China`s Macroeconomic Imbalances: Causes and

... High investment, low consumption, huge current account surplus If these are not corrected, can China’s rapid growth be sustained? Will the imbalances unwind of their own accord , and with what consequences? Among the most important questions facing the Chinese, and the global, macro-economy ...

... High investment, low consumption, huge current account surplus If these are not corrected, can China’s rapid growth be sustained? Will the imbalances unwind of their own accord , and with what consequences? Among the most important questions facing the Chinese, and the global, macro-economy ...

UK current account

... (a) This is the change in UK foreign liabilities, less the change in UK foreign assets, for each category of investment. The total net inward financing flow is equal in magnitude to the current account deficit (plus net errors and omissions). (b) ‘Other investment’ consists mostly of loans and depos ...

... (a) This is the change in UK foreign liabilities, less the change in UK foreign assets, for each category of investment. The total net inward financing flow is equal in magnitude to the current account deficit (plus net errors and omissions). (b) ‘Other investment’ consists mostly of loans and depos ...

Macro Chapter 5 - Mayfield City Schools

... • The US had a $497.9 billion trade deficit in 2010… $1.8 trillion in exports minus $2.3 trillion in imports. ...

... • The US had a $497.9 billion trade deficit in 2010… $1.8 trillion in exports minus $2.3 trillion in imports. ...

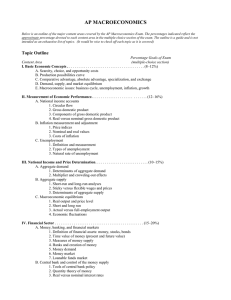

APMACROECONOMICSTopicOutline

... 4. Government deficits and debt B. Inflation and unemployment 1. Types of inflation a. Demand-pull inflation b. Cost-push inflation 2. The Phillips curve: short run versus long run 3. Role of expectations VI. Economic Growth and Productivity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...

... 4. Government deficits and debt B. Inflation and unemployment 1. Types of inflation a. Demand-pull inflation b. Cost-push inflation 2. The Phillips curve: short run versus long run 3. Role of expectations VI. Economic Growth and Productivity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...

Optimum Currency Areas

... Germany. No need to pay unemployment benefits in France (budget deficit does not have to increase in France) and trade deficit need not increase. If none of these two factors work, then France suffers from unemployment and twin deficits (in government budget and trade account) while Germany suffers ...

... Germany. No need to pay unemployment benefits in France (budget deficit does not have to increase in France) and trade deficit need not increase. If none of these two factors work, then France suffers from unemployment and twin deficits (in government budget and trade account) while Germany suffers ...

Foreign Exchange

... When G or T , then government must borrow in order to continue spending. This leads to an increase in the demand for loanable funds or a decrease in the supply of loanable funds, which results in r % . This change in r % leads to IG . In addition, the increase in r% causes as investors seek higher ...

... When G or T , then government must borrow in order to continue spending. This leads to an increase in the demand for loanable funds or a decrease in the supply of loanable funds, which results in r % . This change in r % leads to IG . In addition, the increase in r% causes as investors seek higher ...

A G-Zero World - World Policy Institute

... Following previous crises in emerging markets, such as the Asian financial meltdown of the late 1990s, policymakers in those economies committed themselves to maintaining weak currencies, running current account surpluses, and self-insuring against liquidity runs by accumulating huge foreign exchang ...

... Following previous crises in emerging markets, such as the Asian financial meltdown of the late 1990s, policymakers in those economies committed themselves to maintaining weak currencies, running current account surpluses, and self-insuring against liquidity runs by accumulating huge foreign exchang ...

The Details In The Dollar

... annual bond buying purchases to 80 trillion yen (approximately $724 billion). The monetary policy surprise sent local equity markets soaring and currency investors scrambling. Before I discuss the potential global impact of this surprise announcement, I feel a brief economics review of currency mark ...

... annual bond buying purchases to 80 trillion yen (approximately $724 billion). The monetary policy surprise sent local equity markets soaring and currency investors scrambling. Before I discuss the potential global impact of this surprise announcement, I feel a brief economics review of currency mark ...

Capital Flows and the Balance of Payments

... that any deficit in the current account must be financed by selling assets or accumulating liabilities with respect to the rest of the world. The same accounting truism applies to a firm or individual: if your expenditures exceed your receipts, you need to sell assets or borrow to finance the differ ...

... that any deficit in the current account must be financed by selling assets or accumulating liabilities with respect to the rest of the world. The same accounting truism applies to a firm or individual: if your expenditures exceed your receipts, you need to sell assets or borrow to finance the differ ...

THE EUROZONE ‘DEBT’CRISIS ‘Centre’-’Periphery’ interaction under financial globalization; the case of Europe

... draw a clear distinction between savings and finance. Current accounts are tied to “savings” – a national accounts concept of income not consumed – but finance is provision of purchasing power in the form of money. Consumption and investment require financing but not savings; eventually, after spend ...

... draw a clear distinction between savings and finance. Current accounts are tied to “savings” – a national accounts concept of income not consumed – but finance is provision of purchasing power in the form of money. Consumption and investment require financing but not savings; eventually, after spend ...

National Income Accounts

... Deficits are financed by borrowing => demand for loanable funds increases and the DD curve shifts to the right. The increase in demand for loanable funds causes interest rates to rise. As a result of higher US interest rates, demand for US$ increases => US currency appreciates. Appreciation of the U ...

... Deficits are financed by borrowing => demand for loanable funds increases and the DD curve shifts to the right. The increase in demand for loanable funds causes interest rates to rise. As a result of higher US interest rates, demand for US$ increases => US currency appreciates. Appreciation of the U ...

open economy - Department of Economics

... Net income of foreign investments Unilateral transfers, net ...

... Net income of foreign investments Unilateral transfers, net ...

Answers to Questions in Chapter 23

... exchange rate? The Reserve Bank has a policy objective to keep inflation in the range of 2-3% (see Chapter 19). The substantial fall in the exchange rate will have led to a rise of a similar magnitude in the Australian dollar price of imports. This in turn will have increased the price level increas ...

... exchange rate? The Reserve Bank has a policy objective to keep inflation in the range of 2-3% (see Chapter 19). The substantial fall in the exchange rate will have led to a rise of a similar magnitude in the Australian dollar price of imports. This in turn will have increased the price level increas ...

... 1. General trends The Guyanese economy expanded by 3.9% in 2014, down from growth of 5.2% in 2013. Fiscal policy remained expansionary, widening the government deficit, which is expected to increase further in 2015. Government expenditure grew, owing in part to wage increases for government workers. ...

Eastern Caribbean Currency Union_en.pdf

... central governments of almost all member countries experienced an overall improvement in their fiscal position year on year, with Saint Kitts and Nevis and Dominica achieving overall surpluses of 109.09 million and 3.14 million Eastern Caribbean Dollars (EC$), respectively. Saint Lucia, Saint Vincen ...

... central governments of almost all member countries experienced an overall improvement in their fiscal position year on year, with Saint Kitts and Nevis and Dominica achieving overall surpluses of 109.09 million and 3.14 million Eastern Caribbean Dollars (EC$), respectively. Saint Lucia, Saint Vincen ...

Balance of Payments: Accounts and Analysis

... How BOP accounts are put together Definitions, conventions, presentation Links to other macroeconomic accounts ...

... How BOP accounts are put together Definitions, conventions, presentation Links to other macroeconomic accounts ...

Jul 2016 - State Bank of Pakistan

... Pakistan economy posted notable improvements in FY16 as average annual CPI inflation declined to a 47 year low of 2.9 percent and real GDP growth touched an 8-year high of 4.7 percent. Foreign exchange reserves held by SBP recorded steady increases and while covering four months of imports stood at ...

... Pakistan economy posted notable improvements in FY16 as average annual CPI inflation declined to a 47 year low of 2.9 percent and real GDP growth touched an 8-year high of 4.7 percent. Foreign exchange reserves held by SBP recorded steady increases and while covering four months of imports stood at ...

Griffin_01

... Exporting and Importing • Exporting: selling of products made in one’s own country for use or resale in other countries • Importing: buying of products made in other countries for use or resale in one’s own country ...

... Exporting and Importing • Exporting: selling of products made in one’s own country for use or resale in other countries • Importing: buying of products made in other countries for use or resale in one’s own country ...

Document

... – Ex. If the price level is higher in Canada than in the United States, then American goods are relatively cheaper than Canadian goods, thus Canadians will import more American goods causing the U.S. Dollar to appreciate and the Canadian Dollar to depreciate. ...

... – Ex. If the price level is higher in Canada than in the United States, then American goods are relatively cheaper than Canadian goods, thus Canadians will import more American goods causing the U.S. Dollar to appreciate and the Canadian Dollar to depreciate. ...

China Revalues the Yuan and Moves to a Managed Float Regime

... had maintained this peg even through the difficult Asian currency crisis later in that year, when many emerging Asian countries were forced to abandon their pegs. China argued for years that a fixed and stable currency was critical for the development and growth of its economy. Pegging its currency ...

... had maintained this peg even through the difficult Asian currency crisis later in that year, when many emerging Asian countries were forced to abandon their pegs. China argued for years that a fixed and stable currency was critical for the development and growth of its economy. Pegging its currency ...

click

... (3) Increase in Thai holdings of assets located abroad (4) Increase in foreign holdings of assets located in Thailand ...

... (3) Increase in Thai holdings of assets located abroad (4) Increase in foreign holdings of assets located in Thailand ...

Mr. Mayer AP Macroeconomics

... – Ex. If the price level is higher in Canada than in the United States, then American goods are relatively cheaper than Canadian goods, thus Canadians will import more American goods causing the U.S. Dollar to appreciate and the Canadian Dollar to depreciate. ...

... – Ex. If the price level is higher in Canada than in the United States, then American goods are relatively cheaper than Canadian goods, thus Canadians will import more American goods causing the U.S. Dollar to appreciate and the Canadian Dollar to depreciate. ...

Econ 114 3rd MT W 2016 White.tst

... 14) If a Canadian company builds and operates a mine in Indonesia, in the foreign-exchange market there will be a(n) A) decrease in the debits on Canada's capital account. B) increase in the demand for dollars in the foreign-exchange market. C) fall in the demand for dollars in the foreign-exchange ...

... 14) If a Canadian company builds and operates a mine in Indonesia, in the foreign-exchange market there will be a(n) A) decrease in the debits on Canada's capital account. B) increase in the demand for dollars in the foreign-exchange market. C) fall in the demand for dollars in the foreign-exchange ...

Overview

... In this period of volatile global risk appetite, banks are observed not to have encountered any additional cost pressures in securing external funding. While there has been a limited decline in the external borrowing of the banks, this is attributable mainly to the preferences of domestic banks. Sin ...

... In this period of volatile global risk appetite, banks are observed not to have encountered any additional cost pressures in securing external funding. While there has been a limited decline in the external borrowing of the banks, this is attributable mainly to the preferences of domestic banks. Sin ...

FRBSF E L CONOMIC ETTER

... capital markets, such as collateral constraints and trading costs, how can government policies address the problem? One proposed policy approach is to create explicit price-floor guarantees by international financial organizations for investments in emerging market economies. Mendoza and Durdu intro ...

... capital markets, such as collateral constraints and trading costs, how can government policies address the problem? One proposed policy approach is to create explicit price-floor guarantees by international financial organizations for investments in emerging market economies. Mendoza and Durdu intro ...