AP Macroeconomics Section 8 Practice Test 1. An open economy is

... B. forces of demand and supply in the developed countries. C. forces of demand and supply in the foreign exchange market. D. forces of demand and supply in the domestic money market. E. policies of the World Bank. 13. One of the advantages of adopting a fixed exchange rate system is that: A. it redu ...

... B. forces of demand and supply in the developed countries. C. forces of demand and supply in the foreign exchange market. D. forces of demand and supply in the domestic money market. E. policies of the World Bank. 13. One of the advantages of adopting a fixed exchange rate system is that: A. it redu ...

MCEC_en.pdf

... The ECCU economies are expected to grow by 3.1% in 2008 and then to slow to 1.5% in 2009. Value added in the tourism and construction sectors is expected to exceed 5% while marginal increases are expected in agriculture and manufacturing. The tourism sector is under threat in the ECCU countries as c ...

... The ECCU economies are expected to grow by 3.1% in 2008 and then to slow to 1.5% in 2009. Value added in the tourism and construction sectors is expected to exceed 5% while marginal increases are expected in agriculture and manufacturing. The tourism sector is under threat in the ECCU countries as c ...

HIBT – Pre-Masters - University of Makeni

... (hence the name), though there may be deficits or surpluses on the various sections within the overall accounts. They must balance as any flows of foreign exchange into and out of the country must ultimately match. If there is a deficit in trade on goods and services, then this must be compensated b ...

... (hence the name), though there may be deficits or surpluses on the various sections within the overall accounts. They must balance as any flows of foreign exchange into and out of the country must ultimately match. If there is a deficit in trade on goods and services, then this must be compensated b ...

international assets advisory, llc (“iaa”) “pure” foreign currency

... underlying performance of the company and how, as a result, its price in the local currency market will rise or fall. Futures contracts are marked to market; an investor may need to add funds to his original investment if the currency falls. Early termination of CDs usually results in a penalty. So, ...

... underlying performance of the company and how, as a result, its price in the local currency market will rise or fall. Futures contracts are marked to market; an investor may need to add funds to his original investment if the currency falls. Early termination of CDs usually results in a penalty. So, ...

the problem is not savings but investment

... Individuals are not the only ones that save though. A large proportion of savings nationally are made by the government (from taxes and other earnings) and companies (from income not distributed as interest or dividends). Showing its disbelief in its own rhetoric, the government is currently “dis-s ...

... Individuals are not the only ones that save though. A large proportion of savings nationally are made by the government (from taxes and other earnings) and companies (from income not distributed as interest or dividends). Showing its disbelief in its own rhetoric, the government is currently “dis-s ...

Bahamas_en.pdf

... obtain passports, visitor arrivals to the Bahamas declined by 12.1% to 1.15 million during the first semester of 2007, relative to growth of almost 7% over the similar period of 2006. In addition, a slowdown in construction reinforced the dampening effects of the contraction in tourism. Reflecting s ...

... obtain passports, visitor arrivals to the Bahamas declined by 12.1% to 1.15 million during the first semester of 2007, relative to growth of almost 7% over the similar period of 2006. In addition, a slowdown in construction reinforced the dampening effects of the contraction in tourism. Reflecting s ...

Direct Deposit - OneUnited Bank

... Date: To (Company): Address: City, State, Zip: Re: Change of Instructions for Direct Deposit Dear Employer: I have recently changed banks and will need to have my payroll direct deposit switched from my old account to my new account with OneUnited Bank. My personal information is as follows: ...

... Date: To (Company): Address: City, State, Zip: Re: Change of Instructions for Direct Deposit Dear Employer: I have recently changed banks and will need to have my payroll direct deposit switched from my old account to my new account with OneUnited Bank. My personal information is as follows: ...

AS 3.5 Demonstrate understanding of macro

... – Terms of Trade – Operating Balance – Balance of Payments • current account balance ...

... – Terms of Trade – Operating Balance – Balance of Payments • current account balance ...

Midterm Exam 2003 Question 1 Discuss two of the following: a

... Find the equation for the IS curve Find an equation for the LM curve Solve for equilibrium output (Y) and the equilibrium interest rate (i). Solve for the equilibrium levels of consumption (C) and investment (I). Now assume that the government decides to increase the tax rate (t) to 60%, calculate w ...

... Find the equation for the IS curve Find an equation for the LM curve Solve for equilibrium output (Y) and the equilibrium interest rate (i). Solve for the equilibrium levels of consumption (C) and investment (I). Now assume that the government decides to increase the tax rate (t) to 60%, calculate w ...

Haiti_en.pdf

... 6.1% even though overall lending was up by 16.6% on the back of the 33.9% rise in the public component. The gourde depreciated 6.3% in nominal terms. In real terms, however, the depreciation was only 2.5%, owing to the central bank’s multiple interventions sustained by international reserves, which ...

... 6.1% even though overall lending was up by 16.6% on the back of the 33.9% rise in the public component. The gourde depreciated 6.3% in nominal terms. In real terms, however, the depreciation was only 2.5%, owing to the central bank’s multiple interventions sustained by international reserves, which ...

PSFU NEWS PRIVATE SECTOR MEETS BANK OF UGANDA TO

... c) The Governor proposed to the Private Sector to explore the option of entering into future contracts (e.g. SWAPS, Forwards). These would help in planning since through these the exchange rate is fixed with the specific financial institutions. This however maybe taken with caution since the exchan ...

... c) The Governor proposed to the Private Sector to explore the option of entering into future contracts (e.g. SWAPS, Forwards). These would help in planning since through these the exchange rate is fixed with the specific financial institutions. This however maybe taken with caution since the exchan ...

Trade_gaps_of_LDCs_and_development

... – Increased protectionism in developed world against LDC exports ...

... – Increased protectionism in developed world against LDC exports ...

McKinley Presentation - Carnegie Endowment for International Peace

... Rebalancing China’s Growth Rebalancing China’s growth model by stimulating more domestic consumption is possible since its domestic market is large (consumption is already growing rapidly) But striving for ‘consumption-led’ growth makes no sense (this is a recipe for crisis) The transition to a ...

... Rebalancing China’s Growth Rebalancing China’s growth model by stimulating more domestic consumption is possible since its domestic market is large (consumption is already growing rapidly) But striving for ‘consumption-led’ growth makes no sense (this is a recipe for crisis) The transition to a ...

Downlaod File

... interest rates, Asian corporations with excess cash may now invest in the U.S. or other countries, thereby increasing the demand for American dollars. So a decline in Asian interest rates will place a downward pressure on the value of Asian currencies. 6. Speculative Effects on Exchange Rates. Expla ...

... interest rates, Asian corporations with excess cash may now invest in the U.S. or other countries, thereby increasing the demand for American dollars. So a decline in Asian interest rates will place a downward pressure on the value of Asian currencies. 6. Speculative Effects on Exchange Rates. Expla ...

Slide 1 - Econsult Botswana

... against USD than ZAR Short-term movements against USD and ZAR tend to be in opposite directions BWP-ZAR approaching parity, but not a policy objective ...

... against USD than ZAR Short-term movements against USD and ZAR tend to be in opposite directions BWP-ZAR approaching parity, but not a policy objective ...

Bahamas_en.pdf

... threaten to undermine reserves through import demand. Growth in domestic credit slowed during the first trimester of 2014 compared with 2013. Credit to the public sector contracted as government used part of the proceeds from foreign financing to retire a portion of debt owed to local banks. Credit ...

... threaten to undermine reserves through import demand. Growth in domestic credit slowed during the first trimester of 2014 compared with 2013. Credit to the public sector contracted as government used part of the proceeds from foreign financing to retire a portion of debt owed to local banks. Credit ...

4 Lectures on the €uropean crisis

... spending, and the withdrawal and dismantling of union power and the welfare state. With the euro, despite all the errors, weaknesses, and concessions we will discuss later, this type of irresponsible behavior and forward escape has no longer been possible. it is amusing (and also pathetic) to note t ...

... spending, and the withdrawal and dismantling of union power and the welfare state. With the euro, despite all the errors, weaknesses, and concessions we will discuss later, this type of irresponsible behavior and forward escape has no longer been possible. it is amusing (and also pathetic) to note t ...

IMF International Monetary Fund

... the town of Bretton Woods, New Hampshire, in the northeastern United States, agreed on a framework for international economic cooperation. ...

... the town of Bretton Woods, New Hampshire, in the northeastern United States, agreed on a framework for international economic cooperation. ...

IMF International Monetary Fund

... the town of Bretton Woods, New Hampshire, in the northeastern United States, agreed on a framework for international economic cooperation. ...

... the town of Bretton Woods, New Hampshire, in the northeastern United States, agreed on a framework for international economic cooperation. ...

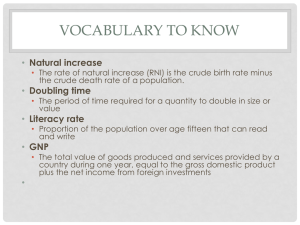

Demography Vocabulary

... • An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power. ...

... • An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power. ...

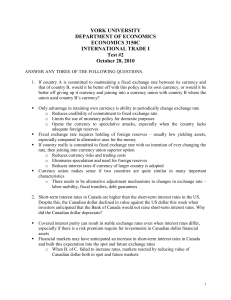

YORK UNIVERSITY

... Fixed exchange rate requires holding of foreign reserves – usually low yielding assets, especially compared to alternative uses for the money If country really is committed to fixed exchange rate with no intention of ever changing the rate, then joining into currency union superior option o Reduces ...

... Fixed exchange rate requires holding of foreign reserves – usually low yielding assets, especially compared to alternative uses for the money If country really is committed to fixed exchange rate with no intention of ever changing the rate, then joining into currency union superior option o Reduces ...

Slide 1

... had borrowed in cheap Japanese yen and bought high yielding assets in Iceland, Brazil, and Australia. Later these investments were unwound due to increased risk ...

... had borrowed in cheap Japanese yen and bought high yielding assets in Iceland, Brazil, and Australia. Later these investments were unwound due to increased risk ...

China and Germany unite to impose global deflation Financial

... Speaking at the end of the National People’s Congress, Mr Wen declared: “What I don’t understand is depreciating one’s own currency, and attempting to pressure others to appreciate, for the purpose of increasing exports. In my view, that is protectionism.” He also insisted he was worried about the s ...

... Speaking at the end of the National People’s Congress, Mr Wen declared: “What I don’t understand is depreciating one’s own currency, and attempting to pressure others to appreciate, for the purpose of increasing exports. In my view, that is protectionism.” He also insisted he was worried about the s ...

Final examination and solution to parts A and B

... and thus can be used to attain an internal (domestic) objective. If used in co-ordination with fiscal policy, two internal objectives, such as a target interest rate and a target real output level, can be attained simultaneously. b. Under a flexible exchange rate system, movements in the exchange ra ...

... and thus can be used to attain an internal (domestic) objective. If used in co-ordination with fiscal policy, two internal objectives, such as a target interest rate and a target real output level, can be attained simultaneously. b. Under a flexible exchange rate system, movements in the exchange ra ...