Beyond the liquidity trap: ineffectiveness of monetary policy as an

... market equilibrium would not help much with regard to macro-equilibrium. On the one hand, labor market equilibrium may not be compatible with recessionary macro-equilibrium (or simply with the steady state balance between savings and investment) but at a particular (natural) level of interest rate; ...

... market equilibrium would not help much with regard to macro-equilibrium. On the one hand, labor market equilibrium may not be compatible with recessionary macro-equilibrium (or simply with the steady state balance between savings and investment) but at a particular (natural) level of interest rate; ...

El Salvador (Complete)

... El Salvador’s GDP growth in 2012-16 will be very modest (at the slowest pace in Central America), reflecting a very weak domestic production base, which limits investment and leads to a persistently negative foreign balance. In 2012 GDP growth will reach only 2.2% (following 1.4% growth in 2011), as ...

... El Salvador’s GDP growth in 2012-16 will be very modest (at the slowest pace in Central America), reflecting a very weak domestic production base, which limits investment and leads to a persistently negative foreign balance. In 2012 GDP growth will reach only 2.2% (following 1.4% growth in 2011), as ...

policy brief - Peterson Institute for International Economics

... Figure 2 shows the sizable exchange rate impacts over the past year in these four cases of political shocks, indicating a strong recovery of the REER for Brazil but a substantial real effective depreciation for the other three economies. ...

... Figure 2 shows the sizable exchange rate impacts over the past year in these four cases of political shocks, indicating a strong recovery of the REER for Brazil but a substantial real effective depreciation for the other three economies. ...

WAMZ/TC/36 - West African Monetary Institute

... for their sterling leadership and support to WAMI since the last meeting in Accra, Ghana. He commended WAMI staff for their dedication to duty and invaluable contributions towards the Institute’s work programme, and also wished the delegates fruitful deliberations. Remarks by the Out-going Chairman ...

... for their sterling leadership and support to WAMI since the last meeting in Accra, Ghana. He commended WAMI staff for their dedication to duty and invaluable contributions towards the Institute’s work programme, and also wished the delegates fruitful deliberations. Remarks by the Out-going Chairman ...

Which of the following combinations of economic policies would be

... d. The size of the federal debt e. The reserve requirement 10. A discretionary fiscal policy action to reduce inflation in the short run would be to a. increase transfer payments to those on fixed incomes b. increase taxes or decrease government spending c. decrease taxes or increase government spen ...

... d. The size of the federal debt e. The reserve requirement 10. A discretionary fiscal policy action to reduce inflation in the short run would be to a. increase transfer payments to those on fixed incomes b. increase taxes or decrease government spending c. decrease taxes or increase government spen ...

Twin Deficits: Squaring Theory, Evidence and Common Sense1

... Conversely, twin deficits are likely to be observed if the economy is relatively open, i.e. highly integrated into world markets, and if the increase in government spending is expected to last for an extended period of time. We derive these results in a standard general equilibrium model, drawing on ...

... Conversely, twin deficits are likely to be observed if the economy is relatively open, i.e. highly integrated into world markets, and if the increase in government spending is expected to last for an extended period of time. We derive these results in a standard general equilibrium model, drawing on ...

GASB Statement No. 54 and Iowa School Districts

... authorized to make assignments and the policy that delegated entity is to follow • Flows: In what order will the resources be used? • Start now with the prior year audit report and determine ...

... authorized to make assignments and the policy that delegated entity is to follow • Flows: In what order will the resources be used? • Start now with the prior year audit report and determine ...

Chapter 16

... Given the small level of official reserves relative to the enormous level of private trading, significant amounts of stabilization are impossible. ...

... Given the small level of official reserves relative to the enormous level of private trading, significant amounts of stabilization are impossible. ...

T N M R

... crises in Asia, Russia, and Brazil. During that same year, inflation in Mexico rose by more than 300 basis points, reaching an annual rate of 19 percent in January 1999. Since then, however, the nominal strength of the peso has permitted a significant decline in inflation. With a flexible exchange r ...

... crises in Asia, Russia, and Brazil. During that same year, inflation in Mexico rose by more than 300 basis points, reaching an annual rate of 19 percent in January 1999. Since then, however, the nominal strength of the peso has permitted a significant decline in inflation. With a flexible exchange r ...

presentation file

... – Initial values of human capital (years of total schooling, higher schooling) • Government Policies – Restrictions: Capital Controls (IMF, AREAER). • Institutional Quality ...

... – Initial values of human capital (years of total schooling, higher schooling) • Government Policies – Restrictions: Capital Controls (IMF, AREAER). • Institutional Quality ...

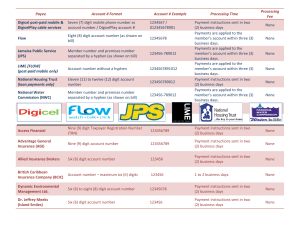

Payee Account # Format - Victoria Mutual Express Online

... VM Wealth Management – Insurance Premium Financing (IPF) ...

... VM Wealth Management – Insurance Premium Financing (IPF) ...

A better indicator for standard of living: The Gross National Disposable Income

... The monetary income element is also captured by the Gross National Income (GNI), which is often regarded as an either complementary or alternative measure with respect to the GDP. In recent years, the GNI has been largely used, but we will show that - contrary to the held view that GNI is the best i ...

... The monetary income element is also captured by the Gross National Income (GNI), which is often regarded as an either complementary or alternative measure with respect to the GDP. In recent years, the GNI has been largely used, but we will show that - contrary to the held view that GNI is the best i ...

Chapter 18: The Open Economy

... But what if only some countries have a recession? Expansionary fiscal policy by all countries might generate inflation in non-recession countries. Some countries may start with high budget deficits and government debt. ...

... But what if only some countries have a recession? Expansionary fiscal policy by all countries might generate inflation in non-recession countries. Some countries may start with high budget deficits and government debt. ...

Macroeconomic Adjustment Mechanisms in An Oil Based Economy: Saudi Arabia Looney, R.E.

... thereby changing the net position of the government with SAMA. Because oil revenues are denominated in dollars, a change in this figure 'Yill also produce a similar change in the foreign reserves of the bank. The relationship between oil revenues, government deposits, and the monetary base distingui ...

... thereby changing the net position of the government with SAMA. Because oil revenues are denominated in dollars, a change in this figure 'Yill also produce a similar change in the foreign reserves of the bank. The relationship between oil revenues, government deposits, and the monetary base distingui ...

final review macro - Open Computing Facility

... 49. Balance of Payments = Current Account (CA) + Capital Account (KA) = 0 50. BOP = CA + KA = 0 51. Balance of trade does not equal Balance of payments 52. CA = NX + Net Financial Investment Income + Net Transfer Payments 53. KA = (Change in foreign private assets in the US - Change in private US as ...

... 49. Balance of Payments = Current Account (CA) + Capital Account (KA) = 0 50. BOP = CA + KA = 0 51. Balance of trade does not equal Balance of payments 52. CA = NX + Net Financial Investment Income + Net Transfer Payments 53. KA = (Change in foreign private assets in the US - Change in private US as ...

Bank Capitalization and Loan Growth

... A few academic papers have recently indicated that banks with a greater amount of capital tend to lend more as a result of lower funding costs. This evidence has been used to support further increases in capital requirements worldwide, including the proposed inclusion of the global systemically impo ...

... A few academic papers have recently indicated that banks with a greater amount of capital tend to lend more as a result of lower funding costs. This evidence has been used to support further increases in capital requirements worldwide, including the proposed inclusion of the global systemically impo ...

Fiscal Policy and Economic Growth

... domestic investment, net foreign investment, or some combination thereof. The reduction in investment reduces the capital stock owned by Americans, and therefore reduces the flow of future capital income. Either the domestic capital stock is reduced (if the reduction in national saving crowds out pr ...

... domestic investment, net foreign investment, or some combination thereof. The reduction in investment reduces the capital stock owned by Americans, and therefore reduces the flow of future capital income. Either the domestic capital stock is reduced (if the reduction in national saving crowds out pr ...

Presentation before the Council of Ministers Erdem Başçı Governor

... • Deposit terms • FX and gold reserves of CBRT ...

... • Deposit terms • FX and gold reserves of CBRT ...

Debt policy in Euro-area countries: Evidence for Germany and Italy

... tests to the United States for the time period from 1960-1984. Other papers followed which also investigated this issue for the United States, some of them confirming Hamilton and Flavin’s result while others reached different conclusions (see e.g. Kremers, 1988, Wilcox, 1989, or Trehan and Walsh, 1 ...

... tests to the United States for the time period from 1960-1984. Other papers followed which also investigated this issue for the United States, some of them confirming Hamilton and Flavin’s result while others reached different conclusions (see e.g. Kremers, 1988, Wilcox, 1989, or Trehan and Walsh, 1 ...

Realignment of the Yen-Dollar Exchange Rate: Aspects of the

... accelerated in the future. This adjustment process could be the most profound in Japanese postwar history. As this process gets under way, the costs of adjustment are already apparent throughout the Japanese economy. Unemployment, while still low by international standards, has touched a record 3% l ...

... accelerated in the future. This adjustment process could be the most profound in Japanese postwar history. As this process gets under way, the costs of adjustment are already apparent throughout the Japanese economy. Unemployment, while still low by international standards, has touched a record 3% l ...

Austria`s External Economic Relations 2010

... (or raise taxes). Theoretically, a depreciation of domestic currency potentially helps cushion the negative growth effects of a fiscal consolidation; however, in a situation with fiscal consolidation occurring simultaneously in many countries, it is clear that not all countries can depreciate at the ...

... (or raise taxes). Theoretically, a depreciation of domestic currency potentially helps cushion the negative growth effects of a fiscal consolidation; however, in a situation with fiscal consolidation occurring simultaneously in many countries, it is clear that not all countries can depreciate at the ...

O Policy Forum

... the bailouts of South Korea, Indonesia, crisis a 5- or 10-year period. Second, the IMF and Thailand. But I don’t know if you realize that those bailouts are possibly the happening at the micro level in the United should be charged with obtaining the folbeginning of something much larger. In my State ...

... the bailouts of South Korea, Indonesia, crisis a 5- or 10-year period. Second, the IMF and Thailand. But I don’t know if you realize that those bailouts are possibly the happening at the micro level in the United should be charged with obtaining the folbeginning of something much larger. In my State ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... accelerated in the future. This adjustment process could be the most profound in Japanese postwar history. As this process gets under way, the costs of adjustment are already apparent throughout the Japanese economy. Unemployment, while still low by international standards, has touched a record 3% l ...

... accelerated in the future. This adjustment process could be the most profound in Japanese postwar history. As this process gets under way, the costs of adjustment are already apparent throughout the Japanese economy. Unemployment, while still low by international standards, has touched a record 3% l ...