* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Pricing - Willamette University

Survey

Document related concepts

Transcript

Pricing

The fundamental pricing rule

Price discrimination

Dynamic limit pricing

The fundamental pricing rule

Produce up to the point where MR=MC,

where MR = P[1-(1/|e|)]

For a price taker:

MR = P[1-(1/|e|)] = P, hence P=MC

For a price searcher MR = MC implies

P = MC/[1 - (1/|e|)], hence (P- MC)/P = 1/|e|

And P/(P- MC) = |e|

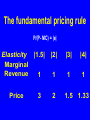

The fundamental pricing rule

P/(P- MC) = |e|

Elasticity

Marginal

Revenue

Price

|1.5|

|2|

|3|

|4|

1

1

1

1

3

2

1.5

1.33

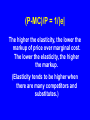

(P-MC)/P = 1/|e|

The higher the elasticity, the lower the

markup of price over marginal cost.

The lower the elasticity, the higher

the markup.

(Elasticity tends to be higher when

there are many competitors and

substitutes.)

QUESTION

True or false: the

optimal price will

always be on the

elastic portion of

the residual

demand curve?

QUESTION

True or false: the

optimal price will

always be on the

elastic portion of

the residual

demand curve?

True.

If |e| is less than 1,

raising price will

both increase

revenue, and

decrease costs.

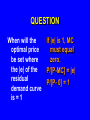

QUESTION

When will the

optimal price

be set where

the |e| of the

residual

demand curve

is = 1

QUESTION

When will the

optimal price

be set where

the |e| of the

residual

demand curve

is = 1

If |e| is 1, MC

must equal

zero.

P/[P-MC] = |e|

P/[P- 0] = 1

QUESTION: Given a linear demand curve that

intersects the Y axis at a price of $10, and a

marginal cost of $2 per unit, what is the

optimal price?

ANSWER: P = $6. 1/|e| = (Pmax - P)/P = ($10 - P)/P.

(P - MC)/P = (P-2)/P. Equating the right side of the

equation to the left, ($10-P)/P = (P - $2)/P or ($10 - P)

= (P - $2).

Price discrimination

Definition: A single organization price

discriminates when it charges different

prices to different consumers that are

not proportional to differences in

marginal cost, i.e., when for two

different consumers (1 & 2), p1/MC1 ≠

p2/MC2 (of course, MR1/MC1 =

MR2/MC2).

Necessary conditions

At least two consumer groups exist with

different elasticities, i.e., different demand

curves.

The organization can identify consumers in

each group, and set prices differently for

consumers in the two groups.

• The organization must be able to prevent

consumers in one group from selling to

consumers in the other (no arbitrage).

Price discrimination: Note

P1 is 3 times MC; P2 is

twice MC. Solving for

|e|: (3 - 1)/3 = 1/|e| =

1.5; (2 - 1)/2 = |e| = 2.

The more inelastic the

demand, the higher the

markup: inverse

elasticity pricing rule

or, where subject to a

revenue constraint,

Ramsey optimal

pricing.

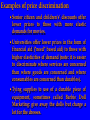

Examples of price discrimination

Senior citizen and children's' discounts offer

lower prices to those with more elastic

demands for movies.

Universities offer lower prices in the form of

financial aid ("need" based aid) to those with

higher elasticities of demand (note: it is easier

to discriminate where services are concerned

than where goods are concerned and where

consumables are concerned than durables).

Tying supplies to use of a durable piece of

equipment, sometimes called Barbie Doll

Marketing: give away the dolls but charge a

lot for the dresses.

One of the most effective price-discrimination

mechanisms is the multi-part tariff.

Multi-part tariffs decompose product/services to

their fundamental attributes and charge users

for their actual consumption of each.

The best example of a multi-part tariff is your

phone bill.

Multi-part Ramsey-optimal tariffs are also

commonly used in internal transfer pricing,

initially for IT services, now more widely in

intra-net based organizations

Price discrimination via 2

part tariff

Dynamic limit pricing