* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download No Slide Title

Darknet market wikipedia , lookup

Congestion pricing wikipedia , lookup

Gasoline and diesel usage and pricing wikipedia , lookup

Yield management wikipedia , lookup

Market penetration wikipedia , lookup

Grey market wikipedia , lookup

First-mover advantage wikipedia , lookup

Global marketing wikipedia , lookup

Revenue management wikipedia , lookup

Product planning wikipedia , lookup

Marketing strategy wikipedia , lookup

Marketing channel wikipedia , lookup

Transfer pricing wikipedia , lookup

Dumping (pricing policy) wikipedia , lookup

Price discrimination wikipedia , lookup

Pricing science wikipedia , lookup

Service parts pricing wikipedia , lookup

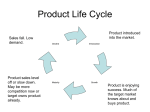

Adm. Issues • Mid-term exam will be held on 15th December, 2005 • Topics in the mid-term exam include: consumer demand, production costs, firm’s supply, price determination, perfect competitive markets And game theory • Final exam will be held on 10th January 2006 Lecture 8 Monopoly Topics covered • • • • • • • The conditions for monopoly. Price and output decisions in monopoly markets. Barriers to entry and exit. Welfare costs of monopoly. Possible dynamic gains from monopoly. Assessing monopoly power. Economic rent seeking behaviour. Learning outcomes This chapter will help you to: • • • • • Identify the circumstances and conditions under which a monopoly is said to exist. Recognise the main features of monopoly markets in terms of price and output decisions. Appreciate why a monopolist can be described as being a price-maker. Understand the importance and various forms of barriers to entry in monopoly markets as means of sustaining a position of market dominance. Grasp the significance of monopoly power and the impact on economic welfare in terms of allocative and productive efficiency. Learning outcomes • • • Assess the degree of monopoly power using various methods of measuring market dominance. Appreciate the importance of potential market entry in limiting monopoly power (referred to as market contestability). Understand the significance of rent seeking behaviour. Price and output decisions in monopoly markets Figure 7.1 Price and output under monopoly Barriers to entry and exit Barriers to entry prevent competitors entering the market. Important examples are the following: • • • • • • • Patents and copyright Government regulations, licences and state ownership Tariffs and non-tariff barriers The existence of natural monopolies. Lower costs of production than competitors Control of necessary factors of production and materials Control of distribution channels Even where there is no absolute barrier to entry,the monopolist may be able to deter competitors by, for example: • • • • • Predatory pricing or the threat of a price war and other action against potential competitors. Creating excess capacity ,which signals to potential suppliers that the monopolist might react to competition by increasing output and thus reducing the market price. Creating brand loyalty ,including large-scale advertising expenditure. High research and development expenditure ,as in the pharmaceuticals industry. A final barrier to entry is a barrier to exit .The main obvious barrier to exit facing a firm occurs where there are appreciable sunk costs . Sunk costs arise when there is a need for high capital investment by a potential new entrant to match the production costs of the monopolist and these are costs which cannot be recouped if the firm subsequently decides to leave the industry. The welfare losses associated with monopoly fall into four main areas of concern. These are: • • • • Higher prices, higher profits and lower outputs. Loss of consumer surplus. Higher production costs. Loss of consumer choice. Higher prices, higher profits and lower outputs than under perfect competition Figure 7.2 The welfare costs of monopoly Patents and monopoly power Assessing monopoly power • Profit rates, and • Concentration ratios. Profit rates Lerner index =(P -MC)/P • Simple concentration ratios These ratios represent the extent of the market supplied by a given number of firms. For example, a four-firm concentration ratio shows the percentage of the market supplied by the four largest producers. • Concentration ratios including market shares One measure commonly used by government competition authorities is the so-called Herfindahl 蓬Hirschman Index (HHI).This index,when measuring the degree of competition in a market,takes into account both the total number of firms in the market and their relative size distribution. It is measured as follows: n Herfindahl-Hirschman Index (HHI) = 2 S i i =1 Where Si represents the market shares of each of the i firms in the market. Key learning points • A pure monopoly exists when a single firm supplies the entire market for a good or service. • Monopoly is associated with supernormal profits and with high barriers to entry to the market that protect the monopolist’s market dominance. • The monopolist’s demand curve will be downward sloping, implying that more can be sold at lower price. • Monopolists are price-makers and profits are maximised where marginal revenue(MR) equals marginal costs (MC). • Barriers to entry prevent competitors entering the market, examples being patents and copyright, government regulations, licences and state ownership,tariffs and nontariff barriers,natural monopolies,lower costs of production than competitors, control of necessary factors of production and control over distribution channels. Key learning points • Sunk costs arise when there is a need for high capital investment by a potential new entrant to match the production costs of the monopolist and these are costs which cannot be recouped if the firm subsequently decides to leave the industry. • The welfare losses associated with monopoly,compared with a competitive industry, fall into four main areas of concern,namely: higher prices,higher profits and lower outputs; loss of consumer surplus; higher production costs; loss of consumer choice. • There are,however,possible dynamic gains from monopoly involving: economies of scale and scope; increased product and process innovation through increased investment in R&D. • A contestable market occurs where there are no barriers to the entry of firms into the market. Key learning points • • • The degree of monopoly power (dominance) in a market can be assessed using: 朴profit rates; - concentration ratios; - the Herfindahl 蓬Hirschman Index. Economic rent is earnings over and above those necessary to maintain an input in its present use (or its opportunity cost ). Rent seeking behaviour exists when economic agents attempt to earn economic rents. Lecture 9 Pricing Strategy Topics covered • • • • • • • • • Price determination and managerial objectives. Generic pricing strategies. Pricing and the competitive environment. The marketing mix and the product life cycle. The economics of price discrimination. Pricing in multi-plant and multi-product firms. Peak-load pricing. Two-part tariffs. Pricing policy and the role of government. Learning outcomes This chapter will help you to: • Understand that price serves three functions: (a) as the basis on which firms generate revenue; (b) as a rationing device in markets; and (c) as a signal to producers to alter supply. • Identify how price is determined in a competitive market economy through the interaction of demand and supply. • Realise that pricing decisions are driven by particular managerial objectives (such as profit maximisation, sales revenue maximisation, etc.). • Distinguish between different generic pricing strategies adopted by firms, namely: marginal cost pricing, incremental pricing, breakeven pricing and mark-up pricing. • Appreciate the nature of various pricing strategies in markets with differing degrees of competition. • Recognise that pricing strategies require the integration of pricing decisions into a wider marketing mix, taking into account nonprice as well as price factors that affect demand. Learning outcomes • • • • • Appreciate how pricing decisions may vary over the life cycle of a product or service in the market. Understand the economics of price discrimination. Grasp the complexities introduced into pricing decisions where multi-plant or multi-product production occurs and the nature of transfer pricing. Identify when peak-load pricing and two-part tariff pricing may be appropriate. Recognise the ways in which government affects prices in market economies today. Price determination and managerial objectives Prices serve three broad functions. • • • Prices raise revenue for the firm. Prices act as a rationing device. Prices indicate changes in the wants of consumers and induce suppliers to alter product accordingly. Figure 12.1 The market for Sony TVs Generic pricing strategies • • • • Marginal cost pricing. Incremental pricing. Breakeven pricing. Mark-up pricing. Marginal cost pricing Marginal cost pricing involves setting prices, and therefore determining the amount produced, according to the marginal costs of production, and is normally associated with a profitmaximising objective. Incremental pricing Incremental pricing deals with the relationship between larger changes in revenues and costs associated with managerial decisions.Proper use of incremental analysis requires a wideranging examination of the total effect of any decision rather than simply the effect at the margin. Breakeven pricing Breakeven pricing requires that the price of the product is set so that total revenue earned equals the total costs of production. Figure 12.2 Pricing strategies compared Mark-up pricing Mark-up pricing is similar to breakeven pricing, except that a desired rate of profit is built into the price (hence this pricing is associated with terms such as cost-plus pricing,full-cost pricing and targetprofit pricing). M = (P - AC)/AC where m is the mark-up, AC is the average total cost, and P - AC is the profit margin. The price, P, is then given by: P = AC (1 + m) Pricing and the competitive environment The nature of the market in which the product is sold will have a major influence on the pricing policy adopted. As we saw earlier markets can be conveniently divided into four broad kinds: • • • • Perfectly competitive markets. Monopoly markets. Monopolistically competitive markets. Oligopoly markets. Pricing in perfectly competitive markets In perfectly competitive markets the firm is a pricetaker . Pricing in monopoly markets In a monopoly situation, the firm is a price-maker. The marketing mix and the product life cycle The marketing mix In developing an effective marketing strategy, marketing professionals draw attention to the importance of the following ‘ four Ps’: • Product. • Place. • Promotion. • Price. Together the four Ps determine what is called the ‘offer’ to the consumer. Figure 12.3 Product positioning and customers’ perceptions The product life cycle (1) ‘Promotional’ or ‘penetration pricing’ occurs when the price is set low to enter the market against existing competitors, attract consumers to the new product and gain market share. (2)A ‘skimming policy ’arises when price is set high initially to earn high profits before competition arrives or to cover large unit costs in the early stage of the product life. Figure 12.4 Phases of the product life cycle Definition of price discrimination Price discrimination represents the practice of charging different prices for various units of a single product when the price differences are not justified by differences in production/supply costs. • • • First-degree price discrimination. Second-degree price discrimination. Third-degree price discrimination. Figure 12.5 First-degree price discrimination Third-degree price discrimination Most frequently found is third-degree price discrimination, which simply involves charging different prices for the same product in different segments of the market. The markets may be separated in the following ways: • • • • By geography 紡as when an exporter charges a different price overseas than at home. By type of demand 紡as in the market for,say,butter where demand by households differs from the bulk purchase demand of large catering firms. By time 殆with a lower price charged for off-peak periods (as in the case of seasonal charges for hotel rooms). By the nature of the product 紡as with private dental care with differential pricing, where if one patient is treated he or she is unable to resell that treatment to someone else. Figure 12.6 Third-degree price discrimination Pricing in multi-plant and multi-product firms The multi-plant firm Where a firm ’s output of the same product is produced on more than one site, the profitmaximising output rule that marginal supply costs must equal marginal revenue, is unchanged, but in this case this marginal cost is the sum of the separate plants ’marginal costs and production must be allocated between the plants so that the marginal supply cost at each plant is identical. Figure 12.7 Pricing in a multi-plant firm Pricing in multi-plant and multi-product firms The multi-product firm When producing and pricing a product, the multi-product firm has to take into consideration not only the impact on the demand for that product of a price change (its own price elasticity of demand)but the impact on the demand for the other products in the firm ’s product range (the relevant cross-price elasticities).In other words, pricing now involves obtaining maximum profits from the full product range rather than from the individual products. Figure 12.8 Peak-load pricing Two-part tariffs A two-part tariff is concerned with levying a charge according to the number of volume of the units consumed, plus a fixed charge to cover fixed joint or common costs, usually on a quarterly of annual basis. Figure 12.9 Two-part tariffs Pricing policy and the role of government Taxes and subsidies Direct price controls • Rate-of-return regulation. • Price-cap regulation. Key learning points • Equilibrium pricing is likely to be short-lived since the conditions of demand and supply are likely to change regularly if not continuously. In addition,producers may lack adequate information about the market to predict the equilibrium price precisely. • Pricing ,in practice,is driven by managerial objectives relating to factors such as profitability,corporate growth,sales revenue, managerial satisfaction,etc. • Generic pricing strategies may be based on marginal cost,incremental cost,break-even or mark-up pricing. • Marginal cost pricing involves setting prices,and therefore determining the amount produced,according to the marginal costs of production,and is normally associated with a profitmaximising objective. • Incremental pricing deals with the relationship between larger changes in revenues and costs associated with managerial decisions. Key learning points • Breakeven pricing requires that the price of the product is set so that total revenue earned equals the total costs of production. • Mark-up pricing is similar to breakeven pricing,except that a desired rate of profit is built into the price (therefore this pricing is also sometimes referred to as cost-plus, full-cost or target-profit pricing). • In perfectly competitive markets, the supplier is a price-taker. • In a monopoly situation,the firm is a price-maker. • In developing an effective marketing strategy, marketing professionals draw attention to the importance of the four Ps: product, place, promotion and price. • With respect to the product life cycle ,promotional or penetration pricing sets the price low to enter the market against existing competitors and in order to attract customers to the new product and gain market share. Key learning points • • • • A skimming policy arises when price is initially set high perhaps to cover large unit costs (e.g.R&D costs)in the early stage of the product life cycle or to make higher profits before competitors can respond. Price discrimination represents the practice of charging different prices for various units of a single product when the price differences are not justified by differences in production/supply costs.Successful price discrimination requires an absence of arbitrage opportunities and differing elasticities of demand in the various markets. First-degree price discrimination arises in the case of a producer selling each unit of output separately,charging a different price for each unit according to the consumer 痴 demand function.This results in the transfer of all consumer surplus to the producer. Second-degree price discrimination involves charging a uniform price per unit for a specific quantity or block of output sold to each consumer. Key learning points • • • Third-degree price discrimination involves charging different prices for the same product in different segments of the market.The market may be segmented by geography,by type of demand,by time,or by the nature of the product itself. In the case of a product produced by a multi-plant firm, the profit-maximising output rule (MR =MC)is unchanged,but in this case the marginal cost is the sum of the separate plants 知 marginal costs and production should be allocated between the plants so that the marginal supply cost at each plant is identical. The multi-product firm has to take into consideration not only the impact of a price change on the demand for the product,but also the impact on the demand for the other products in the firm’s product range.Pricing policy, therefore, involves obtaining the desired rate of return from the full product range rather than from individual products. Key learning points • • • • Decentralisation of large firms brings with it problems of internal resource allocation, one aspect of which is the pricing of products which are transferred between the firm’s divisions.This gives rise to the need for an appropriate transfer pricing policy and the problem of determining the transfer price so as to maximise overall company profits. Peak-load pricing involves differentiated pricing which reflects differences in supply costs,given variations in demand for the product over time. A two-part tariff is concerned with levying a charge per unit according to units consumed plus a charge to reflect fixed joint or common costs. The inverse price elasticity rule ,sometimes referred to as Ramsey pricing,suggests that consumers with the more price inelastic demands should bear a higher proportion of fixed charges than consumers with a higher price elasticity of demand. Key learning points • On the basis of a public interest or economic welfare maximation rule, state enterprises should set prices in order to reflect the marginal social benefits from the additional output and the marginal social costs or producing that output. • Taxes and subsidies should be set so as to minimise the damage to resource allocation in the economy. In practice, state policies are determined by a mixture of political, social and economic criteria so economic welfare maximisation is far from guaranteed. Lecture 10 Monopolistic Competition Topics covered • The conditions for monopolistic competition. • Price and output decisions in the short run and long run. • The implications of monopolistic competition. Learning outcomes This chapter will help you to: • Identify the circumstances and conditions under which monopolistic competition is said to exist. • Recognise the main features of monopolistically competitive markets in terms of price and output decisions. • Appreciate the role of product differentiation in competitive markets and the importance of branding as a competitive strategy. • Understand the economic welfare costs associated with monopolistic competition. • Differentiate between market equilibrium under conditions of monopolistic competition in both the short run and long run. Conditions for monopolistic competition • • • • • There is a large number of firms competing in the market ensuring that each firm has an insignificantly small share of the total market. Each firm has the same,or very similar,costs of production. There is free entry to, and exit from ,the market place. The firms produce and sell goods or services which are similar (and hence they are substitutes for each other)but not identical to their rivals. Firms,therefore,compete by trying to ensure product differentiation for their goods or services. Price and output decisions in monopolistic competition Figure 8.1 Monopolastic competition: short run Price and output decisions in monopolistic competition Figure 8.2 Monopolastic competition: long run Implications of monopolistic competition • • • Competition will lower prices and profits as in a perfectly competitive market. However,the price will remain higher and the output lower than under perfect competition . Production occurs at less than optimum scale and,as a result,there is excess capacity in the market . In practice,markets that approximate to the monopolistically competitive model tend to be associated with non-price competition including branding and other efforts to differentiate the product . Figure 8.3 Long-run equilibrium: comparison of perfect and monopolistic competition Key learning points • A monopolistically competitive market is one in which there is a high degree of competition with a large number of firms selling very similar,but not identical, products or services. • Each firm faces a downward sloping demand curve because the products or services are differentiated in some way.This means that average revenue exceeds marginal revenue (i.e.AR >MR). • The short-run equilibrium in a monopolistically competitive market occurs when profits are maximised. This,as always, is the output associated with the condition that marginal revenue equals marginal cost,i.e.MR =MC. • In the short-run, supernormal profits can exist which act as an incentive for new firms to enter the industry supplying close substitute products or services. • As new firms enter the market,the demand curve facing each firm shifts to the left and becomes more price elastic because of the larger number of suppliers and choice of products or services available in the market. Key learning points • • • In the long-run equilibrium, all of the supernormal profits are competed away and only normal profits now exist,determined by the condition that AR =ATC (longrun). Each firm in monopolistic competition produces an output,in the long run,which is lower than that at which ATC is minimised, i.e.production occurs at a suboptimal scale resulting in excess capacity in the industry. The price paid by consumers in monopolistically competitive markets is higher than under perfect competition (P >MC). Thus the higher price may be interpreted as the cost to consumers of having the choice of selecting from a range of differentiated products.