* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download UK ECONOMIC FORECAST Q3 2012 – LAUNCH ISSUE BUSINESS WITH CoNfIdENCE icaew.com/ukeconomicforecast

Steady-state economy wikipedia , lookup

Economics of fascism wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Business cycle wikipedia , lookup

Long Depression wikipedia , lookup

Chinese economic reform wikipedia , lookup

Economic growth wikipedia , lookup

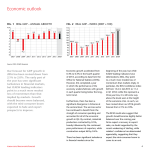

UK ECONOMIC FORECAST Q3 2012 – LAUNCH ISSUE BUSINESS WITH confidence icaew.com/ukeconomicforecast 2 icaew.com/ukeconomicforecast Introduction Welcome to the first edition of the ICAEW Economic Forecast. The report considers the outlook for the UK economy based on the views of ICAEW Chartered Accountants running all types of businesses across the UK, surveyed through the quarterly ICAEW/Grant Thornton UK Business Confidence Monitor (BCM). ICAEW’s forecasts for economic growth, business investment and the outlook for the labour market are based on the historical correlations between BCM indicators and official economic data. Analysis 1 undertaken in 2011, by Cebr, ICAEW’s economic consultants, showed that BCM has successfully tracked these economic indicators. It pointed to the weakening economic environment at the end of 2007 and into 2008 and indicated the brief return to growth in the third quarter of 2009. Since its launch in 2004, data from the BCM has provided a strong steer on the overall direction of travel in the economy – on business confidence, financial performance, challenges and expectations. It includes a range of business performance and planning indicators that build up a picture of how different aspects of the economy are faring and how the economy is likely to evolve in the coming months. We use this information to produce our quarterly Economic Forecast. 1 ICAEW/Grant Thornton BCM: an indicator of future economic trends; icaew.com/bcm icaew.com ECONOMIC OUTLOOK 0 -1 -2 -3 -4 -5 2007 -1.0 2008 -4.0 2009 2010 0.8 2011 -0.5 2012f ................................................. 1 1.8 ................................................. 2 ................................................. 3.6 3 ................................................. 4 ................................................. % ................................................. Fig. 1 Real GDP – annual growth 0.9 2013f Source: ONS, ICAEW forecasts This first economic forecast reveals that the economy is set to contract in 2012 and growth will be subdued in 2013. An investment-led recovery looks unlikely and the labour market could start to deteriorate again. 2 The economy is set to contract for 2012 as a whole, and looks likely to show only very weak growth next year – ICAEW is forecasting a 0.5% contraction in economic output for 2012 as a whole, followed by growth of just 0.9% in 2013. The latest data on UK economic growth have not been encouraging – the Office for National Statistics’ second estimate of economic activity in Q2 2012 showed that the economy shrank by 0.5% compared with the previous quarter. This is the third consecutive quarter of economic contraction. Output in the production industries fell by 0.9%, while in the services sector output declined by 0.1%. Construction sector output fell by a sharp 3.9%, though many economists believe that data for this sector may be inaccurate, painting an overly bleak picture of the sector’s performance. Nevertheless, the overall picture is that the economy is very weak indeed. BCM leading indicators for economic growth paint a weak picture of the short-term outlook. The BCM Confidence Index stood at +1.1 in Q3 2012, down from +12.0 the previous quarter. This marked the fourth largest quarterly decline in confidence since BCM began. In line with falling confidence, other key BCM indicators show business performance slipping back in the 12 months to Q3 2012. Turnover and gross profits have grown by 3.2% and 2.3% respectively, both down from 4.1% for the 12 months to Q2 as economic conditions remain tough. Expectations for growth over the coming 12 months have also weakened. icaew.com/ukeconomicforecast Business Investment -10 -15 -20 2007 -0.2 2008 -14.4 2009 -0.4 2010 2011 4.9 2012f ...................................... 0 -5 1.3 ...................................... 5 ...................................... 10.9 ...................................... 10 ...................................... % 15 ...................................... Fig. 2 Business investment – annual growth -0.9 2013f Source: ONS, ICAEW forecasts With confidence weak, business investment growth is likely to fall – ICAEW’s forecast suggests a 0.9% fall in business investment in 2013. Business investment fell by 1.5% last quarter, probably reflecting continued caution given the weak economic outlook. Business investment is 15.9% below its pre-financial crisis peak, illustrating just how much investment has collapsed following the onset of the financial crisis. In this quarter’s BCM, businesses report capital investment rising by 2.0% over the past year, broadly unchanged from growth rates seen over the previous three quarters, but this is expected to slow over the coming year. These BCM findings suggest that the Office for Budget Responsibility’s business investment growth forecast of 6.4% for 2013 may be very unrealistic. Indeed, ICAEW predicts that business investment will, in real terms, fall by 0.9% in 2013. icaew.com/ukeconomicforecast 3 Labour Market 2007 2008 0.0 2009 2010 2011 1.9 2012f 7 6.5 1.8 6 5.5 5.3 5 2013f 2007 5.7 2008 7.7 2009 7.8 2010 2011 8.1 2012f ........................................... 0 2.4 8 7.5 8.1 ........................................... 1 2.2 ................................. 2 3.5 ................................. 3 ................................. 4 ................................. 5.0 ................................. 5 ................................. % 6 ........................................... 9 8.5 ........................................... % ........................................... Fig. 4 Unemployment Rate, % ........................................... Fig. 3 Average earnings – annual growth 8.4 2013f Source: ONS, ICAEW forecasts Employment and earnings growth look set to remain modest. Unemployment is likely to start rising again – we expect the unemployment rate to average 8.4% next year. Despite the overall bleak economic news, the labour market has fared better than expected in 2012. The unemployment rate fell from 8.4% in the final quarter of 2011 to 8.0% in the second quarter of 2012. However, increases in employment have largely been driven by part-time job creation. Part-time employment now stands at a record high of 8.1m – 9.0% higher than five years ago. In contrast, full-time employment is 1.7% lower. Furthermore, earnings growth remains incredibly subdued, standing at less than half typical pre-financial crisis levels. Forward-looking BCM labour market indicators remain weak, with private sector firms continuing to expect only small increases to their headcount. They expect employee numbers to grow by 1.2% on average over the coming year. With further public 4 sector job cuts planned throughout the current Parliament, and the private sector remaining cautious about job creation, employment conditions are likely to remain fragile. ICAEW expects employment numbers to show zero growth for 2012 as a whole and growth of just 0.4% in 2013 as private sector job creation struggles to offset public sector job losses. As a result of this, the unemployment rate is likely to start rising again – ICAEW expects the unemployment rate to average 8.1% this year and 8.4% next year. BCM salary indicators suggest that subdued pay growth is likely to continue over the coming year. Firms expect average total salaries to increase by 1.1% over the next 12 months. ICAEW expects total pay growth to stand at 1.9% in 2012 and 1.8% in 2013 as a whole. This is less than half the pre-financial crisis growth rate of 4.3%. icaew.com/ukeconomicforecast Forecasting methodology Headline economic forecasts 2007 2008 2009 2010 2011 2012f 2013f +3.6% -1.0% -4.0% +1.8% +0.8% -0.5% +0.9% +10.9% -0.2% -14.4% -0.4% +1.3% +4.9% -0.9% 2007 2008 2009 2010 2011 2012f 2013f Earnings (total pay) – annual growth +5.0% +3.5% +0.0% +2.2% +2.4% +1.9% +1.8% Employment – annual growth +0.7% +0.7% -1.6% +0.2% +0.5% +0.0% +0.4% 5.3% 5.7% 7.7% 7.8% 8.1% 8.1% 8.4% Real GDP – annual growth Business investment – annual growth Labour market forecasts Unemployment rate ICAEW’s forecasts for economic growth, business investment and the outlook for the labour market are based on the historical correlations between ICAEW/Grant Thornton Business Confidence Monitor (BCM) indicators and official economic data. BCM contains data – from a survey of 1,000 UK businesses – on business confidence, financial performance, challenges and expectations. BCM indicators provide a useful and unique steer on future developments in the UK economy. icaew.com/ukeconomicforecast 5 About Cebr Centre for Economics and Business Research ltd is an independent consultancy with a reputation for sound business advice based on thorough and insightful research. Since 1992, Cebr has been at the forefront of business and public interest research. They provide analysis, forecasts and strategic advice to major UK and multinational companies, financial institutions, government departments and agencies and trade bodies. For further information about Cebr please visit cebr.com ICAEW ICAEW is a professional membership organisation, supporting over 138,000 chartered accountants around the world. Through our technical knowledge, skills and expertise, we provide insight and leadership to the global accountancy and finance profession. Our members provide financial knowledge and guidance based on the highest professional, technical and ethical standards. We develop and support individuals, organisations and communities to help them achieve long-term, sustainable economic value. Because of us, people can do business with confidence. ICAEW Chartered Accountants’ Hall Moorgate Place London EC2R 6EA UK T +44 (0)20 7920 8705 E [email protected] icaew.com/ukeconomicforecast linkedin.com – find ICAEW twitter.com/icaew facebook.com/icaew © ICAEW MKTPLM8828 © ICAEW 2012 MKTPLN11606 09/12