DAGSKRÁ

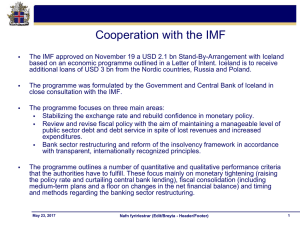

... The fall of the banking sector and subsequent currency market guidelines issued by the Central Bank (CB) caused the currency market to being initially divided into a domestic (on-shore) and a foreign (off-shore) currency markets. ...

... The fall of the banking sector and subsequent currency market guidelines issued by the Central Bank (CB) caused the currency market to being initially divided into a domestic (on-shore) and a foreign (off-shore) currency markets. ...

Russian Federation

... in international oil prices and a contraction in external demand. Exports and imports declined by 35.5% and 37.3% respectively in 2009. As a result, the trade surplus almost halved in 2009 to US$134 billion compared with US$200 billion registered in 2008. Hydrocarbons exports accounted of more than ...

... in international oil prices and a contraction in external demand. Exports and imports declined by 35.5% and 37.3% respectively in 2009. As a result, the trade surplus almost halved in 2009 to US$134 billion compared with US$200 billion registered in 2008. Hydrocarbons exports accounted of more than ...

International Trade

... Free Trade Agreement (CAFTA)—2004, CAFTA has eliminated all tariffs on 80 percent of U.S. manufactured goods, with the remainder phased out over a few years. ...

... Free Trade Agreement (CAFTA)—2004, CAFTA has eliminated all tariffs on 80 percent of U.S. manufactured goods, with the remainder phased out over a few years. ...

Chapter 14

... started to decline. As a result, even more firms could not repay their debts because they were denominated in dollars. • The value of many Southeast Asian currencies dropped by at least half, and production ground to a halt until the IMF created a payback mechanism. Once that happened, real growth p ...

... started to decline. As a result, even more firms could not repay their debts because they were denominated in dollars. • The value of many Southeast Asian currencies dropped by at least half, and production ground to a halt until the IMF created a payback mechanism. Once that happened, real growth p ...

a Global Challenge by David Vines [PPT 235.00KB]

... rates with de facto US dollar-pegged exchange rates. As a result, the ratio of short term external debt to foreign exchange reserves rose dramatically and the exposure to risk of “double mismatch” (maturity risk and currency risk) and when market perceptions changed in 1997 there was a sudden outflo ...

... rates with de facto US dollar-pegged exchange rates. As a result, the ratio of short term external debt to foreign exchange reserves rose dramatically and the exposure to risk of “double mismatch” (maturity risk and currency risk) and when market perceptions changed in 1997 there was a sudden outflo ...

us dollar - Mises Institute

... majority of transactions in the foreign exchange market. As of April 2013, its share of all trades stood at 87 percent, far greater than its closest counterpart, the Euro (Bank of International Settlements, 2014). When it comes to global trade in goods and services, the U.S. dollar was used to settl ...

... majority of transactions in the foreign exchange market. As of April 2013, its share of all trades stood at 87 percent, far greater than its closest counterpart, the Euro (Bank of International Settlements, 2014). When it comes to global trade in goods and services, the U.S. dollar was used to settl ...

3d_Dong He presentation_10 Dec (Bob paper)

... infinitely against the backing of a stagnant stock of gold. This would cause a run on the currency, particularly if the shortterm liabilities were caused by current account deficits ...

... infinitely against the backing of a stagnant stock of gold. This would cause a run on the currency, particularly if the shortterm liabilities were caused by current account deficits ...

Bahamas_en.pdf

... in 2010. The merchandise trade deficit widened by 8.0% in the wake of a 8.0% increase in imports, especially of non-fuel items, which outstripped the 7.9% rise in exports. This offset the improvement in the services surplus, which benefited from higher tourism receipts arising from the modest upturn ...

... in 2010. The merchandise trade deficit widened by 8.0% in the wake of a 8.0% increase in imports, especially of non-fuel items, which outstripped the 7.9% rise in exports. This offset the improvement in the services surplus, which benefited from higher tourism receipts arising from the modest upturn ...

Slide 1

... CHAPTER SIX NOTES I. INTRODUCTION A. WE DEPEND ON FOREIGN PRODUCTS FOR MANY OF OUR ACTIVITIES SUCH AS SUVs, COFFEE, COMPUTERS, FOODS, ETC. B. EVEN MANY “AMERICAN” PRODUCTS ARE MADE WITH FOREIGN COMPONENTS. WE CANNOT LIVE IN ISOLATION, WE DEPEND ON FOREIGN GOODS AND LABOR. II. LINKAGES A. SEVERAL ECO ...

... CHAPTER SIX NOTES I. INTRODUCTION A. WE DEPEND ON FOREIGN PRODUCTS FOR MANY OF OUR ACTIVITIES SUCH AS SUVs, COFFEE, COMPUTERS, FOODS, ETC. B. EVEN MANY “AMERICAN” PRODUCTS ARE MADE WITH FOREIGN COMPONENTS. WE CANNOT LIVE IN ISOLATION, WE DEPEND ON FOREIGN GOODS AND LABOR. II. LINKAGES A. SEVERAL ECO ...

EconS 327 Review for Test 2 1 Test 2 is scheduled for Friday, April

... phenomena of exchange rate overshooting, the reason that the short term exchange rate (US $ per pound) will initially rise "too much" to $2.20 and subsequently fell to $2.10 is that the supply of British pounds became more elastic (S1 instead of S0). The reason the supply of pounds became more elast ...

... phenomena of exchange rate overshooting, the reason that the short term exchange rate (US $ per pound) will initially rise "too much" to $2.20 and subsequently fell to $2.10 is that the supply of British pounds became more elastic (S1 instead of S0). The reason the supply of pounds became more elast ...

Slide 1

... (tesobonos). Now any devaluation would be the government’s problem. Super vulnerable to a financial market crisis; its foreign exchange reserves had fallen to $12.9 billion,18 while it had tesobono obligations of $28.7 billion maturing in ...

... (tesobonos). Now any devaluation would be the government’s problem. Super vulnerable to a financial market crisis; its foreign exchange reserves had fallen to $12.9 billion,18 while it had tesobono obligations of $28.7 billion maturing in ...

Bolivia_en.pdf

... the decade. In 2010, the real effective exchange-rate index in the Plurinational State of Bolivia declined by 3.5%. Up to February 2011, it was maintained at similar levels to those registered in late 2010. ...

... the decade. In 2010, the real effective exchange-rate index in the Plurinational State of Bolivia declined by 3.5%. Up to February 2011, it was maintained at similar levels to those registered in late 2010. ...

New Keynesian Economics

... • The interest rate term might seem counter-intuitive; but, recall that the real rate is assumed to be constant so a rise in i means an increase in expected inflation, which, in turn, reduces the desirability of holding home’s currency • Also, for a country that is not inflating, rising rates of GDP ...

... • The interest rate term might seem counter-intuitive; but, recall that the real rate is assumed to be constant so a rise in i means an increase in expected inflation, which, in turn, reduces the desirability of holding home’s currency • Also, for a country that is not inflating, rising rates of GDP ...

PROBLEM SET 6 14.02 Macroeconomics May 3, 2006 Due May 10, 2006

... May 3, 2006 Due May 10, 2006 I. Answer each as True, False, or Uncertain, and explain your choice. 1. The United States finances its current account deficit by increasing its holdings of foreign assets. 2. The higher productivity and output of another country is a threat to the prosperity of the US. ...

... May 3, 2006 Due May 10, 2006 I. Answer each as True, False, or Uncertain, and explain your choice. 1. The United States finances its current account deficit by increasing its holdings of foreign assets. 2. The higher productivity and output of another country is a threat to the prosperity of the US. ...

Week 5 Lecture Notes

... • Intermediate options include adjustable fixed rates and managed floating rates • Governments intervene in the market by buying and selling their own currency (and those of other countries) • Maintaining a fixed exchange rate when there is a deficit on the current account of the balance of payments ...

... • Intermediate options include adjustable fixed rates and managed floating rates • Governments intervene in the market by buying and selling their own currency (and those of other countries) • Maintaining a fixed exchange rate when there is a deficit on the current account of the balance of payments ...

Homework Quiz 7

... list 3 richest and 3 poorest economies in the world (per capita GDP), include numbers ...

... list 3 richest and 3 poorest economies in the world (per capita GDP), include numbers ...

IMPACT OF FINANCIAL CRISIS ON VIETNAM’S ECONOMY

... FINANCIAL CRISIS AND STABILITY What are the threats to peace and stability? Vietnam Government emphasizes on non- traditional security problems: Food, energy, financial security Poverty Inequality ...

... FINANCIAL CRISIS AND STABILITY What are the threats to peace and stability? Vietnam Government emphasizes on non- traditional security problems: Food, energy, financial security Poverty Inequality ...

Macroeconomic Vulnerability and the Rupee’s Decline C.P. Chandrasekhar

... India’s vulnerability to the effects of changes in international prices has increased with trade liberalisation. Increased concentration due to the dilution of anti-trust measures and reduced regulation tend to encourage a profit driven escalation in the prices of certain manufactured goods, as exe ...

... India’s vulnerability to the effects of changes in international prices has increased with trade liberalisation. Increased concentration due to the dilution of anti-trust measures and reduced regulation tend to encourage a profit driven escalation in the prices of certain manufactured goods, as exe ...

Document

... •Adopting of the exchange rate basket of the US dollar and the Euro as a nominal anchor ...

... •Adopting of the exchange rate basket of the US dollar and the Euro as a nominal anchor ...

SYBCOM (II) - KM Agrawal College

... 1.Industrial Reforms 2.Public Sector Reform & Disinvestment 3.Trade & Capital Flows Reforms 4.Financial Sector Reforms A. Banking Sector Reforms B. Capital Market Reforms C. Insurance Sector Reforms ...

... 1.Industrial Reforms 2.Public Sector Reform & Disinvestment 3.Trade & Capital Flows Reforms 4.Financial Sector Reforms A. Banking Sector Reforms B. Capital Market Reforms C. Insurance Sector Reforms ...

Review Questions Chapter 16

... d. What money supply should the Fed set next year if it wants inflation of ...

... d. What money supply should the Fed set next year if it wants inflation of ...

seminsar_Mar10_Bhanupong

... Corporate income tax cut for newly listed companies in the Stock Exchange of Thailand (SET) from 30% to 25% for three accounting years Corporate income tax cut for existing companies in the SET from 30% to 25% for profit below Bt300 million for three accounting years Depreciation allowance for m ...

... Corporate income tax cut for newly listed companies in the Stock Exchange of Thailand (SET) from 30% to 25% for three accounting years Corporate income tax cut for existing companies in the SET from 30% to 25% for profit below Bt300 million for three accounting years Depreciation allowance for m ...

lecture notes

... • Thailand—CB reserves depleted, rolling over government debt • S. Korea—rolling over foreign-currency denominated bank liabilities • Indonesia—corporations attempt to hedge their currency positions ...

... • Thailand—CB reserves depleted, rolling over government debt • S. Korea—rolling over foreign-currency denominated bank liabilities • Indonesia—corporations attempt to hedge their currency positions ...

Chapter 2 Notes

... trade in merchandise and services, private gifts, and public aid between countries • trade deficit • trade surplus – Capital account – record of all long-term direct investment, portfolio investment, and capital flows ...

... trade in merchandise and services, private gifts, and public aid between countries • trade deficit • trade surplus – Capital account – record of all long-term direct investment, portfolio investment, and capital flows ...

April 4/6

... Real exchange rate = E P*/P where P* is in dollars and P is in pesos. If both remain fixed, then the percentage change in the real exchange rate is the same as the percentage change in E. If export prices are partly in pesos and partly in dollars then we are facing two sets of goods. Call the first ...

... Real exchange rate = E P*/P where P* is in dollars and P is in pesos. If both remain fixed, then the percentage change in the real exchange rate is the same as the percentage change in E. If export prices are partly in pesos and partly in dollars then we are facing two sets of goods. Call the first ...

![a Global Challenge by David Vines [PPT 235.00KB]](http://s1.studyres.com/store/data/008212734_1-d43f41a44ab999eda72c55b2aa583755-300x300.png)