* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Pricing Strategy for Business Markets Chapter Topics

Survey

Document related concepts

Transfer pricing wikipedia , lookup

Market penetration wikipedia , lookup

Yield management wikipedia , lookup

Global marketing wikipedia , lookup

Revenue management wikipedia , lookup

Gasoline and diesel usage and pricing wikipedia , lookup

Marketing channel wikipedia , lookup

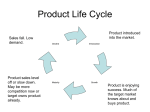

Product planning wikipedia , lookup

Marketing strategy wikipedia , lookup

Pricing science wikipedia , lookup

Dumping (pricing policy) wikipedia , lookup

Perfect competition wikipedia , lookup

Price discrimination wikipedia , lookup

Transcript

Chapter 14: Pricing Strategy for Business Markets PowerPoint by: Ray A. DeCormier, Ph.D. Central Ct. State U. Chapter Topics Understanding how customers value pricing is the essence of the pricing process. Chapter topics include: 1. The value-based approach for pricing 2. The central elements of the pricing process 3. How effective new product prices are established and the need to periodically adjust the prices of existing products 4. How to respond to a price attack by an aggressive competitor 5. Strategic approaches to competitive bidding Customer Value in Business Markets Customer Value Benefits Core Benefits Add-on Benefits Sacrifices Acquisition Costs Processing Costs Usage Costs Source: Adapted with modifications from Ajay Menon, Christian Homburg and Nikolas Beutin, “Understanding Customer Value in Business-to-Business Relationships,” Journal of Business-to-Business Marketing 12, No. 2 (2005), pp. 1-33. Sacrifices = Total Costs Total Costs = Acquisition + Possession + Usage 1. Acquisition: Purchase price, transportation, administrative costs, errors, costs to evaluate supplier, expedition costs 2. Possession Costs: Finance, storage, inspection, insurances, taxes, internal handling 3. Usage Costs: Costs for ongoing use such as installation, training, field repairs, replacement, disposal Customers’ Total Cost-in-Use Components 5 Differentiating through Value-Creation • If relationships are more valuable to customers than price and costs, then marketers need to emphasize unique add-on benefits around: 1. Building trust 2. Demonstrating commitment 3. Being flexible 4. Initiating joint ventures 5. Working on developing deeper relationships These efforts enhance customer value & loyalty. Differentiating through Value-creation • Research suggests that most companies offer similar services, however, the following seem to be more prominent. 1. Service support 2. Personal interactions 3. Supplier know-how 4. Ability to improve customer’s time to market • Moderate differentiating factors include: 1. Product quality 2. Delivery 3. Acquisition and operation costs Key Components of the Price-Setting Decision Process • No easy formula for pricing industrial product or service • Decision is multidimensional • Each interactive variable assumes significance Fig. 14.2 Set Strategic Pricing Objectives Estimate Demand and the Price Elasticity of Demand Determine Costs and their Relationship to Volume Examine Competitors’ Prices and Strategies Set the Price Level Demand Determinants & Assessing Value • There are a number of issues when considering demand: 1. 2. 3. Usage and importance of the product/service by various segments Price Sensitivity (elasticity of demand) Assessing Value: Competitive Value comparisons • Assume same product by 2 different competitors • Assume: (“A” charges $24 ; “B” charges $20); Why might a buyer prefer “A” over “B”? Could it be that buyer prefers “A” more than “B” because “A’s” total offering provides more value than “B”? Fig 14.3 A Value-Based Approach for Pricing Define the key market segments Isolate the most significant drivers of value in customers’ business Quantify the impact of your product or service on each value driver in customers’ business Estimate the incremental value created by your product or service, particularly for those features that are unique and different from competitors’ offerings Develop pricing strategy and marketing plan SOURCE: Adapted from Gerald E. Smith and Thomas T. Nagle, “How Much Are Customers Willing to Pay,” Marketing Research 14 (winter 2002): pp. 20-25. Elasticity Varies by Segments • Price elasticity measures how sensitive customers are to price changes. • Price elasticity of demand refers to rate of percentage change in quantity demanded to percentage change in price. Elasticity of Demand Elastic Demand Inelastic Demand Unitary Elasticity Consumers buy more or less of a product when the price changes An increase or decrease in price will not significantly affect demand An increase in sales exactly offsets a decrease in prices, and revenue is unchanged Elasticity of Demand Price Goes... Revenue Goes... Demand is... Down Up Elastic Down Down Inelastic Up Up Inelastic Up Down Elastic Up or Down Stays the Same Unitary Elasticity Other Factors • Satisfied customers are less price sensitive therefore one strategy is to make our customers very satisfied so price isn’t as much of a determinant. • Switching costs is a consideration depending upon products. The more sophisticated and unique the product is, and the more vested interest (costs) in it is, the more apt for the customer to not switch. Other Factors • End Use: How important is the product as in input into the total cost of the end product? – If cost is insignificant, then demand is inelastic. • End-Market Focus: Since demand for many industrial products is derived from the demand for the product of which they are a part, STRONG end user focus is needed. Value-Based Segmentation Some industrial product may serve different purposes for different markets. Each segment may value the product differently. By identifying applications where the firm has a clear advantage, and by understanding the value of it to each segment, marketer may be able to administer price differentiation in each segment. Target Pricing & Costing • Many companies base price off of costs • Problem: Method is internally driven, not market driven • A better approach is to use Target Pricing 1.It starts by examining and segmenting the market 2.Determine what type, quality and attributes each segment wants at a pre-determined target price 3.Understand the perception of value to the target selling price 4.Then calculate costs considering margins Cost Concept Analysis • Direct Traceable or Attributable Costs: All costs, fixed or variable, that are solely incurred for a particular product, territory, or customer (e.g., raw materials) • Indirect Traceable Costs: All costs, fixed or variable, that can be traced to a particular product, customer or territory (e.g., general plant overhead) • General Costs: Costs that support a number of activities not directly related to a particular product (e.g., administrative overhead, R&D) Competition • Competition establishes an upper limit on price. • Price is only a component of the cost/benefit equation. • There are many ways to have a differential advantage other than price: advanced features, technical expertise, timely delivery and product reliability (zero defects) to name a few. • Service and support also have a differentiating affect. Followers vs. Pioneers Pricing Strategies • 3 Major Pricing Strategies 1. Follow the Crowd 2. Price Skimming 3. Penetration Pricing Price Skimming Price Skimming is charging a high initial price Price Skimming: – Appropriate for distinctly new products – Provides the firm with opportunity to profitably reach market segments not sensitive to high initial price – Enables marketer to capture early profits – Enables innovator to recover high R&D costs more quickly Strategy: As the product goes through its product life cycle, the strategy is to lower the price in line with production and demand capacity. Penetration Pricing Penetration Pricing is charging a very low initial price. Penetration Pricing is appropriate when there is: › High price elasticity of demand › Strong threat of imminent competition › Opportunity for substantial production cost reduction as volume expands Price Discrimination The Robinson-Patman Act of 1936: “…holds that it is unlawful to ‘discriminate’ in price between different purchasers of commodities of like grade and quality…where the effect of such discrimination may be substantially to lessen competition or tend to create a monopoly, or to injure, destroy or prevent competition..” Evaluating A Competitive Threat Competitive price or “low cost” product entry Accommodate or Ignore No Is your position in other markets at risk? No Is there a response that Yes would cost less than the preventable sales lost? Yes No Does the value of the markets at risk justify the cost of response? Yes Respond If you respond, is competition willing and able to reestablish the price difference? No Yes No Will the multiple responses required to match a competitions cost less than the preventable sales loss? Yes Respond Source: Figure from “How to Manage an Aggressive Competitor” by George E. Cressman, Jr. and Thomas T. Nagle from BUSINESS HORIZONS 45 (March-April 2002): p. 25. Reprinted with permission from Elsevier. Respond Competitive Bidding • Certain groups do bidding 1. Governments 2. Large companies (using preferred suppliers) bid for: a. Non-standard material b. Complex designs and difficult manufacturing methods Types of Bidding • Closed bidding: Suppliers submit a written bid on a specific contract and all bids are opened simultaneously and often job goes to lowest bidder… • But not always. • Open bidding: Auction & reverse auction bidding – The goal is to push the price down. – Sometimes it has a negative effect because it brings out sensitive financial standings between competitors. – The result can cause distrust between supplier and buyer. Strategy for Competitive Bidding Bidding is costly and time consuming. A. Screen the project to make sure the contract is related to your core competencies and is one you can perform (profitably). B. Price to a level that, hopefully, will allow you to win the contract but not bankrupt you. C. Sometimes it is worth winning a contract even at a small loss if it can lead to bigger contracts. D. The determinant is the switching costs involved for the buyer to bring on another vendor. Strategic Approach to Reverse Auctions Reverse auctions are used to: 1. Purchase commodity products at lowest price 2. Tempt suppliers to sacrifice their profit margins in the heat of bidding To minimize risk of winning an unprofitable bid, 1. Carefully estimate true incremental cost of project 2. Include costs associated with special terms: 1. Technical 2. Marketing 3. Sales support This analysis should result in a “walk-away” price. Strategic Approach to Reverse Auctions con’t. • To cope with a reverse auction: 1. Convince buyer not to initiate the auction because you have a “unique value proposition” and will not participate in auction. 2. Manage the process. Influence the bid specifications and vendor qualifications. 3. Walk away and refuse to participate. This approach defines winning as only doing those bids that are profitable.