* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Recessions Happened Each Time Federal Taxes Reached 18% of

Survey

Document related concepts

Transcript

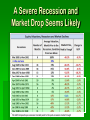

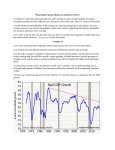

Rational Investing Special Interest Group combines fundamental and technical analysis Economic Climate and Market Weather Conditions Presented by Herb Geissler, Managing Director of St.Clair Group November 2015 Only 1 in 7 economists expects a recession in the U.S, within 12 months. What does that “one economist” know that the other six may be missing? Consensus: Washington politicians “would never allow a recession to occur in the year of a Presidential election” Consensus: Year before a Presidential election (eg: 2015) always has been the most profitable for the stock market Recessions Happened Each Time Federal Taxes Reached 18% of GDP Slipping Profit Margins Have Reliably Predicted Imminent Recession Bad Winter, Sluggish Spring, Weak Summer => Declining US Economy 3Q/15 = 1.6% p Causing Manufacturing PMI to Drop Since Last Thanksgiving 9 of 11 recessions started when PMI was 50 or lower As Confirmed By Regional Federal Reserve Banks Causing Job Gains to Flatten, then Fall Monthly Jobs Added Post Mid Term Returns Have Been Shrinking During Current Kuznets Bear Cycle This year may be first time, ever, that 3rd Year was not profitable Market Valuation is at an Unsustainable Extreme Tobin’s Q Ratio = total stock market valuation / replacement value of assets A Severe Recession and Market Drop Seems Likely However Moving Average Spreadsheet Has Flipped to “All Clear” for November 13.7% 14.3% 8.2% 4.5% 9.6% timed 5.6% 10.0% 6.7% (-1.6%) 0.4% B&H (-12.1%) (-11.7%) (-20.2%) (-12.7%) (-19.3%) mmDD Timed With Growth Stocks Continuing to Outperform Value Stocks 50/50/0 Dilemma • 50/50/0 measures are all pulling back from positive extremes • Struggling all year to break above January 2 price • Close is barely above MA200day and MA50 is below MA 200 • PEt = 23.4 = 4.3% earnings yield vs 2.3% 10yr TBond Major Global Markets All Are Bouncing up from LT Support Santa Claus may be generous to Wall Street, once again Intermediate-Term Net-Out Prudent Caution is still called for FED is no longer fueling excess liquidity, but Europe is still in QE. US economy is weakening and Washington remains dysfunctional Election hoopla increases confusion and uncertainties Recession is imminent, but not immediate US stocks struggling in a trading range: favorable seasonal forces providing long-term support and excessive valuation limits tops Can be “cautiously safe” when above 4 and12 month moving average After Santa Rally during next few weeks, tough correction is likely Index and Momentum trading handicapped by lack of decent trends Disciplined Position Trading could profitably ride isolated trend-bursts Spreadsheets and Technicals will show red lights for jumping into safe haven and green lights for when to bottom-fish the bargains For the longer haul, Seminar scheduled for February 13 Seminar will examine the Dangerous D’s Debt, Deleveraging, Devaluation, and Deflation Debilitating Demographics Dysfunctional Democracies But, for investors, problems often are opportunities in disguise Preserve capital to buy bargains with simple market timing Identify best opportunities with trend-following methods Surface strongest prospects with rational stock selection Assure gains with disciplined entry and exit rules Saturday morning seminar starts at 8:30 and ends by 1 pm Registration fee is $125 in advance, $150 at the door Copy of slides and spreadsheets for enhanced 5 Diverse Strategies assured with pre-registration ($75 credit for previous purchasers) During tumultuous markets, a fact-based outlook, a sound plan, and good discipline are all more essential than ever Tonight, Lucio Facchini will discuss Tony Robbins’ research and insights on managing your investments Before we begin that next segment, any questions about market climate?