PDF

... provided necessary tightening of monetary policy in order to secure the exchange rate pressure. This way, the monetary authorities demonstrated their independence and responsibility in sustaining monetary stability in the economy. For their expedient response to the current market situation, they ha ...

... provided necessary tightening of monetary policy in order to secure the exchange rate pressure. This way, the monetary authorities demonstrated their independence and responsibility in sustaining monetary stability in the economy. For their expedient response to the current market situation, they ha ...

The US Economy 1. How do economists define real gross domestic

... a. the value of all final goods and services produced during a single year b. the value of all final goods and services produced during a single year adjusted for inflation c. the value of all final goods and services produced over the course of a specified number of years d. the value of all capita ...

... a. the value of all final goods and services produced during a single year b. the value of all final goods and services produced during a single year adjusted for inflation c. the value of all final goods and services produced over the course of a specified number of years d. the value of all capita ...

Lecture 6 Slides

... Price level does respond fully to supply and demand conditions Price inflation depends upon the growth rate of the country’s money supply relative to its output growth (M=kPy) ...

... Price level does respond fully to supply and demand conditions Price inflation depends upon the growth rate of the country’s money supply relative to its output growth (M=kPy) ...

Depreciation and Trade Balance - Economics-Management-Blog

... – Exports increases as they are cheaper abroad – Imports decrease as they are expensive at home ...

... – Exports increases as they are cheaper abroad – Imports decrease as they are expensive at home ...

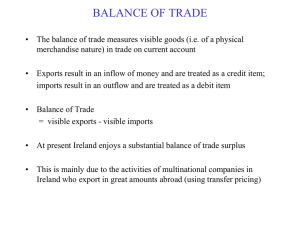

BALANCE OF TRADE

... - a dramatic increase in size of European Satbility Mechanism (ESM) that has European Finance and Stability Facility (EFSF) and European finacial stabilisation Mechanism (EFSM) to meet possible costs of bailing out larger economies such as Spain and Italy. (This however is likely to be resisted stro ...

... - a dramatic increase in size of European Satbility Mechanism (ESM) that has European Finance and Stability Facility (EFSF) and European finacial stabilisation Mechanism (EFSM) to meet possible costs of bailing out larger economies such as Spain and Italy. (This however is likely to be resisted stro ...

The Impact of the Great Recession and Policy Responses in

... a) Fiscal policy: increase in public spending (subsidies to private sector – energy, transport and food industries), lower tax rates on wages, adjustment of retirement contributions and programs to ...

... a) Fiscal policy: increase in public spending (subsidies to private sector – energy, transport and food industries), lower tax rates on wages, adjustment of retirement contributions and programs to ...

Barbados_en.pdf

... During 2008 public finances worsened due to the adverse economic environment, with an accumulated fiscal deficit equivalent to 3.4% of GDP being registered for the first three quarters of the calendar year. This was a significant deterioration with respect to the situation in the same period of 2007 ...

... During 2008 public finances worsened due to the adverse economic environment, with an accumulated fiscal deficit equivalent to 3.4% of GDP being registered for the first three quarters of the calendar year. This was a significant deterioration with respect to the situation in the same period of 2007 ...

The World Economy

... repeat of the economic meltdown experienced by Japan in the 1990s. Fortunately for the slow-growing euro area economies, given their general lack of housing bubbles, the ECB should not face too many problems. US-style markets are rather more risky since the housing bubble has allowed households to b ...

... repeat of the economic meltdown experienced by Japan in the 1990s. Fortunately for the slow-growing euro area economies, given their general lack of housing bubbles, the ECB should not face too many problems. US-style markets are rather more risky since the housing bubble has allowed households to b ...

Sources-of-External-Finance

... • Function: promote long-term growth by providing loans for investment and development • May be conditional on radical supply-side reforms (eg. privatisation of state monopoly; trade liberalisation) – these reforms may have made things worse, not better, at least for some • Since late ’90’s more foc ...

... • Function: promote long-term growth by providing loans for investment and development • May be conditional on radical supply-side reforms (eg. privatisation of state monopoly; trade liberalisation) – these reforms may have made things worse, not better, at least for some • Since late ’90’s more foc ...

The Global Economy - Overflow Education

... § Exporters – use the FOREX markets because they wish to receive the payments for their goods in their own currency. Only represents a small proportion of overall foreign exchange transactions. § Foreign investors – who are purchasing assets in another country, must exchange their currency for the l ...

... § Exporters – use the FOREX markets because they wish to receive the payments for their goods in their own currency. Only represents a small proportion of overall foreign exchange transactions. § Foreign investors – who are purchasing assets in another country, must exchange their currency for the l ...

Argentina_en.pdf

... are projected to boost customs revenues, and the changes to the subsidies system could deliver some savings, the primary deficit will likely widen in 2014 as a result of measures designed to moderate the slowdown in output and consumption. The overall deficit will rise only proportionately despite i ...

... are projected to boost customs revenues, and the changes to the subsidies system could deliver some savings, the primary deficit will likely widen in 2014 as a result of measures designed to moderate the slowdown in output and consumption. The overall deficit will rise only proportionately despite i ...

Slide 1

... The Department of Finance had been borrowing dollars from the CB to finance some of its debt payments DOF also announced that the Philippines will limit sovereign borrowing and use more domestic debt. Although stemming the peso appreciation may be the main objective, it has a beneficial result o ...

... The Department of Finance had been borrowing dollars from the CB to finance some of its debt payments DOF also announced that the Philippines will limit sovereign borrowing and use more domestic debt. Although stemming the peso appreciation may be the main objective, it has a beneficial result o ...

'The State of the World Economy' (pdf).

... Short term: To compensate for lower exports. Medium term: To increase consumption and investment. ...

... Short term: To compensate for lower exports. Medium term: To increase consumption and investment. ...

Belize_en.pdf

... sharp increase in revenues and a moderate decline in spending. For calendar year 2010, the overall fiscal deficit is projected to be 2.7% of GDP, but if the pattern for the first quarter continues, the deficit could exceed this projection. High public-sector debt remains a major challenge, leaving t ...

... sharp increase in revenues and a moderate decline in spending. For calendar year 2010, the overall fiscal deficit is projected to be 2.7% of GDP, but if the pattern for the first quarter continues, the deficit could exceed this projection. High public-sector debt remains a major challenge, leaving t ...

US Dollar Collapse? - Malaysian Institute of Accountants

... revert to its “normal” course or risk an rates could induce investors to park their The US market has always been eveimminent collapse that will render huge savings elsewhere, causing a blow to the ryone’s favourite destination to invest losses to their economy already and trade. These trade dealing ...

... revert to its “normal” course or risk an rates could induce investors to park their The US market has always been eveimminent collapse that will render huge savings elsewhere, causing a blow to the ryone’s favourite destination to invest losses to their economy already and trade. These trade dealing ...

Call for China to Remove Peg on Yuan Currency (Greece)

... Noting that this peg effectively eliminates appreciation or depreciation of the Yuan. ...

... Noting that this peg effectively eliminates appreciation or depreciation of the Yuan. ...

Venezuela_en.pdf

... hardest-hit sectors were manufacturing, petroleum and commerce. Growth in the communications, construction and government services sectors was insufficient to counteract the economic slowdown. In terms of overall demand, the contractions in private consumption, investment and exports were only parti ...

... hardest-hit sectors were manufacturing, petroleum and commerce. Growth in the communications, construction and government services sectors was insufficient to counteract the economic slowdown. In terms of overall demand, the contractions in private consumption, investment and exports were only parti ...

Guatemala_en.pdf

... peace agreements (IETAP), which is due to expire at the end of 2007. If this is agreed, it will generate revenue equivalent to 1% of GDP for the 2008 budget. In the course of the year, in order to counter inflationary pressures, the monetary authorities made five increases of 0.25 points each to the ...

... peace agreements (IETAP), which is due to expire at the end of 2007. If this is agreed, it will generate revenue equivalent to 1% of GDP for the 2008 budget. In the course of the year, in order to counter inflationary pressures, the monetary authorities made five increases of 0.25 points each to the ...

age of exploration

... Economics is also the science of choices. Scarcity pushes people to make choices, simply because we can’t have it all. And we sacrifice things while making those choices. These things sacrificed, meaning the next best options forgone/passed over while we make choices, are called the opportunity cost ...

... Economics is also the science of choices. Scarcity pushes people to make choices, simply because we can’t have it all. And we sacrifice things while making those choices. These things sacrificed, meaning the next best options forgone/passed over while we make choices, are called the opportunity cost ...

ECON 401 November 19, 2012 Fragile Economy in the 1990s

... Exports became industry’s only solution to gain higher ...

... Exports became industry’s only solution to gain higher ...

Haiti_en.pdf

... of the 2010 earthquake combined with a long period of uncertainty (as the presidential election period stretched from November 2010 to May 2011) and delays in installing the new administration. Haiti’s economy thus grew by just 4.5% instead of the 8% originally forecast. However, public finances (ca ...

... of the 2010 earthquake combined with a long period of uncertainty (as the presidential election period stretched from November 2010 to May 2011) and delays in installing the new administration. Haiti’s economy thus grew by just 4.5% instead of the 8% originally forecast. However, public finances (ca ...

Exchange Rates

... becomes more fashionable in the U.S. So the pound will appreciate and the dollar will depreciate. ...

... becomes more fashionable in the U.S. So the pound will appreciate and the dollar will depreciate. ...

Document

... United States, then American goods are relatively cheaper than Canadian goods, thus Canadians will import more American goods causing the U.S. Dollar to appreciate and the Canadian Dollar to depreciate. ...

... United States, then American goods are relatively cheaper than Canadian goods, thus Canadians will import more American goods causing the U.S. Dollar to appreciate and the Canadian Dollar to depreciate. ...

Are China`s macroeconomic imbalances

... High investment, low consumption, huge current account surplus If these are not corrected, can China’s rapid growth be sustained? Will the imbalances unwind of their own accord , and with what consequences? Among the most important questions facing the Chinese, and the global, macro-economy ...

... High investment, low consumption, huge current account surplus If these are not corrected, can China’s rapid growth be sustained? Will the imbalances unwind of their own accord , and with what consequences? Among the most important questions facing the Chinese, and the global, macro-economy ...

Chapter 31 - Impacts - Government Borrowing

... and 2000. Military expenditures, entitlement programs, and the decrease in tax revenue coupled with increased safety net support during the Great Recession are major contributors to the dramatic increases in the deficit after 2008. (Source: www.whitehouse.gov/omb) ...

... and 2000. Military expenditures, entitlement programs, and the decrease in tax revenue coupled with increased safety net support during the Great Recession are major contributors to the dramatic increases in the deficit after 2008. (Source: www.whitehouse.gov/omb) ...