- Prudential Indonesia

... “Susanne” made a profit of $657. The better net position favoured “Susanne” who dollar cost averaged. ...

... “Susanne” made a profit of $657. The better net position favoured “Susanne” who dollar cost averaged. ...

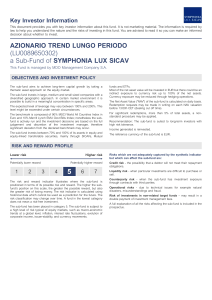

AZIONARIO TREND LUNGO PERIODO (LU0089650302) a Sub

... Liquidity risk - when particular investments are difficult to purchase or sell. Counterparty risk - when the sub-fund has investment exposure through contracts with third parties. Operational risks - due to technical issues for example natural disasters, misunderstandings and fraud. Risk of investme ...

... Liquidity risk - when particular investments are difficult to purchase or sell. Counterparty risk - when the sub-fund has investment exposure through contracts with third parties. Operational risks - due to technical issues for example natural disasters, misunderstandings and fraud. Risk of investme ...

Alistair Nolan, Head, OECD Investment Compact for South East

... to link FDI and local businesses. IPAs could do more to help investors navigate license and permit approval procedures at the local level. ...

... to link FDI and local businesses. IPAs could do more to help investors navigate license and permit approval procedures at the local level. ...

INVESTMENT POLICY NOVEMBER 2014 PRIVATE BANKING – INVESTMENT RESEARCH

... Investment Committee has not changed its macroeconomic views or the main tenets of its investment policy, which are protection and convictions. There is no chance of a recession in the US as things stand now. Moreover, the correction in stockmarkets is a healthy development as it is drawing down par ...

... Investment Committee has not changed its macroeconomic views or the main tenets of its investment policy, which are protection and convictions. There is no chance of a recession in the US as things stand now. Moreover, the correction in stockmarkets is a healthy development as it is drawing down par ...

FDIC Limit Raised

... of such a program is advancing money by depositing funds onto an electronic credit card specific to that company. Purchases made with the card are then discounted, and the amount is deducted from the card balance. There are some vendors such as airlines that are offering significant airfare discount ...

... of such a program is advancing money by depositing funds onto an electronic credit card specific to that company. Purchases made with the card are then discounted, and the amount is deducted from the card balance. There are some vendors such as airlines that are offering significant airfare discount ...

Kathryn Campbell-Savours Priority Axis 5: Promoting climate

... Utilising ERDF to safeguard and enable sustainable economic growth, ensuring ‘at risk’ communities, businesses and their local economy can adapt to climate change, thus contribute to and benefit from sustainable local economic growth ...

... Utilising ERDF to safeguard and enable sustainable economic growth, ensuring ‘at risk’ communities, businesses and their local economy can adapt to climate change, thus contribute to and benefit from sustainable local economic growth ...

SVLS Fact sheet FEB AW - International Biotechnology Trust plc

... and is not guaranteed, and investors may not get back the full amount invested. Exchange rate changes may cause the value of overseas investments to rise or fall. Investors should bear in mind that investment in biotechnology shares can be subject to risks not normally associated with more developed ...

... and is not guaranteed, and investors may not get back the full amount invested. Exchange rate changes may cause the value of overseas investments to rise or fall. Investors should bear in mind that investment in biotechnology shares can be subject to risks not normally associated with more developed ...

Pyramid and Ponzi schemes

... Pyramid schemes get their name from their triangularly-shaped corporate structure and can be promoted under any number of business names. While it is common for a product or service to be represented in the scheme, the sale of this product or service is a secondary factor in the generation of return ...

... Pyramid schemes get their name from their triangularly-shaped corporate structure and can be promoted under any number of business names. While it is common for a product or service to be represented in the scheme, the sale of this product or service is a secondary factor in the generation of return ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... 2. Information on foreign markets and investments is becoming readily accessible and deregulation across the globe is allowing ...

... 2. Information on foreign markets and investments is becoming readily accessible and deregulation across the globe is allowing ...

our theory of change - Big Society Capital

... intermediaries • Increased growth and sustainability of intermediaries • Increased understanding of how capital can be used to create impact through sustainable models ...

... intermediaries • Increased growth and sustainability of intermediaries • Increased understanding of how capital can be used to create impact through sustainable models ...

Not So Fast - Columbia Center on Sustainable Investment

... region (the Trans-Pacific Partnership) and Europe (the Trans-Atlantic Trade and Investment Partnership) without the possibility for Congressional amendments. Both are being sold generally as "trade agreements," yet they involve key areas of business law and regulation far beyond trade. Before Congre ...

... region (the Trans-Pacific Partnership) and Europe (the Trans-Atlantic Trade and Investment Partnership) without the possibility for Congressional amendments. Both are being sold generally as "trade agreements," yet they involve key areas of business law and regulation far beyond trade. Before Congre ...

April 24, 2006 Investment Letter 18966 Mc Cowan Road www

... market conditions. It is recommended that investors stay out of the US market due to the two US major deficits. A Budget deficit risen from 5 trillion to 15 trillion in the past six years, also a trade deficit with Asian countries, mainly China. The US continues to borrow 2 billion a day. Added to t ...

... market conditions. It is recommended that investors stay out of the US market due to the two US major deficits. A Budget deficit risen from 5 trillion to 15 trillion in the past six years, also a trade deficit with Asian countries, mainly China. The US continues to borrow 2 billion a day. Added to t ...

Initiates file download

... A recent FAO survey on the Current Investment in Agriculture (FAO/IAP, 2011) in 94 countries revealed that annual investments in agricultural research and extension in developing countries are often lagging far behind the required level to meet the Zero Hunger Objectives in most developing countries ...

... A recent FAO survey on the Current Investment in Agriculture (FAO/IAP, 2011) in 94 countries revealed that annual investments in agricultural research and extension in developing countries are often lagging far behind the required level to meet the Zero Hunger Objectives in most developing countries ...

Initiates file download

... A recent FAO survey on the Current Investment in Agriculture (FAO/IAP, 2011) in 94 countries revealed that annual investments in agricultural research and extension in developing countries are often lagging far behind the required level to meet the Zero Hunger Objectives in most developing countries ...

... A recent FAO survey on the Current Investment in Agriculture (FAO/IAP, 2011) in 94 countries revealed that annual investments in agricultural research and extension in developing countries are often lagging far behind the required level to meet the Zero Hunger Objectives in most developing countries ...

Initiates file download

... A recent FAO survey on the Current Investment in Agriculture (FAO/IAP, 2011) in 94 countries revealed that annual investments in agricultural research and extension in developing countries are often lagging far behind the required level to meet the Zero Hunger Objectives in most developing countries ...

... A recent FAO survey on the Current Investment in Agriculture (FAO/IAP, 2011) in 94 countries revealed that annual investments in agricultural research and extension in developing countries are often lagging far behind the required level to meet the Zero Hunger Objectives in most developing countries ...

WiseEnergy Group announces Framework Agreement with leading

... energy assets, is pleased to announce the signature of a framework agreement with one of the largest Investment Funds in the photovoltaic market. WiseEnergy will provide full asset management services for a portfolio, currently consisting of 17 MWp of plants and which will increase significantly ove ...

... energy assets, is pleased to announce the signature of a framework agreement with one of the largest Investment Funds in the photovoltaic market. WiseEnergy will provide full asset management services for a portfolio, currently consisting of 17 MWp of plants and which will increase significantly ove ...

Why a new investment proposition?

... Until the introduction of our new investment proposition we researched and recommended individual funds that were reviewed to suit the needs of our clients and an attempt was made at rebalancing from time to time. The ‘old model’ had become increasingly cumbersome as we tried to keep abreast of so m ...

... Until the introduction of our new investment proposition we researched and recommended individual funds that were reviewed to suit the needs of our clients and an attempt was made at rebalancing from time to time. The ‘old model’ had become increasingly cumbersome as we tried to keep abreast of so m ...

Credit

... Source: Standard & Poor’s, Robert Shiller Data, FRB, FactSet, J.P. Morgan Asset Management. ...

... Source: Standard & Poor’s, Robert Shiller Data, FRB, FactSet, J.P. Morgan Asset Management. ...

The primary objective of business financial

... 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the timing of expected cash flows. 3. Consider a bond that has a $1000 face value, a 6.875% ...

... 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the timing of expected cash flows. 3. Consider a bond that has a $1000 face value, a 6.875% ...

Regulatory Risk, Cost of Capital and Investment

... that has been developed lately that tries to explain cross-national variation in firm characteristics and product market strategies as a result of differences in national institutional frameworks (Hollingsworth, 1997, Soskice, 1999) and sets the theoretical framework for the analysis. Section III an ...

... that has been developed lately that tries to explain cross-national variation in firm characteristics and product market strategies as a result of differences in national institutional frameworks (Hollingsworth, 1997, Soskice, 1999) and sets the theoretical framework for the analysis. Section III an ...

Investment Management Process p2ch1

... Structured – match the funds received from contributions to the future liabilities ...

... Structured – match the funds received from contributions to the future liabilities ...

LIMITED MATURITY INCOME FUND Fourth Quarter 2015

... Fund and is assisted in that role by the Investment Committee. A professional Investment advisor has been retained by the Investment Committee to meet regularly with the Committee to assist with overseeing the management and operation of the Limited Maturity Income Fund. The Investment Committee, wi ...

... Fund and is assisted in that role by the Investment Committee. A professional Investment advisor has been retained by the Investment Committee to meet regularly with the Committee to assist with overseeing the management and operation of the Limited Maturity Income Fund. The Investment Committee, wi ...

the presentation

... This presentation is made only for informational and academic purpose. This presentation neither constitutes an offer to sell nor a solicitation to invest in any of the funds managed by Andrew Weiss (collectively, the “Funds”). Solicitations to invest in the Funds are made only by means of a confide ...

... This presentation is made only for informational and academic purpose. This presentation neither constitutes an offer to sell nor a solicitation to invest in any of the funds managed by Andrew Weiss (collectively, the “Funds”). Solicitations to invest in the Funds are made only by means of a confide ...

Banks and European exchanges seek to profit from Mifid Luke Jeffs

... particularly in London. We are seeing some of the early adopters behaving differently than they were six months ago,” he said. He cited the examples of Project Boat, the trade reporting service launched by nine investment banks last month, and Euronext’s recent venture. Unlike Euronext, which claime ...

... particularly in London. We are seeing some of the early adopters behaving differently than they were six months ago,” he said. He cited the examples of Project Boat, the trade reporting service launched by nine investment banks last month, and Euronext’s recent venture. Unlike Euronext, which claime ...

International Emerging Markets Separate Account

... Before directing retirement funds to a separate account, investors should carefully consider the investment objectives, risks, charges and expenses of the separate account as well as their individual risk tolerance, time horizon and goals. For additional information contact us at 1-800-547-7754 or b ...

... Before directing retirement funds to a separate account, investors should carefully consider the investment objectives, risks, charges and expenses of the separate account as well as their individual risk tolerance, time horizon and goals. For additional information contact us at 1-800-547-7754 or b ...