DOC - Europa.eu

... million (Ksh70 billion) scheme will transform supply of renewable energy in East Africa and benefit from additional financial support from the European Union, through the EU-Africa Infrastructure Trust Fund and a broad range of international investors. As the largest single wind farm in sub-Saharan ...

... million (Ksh70 billion) scheme will transform supply of renewable energy in East Africa and benefit from additional financial support from the European Union, through the EU-Africa Infrastructure Trust Fund and a broad range of international investors. As the largest single wind farm in sub-Saharan ...

Seminar in Financial Management

... The derivation of post-tax investment rules and neutral tax systems under risk neutrality and risk aversion for irreversible investment projects. ...

... The derivation of post-tax investment rules and neutral tax systems under risk neutrality and risk aversion for irreversible investment projects. ...

Presentation - Kerns Capital Management, Inc.

... charges and expenses of the KCM Macro Trends Fund before investing. The Fund may invest in small, less well-known companies, which may be subject to more erratic market movements than large-cap stocks; foreign securities, which are subject to currency fluctuations and political uncertainty; and deri ...

... charges and expenses of the KCM Macro Trends Fund before investing. The Fund may invest in small, less well-known companies, which may be subject to more erratic market movements than large-cap stocks; foreign securities, which are subject to currency fluctuations and political uncertainty; and deri ...

RBC Multi-Strategy Alpha Fund

... The Overall Best Hedge Fund was awarded to the fund with the best combined 10 year return and Sharpe Ratio as calculated by Fundata as of June 30, 2016. This information is not intended to be an offer or solicitation to buy or sell securities or to participate in or subscribe for any service. No sec ...

... The Overall Best Hedge Fund was awarded to the fund with the best combined 10 year return and Sharpe Ratio as calculated by Fundata as of June 30, 2016. This information is not intended to be an offer or solicitation to buy or sell securities or to participate in or subscribe for any service. No sec ...

Global Banking and Markets (GBM)

... Hang Seng‘s Global Banking business provides a broad spectrum of financing solutions to large corporations and financial institutions. As a strategic financial partner to corporate customers, Hang Seng offers a comprehensive range of products and services including bilateral and syndication loans, p ...

... Hang Seng‘s Global Banking business provides a broad spectrum of financing solutions to large corporations and financial institutions. As a strategic financial partner to corporate customers, Hang Seng offers a comprehensive range of products and services including bilateral and syndication loans, p ...

Investment in Financial Capital

... • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. ...

... • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. ...

July 24, 2016 - Stearns Financial Group

... readings following a batch of “surprisingly positive” (at least to the consensus of industry analysts) economic news in the last several weeks. Some of these positive developments were discussed in our last Poolside Chat. The CESI measures whether economic data is coming in better or worse than expe ...

... readings following a batch of “surprisingly positive” (at least to the consensus of industry analysts) economic news in the last several weeks. Some of these positive developments were discussed in our last Poolside Chat. The CESI measures whether economic data is coming in better or worse than expe ...

CLOs, CDOs and the Search for High Yield

... Whilst considerable care has been taken to ensure the information contained within is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of t ...

... Whilst considerable care has been taken to ensure the information contained within is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of t ...

Staying on course in volatile markets CIO Flash

... market moves are here to stay. Increasing illiquidity in certain market segments and banks’ scaled-down trading desks are having a strong impact on volatility. Bond markets also suffer from being so heavily driven by central-bank action that pricing on a fundamental basis has become all but impossib ...

... market moves are here to stay. Increasing illiquidity in certain market segments and banks’ scaled-down trading desks are having a strong impact on volatility. Bond markets also suffer from being so heavily driven by central-bank action that pricing on a fundamental basis has become all but impossib ...

MC312 - SYLLABUS

... Teaching will be by a mix of lectures and problem solving classes over 11 weeks. This will comprise a mix of formal delivery interspersed with worked problems. The former will meet the prime objective of providing an introduction to the investment management process and the philosophical approaches ...

... Teaching will be by a mix of lectures and problem solving classes over 11 weeks. This will comprise a mix of formal delivery interspersed with worked problems. The former will meet the prime objective of providing an introduction to the investment management process and the philosophical approaches ...

Investment in private and public sectors

... • Sensitivity analysis is a technique for incorporating risk assessment in investment appraisal. • It works by highlighting the key assumptions upon which investment appraisal figures were based. • Sensitivity analysis would calculate the effects on an investment appraisal of changes in these assump ...

... • Sensitivity analysis is a technique for incorporating risk assessment in investment appraisal. • It works by highlighting the key assumptions upon which investment appraisal figures were based. • Sensitivity analysis would calculate the effects on an investment appraisal of changes in these assump ...

SPECIAL ASPECTS OF BANKS INVESTMENT ACTIVITY IN UKRAINE

... the purpose of obtaining income from transactions with securities from operations long-term funding for ...

... the purpose of obtaining income from transactions with securities from operations long-term funding for ...

INVESTMENT focuS - Castanea Partners

... INVESTMENT focus Castanea Partners is principally focused on investing in high-engagement consumer brands and marketing services companies that enable such brands to connect most successfully with target customers. We also seek to invest in select business-to-business must-have information service p ...

... INVESTMENT focus Castanea Partners is principally focused on investing in high-engagement consumer brands and marketing services companies that enable such brands to connect most successfully with target customers. We also seek to invest in select business-to-business must-have information service p ...

PPT

... (the IMF’s Standardized Report Forms for Monetary and Financial Statistics cover banks, non-bank depository corporations, insurance companies, pension funds, investment funds, special purpose entities, etc.) ...

... (the IMF’s Standardized Report Forms for Monetary and Financial Statistics cover banks, non-bank depository corporations, insurance companies, pension funds, investment funds, special purpose entities, etc.) ...

Sales Aid

... Important information: This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of Schroder International Selection Fund (the “Company”). Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shar ...

... Important information: This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of Schroder International Selection Fund (the “Company”). Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shar ...

07 - Commercial Real Estate Analysis and Investment

... INCOME (CURRENT CASH FLOW) -SHORT-TERM & ON-GOING NEED ...

... INCOME (CURRENT CASH FLOW) -SHORT-TERM & ON-GOING NEED ...

Eikon Private Equity PDF

... from contributing fund managers’ financial statements and subjected to additional layers of rigorous quality control • Detail-driven report types give access to enhanced analysis including quarterly aggregate benchmark cash flow and net asset value (NAV) data for over 6,700 funds, percentile analysi ...

... from contributing fund managers’ financial statements and subjected to additional layers of rigorous quality control • Detail-driven report types give access to enhanced analysis including quarterly aggregate benchmark cash flow and net asset value (NAV) data for over 6,700 funds, percentile analysi ...

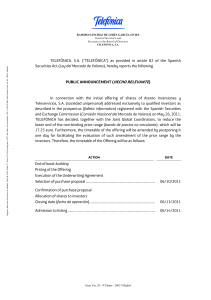

TELEFÓNICA, S.A. (“TELEFÓNICA”) as provided in article 82 of the

... (including any supplements or amendments thereto, if any) filed with the Spanish SEC for investors in Spain and the international offering memorandum for qualified institutional investors only outside of Spain. An investment decision regarding the offered securities of ATENTO should only be made on ...

... (including any supplements or amendments thereto, if any) filed with the Spanish SEC for investors in Spain and the international offering memorandum for qualified institutional investors only outside of Spain. An investment decision regarding the offered securities of ATENTO should only be made on ...

Prudential Jennison Mid Cap Growth A LW

... assets in equity and equity-related securities of medium-sized companies with the potential for above-average growth. The fund's investable assets will be less than its total assets to the extent that it has borrowed money for non-investment purposes, such as to meet anticipated redemptions. ...

... assets in equity and equity-related securities of medium-sized companies with the potential for above-average growth. The fund's investable assets will be less than its total assets to the extent that it has borrowed money for non-investment purposes, such as to meet anticipated redemptions. ...

Protecting Against Alternative Investment Risk

... can play an important role in enhancing institutional investor portfolios. However, many institutional investors have concerns over the inclusion of alternative investments in their strategy. Comprehensive and thorough risk management is key to allaying these concerns – but it is something that must ...

... can play an important role in enhancing institutional investor portfolios. However, many institutional investors have concerns over the inclusion of alternative investments in their strategy. Comprehensive and thorough risk management is key to allaying these concerns – but it is something that must ...

Investment in Financial Capital

... • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. ...

... • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. ...

Chapter13overheadsFall2015

... • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. ...

... • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. ...

UK current account - November 2016

... (a) Data as on 30 September 2016, for the seven largest UK banks, UK-resident entities only. (b) Total assets (liabilities) includes gross reverse repo (repo) and group lending (funding). Total foreign currency assets (liabilities) calculated as total assets (liabilities) less sterling only assets ( ...

... (a) Data as on 30 September 2016, for the seven largest UK banks, UK-resident entities only. (b) Total assets (liabilities) includes gross reverse repo (repo) and group lending (funding). Total foreign currency assets (liabilities) calculated as total assets (liabilities) less sterling only assets ( ...