Lecture 3 - Akateeminen talousblogi

... o Key assumption: There is a market failure (external economies of scale, imperfect capital markets…). If this does not hold, you should ask why doesn’t the industry proceed on its own? o Implementation Problem with identifying the right industries Time consistency: will the protection eventua ...

... o Key assumption: There is a market failure (external economies of scale, imperfect capital markets…). If this does not hold, you should ask why doesn’t the industry proceed on its own? o Implementation Problem with identifying the right industries Time consistency: will the protection eventua ...

Staff Report

... consolidation could be considered to reduce public debt further as well as create more fiscal space for the government to respond effectively to future shocks. In order to achieve consolidation as well as allow the government to provide key public goods and services it will be essential to raise the ...

... consolidation could be considered to reduce public debt further as well as create more fiscal space for the government to respond effectively to future shocks. In order to achieve consolidation as well as allow the government to provide key public goods and services it will be essential to raise the ...

A Review of Philippine Monetary Policy Towards An Alternative Monetary... Joseph Lim 3-D 12

... The Philippines’ shift in monetary policy from ‘monetary targeting’ in the 1980s and 1990s to ‘inflation targeting’ in 2002 -- wherein policy interest rates replaced stringent monetary targets as the key monetary instrument -- has so far brought in a more ‘benign’ monetary policy that is more sensit ...

... The Philippines’ shift in monetary policy from ‘monetary targeting’ in the 1980s and 1990s to ‘inflation targeting’ in 2002 -- wherein policy interest rates replaced stringent monetary targets as the key monetary instrument -- has so far brought in a more ‘benign’ monetary policy that is more sensit ...

Analysis of the RMB`s Chance to be Included in the SDR The

... rapid growth. Moreover, those indicators are not meant to be used mechanically. IMF also emphasizes that the Executive Board’s judgment is necessary. Combined with Christine Lagarde’s latest comment that it is a matter of when, not if, the RMB makes it into the SDR, and the RMB internationalization’ ...

... rapid growth. Moreover, those indicators are not meant to be used mechanically. IMF also emphasizes that the Executive Board’s judgment is necessary. Combined with Christine Lagarde’s latest comment that it is a matter of when, not if, the RMB makes it into the SDR, and the RMB internationalization’ ...

Positioning Austria in the Global Economy: Value Added

... Austrian exports than jobs in Austria. The most important locations of these foreign jobs are China, Germany, the CEEC-5 (which include the Czech Republic, Hungary, Poland, Slovakia and Slovenia) and India, in that order. It should be mentioned, however, that this comparison of foreign jobs and Aust ...

... Austrian exports than jobs in Austria. The most important locations of these foreign jobs are China, Germany, the CEEC-5 (which include the Czech Republic, Hungary, Poland, Slovakia and Slovenia) and India, in that order. It should be mentioned, however, that this comparison of foreign jobs and Aust ...

macroeconomic policy and us competitiveness abstract

... will to make a choice. At the end of this essay, we will suggest how we might make those choices. Monetary policy, the other main economic tool of government, has a more subtle role in competitiveness, and debate continues on the effects of current and recent U.S. monetary policy on competitiveness. ...

... will to make a choice. At the end of this essay, we will suggest how we might make those choices. Monetary policy, the other main economic tool of government, has a more subtle role in competitiveness, and debate continues on the effects of current and recent U.S. monetary policy on competitiveness. ...

Presentation by Liqing Zhang, Zhigang Huang

... trade surplus, net inflows of foreign direct investment, net income in the current account, and funds financed from foreign stock markets. 1.3 The main channels of the capital inflows Under the capital control policy, only a small part of short term capital flows into China legally through the Quali ...

... trade surplus, net inflows of foreign direct investment, net income in the current account, and funds financed from foreign stock markets. 1.3 The main channels of the capital inflows Under the capital control policy, only a small part of short term capital flows into China legally through the Quali ...

answers to questions - ORU Accounting Information

... (a) General journal. (b) General journal. (c) Cash receipts journal. ...

... (a) General journal. (b) General journal. (c) Cash receipts journal. ...

US Debt and Deficit - Synergetic Investment Group

... employment. At full employment, for example, the federal budget may run a surplus. This means fiscal policy may not be expansionary enough even when the budget is in deficit. ...

... employment. At full employment, for example, the federal budget may run a surplus. This means fiscal policy may not be expansionary enough even when the budget is in deficit. ...

146s10_l20.pdf

... Jan 1 1999 11 member countries of EU adopted common currency The European Union is a system of international institutions, Now represents 27 European countries through the: European Parliament: elected by citizens of member countries Council of the European Union: appointed by governments of the mem ...

... Jan 1 1999 11 member countries of EU adopted common currency The European Union is a system of international institutions, Now represents 27 European countries through the: European Parliament: elected by citizens of member countries Council of the European Union: appointed by governments of the mem ...

2006 and over the next few years, supported by

... 16.5 million poorest households in the country. Notwithstanding the likely positive fiscal impact of this measure, questions remain about the efficacy of the policy package for the economy of Indonesia. How will the local government machinery ensure that the cash compensation reaches eligible househ ...

... 16.5 million poorest households in the country. Notwithstanding the likely positive fiscal impact of this measure, questions remain about the efficacy of the policy package for the economy of Indonesia. How will the local government machinery ensure that the cash compensation reaches eligible househ ...

Lecture 1 Introduction – Geography, Demography and Economics

... bridging savings and investments. In this context we find his analysis of the rate of interest and its relationship to the rate of profit. An early articulation of Wicksell's two rates analysis one hundred years later. ...

... bridging savings and investments. In this context we find his analysis of the rate of interest and its relationship to the rate of profit. An early articulation of Wicksell's two rates analysis one hundred years later. ...

Mankiw 5/e Chapter 15: Government Debt

... – politicians can shift burden of taxes from current to future generations – may reduce country’s political clout in international affairs or scare foreign investors into pulling their capital out of the country CHAPTER 15 ...

... – politicians can shift burden of taxes from current to future generations – may reduce country’s political clout in international affairs or scare foreign investors into pulling their capital out of the country CHAPTER 15 ...

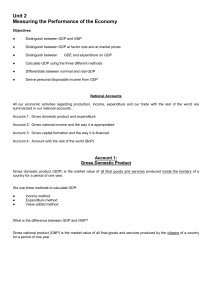

Unit 2 Measuring the Performance of the Economy Objectives

... National Accounts All our economic activities regarding production, income, expenditure and our trade with the rest of the world are summarized in our national accounts. Account 1: Gross domestic product and expenditure Account 2: Gross national income and the way it is appropriated Account 3: Gross ...

... National Accounts All our economic activities regarding production, income, expenditure and our trade with the rest of the world are summarized in our national accounts. Account 1: Gross domestic product and expenditure Account 2: Gross national income and the way it is appropriated Account 3: Gross ...

3. terms, definitions and explanations[1]

... (possibly goods) for individual or collective consumption and redistribute income and wealth. The general government sector in Israel includes the following units: government ministries, the National Insurance Institute, local authorities, national institutions, and non-profit institutions which are ...

... (possibly goods) for individual or collective consumption and redistribute income and wealth. The general government sector in Israel includes the following units: government ministries, the National Insurance Institute, local authorities, national institutions, and non-profit institutions which are ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Generational Accounting around the World

... the economy’s intertemporal budget constraint and appears to underlie actual attempts to run tight fiscal policy. It says take in net present value from each new young generation an amount equal to the flow of government consumption less interest on the difference between (a) the value of the econom ...

... the economy’s intertemporal budget constraint and appears to underlie actual attempts to run tight fiscal policy. It says take in net present value from each new young generation an amount equal to the flow of government consumption less interest on the difference between (a) the value of the econom ...

A New Paradigm for Macroeconomic Policy Philip Arestis, University

... the excess of private savings over private investment, these arguments have no validity (as was shown long ago by Kalecki, 1944; see also Arestis and Sawyer, 2004, Sawyer, 2009). At one level, interest payments on government debt can be treated as a transfer payment, and akin to the other range of ...

... the excess of private savings over private investment, these arguments have no validity (as was shown long ago by Kalecki, 1944; see also Arestis and Sawyer, 2004, Sawyer, 2009). At one level, interest payments on government debt can be treated as a transfer payment, and akin to the other range of ...

10APMacroCh25_26

... and operated by a foreign entity is called foreign direct investment. (Ford Motor might build a car factory in Mexico) An investment that is financed with foreign money but operated by domestic residents is called foreign portfolio investment. (An American might buy stock in a Mexican ...

... and operated by a foreign entity is called foreign direct investment. (Ford Motor might build a car factory in Mexico) An investment that is financed with foreign money but operated by domestic residents is called foreign portfolio investment. (An American might buy stock in a Mexican ...

NATIONAL ACCOUNTS DATA AND MACROECONOMIC ANALYSIS

... to their investment rates, a low investment rate measured by the ratio I/K in a particular country, does not necessarily mean that investment expenditures are low. When a national economy holds a large amount of capital and invests substantially, the investment rate might still be relatively low. On ...

... to their investment rates, a low investment rate measured by the ratio I/K in a particular country, does not necessarily mean that investment expenditures are low. When a national economy holds a large amount of capital and invests substantially, the investment rate might still be relatively low. On ...

The impact of capital flows on the South African economic growth

... was the swap agreement where South African firms were allowed to invest offshore if they could secure foreign investment into South Africa. This finding indicates that investors prefer to take short-term positions in South Africa. Wesso also finds that “Portfolio investors usually chase high-yield ...

... was the swap agreement where South African firms were allowed to invest offshore if they could secure foreign investment into South Africa. This finding indicates that investors prefer to take short-term positions in South Africa. Wesso also finds that “Portfolio investors usually chase high-yield ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... For instance, under fixed rates the bailout rate is mostly determined by the amount of reserves authorities are willing to use in order to defend the currency. In contrast, in a pure floating regime the bailout may take the form of direct transfers to agents. Fifth, in the event of a crisis the amou ...

... For instance, under fixed rates the bailout rate is mostly determined by the amount of reserves authorities are willing to use in order to defend the currency. In contrast, in a pure floating regime the bailout may take the form of direct transfers to agents. Fifth, in the event of a crisis the amou ...

Spillover Notes, Issue 2: Spillovers from Dollar Appreciation

... and abstracts from general equilibrium effects from a USD appreciation, including through trade and EM policy responses.1 The paper is structured in three parts. First, it examines past episodes of prolonged USD appreciation, and in particular the 1995–2001 episode which is more similar in nature to ...

... and abstracts from general equilibrium effects from a USD appreciation, including through trade and EM policy responses.1 The paper is structured in three parts. First, it examines past episodes of prolonged USD appreciation, and in particular the 1995–2001 episode which is more similar in nature to ...

Untitled

... from both domestic and export sales. Companies reported expectations of continued increases in activity in the next quarter. The tourist industry has recovered from the Second Lebanon War in the summer of 2006, and from April 2007 tourist entries into Israel and tourist bed nights rose steeply (seas ...

... from both domestic and export sales. Companies reported expectations of continued increases in activity in the next quarter. The tourist industry has recovered from the Second Lebanon War in the summer of 2006, and from April 2007 tourist entries into Israel and tourist bed nights rose steeply (seas ...

Turning Over a Golden Leaf? Global Liquidity and Emerging Market

... The dominance of the US dollar in the international monetary system (IMS) as the main reserve currency following the Bretton woods era has perpetuated the so-called Triffin dilemma (Triffin, 1960). The Triffin dilemma in its earlier form was in the context of the Bretton woods agreement of convertibi ...

... The dominance of the US dollar in the international monetary system (IMS) as the main reserve currency following the Bretton woods era has perpetuated the so-called Triffin dilemma (Triffin, 1960). The Triffin dilemma in its earlier form was in the context of the Bretton woods agreement of convertibi ...

2. I E D

... the aim to bring inflation closer to the target range. Other emerging market central banks, particularly in Eastern Europe, continued to ease monetary policy in this period as inflation remained mostly below the target. The first quarter of 2014 was marked by policy rate hikes across countries such ...

... the aim to bring inflation closer to the target range. Other emerging market central banks, particularly in Eastern Europe, continued to ease monetary policy in this period as inflation remained mostly below the target. The first quarter of 2014 was marked by policy rate hikes across countries such ...

![3. terms, definitions and explanations[1]](http://s1.studyres.com/store/data/010549898_1-49fd4dad7e8eab67968f841389c20bb0-300x300.png)