* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Why do prices change?

Merchant account wikipedia , lookup

Yield spread premium wikipedia , lookup

Internal rate of return wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Pensions crisis wikipedia , lookup

Financialization wikipedia , lookup

Stagflation wikipedia , lookup

Interbank lending market wikipedia , lookup

Credit rationing wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Monetary policy wikipedia , lookup

Inflation targeting wikipedia , lookup

Present value wikipedia , lookup

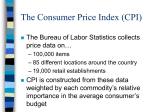

The Consumer Price Index (CPI) The Bureau of Labor Statistics collects price data on… – 100,000 items – 85 different locations around the country – 19,000 retail establishments CPI is constructed from these data weighted by each commodity’s relative importance in the average consumer’s budget The CPI (continued) It reflects both – the change in individual product/service prices due to shifts in supply and/or demand (given the product/service’s weight in the market basket) – the general rise (decline) in market prices What Does the CPI Look Like? http://research.stlouisfed.org/fred2/series/CPIAUCNS?cid=9 250 210.2 200 156.3 150 108.6 100 50 CPI 56.1 32.3 0 1966 1976 1986 1996 2007 new old 100 old Relationship Between CPI & Inflation Inflation = the Percentage Change from one year to the next = new old 100 old Example: • CPI1992=140.3 • CPI1993=144.5 • Annual rate of inflation between 1992 and 1993 = 144.5 140.3 100 140.3 • = 2.99% More Examples... Example: • • • • CPI1979=72.6 CPI1980=82.4 Annual rate of inflation between 1979 and 1980 = 82.4 72.6 100 72.6 • = 13.5% Example: • Overall rate of inflation between 1979 and 1993 = 144.5 72.6 100 72.6 • = 99% So what? Why does the CPI Matter Helps to answer the age-old question: Are you better off now than you were five years ago? Helps to understand how price changes may lead to shifts in household resource allocation patterns over time Critical to understanding how costs/benefits may vary through time. Proverb #6: Only Today’s Dollars are Comparable We need to account for the fact that the costs and benefits associated with various alternatives don’t always occur at the same point in time. Some Definitions... Real interest rate - interest rate that compensates individuals for – opportunity cost of lending – risk of lending Nominal interest rate - interest rate that compensates individuals for – opportunity cost of lending – the risk of lending – inflation In other words… The stated nominal interest rate includes monetary compensation for inflation. – What the bank offers you is the nominal interest rate, it is the price of the money you either loan or lend from them. Real interest rate adjusts for inflation. – It allows us to compare prices across time, adjusted for the effect of inflation – A cost of $5 in real dollars in 1950 buys the same amount of stuff as $5 in real dollars in 2000 Nominal interest rate = real interest rate + inflation Nominal interest rate = Real interest rate = real inf real inf nom inf 1 inf Examples... If the credit union needs to get a real rate of return on loans of 7% to cover costs and inflation is projected to be 9%, what is the nominal interest rate that should be charged on their consumer loans? Please note: All percentages must be converted to decimals real inf real inf =.07 + .09 + (.07)(.09) = .1663 = 16.63% Examples... The rate of inflation is forecast to be 10% and the bank is currently offering 7% interest on its passbook savings accounts. What is the real interest rate earned on these accounts? Please note: All percentages must be converted to decimals .07 .10 1 .10 = -.027 = -2.7% Sample Test Question Your bank offers you a five year CD with an annual interest rate of 7%; annual inflation rates are forecast at 3% for the next five years. Based on this information, which of the following statements is true: A. The nominal interest rate is 4% B. The real interest rate is 7% C. The nominal interest rate is 7% D. The real interest rate is 3% E. Both the real and nominal interest rates are 7%