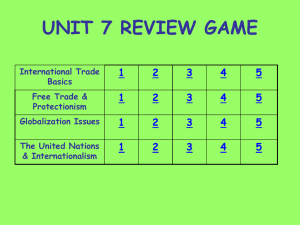

Unit 7 Review Game

... how does it enter into the global trade debate. Trying to use resources more wisely. Some argue that conservation leads to slower economic growth. ...

... how does it enter into the global trade debate. Trying to use resources more wisely. Some argue that conservation leads to slower economic growth. ...

SK Preparing for WACE Economics Exam CCI Student Economic Forum

... around 60 – 80% of the paper 2. Use models in your answers 3. Be aware of current economic ...

... around 60 – 80% of the paper 2. Use models in your answers 3. Be aware of current economic ...

International Political Economy

... European and Asian protection, particularly on the part of West Germany and Japan. The result was recovery. MULTILATERAL MANAGEMENT UNDER US LEADERSHIP The system relied upon a mechanism that would, ultimately, undermine confidence in the system, US dollar outflows and deficits. By 1958 the US no lo ...

... European and Asian protection, particularly on the part of West Germany and Japan. The result was recovery. MULTILATERAL MANAGEMENT UNDER US LEADERSHIP The system relied upon a mechanism that would, ultimately, undermine confidence in the system, US dollar outflows and deficits. By 1958 the US no lo ...

View the entire report

... isn’t necessarily expected to depreciate the yuan to boost exports, but it does need to address growing imbalances. ...

... isn’t necessarily expected to depreciate the yuan to boost exports, but it does need to address growing imbalances. ...

Policy Innovations - Decouple the World from the Dollar

... United States to choose between trying to keep unemployment from rising further into double digits or defending the dollar, the United States could probably succeed in neither. Reversing its policy of extreme monetary easing and fiscal stimulus in order to defend the dollar could be as disastrous as ...

... United States to choose between trying to keep unemployment from rising further into double digits or defending the dollar, the United States could probably succeed in neither. Reversing its policy of extreme monetary easing and fiscal stimulus in order to defend the dollar could be as disastrous as ...

Trinidad_and_Tobago_en.pdf

... outstanding grew by 7.1% in August, compared with the corresponding period a year earlier. The further deterioration in credit demand and reductions in the repo rate may be attributed to uncertainty about growth in the economy and employment prospects. Many would-be borrowers have preferred to avoid ...

... outstanding grew by 7.1% in August, compared with the corresponding period a year earlier. The further deterioration in credit demand and reductions in the repo rate may be attributed to uncertainty about growth in the economy and employment prospects. Many would-be borrowers have preferred to avoid ...

Downward Revision of Sri Lanka`s Outlook by the Fitch Ratings is

... implemented by the Sri Lankan authorities to raise external financing, and also its pessimistic views on external current account deficit and future economic growth prospects. According to Fitch Ratings, the revision reflects the concerns regarding the sovereign’s external financial position in ligh ...

... implemented by the Sri Lankan authorities to raise external financing, and also its pessimistic views on external current account deficit and future economic growth prospects. According to Fitch Ratings, the revision reflects the concerns regarding the sovereign’s external financial position in ligh ...

Slide 1 - Arsip UII

... representative offices of branches of foreign companies without local sponsors. The Kingdom of Bahrain has been ranked 40th out of 160 countries, topping the Arab countries in terms of attracting foreign direct investment as published in the United Nations Annual World Investment Report (2002). ...

... representative offices of branches of foreign companies without local sponsors. The Kingdom of Bahrain has been ranked 40th out of 160 countries, topping the Arab countries in terms of attracting foreign direct investment as published in the United Nations Annual World Investment Report (2002). ...

Ch. 8: Money and inflation

... – Factors affecting money supply /demand – Bond market when interest rates are above or below equililbrium. ...

... – Factors affecting money supply /demand – Bond market when interest rates are above or below equililbrium. ...

Образец № 1

... end of 2008 BGN 13 billion – about 20% оf GDP. International currency reserves of BNB as of end September 2008 are BGN 29.4 billion - 45% of expected GDP. The government and government guaranteed debt amount to BGN 10.5 billion – 15.9% of DGP. Direct foreign investments as of September 2008 ar ...

... end of 2008 BGN 13 billion – about 20% оf GDP. International currency reserves of BNB as of end September 2008 are BGN 29.4 billion - 45% of expected GDP. The government and government guaranteed debt amount to BGN 10.5 billion – 15.9% of DGP. Direct foreign investments as of September 2008 ar ...

Lecture 7: Factors Affect Current Account

... worsened. However, there are few episodes shown that the reversal of the current account associated with a reversal in the NIIP. Alternative Theories of Adjustment The current account reversals in Canada, Denmark, and Norway were accomplished without a real or a nominal depreciation, and in Singapor ...

... worsened. However, there are few episodes shown that the reversal of the current account associated with a reversal in the NIIP. Alternative Theories of Adjustment The current account reversals in Canada, Denmark, and Norway were accomplished without a real or a nominal depreciation, and in Singapor ...

Guyana_en.pdf

... other major crop, was up by 10.6%, but logging also contracted sharply (by 16.7%). Manufacturing was down by 1.9%. High fuel and inputs costs were the main factors behind this contraction. The mining sector grew by 6.1%, although this represented a significant slowdown compared with the growth rate ...

... other major crop, was up by 10.6%, but logging also contracted sharply (by 16.7%). Manufacturing was down by 1.9%. High fuel and inputs costs were the main factors behind this contraction. The mining sector grew by 6.1%, although this represented a significant slowdown compared with the growth rate ...

MKT 301 - John Stockmyer

... • A country’s balance of payments is an accounting record of all its transactions with all the other nations in the world. • A country’s trade balance is the difference between what it exports and what it imports. ...

... • A country’s balance of payments is an accounting record of all its transactions with all the other nations in the world. • A country’s trade balance is the difference between what it exports and what it imports. ...

The European Union (EU) - Lisa Williams Social Studies

... members of the EU have by sharing the same currency? ...

... members of the EU have by sharing the same currency? ...

The Governor of the Bank of Israel, Prof

... draw conclusions from this about the short term, since it is very difficult to forecast trends in the exchange rates. Financial crises occur, and apparently will continue to occur. However, different countries dealt with, for example, the last crisis in different ways. It can be seen that countries ...

... draw conclusions from this about the short term, since it is very difficult to forecast trends in the exchange rates. Financial crises occur, and apparently will continue to occur. However, different countries dealt with, for example, the last crisis in different ways. It can be seen that countries ...

Exercise Set 10_Answers

... 18. Which of the following is a statement of the purchasing power parity theory of exchange rate determination? The exchange rate will adjust in the a. long run until the interest rate is roughly the same in both countries. b. long run until real GDP is roughly the same in both countries. c. long r ...

... 18. Which of the following is a statement of the purchasing power parity theory of exchange rate determination? The exchange rate will adjust in the a. long run until the interest rate is roughly the same in both countries. b. long run until real GDP is roughly the same in both countries. c. long r ...

File - Ms. Davis` Domain

... – Human capital is the collection of capabilities of the individuals required to provide solutions to customers. – Human capital is (worth) more important than financial capital. ...

... – Human capital is the collection of capabilities of the individuals required to provide solutions to customers. – Human capital is (worth) more important than financial capital. ...

Learning Outcome One

... Keynes: The Return of the Master (2009), Robert Skidelsky • "One of the main causes of the Great Depression, [Keynes] believed, had been a global 'saving glut' originating in the United States. The US's accumulation of gold through its current account surplus had forced other countries on the gold s ...

... Keynes: The Return of the Master (2009), Robert Skidelsky • "One of the main causes of the Great Depression, [Keynes] believed, had been a global 'saving glut' originating in the United States. The US's accumulation of gold through its current account surplus had forced other countries on the gold s ...

Postwar US economic resurgence after self destructiopn of Europe

... Even China’s government played a role in facilitating the US real-estate bubble, by investing a huge portion of China’s export earnings into Fannie Mae and Freddie Mac bonds, and by “sterilizing” the inflow of cash into China for speculation or for goods by using existing RMB (rather than printing n ...

... Even China’s government played a role in facilitating the US real-estate bubble, by investing a huge portion of China’s export earnings into Fannie Mae and Freddie Mac bonds, and by “sterilizing” the inflow of cash into China for speculation or for goods by using existing RMB (rather than printing n ...

Session 13: COUNTRY RISK, MACROECONOMIC MODELS AND

... Consensus forecasting, popular in recent years, help understanding the mind of the market, can miss critical turning points (e.g., Blue Chip Economic Indicators, a monthly survey of 50+ economists, missed severe downturn in 1982 and the onset of the 1990-91 recession. ii. Scenario analysis, a sophis ...

... Consensus forecasting, popular in recent years, help understanding the mind of the market, can miss critical turning points (e.g., Blue Chip Economic Indicators, a monthly survey of 50+ economists, missed severe downturn in 1982 and the onset of the 1990-91 recession. ii. Scenario analysis, a sophis ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... strategy includes financing a large U.S. current account deficit, governments in the periphery will see it in their interest to provide financing even in circumstances where private international investors would not. The losses and abrupt price breaks forecast by the conventional wisdom of internati ...

... strategy includes financing a large U.S. current account deficit, governments in the periphery will see it in their interest to provide financing even in circumstances where private international investors would not. The losses and abrupt price breaks forecast by the conventional wisdom of internati ...

BNZ Economy Watch

... 2% of GDP. Such a deficit would be well less than its 4.2% 10-year average. There are obviously many moving parts and global risks abound. But it is a benign outlook. It is certainly a lot more benign than many, including from officials, forecasts from a year or two back. Back then it was not unusua ...

... 2% of GDP. Such a deficit would be well less than its 4.2% 10-year average. There are obviously many moving parts and global risks abound. But it is a benign outlook. It is certainly a lot more benign than many, including from officials, forecasts from a year or two back. Back then it was not unusua ...

CA deficit

... because we give them real or financial assets in return. This is called “dissaving” or borrowing money. • A trade deficit is an exchange of assets for goods and services. It is borrowing from abroad. ...

... because we give them real or financial assets in return. This is called “dissaving” or borrowing money. • A trade deficit is an exchange of assets for goods and services. It is borrowing from abroad. ...