would have received if you had owned the securities in the Index during the term of your notes, although the level of the Index may be adversely affected by general exchange rate movements in the market. ...

... value of the euro against the U.S. dollar, which you would have received if you had owned the securities in the Index during the term of your notes, although the level of the Index may be adversely affected by general exchange rate movements in the market. ...

SMSFs drop the ball on risk in asset allocation

... consistent with SMSF investors’ risk tolerance or financial needs. SMSFs are saving for retirement and such a high exposure to growth assets involves more risk than they need to meet their cash flow. Good investment advice can help to minimise this risk. At the very least, advisers should be testing ...

... consistent with SMSF investors’ risk tolerance or financial needs. SMSFs are saving for retirement and such a high exposure to growth assets involves more risk than they need to meet their cash flow. Good investment advice can help to minimise this risk. At the very least, advisers should be testing ...

Party Like It`s 1999 - FBB Capital Partners

... We kept a balanced approach to equities by offsetting these additions with two sales, McDonalds and T. Rowe Price. We previously favored McDonalds’ management change and new growth strategies, but we believe execution risks are rising and investors are fully valuing the company’s improvements. We ex ...

... We kept a balanced approach to equities by offsetting these additions with two sales, McDonalds and T. Rowe Price. We previously favored McDonalds’ management change and new growth strategies, but we believe execution risks are rising and investors are fully valuing the company’s improvements. We ex ...

Manager Bio - Natixis Global Asset Management

... Pavel Vaynshtok is a Managing Director and Senior Portfolio Manager of the U.S. Behavioral Finance Equity group responsible for the Intrepid strategies. Pavel rejoined the firm in 2011. Previously Pavel was a portfolio manager and the head of quantitative research at ING Investment Management where ...

... Pavel Vaynshtok is a Managing Director and Senior Portfolio Manager of the U.S. Behavioral Finance Equity group responsible for the Intrepid strategies. Pavel rejoined the firm in 2011. Previously Pavel was a portfolio manager and the head of quantitative research at ING Investment Management where ...

Curb Your Mind – Understanding Why Investors Don`t Achieve Their

... investor to stick to one strategy thru this much trauma. Consider this scenario: if you started investing with 100% of your money in the stock market on the worst day in modern history on 10-9-2007 (the previous stock peak), you would have lived through the worst financial crisis since the Great Dep ...

... investor to stick to one strategy thru this much trauma. Consider this scenario: if you started investing with 100% of your money in the stock market on the worst day in modern history on 10-9-2007 (the previous stock peak), you would have lived through the worst financial crisis since the Great Dep ...

Strategy Highlight - Silvant Capital Management

... Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this fund will fluctuate as the value of the securities in the portfolio changes. ...

... Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this fund will fluctuate as the value of the securities in the portfolio changes. ...

Read more

... Societe Generale has been playing a vital role in the economy for 150 years. With more than 145,000 145,000 employees, based in 66 ...

... Societe Generale has been playing a vital role in the economy for 150 years. With more than 145,000 145,000 employees, based in 66 ...

Financial Markets and Institutions

... justify the common practice of thinking about firms, especially large firms, as being separate entities from their owners. ...

... justify the common practice of thinking about firms, especially large firms, as being separate entities from their owners. ...

Southeast Asia`s Capital Markets Getting It Right This Time

... Two, setting up the physical backbone for capital markets activity is easy, but investing in people to run it is often an afterthought. There’s a need to develop qualified professionals who act based on best practices and ethical and professional standards, and who are continually updating their tra ...

... Two, setting up the physical backbone for capital markets activity is easy, but investing in people to run it is often an afterthought. There’s a need to develop qualified professionals who act based on best practices and ethical and professional standards, and who are continually updating their tra ...

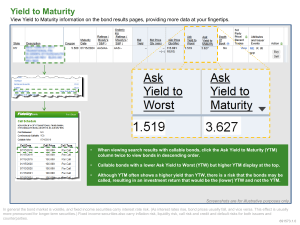

Yield to Maturity

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...