* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download External Sector - Bilkent University

Survey

Document related concepts

Transcript

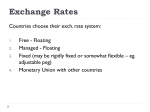

External Sector Econ 102 _2013 External Sector How is a country linked with other countries in the global world? 1) There are exchange of Goods and Services 2) There are exchange of Assets What is different? We have Turkish Lira (TL), US has US dollars ($) and European Union has Euro(€) Foreign currency • Exchange rate is the TL price of a foreign currency in Turkey. Eg. 1 $= 2.08 TL (TL price of one dollar) or 0.48 $ = 1 TL ( dollar price of one TL) • If TL price of a $ increases, TL depreciates • (TL becomes less valuable compared to $) Exchange of Goods and Services • Exports are the goods that we sell (and foreign economies buy). Hence, it is a source of foreign exchange. Exports= F( Yforeign, exchange rate) • Imports are the good that we buy (foreign sell to us). Hence we use foreign exchange to purchase imports Imports= F( Ydomestic, exchange rate) Net Exports • Net Exports = value of Exports- value of imports Net Exports = F( Y domestic , Yforeign, exchange rate) This is also called the Trade Balance Exchange of Financial Assets • We exchange Bonds, Shares, other assets. Asset demand depends on relative returns, i.e. interest rates, hence investors compare domestic interest rate < or > foreign interest rates i < or > i* Asset demand • Example: Turkish treasury TL bonds: i = 10%, German treasury Euro bonds: i* = 8% Which one will the investors prefer to buy? Asset demand • Example: Turkish treasury TL bonds: i = 10%, German treasury Euro bonds: i* = 8% Which one will the investors prefer? What if during this period it is expected that e will increase by 5 %, that is TL depreciates by 5 %, will you still prefer to buy Turkish Bonds.? Asset demand • Example: Turkish treasury TL bonds: i = 10%, German treasury Euro bonds: i* = 8% Which one will the investors prefer? iEURO = iTL - expected % change in e. 8% = 10 % - expected D % in e How are the foreign transaction recorded? • Balance of Payments: (Ödemeler Dengesi) Accounting method of all monetary transactions, with double entry system. Every transaction is recorded in different parts of the Balance of Payments. Balance of Payments 1. 2. 3. 4. Current Account Financial Account Central Bank reserve positions Errors and Omissions All adds up to zero. Current Account - Exports of goods (+) - Imports of goods (-) - Balance of trade - Exports of services(+) - Imports of services(-) - Balance of services - Income received on investment (+) - Income payments on investment (-) - Net income on investment - Net transfers (+) (-) - Balance on current account Financial Account - Increase in foreign holdings of assets in Turkey (+) - Increase in Turkey’s holding of assets in foreign countries () - Balance on Financial Account Capital Account - Statistical Discrepancy - Balance of Payments BOP of Turkey Foreign Exchange Market • Systems of Foreign Exchange: 1. Fixed Exchange Rate System: Central Bank determines the rate at which domestic currency is exchanged in to foreign currency. 2. Flexible Exchange Rate System: market determines the the rate at which domestic currency is exchanged in to foreign currency Foreign Exchange Market TL price of foreign currency Demand for foreign currency Supply of Foreign Currency Quantity of Foreign Currency Foreign Exchange Market TL price of $ Demand for $ Supply of $ Quantity of $ The Change in Foreign Exchange Market Equilibrium when Turkish Imports increase TL price of foreign currency Demand for foreign currency Supply of Foreign Currency Quantity of Foreign Currency The TL price of US dollar increases, i.e. TL depreciates The Change in Foreign Exchange Market Equilibrium when Turkish residents purchase Foreign Bonds TL price of foreign currency Demand for foreign currency Supply of Foreign Currency Quantity of Foreign Currency The TL price of US dollar increases, i.e. TL depreciates Current Account Balance Current Account Balance Foreign Trade Balance Services Balance TourismRevenues (net) Income Balance Current Transfers Capital and Financial Accounts Direct Investments (net) Portfolio Investments (net) Equity Securities Debt Securities Other Investments (net) Assets Currency and Deposits Liabilities Loans Banking Sector Non-bank Sectors Deposits Foreign Banks Foreign Exchange Turkish Lira Non-residents Reserve Assets (net) Net Errors and Omissions December 2012 -4,658 -5,403 804 897 -321 262 6,531 599 5,560 852 4,356 -390 -2,193 -2,535 1,803 2,173 1,230 944 -222 -308 -686 378 207 762 -1,873 (USD million) January-December % 2011 2012 Change -77,219 -48,867 -36.7 -89,139 -65,602 -26.4 18,003 21,932 21.8 18,044 19,389 7.5 -7,841 -6,594 -15.9 1,758 1,397 -20.5 65,659 44,845 -31.7 13,698 8,301 -39.4 21,986 40,773 85.4 -986 6,274 20,284 31,858 57.1 28,187 16,628 -41.0 11,136 -1,152 12,852 657 -94.9 17,051 17,780 4.3 18,866 8,495 -55.0 12,527 4,267 -65.9 7,121 6,373 -10.5 -4,309 7,783 -5,841 7,113 1,759 5,229 197.3 -7,600 1,884 3,447 2,914 -15.5 1,813 -20,814 11,560 4,022 -65.2 12 Month Cumulative -48,867 -65,602 21,932 19,389 -6,594 1,397 44,845 8,301 40,773 6,274 31,858 16,628 -1,152 657 17,780 8,495 4,267 6,373 7,783 7,113 5,229 1,884 2,914 -20,814 4,022 Source: CBRT Exports of Good and Services t o 4 8 .9 billion USD t ivit y during t he last alized t o t he ext ent rrent account def icit riod. Mont hly current market expect at ions 2 and annual current lion USD in 2011 t o ccount def icit t o GDP m 9.9% at t he end of 2012. Excluding t he ce gave a surplus of t def icit t hroughout est ic demand w hich easures t aken by t he in export s w it h t he y and t he increase in ost t o export s during b-it ems of t he current ade def icit narrow ed o 2011 and realized as s in services balance ompared t o 2011 and er support ing t he ef icit . The increase in he rise in t he net nues during 2012. In Current Account Balance (USD billion) 40 11.2 20 0 -20 -23.1 -40 -60 -48.9 Current Account Balance -80 Current Account Balance (energy import s exluded) -77.2 -100 2005 2006 2007 2008 2009 2010 2011 2012 Financing of Current Account Deficit (USD billion) 70 60 50 Ot her Invest ment s Portf olio Invest ment s Direct Investment s 40 30 20 10 0 -10 2005 2006 2007 2008 2009 2010 2011 2012 External Total Debt External Debt 306.6 277.1 247.1 193.6 169 147.3 104 109 118.3 118.3 170.1 268.3 270.7