* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 24 The Keynesian Framework Chapter 25 The IS-LM World

Pensions crisis wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Real bills doctrine wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Phillips curve wikipedia , lookup

Quantitative easing wikipedia , lookup

Monetary policy wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

Interest rate wikipedia , lookup

Business cycle wikipedia , lookup

Keynesian economics wikipedia , lookup

Helicopter money wikipedia , lookup

Stagflation wikipedia , lookup

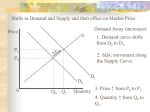

Chapter 24 The Keynesian Framework Chapter 25 The IS-LM World Keynesian Theory Advocates active role of the federal government in correcting economic problems Manipulate money supply to adjust interest rates to induce borrowing or decrease borrowing Looks at the short-run--sees immediate problem, fix it now, rather than let it fix itself Liquidity Preference Theory - Market rate of interest is determined by demand/supply of money balances. Demand of Money Transaction Precautionary Speculative + f(y) f(r) Since: + − D m = f (Y , r ) If MS increases then either income increases or interest rates drop. Supply of Money Fed basically determines supply Few uncontrollable factors (1) banks lending (2) public's preference for cash Letting D=S then solve for interest rate: + r= f ( Y − ,M , • + P ) e Liquidity Trap: At some point rates will not drop further. At this point no one would trade money for bonds. Keynesian Focus Focus on aggregate spending as the variable that must be adjusted through adjusting interest rates: ie. Excessive inflation--Keynesians see it as excessive spending (demand-pull inflation) so they would manipulate money supply to raise interest rates to decrease spending Focus on ensuring low unemployment Keynesians vs Monetarists Break with Quantity Theory (Monetarists): 1. Since interest rates change when MS change, the rigid proportional link between money and income is broken. 2. If the demand for money depends on interest rates, then velocity is a function of interest rates which implies income no longer proportional to change in money supply. Reaction to Recession: Keynesians immediately increase money supply to drive rates lower (later inflation) Monetarists allow lack of spending in economy to lower rates gradually Keynesians assume that the quantity of loanable funds does not change when monetary supply is adjusted (reduced/increased) Monetarists and Rational Expectations suggest that when money supply is increased, inflationary expectations rise which cause a higher demand for loanable funds This shifts the demand curve which could offset the shift in the supply curve caused by the monetary policy decision. If both demand and supply shift equally, no change occurs in the interest rate would occur and business investment would not change FOMC decision reflect both Monetarists and Keynesian viewpoints. In addition, their political affiliation tends to be related to their viewpoints--those appointed by a democratic president tend to favor loose monetary policy while those appointed by a republican president tend to favor tighter monetary policies. Development of the IS/LM Curve Keynesian Theory Economy has 2 sectors: (1) financial and (2) real. Financial sector described by demand and supply equations for money. - Financial Sector (LM) - Liquidity Preference Theory - Transaction & Precautionary Demand for Money - LP = DM DM - + = f (Y ) Speculative Demand for Money LP = DM = − DM = f ( i ) - Total Demand for Money LP = DM = + − DM= f (Y, i) - Supply of Money Determined by Fed + + SM= f (R,i) - Equilibrium SM = DM _ + + i = f ( R ,Y , P ) Ignoring price expectations: The relationship between interest rate and aggregate nominal income is the LM function. Financial sector is in equilibrium at all points along the LM function. Without changes in reserves, an increase in income will result in an increase in interest rates. - Real Sector (IS) - Components: Y = C + I + G Consumption - C = f (Y) - C=a+b Y b=marginal propensity to consume b<1 for all periods but exceptional periods Ignoring government spending: Y=C+S S = Y - C = Y - (a+b Y) = -a+(1-b) Y marginal propensity to save (1-b) reacts inversely to the marginal propensity to consume (b) - Savings when consider taxes - S = f (Y-T) - Wealth effect + C = f (W ) − W = f (i) + C = f (Y , S = − + i, W ) + + + f ( Y , i ,W ) - Investment - Buildup of Capital goods planned savings = planned investment − I = f (i) - - Government spending - independent of r, prices, Y Total Spending − + i = f (Y , G ) All points on the IS curve the real sector is in equilibrium. Market Rate : IS=LM Deflationary Gap--close by increasing money supply Inflationary Gap--close by decreasing money supply Strength of Monetary Policy - Stabilization policy involves shifting either IS or LM Curve Measured by the resulting change in nominal income per dollar change in mo ney supply - Change in income produced by a shift in the LM curve depends on - Size of the shift - Slope of the LM curve - Slope of the IS curve - LM Shifts LM Shifts Demand for LP increases, LM shifts left Demand for LP increases, LM shifts left Money Supply increases, LM shifts right - Slope of LM Curve LM Slopes - Greater sensitivity LP has to r change - (flatter the LP curve) the flatter is the LM curve - The less sensitive LP is to income (flatter the LP curve the flatter is the LM curve) - Vertical LM - Horizontal LM---Liquidity Trap - Fiscal policy dictates the income - Bottom of deep recessions - Fed is pegging interest rates IS Shifts - IS Shifts - Increase investment or Gov't spending, IS shifts right Increase taxes, shift IS left IS Slopes - Slope of IS Curves Greater sensitivity of I to r change (flatter I curve), the flatter the IS curve - Greater MPS (more income sensitive the S curve), the steeper the IS curve . IS/LM Summary: Shifts: Increase demand £or Speculative Money LM shifts left Increase demand £or Transaction Money LM shifts left Increase money supply LM curve shifts right Increase Investment or Gov't spending shift IS to right Increase Taxes shift IS to left Increase in MPS shift IS to left Slopes: Greater sensitive LPs is to interest change's (flatter LPs curve) the flatter is the LM curve and shifts LM right Less sensitive LPt is to income (flatter LP t curve) the flatter is the LM curve and shifts LM right Highly interest sensitive I (flatter curve) the flatter the IS and shifts IS left. Greater MPS (more income sensitive) the steeper the IS and shifts IS left Policy Effectiveness: Steeper LM---More Effective Monetary Policy Flatter IS----More Effective Monetary Policy Steeper IS----More Effective Fiscal Policy Flatter LM---More Effective Fiscal, Policy Money Multiplier Summary: 1+C+0 K = rd +rt (t)+ro(o)+c+e IF c increases, k decreases, money supply decreases IF t increases, k decreases, money supply decreases IF r.r. increases, k decreases, money supply decreases IF e increases, k decreases, money supply decreases IF o increases, k increases, money supply increases Points on the IS-LM Curves - Transmission Mechanism Lags Recognition Action Impact - Policy Impact Monetary Policy strong Steep LM Flat IS Fiscal Policy strong Steep IS Flat LM Points off the ISLM Curve Crowding Out Effect Expansive Action--Crowd Out Restrictive Action--Crowd In