Pure or Wake-up-call Contagion?

... we include the general government debt, the private debt (de…ned as household plus non …nancial corporation debt), GDP growth and the current account surplus.9 We also control for liquidity, measured by the bid-ask spread.10 Given we are dealing only with advanced economies, we are not concerned wit ...

... we include the general government debt, the private debt (de…ned as household plus non …nancial corporation debt), GDP growth and the current account surplus.9 We also control for liquidity, measured by the bid-ask spread.10 Given we are dealing only with advanced economies, we are not concerned wit ...

PSA - OECD

... Assets in ESPP, social security and individual saving plans are very significant As assets in these funds grew sharply beginning in about 1987-90s, they have had a substantial influence on capital markets – both growth and fluctuations As these funds are drawn down by retirees over the years t ...

... Assets in ESPP, social security and individual saving plans are very significant As assets in these funds grew sharply beginning in about 1987-90s, they have had a substantial influence on capital markets – both growth and fluctuations As these funds are drawn down by retirees over the years t ...

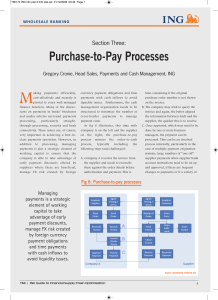

Purchase-to-Pay Processes

... time-consuming if the original purchase order number is not shown on the invoice. B. The company may wish to query the invoice and again, the better aligned the information between itself and the supplier, the quicker this is to resolve. C. Once approved, which may need to be done by one or more bus ...

... time-consuming if the original purchase order number is not shown on the invoice. B. The company may wish to query the invoice and again, the better aligned the information between itself and the supplier, the quicker this is to resolve. C. Once approved, which may need to be done by one or more bus ...

Fiscal (and External) Sustainability

... S. Fischer (1990), “The Economics of the Government Budget Constraint,” World Bank Research ...

... S. Fischer (1990), “The Economics of the Government Budget Constraint,” World Bank Research ...

PPT

... Other surplus / deficit indicators are also widely used e.g. • Primary balance (or primary surplus / deficit) • Structural / cyclical balances All these indicators provide an indication of the in-year fiscal position. ...

... Other surplus / deficit indicators are also widely used e.g. • Primary balance (or primary surplus / deficit) • Structural / cyclical balances All these indicators provide an indication of the in-year fiscal position. ...

CUI Zhiyuan

... billion yuan for 1998. (According to Xiang Huaicheng, there might be a minor difference between the figure he cited and the final figure.) A similar situation applies in 1999: Half of additional 60-billion-yuan debt was for local governments, and therefore was not included in the central government’ ...

... billion yuan for 1998. (According to Xiang Huaicheng, there might be a minor difference between the figure he cited and the final figure.) A similar situation applies in 1999: Half of additional 60-billion-yuan debt was for local governments, and therefore was not included in the central government’ ...

Fighting Fit: Are you ready to tackle future eurozone shocks

... there are, conceptually, two main dimensions to reforming the eurozone, given its current evolving circumstances. The first is political integration. The second is fiscal transfers between member states. Neither could be achieved without significant political strains at a national level. ...

... there are, conceptually, two main dimensions to reforming the eurozone, given its current evolving circumstances. The first is political integration. The second is fiscal transfers between member states. Neither could be achieved without significant political strains at a national level. ...

Chapter 16: Government Debt

... little evidence that the link between fiscal and monetary policy is important most governments know the folly of creating inflation most central banks have (at least some) political independence from fiscal policymakers Government Debt and Budget Deficits ...

... little evidence that the link between fiscal and monetary policy is important most governments know the folly of creating inflation most central banks have (at least some) political independence from fiscal policymakers Government Debt and Budget Deficits ...

Latin America’s Road to Inflation Targeting

... The real appreciation lasts because frictions limit inter-sectorial and inter-national factor mobility. The real appreciation hinders growth inasmuch as a smaller T sector generates less learning externalities. National saving is suboptimal because externalities are not internalized. NB1: The fricti ...

... The real appreciation lasts because frictions limit inter-sectorial and inter-national factor mobility. The real appreciation hinders growth inasmuch as a smaller T sector generates less learning externalities. National saving is suboptimal because externalities are not internalized. NB1: The fricti ...

Document

... Even though this chapter shows that trade barriers are usually inefficient and costly, and worse they often lead to retaliation, barriers still continue to be used. This probably says more about the level of understanding about the real effects of international trade than anything else. Also, certai ...

... Even though this chapter shows that trade barriers are usually inefficient and costly, and worse they often lead to retaliation, barriers still continue to be used. This probably says more about the level of understanding about the real effects of international trade than anything else. Also, certai ...

Twin-Targeting Analytics of a Financial CGE Model ∗

... With the collapse of the program in February 2001, a new round of stand by is initiated under the direct management of Mr. Kemal Dervis, who resigned from his post at the World Bank as Vice Chair and joined the then three-party coalition cabinet. Finally, in the November 2002 elections the Justice a ...

... With the collapse of the program in February 2001, a new round of stand by is initiated under the direct management of Mr. Kemal Dervis, who resigned from his post at the World Bank as Vice Chair and joined the then three-party coalition cabinet. Finally, in the November 2002 elections the Justice a ...

Discretionary fiscal policy: Review and estimates for the EU

... “rule-of-thumb” consumers who consume their entire disposable income (income minus taxes) and, thus, do not save. Hence, these consumers spend immediately the entire increase in their real wage. Provided that this group of consumers is sufficiently large, the net effect on current consumption may be ...

... “rule-of-thumb” consumers who consume their entire disposable income (income minus taxes) and, thus, do not save. Hence, these consumers spend immediately the entire increase in their real wage. Provided that this group of consumers is sufficiently large, the net effect on current consumption may be ...

The Euro Experience: A Review of the Euro Crisis, Policy Issues

... Furthermore, we would expect that a stronger form of integration, like the common currency, would promote growth beyond the level due to trade integration alone. There is at least one way in which the adoption of a common currency fosters growth in the smaller economies, which is the impact of a str ...

... Furthermore, we would expect that a stronger form of integration, like the common currency, would promote growth beyond the level due to trade integration alone. There is at least one way in which the adoption of a common currency fosters growth in the smaller economies, which is the impact of a str ...

Accounting for Receivables

... Valuing receivables involves reporting them at their ________________________. Net realizable value is the net amount expected to be received in _______. __________ losses are considered a __________ and ____________ risk of doing business on a credit basis. Credit losses may be recognized under the ...

... Valuing receivables involves reporting them at their ________________________. Net realizable value is the net amount expected to be received in _______. __________ losses are considered a __________ and ____________ risk of doing business on a credit basis. Credit losses may be recognized under the ...

CENTRE for ECONOMIC PERFORMANCE DISCUSSION PAPER

... world GDP (6% versus 3%). Nations and regions are therefore increasingly open to trade in goods and services, meaning that foreign markets account for an increasing share of domestic production and that imports account for an increasing share of domestic expenditure. The international mobility of fi ...

... world GDP (6% versus 3%). Nations and regions are therefore increasingly open to trade in goods and services, meaning that foreign markets account for an increasing share of domestic production and that imports account for an increasing share of domestic expenditure. The international mobility of fi ...

Estimates of Fundamental Equilibrium Exchange Rates, May 2016

... (ECB) moved its already negative deposit rate from –0.2 to –0.3 percent and in March 2016 to –0.4 percent (ECB 2016). Japan entered the realm of negative interest rate policy at the end of January, when it announced a rate of –0.1 percent on excess reserves.2 In contrast, in mid-December the Federal ...

... (ECB) moved its already negative deposit rate from –0.2 to –0.3 percent and in March 2016 to –0.4 percent (ECB 2016). Japan entered the realm of negative interest rate policy at the end of January, when it announced a rate of –0.1 percent on excess reserves.2 In contrast, in mid-December the Federal ...

The Virtue of Saving - Australian Centre for Financial

... The paradox of thrift is often explained in terms of a more general concept, the fallacy of composition. The latter argues that the desirable characteristics of an aggregate cannot be deduced from the desirable characteristics of its constituent parts. In this application, it is argued that what is ...

... The paradox of thrift is often explained in terms of a more general concept, the fallacy of composition. The latter argues that the desirable characteristics of an aggregate cannot be deduced from the desirable characteristics of its constituent parts. In this application, it is argued that what is ...

LCCARL97_en.pdf

... and, to a lesser extent, through the implementation of fiscal reform proposals. Countries also plan to introduce reforms to the taxation of the consumption of oil and petroleum products. Most governments subsidize the consumption of oil generating fiscal losses due to the widening gap between the in ...

... and, to a lesser extent, through the implementation of fiscal reform proposals. Countries also plan to introduce reforms to the taxation of the consumption of oil and petroleum products. Most governments subsidize the consumption of oil generating fiscal losses due to the widening gap between the in ...

Lecture32(Ch29)

... • Leave it? Cut taxes? Increase spending? • The social security problem – As baby boom generation retires, benefits will grow relative to payroll tax revenues – Will need to reduce benefits or increase taxes – Some suggest privatizing part of social security ...

... • Leave it? Cut taxes? Increase spending? • The social security problem – As baby boom generation retires, benefits will grow relative to payroll tax revenues – Will need to reduce benefits or increase taxes – Some suggest privatizing part of social security ...

IB ECONOMICS SL

... e. Lack of a functioning financial system f. Unequal distribution of income g. Adverse terms of trade/foreign protectionism 91. Explain the Harrod-Domar model and Lewis model for growth/development strategies. 92. What is the “Washington Consensus”? Name five of its key points. 93. What is Foreign D ...

... e. Lack of a functioning financial system f. Unequal distribution of income g. Adverse terms of trade/foreign protectionism 91. Explain the Harrod-Domar model and Lewis model for growth/development strategies. 92. What is the “Washington Consensus”? Name five of its key points. 93. What is Foreign D ...

Speech: The Role of International Financial Institutions

... obligations. In addition, IMF lending has not only been used to finance the payment deficits of Greece, Ireland, and Portugal with other euro area countries, but also has been used to cover those countries’ fiscal deficits and help to recapitalize their banking systems. The truth is that IMF lending ...

... obligations. In addition, IMF lending has not only been used to finance the payment deficits of Greece, Ireland, and Portugal with other euro area countries, but also has been used to cover those countries’ fiscal deficits and help to recapitalize their banking systems. The truth is that IMF lending ...

The future of international capital flows

... • The distribution of external assets shifts to emerging markets. By 2050, more than 40% of all external assets are held by the BRICs, up from the current 10%. • Non-G7 annual capital outflows are simulated to be more than twice the size of G7 outflows by 2050. • Global current account imbalances (t ...

... • The distribution of external assets shifts to emerging markets. By 2050, more than 40% of all external assets are held by the BRICs, up from the current 10%. • Non-G7 annual capital outflows are simulated to be more than twice the size of G7 outflows by 2050. • Global current account imbalances (t ...

LCCARL252_en.pdf

... The global economic crisis prompted a myriad of policy responses in Caribbean countries on different fronts. Despite limited fiscal space due to excessive public debt stocks, various countries managed to introduce counter-cyclicality through some combination of larger public infrastructure investmen ...

... The global economic crisis prompted a myriad of policy responses in Caribbean countries on different fronts. Despite limited fiscal space due to excessive public debt stocks, various countries managed to introduce counter-cyclicality through some combination of larger public infrastructure investmen ...

Chapter 5 M F L

... accounted for more than 27 per cent of the revenue receipts. This figure rose sharply in 2008-09 to around 55 per cent and fell marginally to around 50 per cent in the current year. In comparison with revenue expenditure, on an average for the X Plan period, revenue deficit amounted to over 21 per c ...

... accounted for more than 27 per cent of the revenue receipts. This figure rose sharply in 2008-09 to around 55 per cent and fell marginally to around 50 per cent in the current year. In comparison with revenue expenditure, on an average for the X Plan period, revenue deficit amounted to over 21 per c ...