* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Contraction

Nouriel Roubini wikipedia , lookup

Economic bubble wikipedia , lookup

Steady-state economy wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Production for use wikipedia , lookup

Transformation in economics wikipedia , lookup

Great Recession in Europe wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

Non-monetary economy wikipedia , lookup

Fiscal multiplier wikipedia , lookup

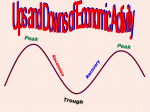

An Overview of Business Cycle Theories peak contraction recovery trough Dr. Dennis Foster Characteristics & Features • Rise and fall in Gross Domestic Product (GDP) around some long term trend. • Unemployment generally lags ∆GDP • Inflation generally inversely related and lags during the expansion. • Four phases: peak, contraction, trough, recovery • Contraction aka “recession” or “downturn” or “depression” [old days – “panic”] National Bureau of Economic Research • Identifies dates of business cycles (here). • Dec. 2007 peak called in Dec. of 2008 (here). A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough. • June 2009 trough called in Sept. 2010 (here). The recession lasted 18 months, which makes it the longest of any recession since World War II. The Data on U.S. Business Cycles Problematic Recovery Ave. = 2.8% 2001 2008 Ave. = 2.25% Thomas Malthus • Workers paid less than the value of their production. • Excess supply develops across the economy. • Firms/owners reduce employment to liquidate these inventories. • Depression. • FYI – long run wages at subsistence. [Economics as the “dismal science.”] Joseph Schumpeter • Business cycles form patterns. • Inventory adjustments – 3 to 5 yrs. • Fixed investment – 7 to 11 yrs. This is what we call the business cycle. • Infrastructure building – 15 to 25 yrs. • Major innovations – 45 to 60 yrs. Karl Marx • Capitalism produces surplus value. • Production goes unsold. • Crisis ensues; depression. • Worsens over time!! Lord John Maynard Keynes • Lack of confidence reduces spending. • Normal channel of saving to investment breaks down. • Wages (and prices) don’t fall. • Result – depression. • Solution – replace private spending with public spending. Milton Friedman • Emphasizes the role of money. • Depressions preceded by fall in MS. • Government controls money supply. • Government is the source of failure. • In a depression, raise MS to counter. • Ben Bernanke as follower. Ludwig von Mises • The Austrian School – Hayek, too. • Embrace Say’s Law. • Depressions due to “credit bubbles.” • Bubbles perpetuated by the Fed. • Depression allows reallocation. • “Solution” – leave it alone. • Worst case – try to undo it. Say’s Law • Casually – supply creates demand. • Our total purchasing power (spending) comes from our sales (income). • Excess supply is impossible in every sector of the economy. • Sectors with excess demand will attract more resources. An Overview of Business Cycle Theories peak contraction recovery trough Dr. Dennis Foster